A Grant Deed conveys possession of certain property to another individual. In this case, the Grantor is a Husband and he wishes to grant the described property to both him and his wife.

California Grant Deed from Husband to Himself and Wife

Description

Key Concepts & Definitions

What is a Grant Deed?

A grant deed is a legal document used to transfer ownership of real property. The grantor (the person who is transferring the property) guarantees that the title is clear and free from any encumbrances apart from those the grantee (the receiver of the property) is aware of at the time of the transfer.

Grant Deed from Husband to Himself and Wife

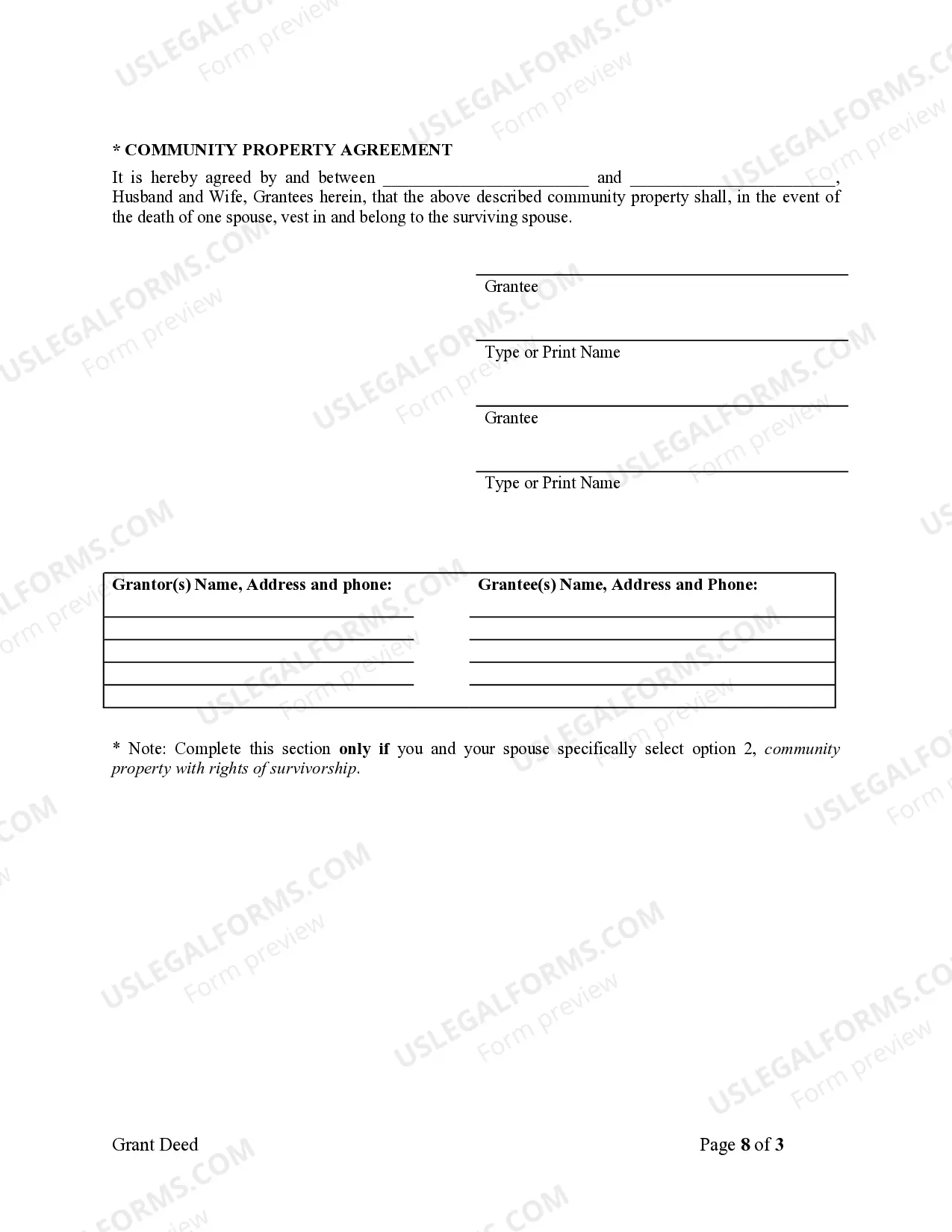

This specific type of grant deed refers to a situation where a husband owns property individually and wishes to add his wife to the title, effectively making them co-owners. This deed guarantees that the husband transfers his interest in the property to himself and his wife jointly with the promise that he has not encumbered the property other than as known by the wife.

