Arizona Employment Firm Audit is a comprehensive examination carried out by professional auditors to assess the compliance, accuracy, and efficiency of employment practices and processes within firms based in Arizona. By conducting this audit, employers can identify any gaps or areas of improvement to ensure their practices align with state regulations, industry standards, and best practices. The Arizona Employment Firm Audit typically covers various key areas to ensure compliance and efficiency. These may include labor law compliance, employee benefits, payroll and tax procedures, recruitment and hiring, record-keeping, worker classification, safety and health regulations, equal opportunity employment, and overall human resources practices. The audits can be classified into different types based on their focus and scope. Some common types of Arizona Employment Firm Audits are: 1. Compliance Audit: This type of audit focuses on evaluating whether the firm complies with legal requirements, such as labor laws, minimum wage laws, anti-discrimination laws, and other employment-related regulations in Arizona. 2. Payroll and Tax Audit: This audit concentrates on verifying the accuracy and compliance of payroll records, tax withholding procedures, reporting obligations, and the adherence to Arizona-specific tax laws. 3. Recruitment and Hiring Audit: This type of audit ensures that the firm's recruitment and selection processes align with fair employment practices, equal opportunity laws, and meet the stipulated requirements for job postings, interviews, background checks, and candidate evaluations. 4. Employee Benefits Audit: This audit reviews the firm's compliance with Arizona-specific regulations regarding employee benefits, including health insurance, retirement plans, leave policies, disability benefits, and any other benefits provided by the employer. 5. Safety and Health Audit: This audit focuses on assessing the firm's compliance with workplace safety regulations, ensuring the presence and adequacy of safety protocols, employee training programs, and the maintenance of a safe working environment. 6. Record-Keeping Audit: This audit evaluates the accuracy, completeness, and retention of employee records, including personnel files, employment contracts, performance evaluations, and any other documentation required by Arizona employment laws. By conducting an Arizona Employment Firm Audit, employers can not only ensure compliance with state-specific regulations but also identify areas of improvement to enhance their human resources practices and maintain a productive and legally compliant workforce.

