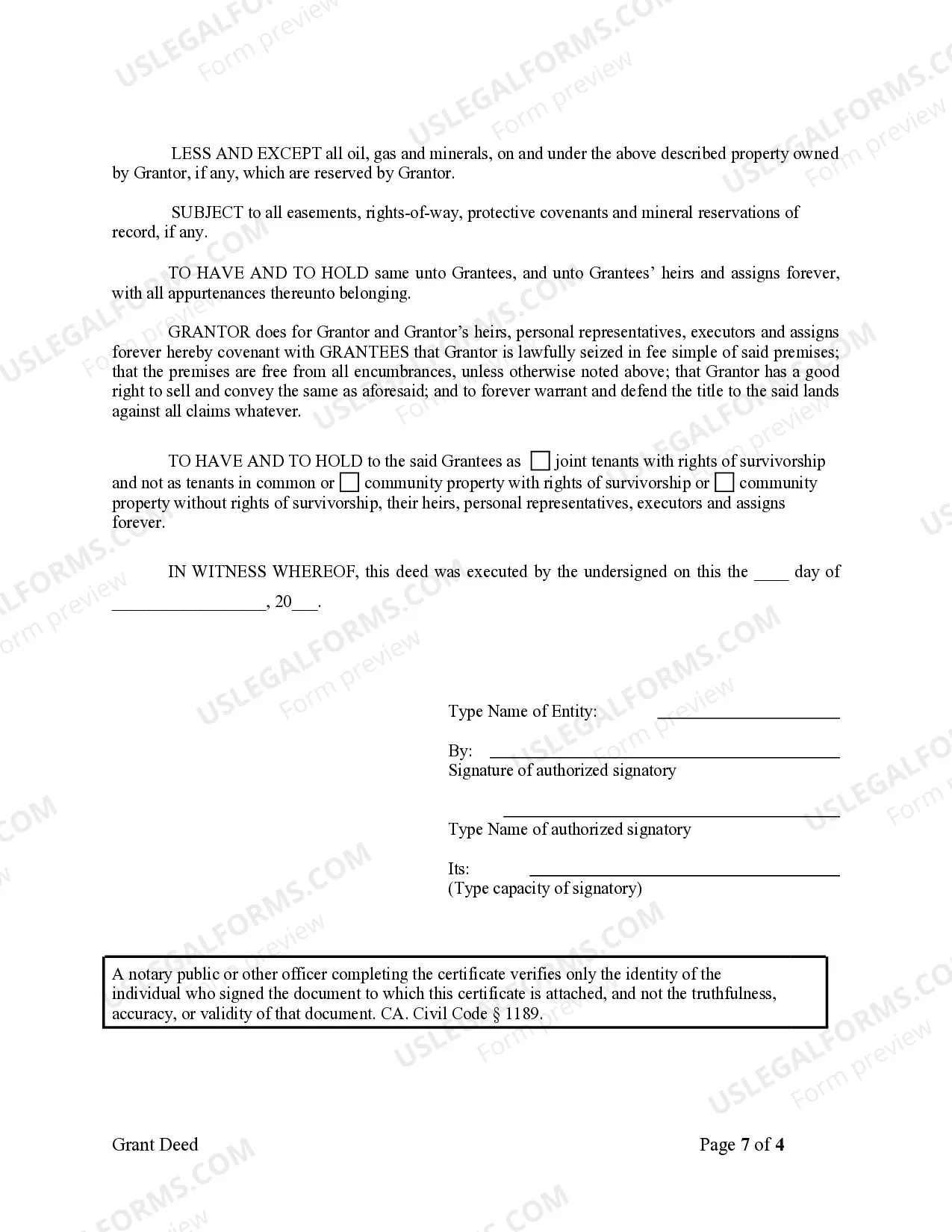

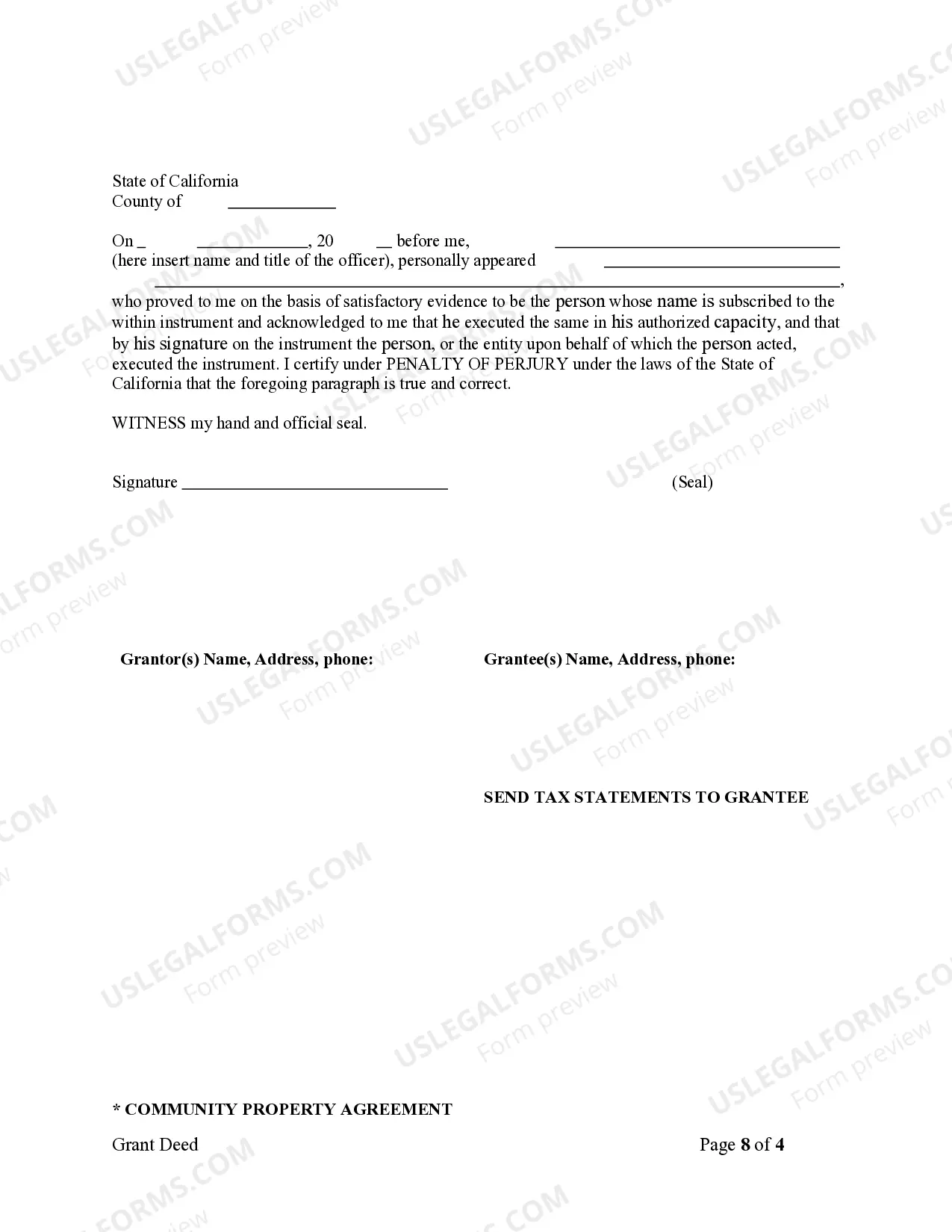

This Warranty Deed from Corporation to Husband and Wife form is a Warranty Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and warrants the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

