Arizona Stop Annuity Request is a legal process available in the state of Arizona that allows an individual to halt or terminate an annuity contract. An annuity is a financial product typically offered by insurance companies, where an individual invests a lump sum of money or makes regular premium payments in exchange for a guaranteed income stream in the future. When circumstances change or the annuity no longer meets the individual's financial needs, they may consider submitting an Arizona Stop Annuity Request. This request can be made for various reasons, such as needing immediate access to funds, dissatisfaction with the annuity's performance, or a desire to invest in alternative financial strategies. The Arizona Stop Annuity Request serves as a formal request to cancel or cease the annuity contract and can result in either a full surrender of the annuity or a partial withdrawal of funds. In some cases, individuals may choose to transfer the annuity to a different financial product or company that better aligns with their financial goals. There are different types of Arizona Stop Annuity Requests available, depending on the individual's specific situation: 1. Full Surrender: This type of request involves the complete termination of the annuity contract, resulting in the withdrawal of the total accumulated funds. However, surrendering the annuity may lead to tax consequences and potential surrender charges imposed by the insurance company. 2. Partial Withdrawal: Instead of terminating the entire annuity contract, an individual may choose to make a partial withdrawal from their annuity. This allows them to access only a portion of the accumulated funds while keeping the remaining balance invested. 3. 1035 Exchange: In certain cases, an individual may decide that terminating the annuity is not the best option. Instead, they can opt for a 1035 exchange, which allows them to transfer the accumulated funds from one annuity to another without incurring immediate tax consequences. This exchange offers the opportunity to explore alternative annuities that better suit the individual's financial goals. Submitting an Arizona Stop Annuity Request requires careful consideration of the contractual terms associated with the annuity, as well as potential tax implications. It is essential to consult with a financial advisor or attorney specializing in annuities to navigate this process effectively and make informed decisions. Keywords: Arizona Stop Annuity Request, annuity contract, terminate annuity, surrender annuity, partial withdrawal, 1035 exchange, financial product, insurance company, annuity cancellation, annuity termination, annuity surrender, tax consequences, annuity withdrawal.

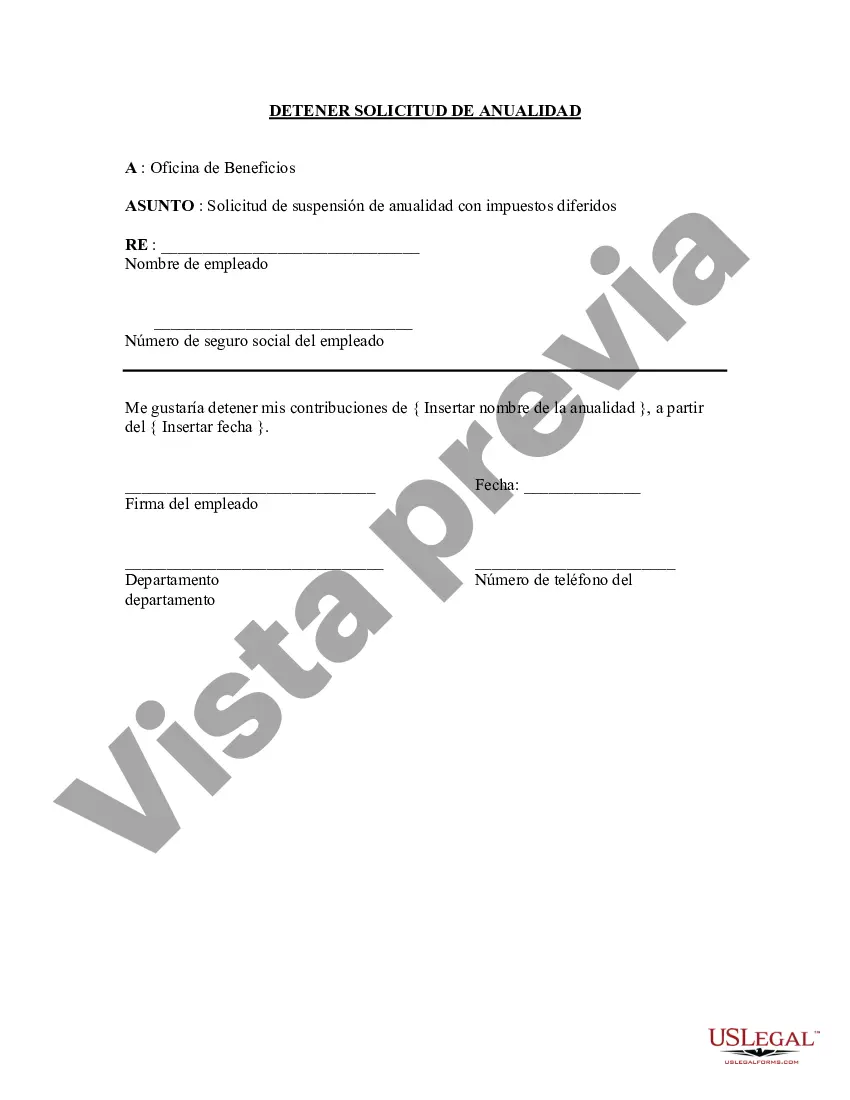

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arizona Detener solicitud de anualidad - Stop Annuity Request

Description

How to fill out Arizona Detener Solicitud De Anualidad?

If you need to total, obtain, or print out lawful document themes, use US Legal Forms, the largest selection of lawful varieties, that can be found on the web. Take advantage of the site`s simple and handy research to obtain the files you will need. Numerous themes for company and person purposes are categorized by types and says, or keywords. Use US Legal Forms to obtain the Arizona Stop Annuity Request within a handful of clicks.

When you are already a US Legal Forms client, log in to the accounts and click on the Down load button to have the Arizona Stop Annuity Request. You may also gain access to varieties you previously downloaded inside the My Forms tab of your own accounts.

If you are using US Legal Forms for the first time, refer to the instructions below:

- Step 1. Ensure you have chosen the shape to the proper area/region.

- Step 2. Use the Review option to check out the form`s articles. Don`t overlook to see the outline.

- Step 3. When you are not satisfied with the kind, use the Research area on top of the display to discover other types in the lawful kind template.

- Step 4. When you have discovered the shape you will need, go through the Get now button. Opt for the costs prepare you prefer and add your credentials to register to have an accounts.

- Step 5. Procedure the purchase. You can utilize your bank card or PayPal accounts to accomplish the purchase.

- Step 6. Find the formatting in the lawful kind and obtain it in your product.

- Step 7. Complete, modify and print out or indicator the Arizona Stop Annuity Request.

Each lawful document template you get is your own for a long time. You have acces to every kind you downloaded in your acccount. Click the My Forms portion and choose a kind to print out or obtain once more.

Contend and obtain, and print out the Arizona Stop Annuity Request with US Legal Forms. There are many professional and status-certain varieties you can utilize for the company or person requirements.