Step-by-Step Guide to Processing a Grant Deed from Husband to Himself and Wife

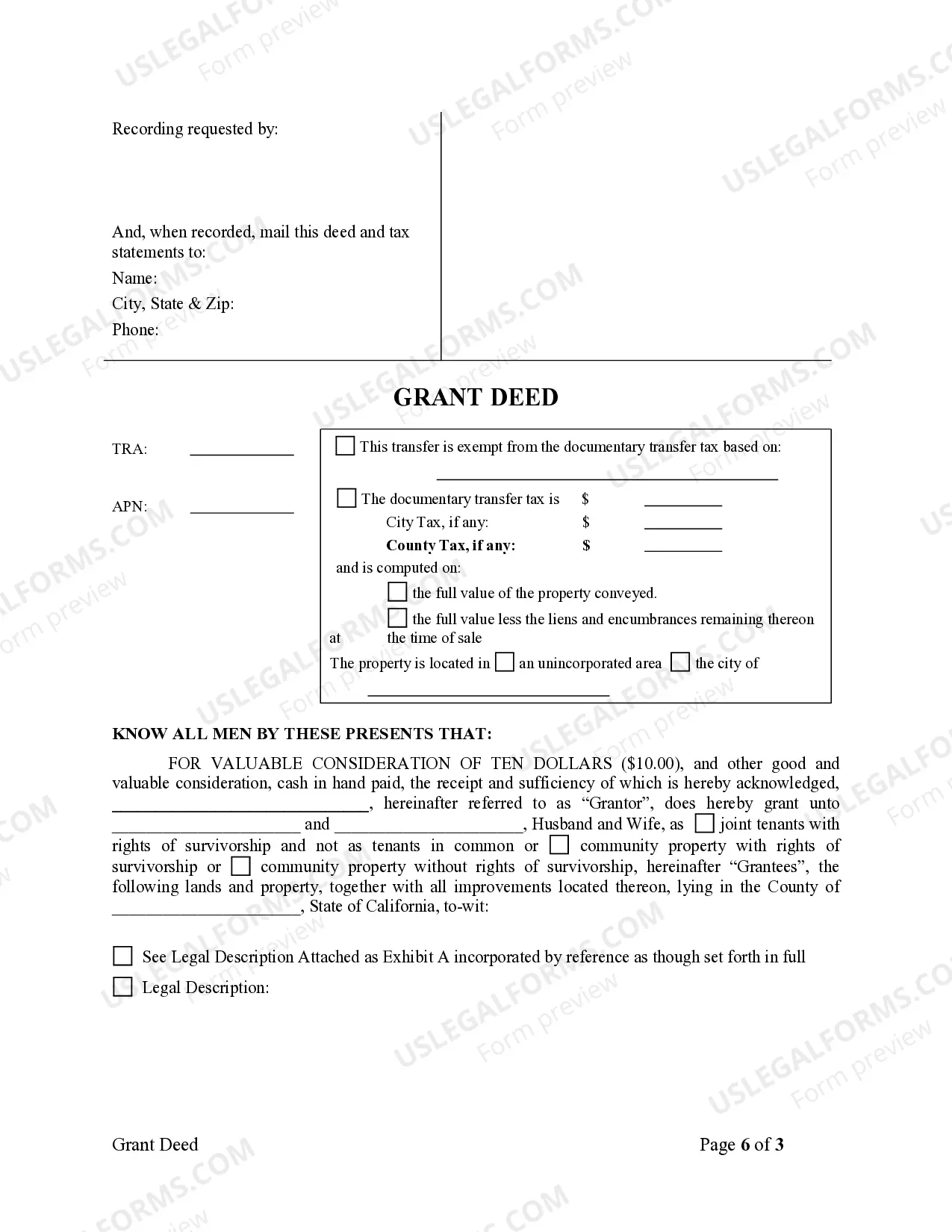

- Preparation of the Deed: Start by drafting the grant deed. This document should include the legal description of the property, and clearly list the husband as the grantor and both the husband and wife as the grantees.