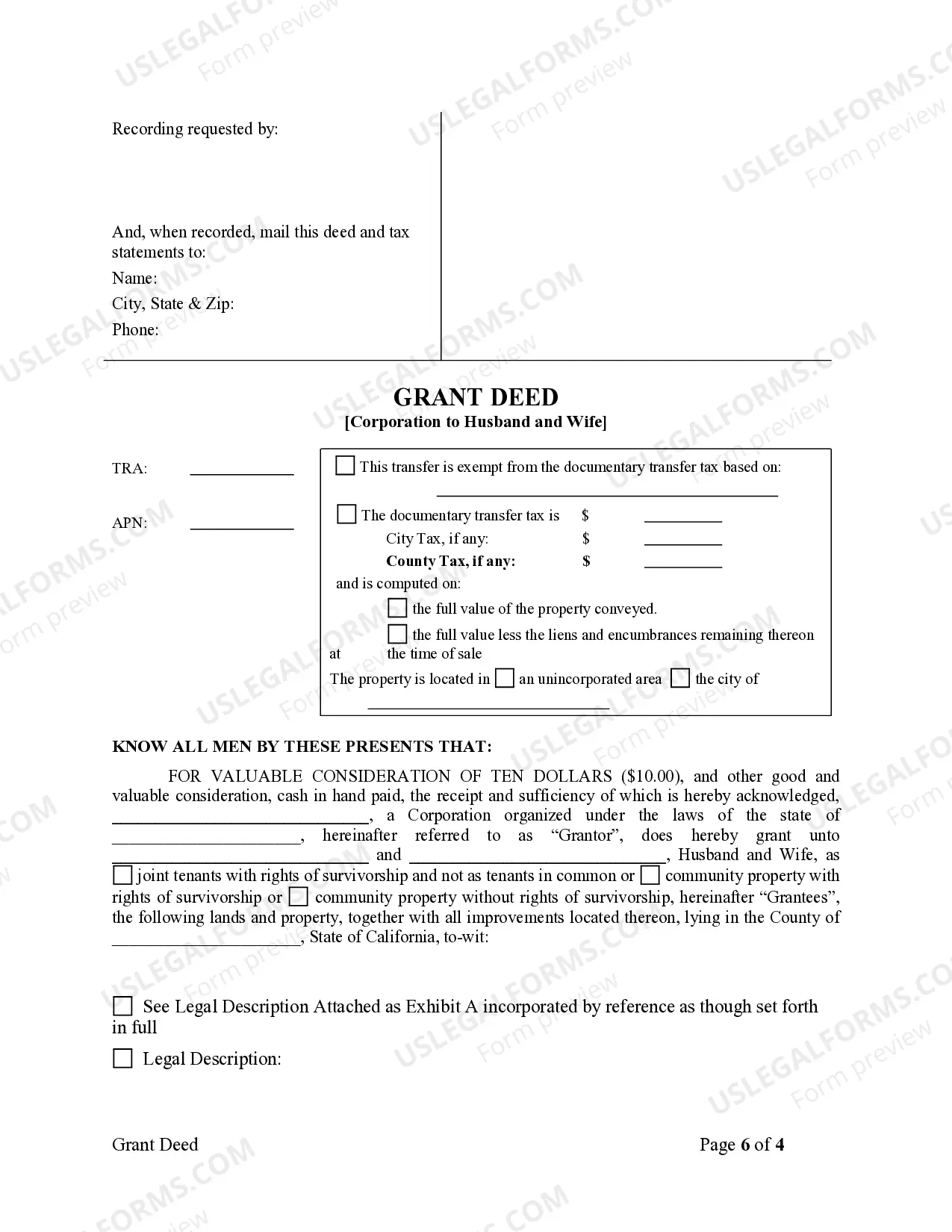

California Grant Deed from Corporation to Husband and Wife

Description

How to fill out California Grant Deed From Corporation To Husband And Wife?

If you are in search of precise California Grant Deed examples from Corporation to Husband and Wife, US Legal Forms is what you should consider; find documents created and authenticated by state-certified attorneys.

Utilizing US Legal Forms not only spares you from worries regarding legal documents; additionally, you save time, energy, and finances! Acquiring, printing, and filling out a professional template is considerably more economical than hiring legal representation to do it for you.

