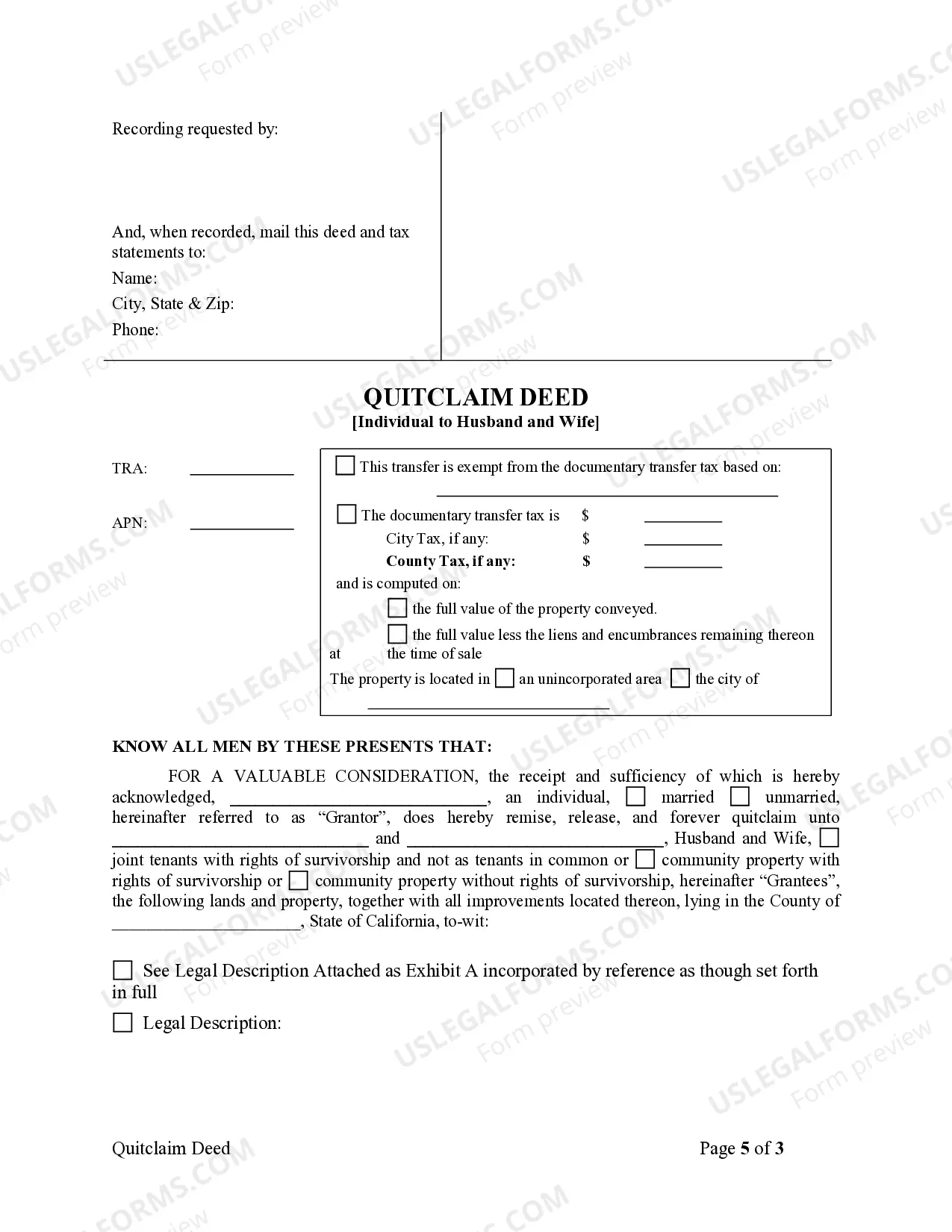

Quitclaim Deed Husband

Description Quitclaim Deed Individual

How to fill out California Husband Wife?

- If you have an existing account, log in and confirm your subscription is active. Click the Download button to get your necessary form template.

- For new users, start by reviewing the Preview mode and description of available forms. Make sure the document fits your legal needs and adheres to local jurisdiction guidelines.

- If you cannot find a suitable form, utilize the Search tab to look for alternatives that bettermatchyour requirements.

- Once you identify the correct document, proceed to purchase it by selecting the Buy Now button and the preferred subscription plan.

- Provide your payment information, either credit card details or your PayPal account, to complete your subscription purchase.

- Finally, download your Quitclaim Deed template and save it on your device. You can access it at any time via the My Forms section of your profile.

