Title: Arizona Employee Payroll Records Checklist — Key Requirements and Types Introduction: An accurate and complete payroll records checklist is essential for businesses operating in Arizona to ensure compliance with state regulations. This article provides a comprehensive overview of the Arizona Employee Payroll Records Checklist, outlining its significance and highlighting any variations or additional requirements for different types of businesses. Keywords: Arizona, employee payroll records, checklist, compliance, state regulations, types of businesses, requirements. 1. The Importance of Arizona Employee Payroll Records: Maintaining accurate and organized payroll records is crucial for businesses in Arizona to comply with state laws, fulfill tax obligations, and respond to potential audits or legal disputes. The Arizona Employee Payroll Records Checklist helps organizations ensure they have all necessary records readily available and accessible. 2. General Requirements of an Employee Payroll Records Checklist: The Arizona Employee Payroll Records Checklist typically includes the following documentation: a. Employee Information: — Employee names, addresses, and social security numbers. — Employee hire and termination dates— - Employee classifications (full-time, part-time, temporary, etc.). — Bank account information for direct deposit purposes. b. Compensation Details: — Wages, salary, or hourly rates for each employee. — Overtime pay records, if applicable— - Bonus, commission, or incentive payments. — Pay frequency and pay periods covered. c. Time and Attendance: — Timesheets or time records reflecting hours worked. — Attendance registers or sign-in sheets. — Records of absences, leaves, and vacations. d. Deductions and Withholding: — Federal, state, and local taxes withheld. — Social Security and Medicare contributions. — Garnishments, child support payments, or other court-ordered deductions. — Voluntary deductions, such as health insurance or retirement contributions. e. Employment Agreements and Policies: — Signed employment contracts and agreements. — Policies related to overtime, breaks, vacation accrual, etc. — Employee handbook and acknowledgments. f. Tax Forms and Documentation: — W-4 forms with employee tax withholding details. — State-specific tax forms, such as Arizona Form A-4. — Year-end tax forms (W-2, 1099, etc.) provided to employees. 3. Industry-Specific Variations in the Checklist: While the majority of the Arizona Employee Payroll Records Checklist requirements apply to most businesses, certain industries may have additional documentation needs. Industries such as healthcare, construction, or hospitality might require: a. Certifications and Licenses: — Copies of professional licenses or certifications. — Evidence of compliance with industry-specific regulations. b. Training and Safety Records: — Documentation of employee training programs or certifications. — Safety incident reports and records— - OSHA compliance logs (if applicable). c. Job-Specific Records: — Union agreements or collective bargaining records. — Job classifications or levels and associated wage rates. Conclusion: Complying with Arizona's payroll record keeping requirements is crucial for every business. By maintaining an accurate Arizona Employee Payroll Records Checklist, businesses can ensure they are well-prepared for any audits, legal requirements, or inquiries regarding employee payroll. Adhering to these guidelines will help businesses avoid potential penalties and legal repercussions.