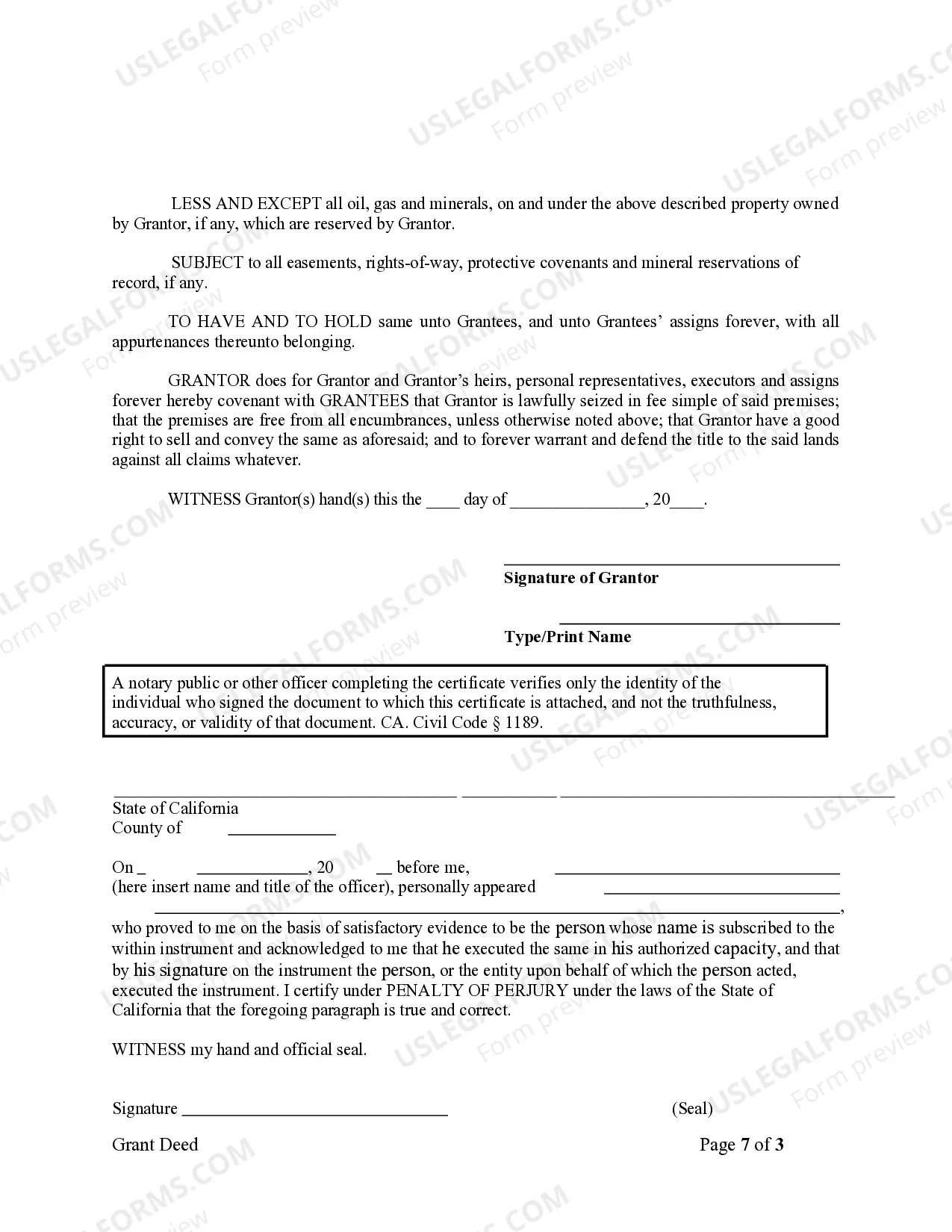

- Signatures: The deed must be signed by the grantor in the presence of a notary public to make it legally binding.

- Recording the Deed: Once signed, the grant deed should be filed with the county recorder's office in the county where the property is located. This makes the transfer public record, providing legal notice to others regarding the updated ownership status.

- Verify Transfer: After the deed is recorded, verify the details are accurately represented in the public records to ensure legal recognition of the property's joint ownership.

Risk Analysis of Transferring Property Through a Grant Deed

- Incorrect Legal Descriptions: An improperly described property can lead to disputes over ownership or problems in future sales.

- Failure to Record: If the deed is not recorded, subsequent transactions may not have legal precedence, which can complicate future title clarity.

- Potential for Fraud: Proper verification processes need to be in place as there is a risk of fraud, especially in not verifying the identity of the parties signing the deed.

Best Practices in Handling a Grant Deed Transfer

- Legal Consultation: Always consult with a lawyer to ensure that all aspects of the deed transfer are legally compliant and accurately reflect the intentions of the grantor and grantee.

