Arizona Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan

Description

How to fill out Authorization To Adopt A Plan For Payment Of Accrued Vacation Benefits To Employees With Company Stock With Copy Of Plan?

Choosing the right authorized record web template can be a have a problem. Of course, there are plenty of themes accessible on the Internet, but how can you get the authorized kind you require? Take advantage of the US Legal Forms website. The support delivers a large number of themes, including the Arizona Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan, that can be used for company and private demands. Every one of the varieties are examined by specialists and meet federal and state demands.

Should you be already authorized, log in to your account and click the Download button to obtain the Arizona Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan. Make use of your account to check throughout the authorized varieties you might have purchased in the past. Proceed to the My Forms tab of your respective account and acquire yet another version in the record you require.

Should you be a new end user of US Legal Forms, allow me to share simple recommendations so that you can adhere to:

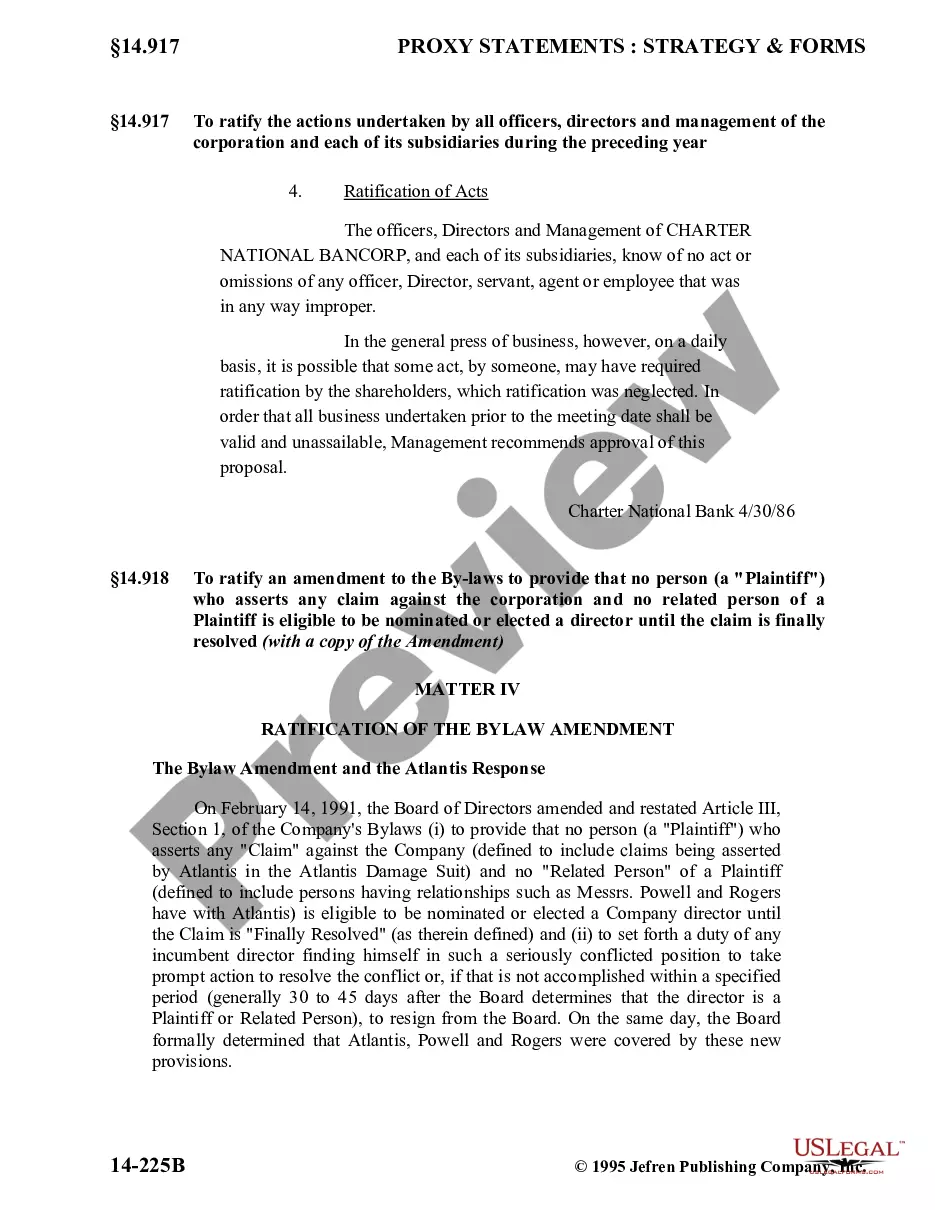

- Initial, be sure you have selected the appropriate kind for your personal area/county. It is possible to check out the form utilizing the Review button and look at the form explanation to guarantee it will be the best for you.

- In case the kind will not meet your expectations, make use of the Seach discipline to obtain the right kind.

- When you are certain the form is suitable, click on the Buy now button to obtain the kind.

- Choose the rates plan you need and type in the needed info. Make your account and buy your order using your PayPal account or credit card.

- Opt for the document structure and download the authorized record web template to your device.

- Total, revise and printing and signal the obtained Arizona Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan.

US Legal Forms may be the most significant catalogue of authorized varieties that you can find different record themes. Take advantage of the service to download skillfully-made documents that adhere to condition demands.