US Legal Forms not only makes document preparation easy, but it also ensures you have access to premium experts for assistance, ensuring your legal documents are accurate and compliant.

Don't wait any longer! Start simplifying your legal documentation process with US Legal Forms today.

Deed Husband Wife Form popularity

California Quitclaim Wife Other Form Names

Deed Individual Wife FAQ

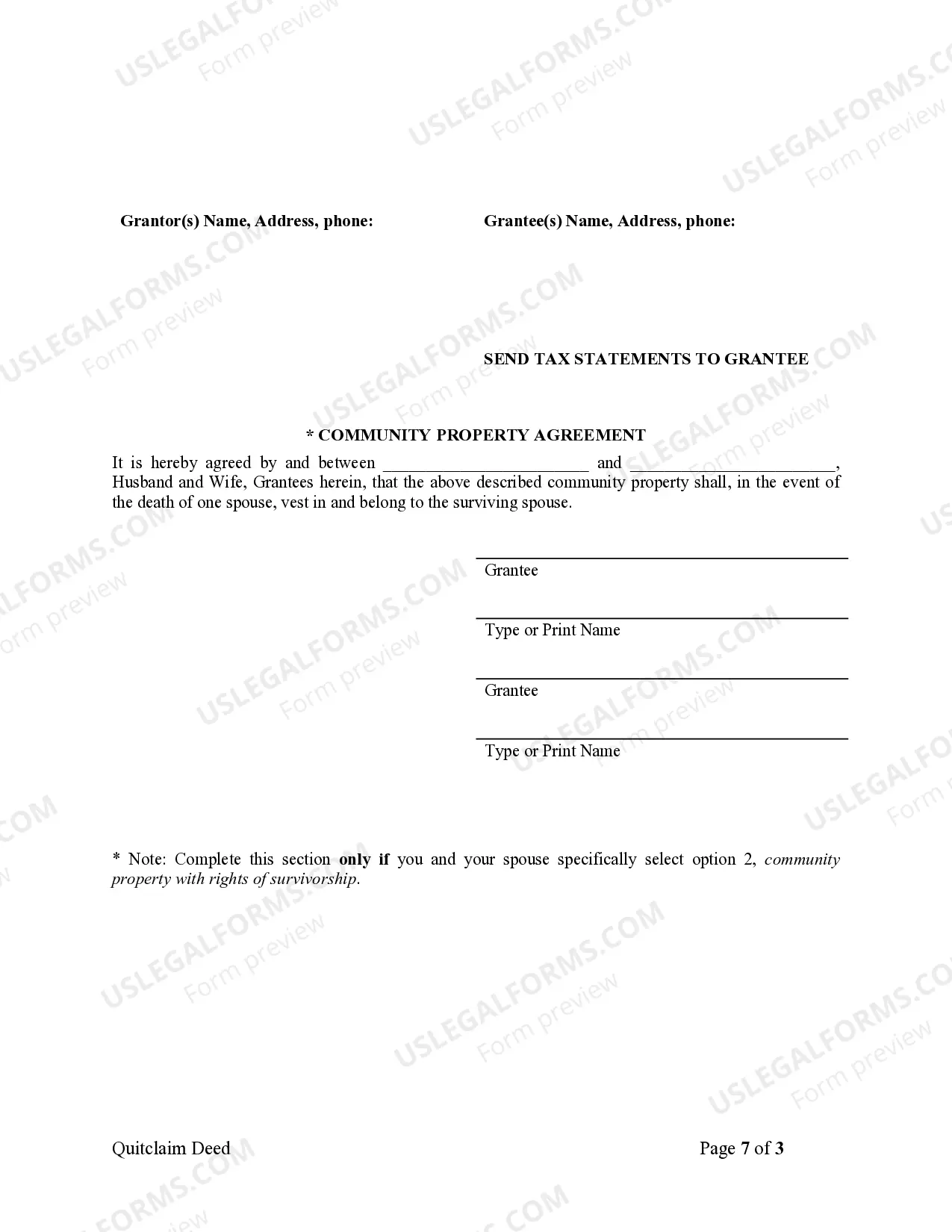

The easiest way to grant your spouse title to your home is via a quitclaim deed (Californians generally use an interspousal grant deed). With a quitclaim deed, you can name your spouse as the property's joint owner. The quitclaim deed must include the property's description, including its boundary lines.

Transfers of assets between other persons do not escape capital gains tax.However, because stamp duty land tax is based on 'consideration' (effectively the amount paid for the property), it is possible to transfer a property to a spouse, or anyone for that matter, with no stamp duty land tax being payable.