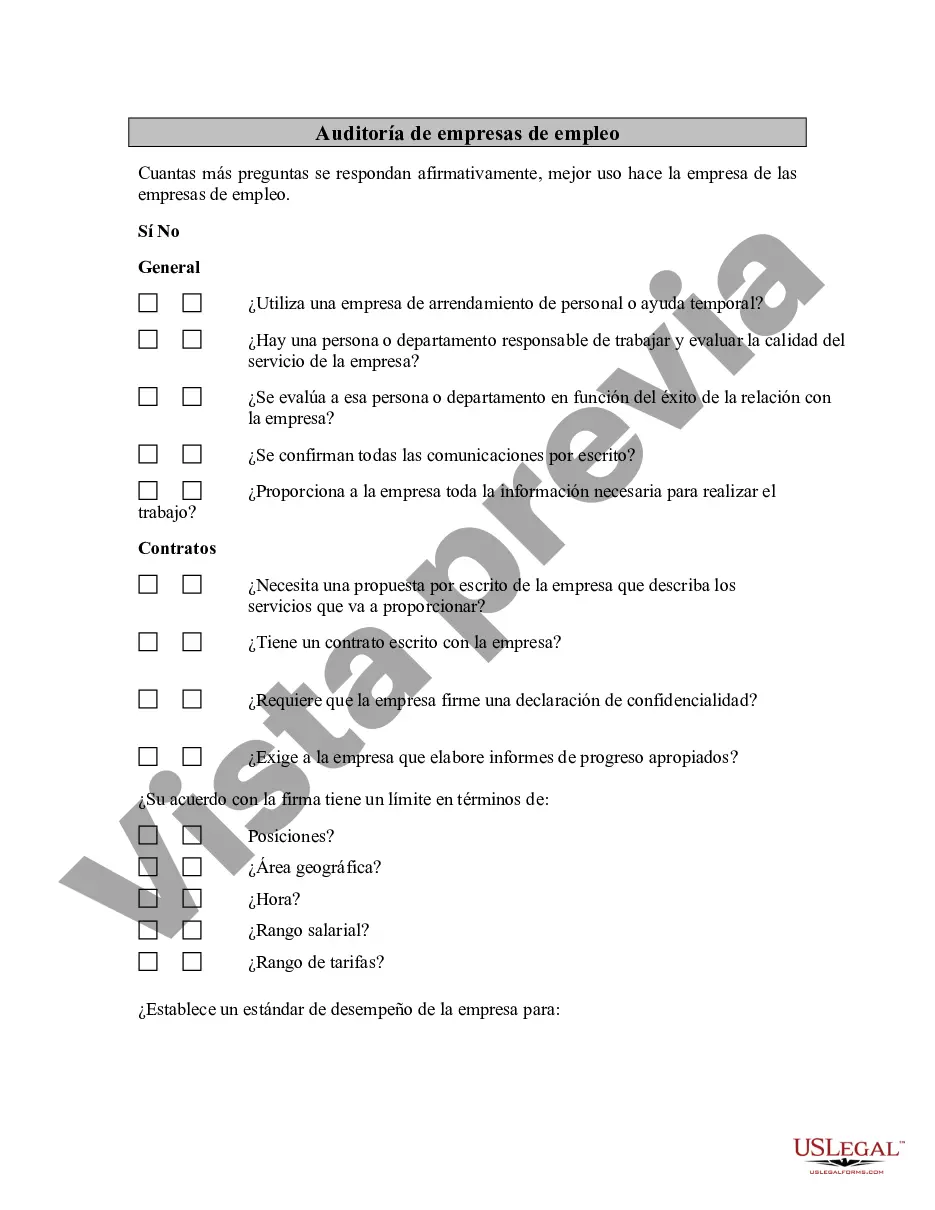

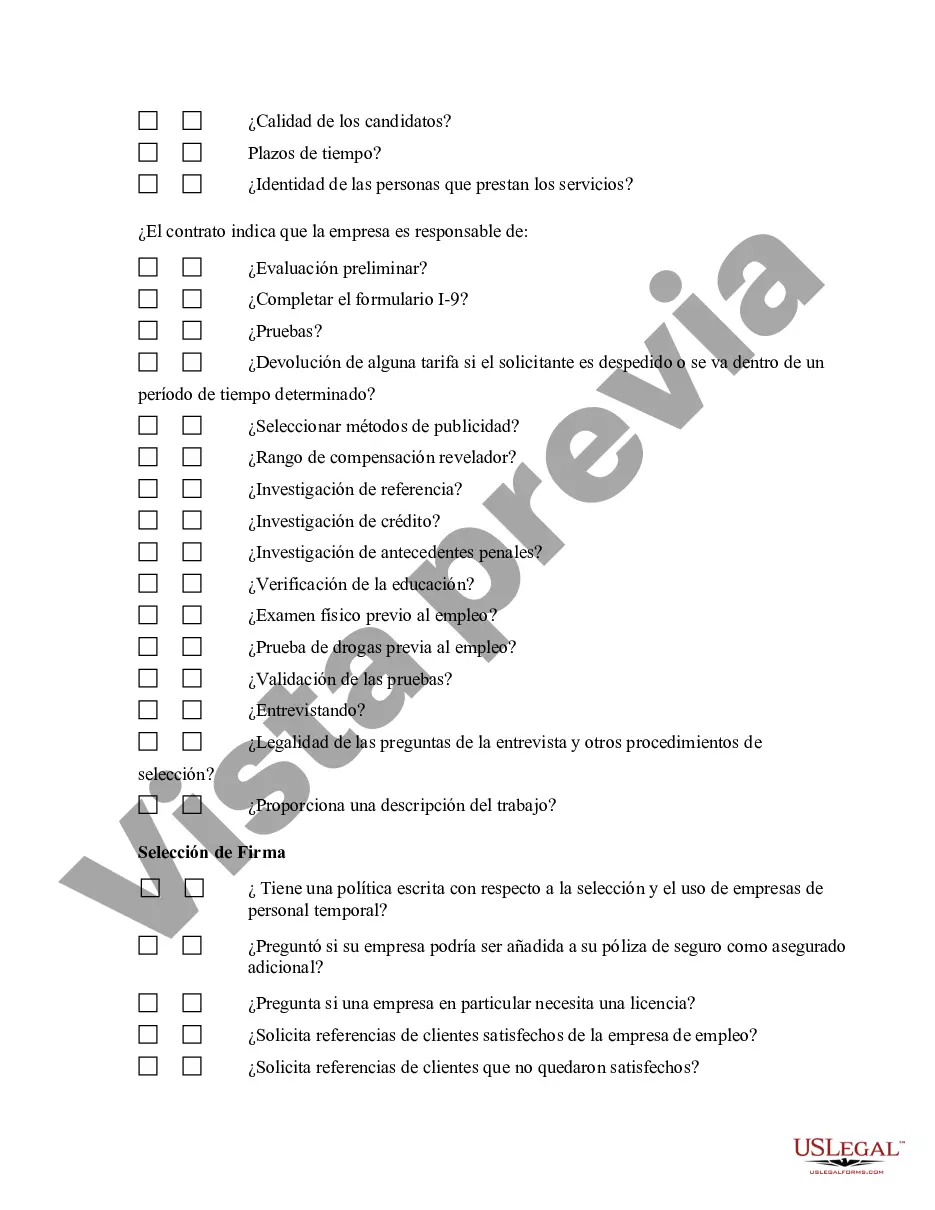

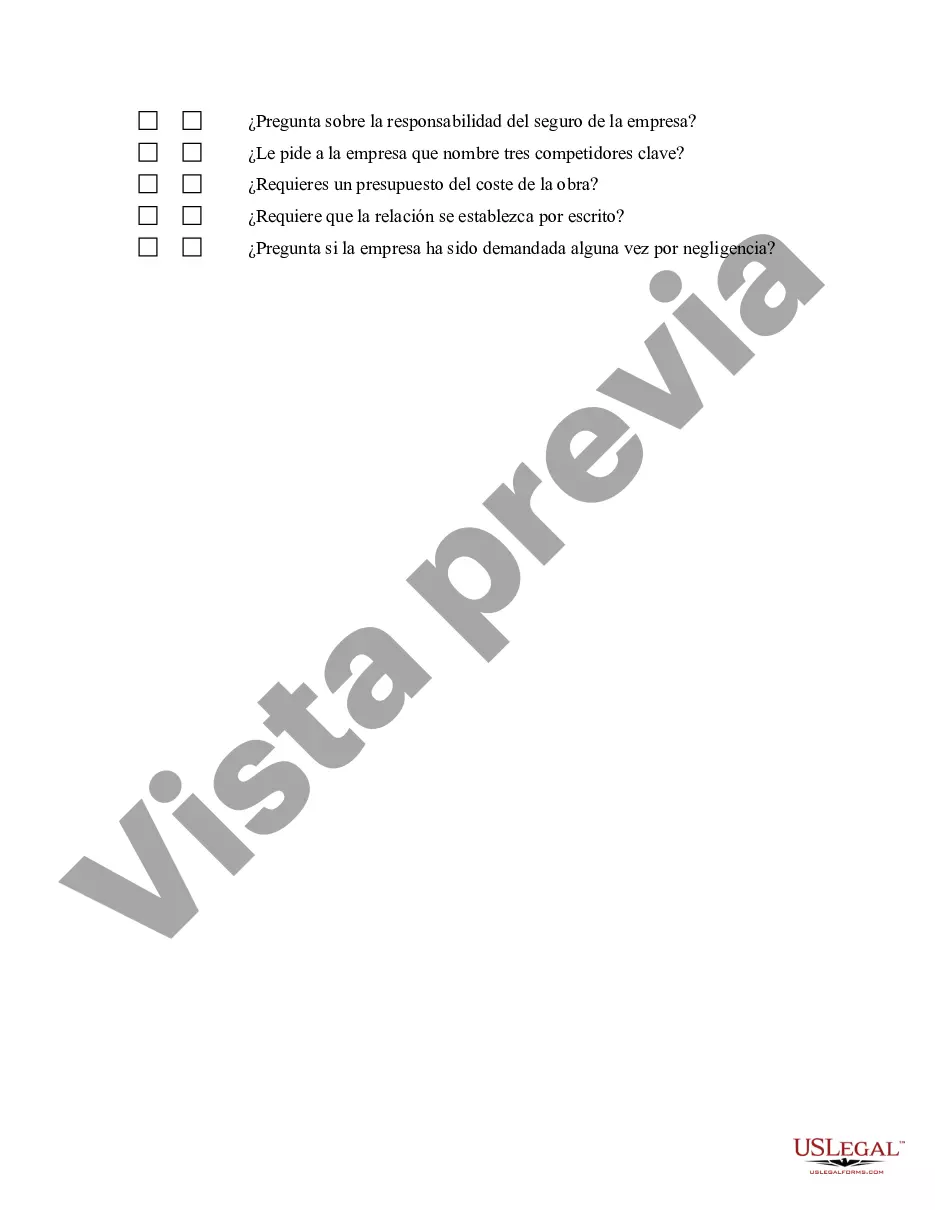

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arizona Auditoría de empresas de empleo - Employment Firm Audit