Arizona Employee Payroll Records Checklist

Description

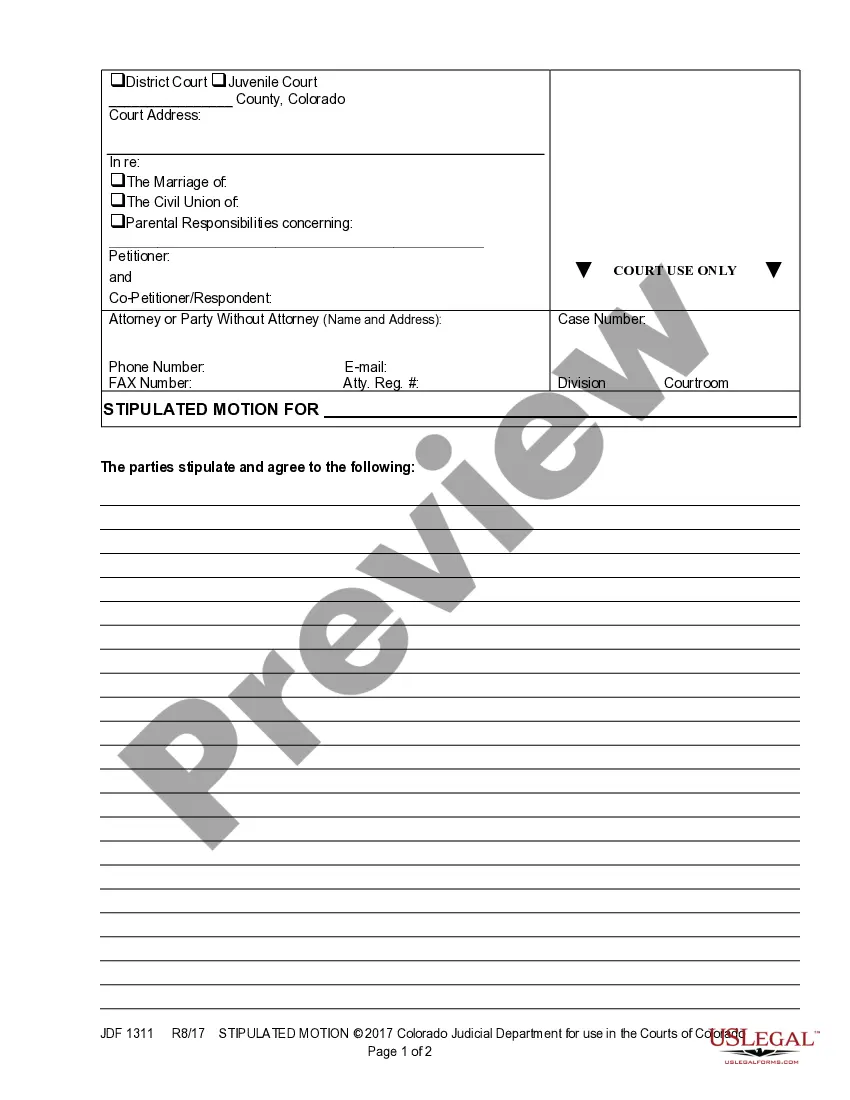

How to fill out Arizona Employee Payroll Records Checklist?

US Legal Forms - one of the greatest libraries of authorized forms in America - provides a wide range of authorized record web templates it is possible to obtain or print. Utilizing the site, you will get a large number of forms for organization and individual reasons, sorted by groups, states, or keywords.You can find the most up-to-date versions of forms just like the Arizona Employee Payroll Records Checklist within minutes.

If you already possess a monthly subscription, log in and obtain Arizona Employee Payroll Records Checklist in the US Legal Forms collection. The Obtain button will show up on each and every form you view. You have accessibility to all previously acquired forms inside the My Forms tab of the accounts.

If you wish to use US Legal Forms for the first time, here are easy recommendations to get you began:

- Ensure you have picked the best form for the city/area. Select the Preview button to examine the form`s information. Browse the form outline to ensure that you have chosen the proper form.

- If the form does not match your needs, make use of the Search area at the top of the screen to get the the one that does.

- Should you be content with the shape, verify your selection by visiting the Buy now button. Then, select the pricing plan you prefer and supply your accreditations to register on an accounts.

- Method the deal. Make use of credit card or PayPal accounts to finish the deal.

- Select the format and obtain the shape on your own system.

- Make modifications. Load, edit and print and signal the acquired Arizona Employee Payroll Records Checklist.

Every single template you added to your money lacks an expiry time and is your own eternally. So, in order to obtain or print an additional duplicate, just visit the My Forms segment and click about the form you will need.

Get access to the Arizona Employee Payroll Records Checklist with US Legal Forms, by far the most comprehensive collection of authorized record web templates. Use a large number of expert and express-certain web templates that meet up with your company or individual needs and needs.