Choose a suitable file format and save the document. And there you have it. In just a few easy steps, you possess an editable California Grant Deed from Corporation to Husband and Wife. Once you register for an account, all subsequent orders will be processed even more smoothly. With a US Legal Forms subscription, just Log In to your account and click the Download button visible on the form's page. Afterward, when you wish to utilize this blank again, you will always be able to find it in the My documents section. Do not waste your time and effort comparing numerous forms on different websites. Purchase professional documents from one secure service!

- To start, complete your registration process by entering your email and setting a password.

- Follow the steps outlined below to establish an account and obtain the California Grant Deed from Corporation to Husband and Wife template to resolve your issues.

- Use the Preview option or examine the document details (if accessible) to ensure that the form is the correct one.

- Verify its legitimacy in your residing state.

- Click Buy Now to place an order.

- Select a recommended pricing plan.

- Create your account and make a payment with your credit card or PayPal.

Form popularity

FAQ

The interspousal transfer grant deed is a legal document used when transferring property between spouses. In California, this deed facilitates the transfer of property from a corporation to a husband and wife with ease and minimal tax implications. This process ensures that the transfer is clear, efficient, and protects both parties' interests. For anyone looking to execute a California Grant Deed from Corporation to Husband and Wife, using US Legal Forms can simplify this process considerably.

To add your spouse to a grant deed, initiate the process by completing a California Grant Deed from Corporation to Husband and Wife form. Ensure you accurately include all relevant details, such as your names and the property description. After acquiring signatures from both parties, submit this deed to your local county recorder’s office. This formalizes the transfer and grants your spouse their rightful ownership interests.

To add your spouse to the title of your house in South Africa, you must complete a deed of transfer, which requires specific documents like the original title deed and personal identification. Consult a local attorney or conveyancer to understand the requirements fully. If you want an efficient solution for title changes in California, consider using the California Grant Deed from Corporation to Husband and Wife. This could guide your approach no matter where you need to transfer property rights.

A quitclaim deed in Ohio allows a property owner to transfer their interest in a property without guaranteeing title clarity. This legal document can efficiently transfer property ownership but offers no warranties to the recipient. For those in California considering similar transactions, a California Grant Deed from Corporation to Husband and Wife provides a more secure option, as it confirms the transfer of ownership rights. Always seek legal guidance when dealing with property transfers.