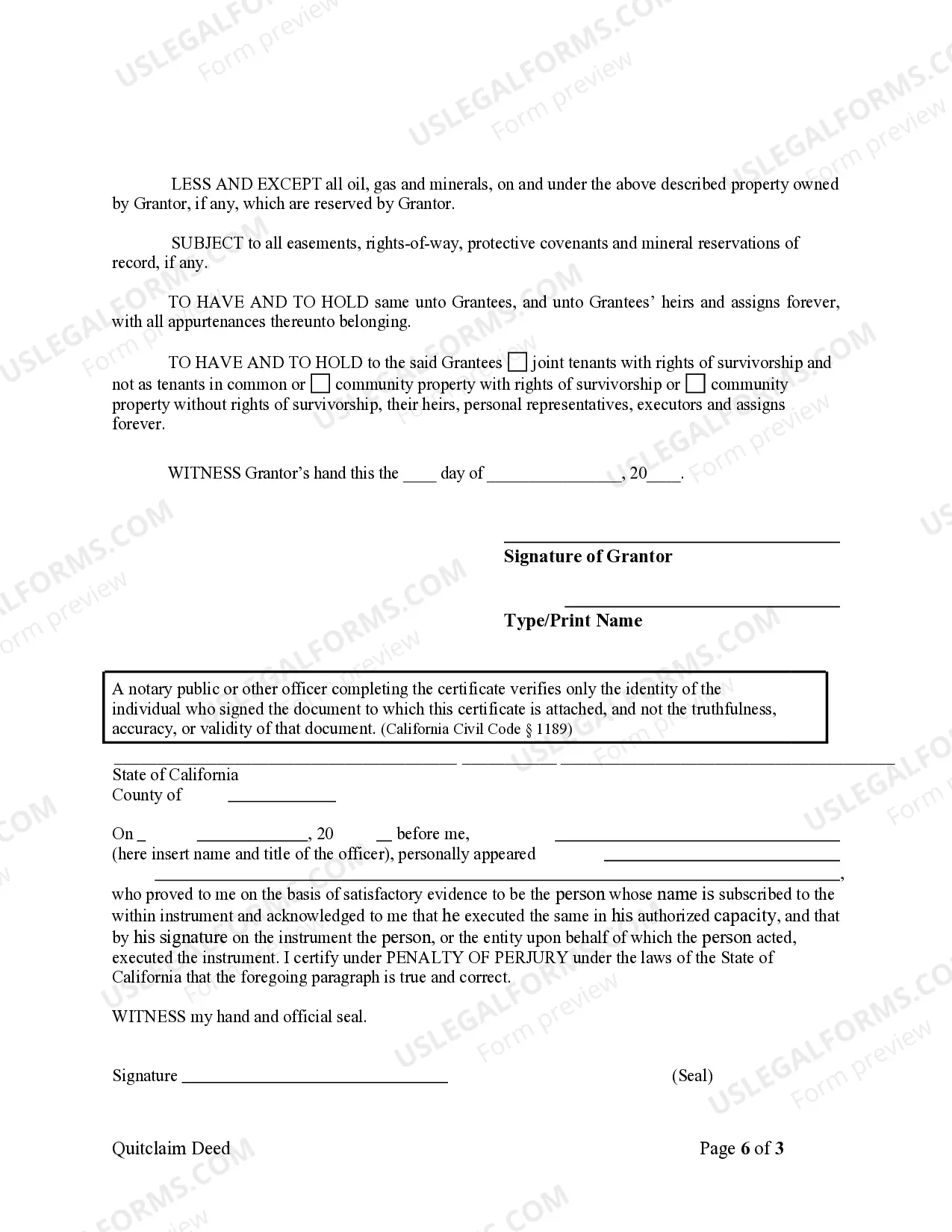

An "interspousal transfer deed" transfers title (ownership) between a married couple. A gift given by one spouse to the other during the marriage is considered "separate" (owned separately), not "marital" (mutually-owned) property.

If you live in a common-law state, you can keep your spouse's name off the title the document that says who owns the property.You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

A quitclaim deed will remove the out-spouse (or departing spouse) from the title to the property, effectively relinquishing their equity or ownership in the home. The execution of a quitclaim deed is typically a requirement of a divorce settlement in order to complete the division of assets.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

Two of the most common ways to transfer property in a divorce are through an interspousal transfer deed or quitclaim deed. When spouses own property together, but then one spouse executes an interspousal transfer or a quitclaim deed, this is known as transmutation.

On its face, an interspousal transfer grant deed or quitclaim deed between spouses involves one spouse foregoing or waiving any future interest he or she may have in the residence.