- Detailed Record Keeping: Maintain accurate and detailed copies of the grant deed and any related documents for both personal records and potential future legal needs.

- Accuracy is Key: Double-check all entries on the grant deed, including spelling of names and the legal description of the property, to prevent any future legal issues.

Common Mistakes & How to Avoid Them

- Failing to Use a Notary: Skipping this step can render the deed unenforceable. Always ensure the grant deed is properly notarized.

- Not Checking for Encumbrances: Ensure that the title is checked for encumbrances prior to transferring the property to avoid disputes.

- Neglecting to Record the Deed: Filing the deed with the county recorders office is crucial for making the transfer official and public.

How to fill out California Grant Deed From Husband To Himself And Wife?

Amidst countless paid and complimentary templates available online, you cannot guarantee their precision.

For instance, who created them or whether they possess the necessary qualifications to handle your requirements.

Always remain calm and utilize US Legal Forms!

If this is your first time using our service, follow these steps to quickly retrieve your California Grant Deed from Husband to Himself and Wife.

- Find California Grant Deed from Husband to Himself and Wife templates crafted by skilled legal professionals.

- Avoid the costly and time-consuming task of searching for a lawyer.

- Subsequently, you won’t have to pay them to draft a document for you that you can easily obtain on your own.

- If you already hold a subscription, Log In to access your account.

- Locate the Download button next to the file you are looking for.

- You will also have access to all your previously saved templates in the My documents section.

Form popularity

FAQ

To change a grant deed in California, you need to fill out a new grant deed form reflecting the changes. If you are using a California Grant Deed from Husband to Himself and Wife, this form can be efficiently utilized for modifications. After preparing the new deed, sign it in front of a notary, and file it with the county recorder's office. Ensure you meet all local requirements for a smooth transition.

Yes, a grant deed serves as proof of ownership in California. When you use a California Grant Deed from Husband to Himself and Wife, it legally confirms the ownership transfer of real property. However, while a grant deed provides evidence of ownership, it is also advisable to confirm against the county records for full assurance. Recording the grant deed solidifies your legal standing.

To remove someone from a grant deed in California, you typically need to prepare a new grant deed that transfers the ownership interest of the person you wish to remove. Using a California Grant Deed from Husband to Himself and Wife can effectively facilitate this process. After drafting the new grant deed, ensure it is signed, notarized, and recorded with your local county office. This ensures that the public record accurately reflects the current ownership.

To transfer property in California using a California Grant Deed from Husband to Himself and Wife, you will need to prepare the grant deed form. Ensure that it clearly states the names of both the grantor and grantee. After completing the form, you must sign it in front of a notary public and record it with the county recorder's office. This process legally documents the change of ownership.

To transfer a grant deed in California, you must complete a California Grant Deed from Husband to Himself and Wife and file it with the appropriate county recorder's office. First, gather the necessary information about the property and the parties involved. After preparing the deed, you should sign it in front of a notary public, then record it officially. Utilizing services from USLegalForms can provide you with the necessary templates and guidance for a seamless transfer.

Adding a spouse to a deed is relatively straightforward, especially when you use a California Grant Deed from Husband to Himself and Wife. You typically need to prepare a new deed that includes both spouses' names and file it with the county recorder. While it can be done without legal help, using a platform like USLegalForms can simplify the process and ensure that everything meets California's requirements. This way, you can complete the transfer smoothly.

To add your spouse to the grant deed in California, you will need to create a new grant deed that includes both names. This can be accomplished by filling out the deed with the appropriate legal information and indicating the type of ownership, such as joint tenancy. Again, platforms like UsLegalForms can assist you in obtaining the correct forms and procedures for adding your spouse to the deed.

While the process for transferring property after death may vary from place to place, it generally involves legal documentation to establish ownership rights. However, this specific scenario typically requires the creation of a will or trust before death. If you need help navigating property transfers, consider relying on online resources for creating legal forms that fit your specific needs.

Filling out a California grant deed requires specific information about the property, including its legal description and the names of the owners. Ensure that you include details such as the date of transfer and the type of ownership being established. Using a platform like UsLegalForms can simplify this process, providing templates and guidance tailored to creating a California grant deed from husband to himself and wife.

Transferring ownership typically involves completing a California grant deed from husband to himself and wife. You will need to fill out the deed with details about the property and the parties involved. Once completed, the document must be signed, notarized, and then filed with the county recorder to finalize the transfer.