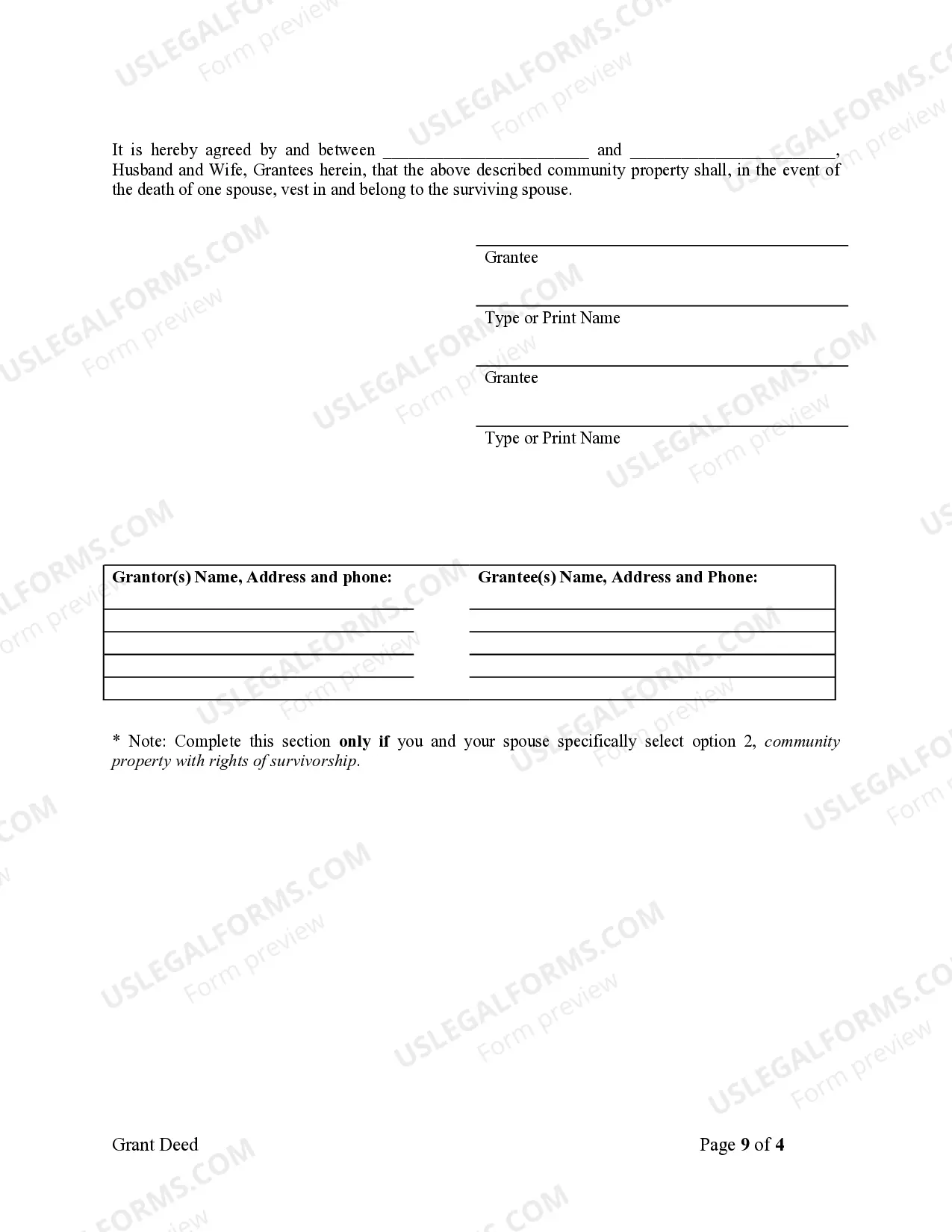

In California, husbands and wives can hold title in various ways, including joint tenancy or community property. The choice impacts property rights, tax implications, and inheritance issues. A common approach for married couples is to use a California Grant Deed from Corporation to Husband and Wife, which simplifies ownership transfer and supports community property rights. Always consult a legal professional for personalized advice based on your situation.

Filling out a California grant deed involves providing specific information such as the property description, the names of the current and new owners, and consideration details. Use the California Grant Deed from Corporation to Husband and Wife form to ensure you include all legal requirements. Review your information carefully, as errors may delay the process. After completing the grant deed, file it with the county recorder's office to finalize the transfer.

To add your wife to your deed effectively, consider using a California Grant Deed from Corporation to Husband and Wife. This method ensures clear ownership transfer and establishes her legal rights to the property. You can obtain the necessary forms online or through legal resources, ensuring that all required information is accurately completed. Make sure to file the grant deed with your local county recorder for it to be legally binding.

The most common way to transfer ownership of property in California is through a grant deed. This legal document clearly conveys the title and can efficiently facilitate ownership transfers, such as a California Grant Deed from Corporation to Husband and Wife. It eliminates ambiguity and ensures that the transfer is recorded. By using resources provided by platforms like uslegalforms, you can simplify your experience in executing these deeds properly.

Yes, you can transfer shares from husband to wife, often through a simple transfer agreement. However, it's crucial to follow the laws regulating shares and ownership rights of both parties. Utilizing the California Grant Deed from Corporation to Husband and Wife can help simplify transaction processes relating to property indirectly tied to those shares. For efficient handling of this transfer, consider using uslegalforms to ensure all requirements are met.

Transferring property from husband to wife after death can be accomplished through a few methods, including using a California Grant Deed from Corporation to Husband and Wife. Although this may be a complex process, utilizing online legal platforms can simplify the journey. You can find guidelines on how to navigate this process, ensuring all legal requirements are met, thus honoring the deceased's wishes while helping the surviving spouse secure ownership.