Description

How to fill out Arizona Auditoría De Empresas De Empleo?

US Legal Forms - one of the largest libraries of authorized varieties in America - provides a wide range of authorized papers layouts you may acquire or print. Making use of the internet site, you will get a huge number of varieties for enterprise and specific functions, sorted by categories, says, or key phrases.You can get the most recent versions of varieties just like the Arizona Employment Firm Audit in seconds.

If you currently have a registration, log in and acquire Arizona Employment Firm Audit in the US Legal Forms catalogue. The Obtain button will show up on every develop you look at. You have accessibility to all in the past acquired varieties from the My Forms tab of your own bank account.

If you want to use US Legal Forms the first time, listed below are straightforward instructions to help you get started off:

- Make sure you have selected the correct develop for your personal metropolis/county. Click on the Preview button to examine the form`s content. Look at the develop information to actually have selected the proper develop.

- If the develop does not suit your demands, make use of the Search discipline at the top of the display to obtain the one that does.

- Should you be pleased with the form, affirm your choice by visiting the Buy now button. Then, select the pricing prepare you want and offer your accreditations to register to have an bank account.

- Method the transaction. Utilize your charge card or PayPal bank account to complete the transaction.

- Pick the formatting and acquire the form on your gadget.

- Make alterations. Fill up, modify and print and indicator the acquired Arizona Employment Firm Audit.

Each web template you included with your account lacks an expiration day and is also the one you have eternally. So, if you want to acquire or print yet another duplicate, just check out the My Forms portion and click on around the develop you require.

Obtain access to the Arizona Employment Firm Audit with US Legal Forms, one of the most considerable catalogue of authorized papers layouts. Use a huge number of professional and express-certain layouts that satisfy your small business or specific requirements and demands.

Form popularity

FAQ

Human Resource audits are used to assess the compliance of your HR policies and procedures. They can diagnose issues before they become real problems and help you find the right solutions. But HR compliance audits can be used for more than just defining risk.

Depending on the reason for your EDD audit, you could be liable to face a wide range of fines that can cause you a considerable amount of financial strain. These sorts of fines include a percentage of unpaid taxes, set dollar amounts for each case of unreported employees or independent contractors, and much more.

A job audit is a formal review of the current duties and responsibilities assigned to a position to ensure appropriate classification within the classified pay program. An audit should be requested if the duties and responsibilities of a position have significantly changed.

In essence, an HR audit involves identifying issues and finding solutions to problems before they become unmanageable. It is an opportunity to assess what an organization is doing right, as well as how things might be done differently, more efficiently or at a reduced cost.

The EDD can decide to audit if a worker makes the case that he or she is an employee rather than an independent contractor (typically found out when the employee tries to apply for unemployment insurance). Other triggers for an audit include: Filing or paying late. Errors in time records or other statement or documents.

The EDD Verification Process While the Employment Development Department does not audit all employers, rather it does conduct verification audits of companies that are selected at random or based on certain criteria.

There are three main types of audits: external audits, internal audits, and Internal Revenue Service (IRS) audits.

An audit can be as simple as reviewing employment files to ensure that they are in order or it can involve reviewing effectiveness of corporate HR policies, which may include interviewing supervisors, managers and employees. Audits can be broad, incorporating how a business operates and reviewing efficiencies.

Request EDD AuditRequest Audits are the more serious of the two. Your business has been specifically targeted because of information developed either by EDD investigators or through information provided by outsiders-most typically by employees or former employees.

The DOL can choose to audit an employer at any time, but most often audits are initiated when a complaint filed by a current or former employee, or as a result of the DOL's efforts to target specific low-wage, high-violation industries (agriculture, child care, food services, health care, landscaping, retail, etc.)