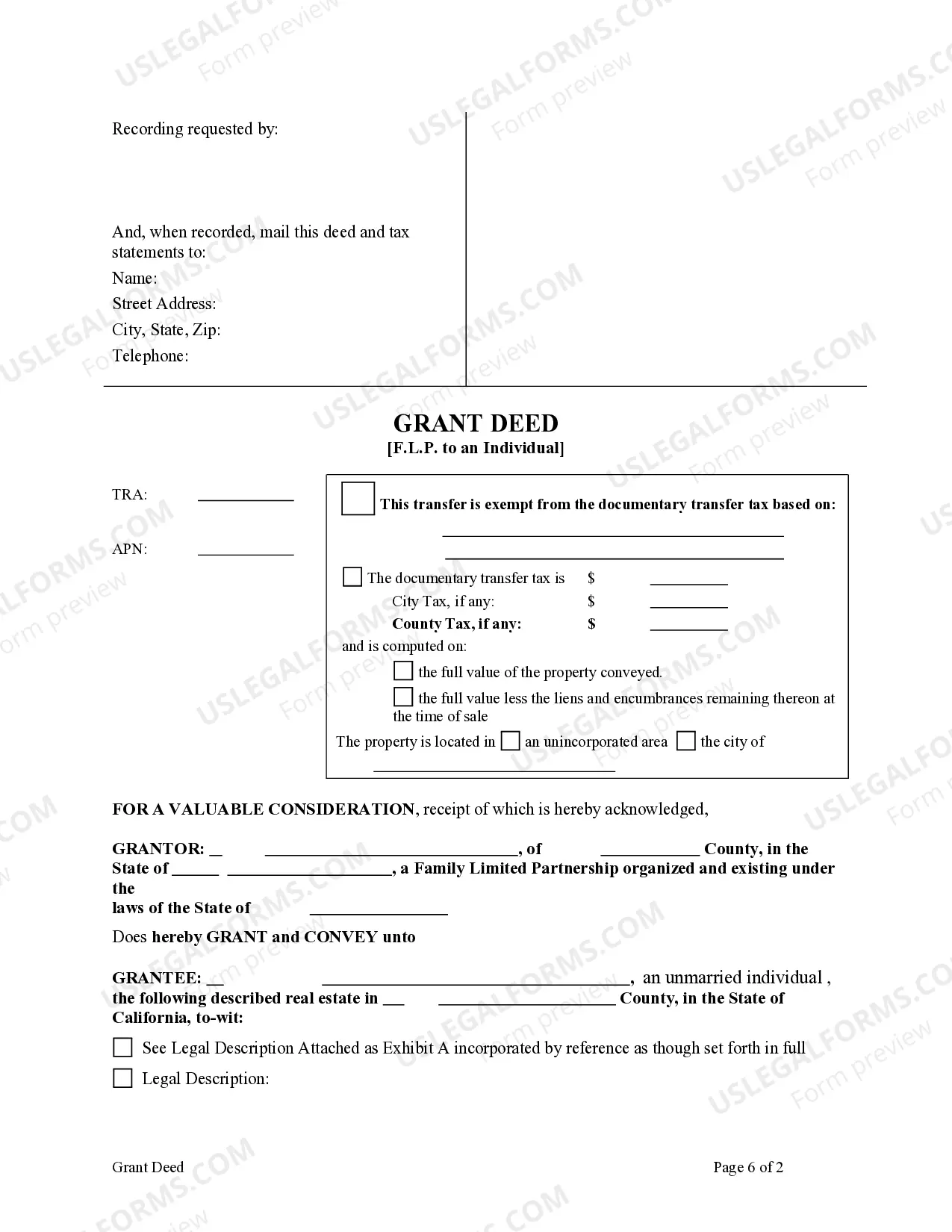

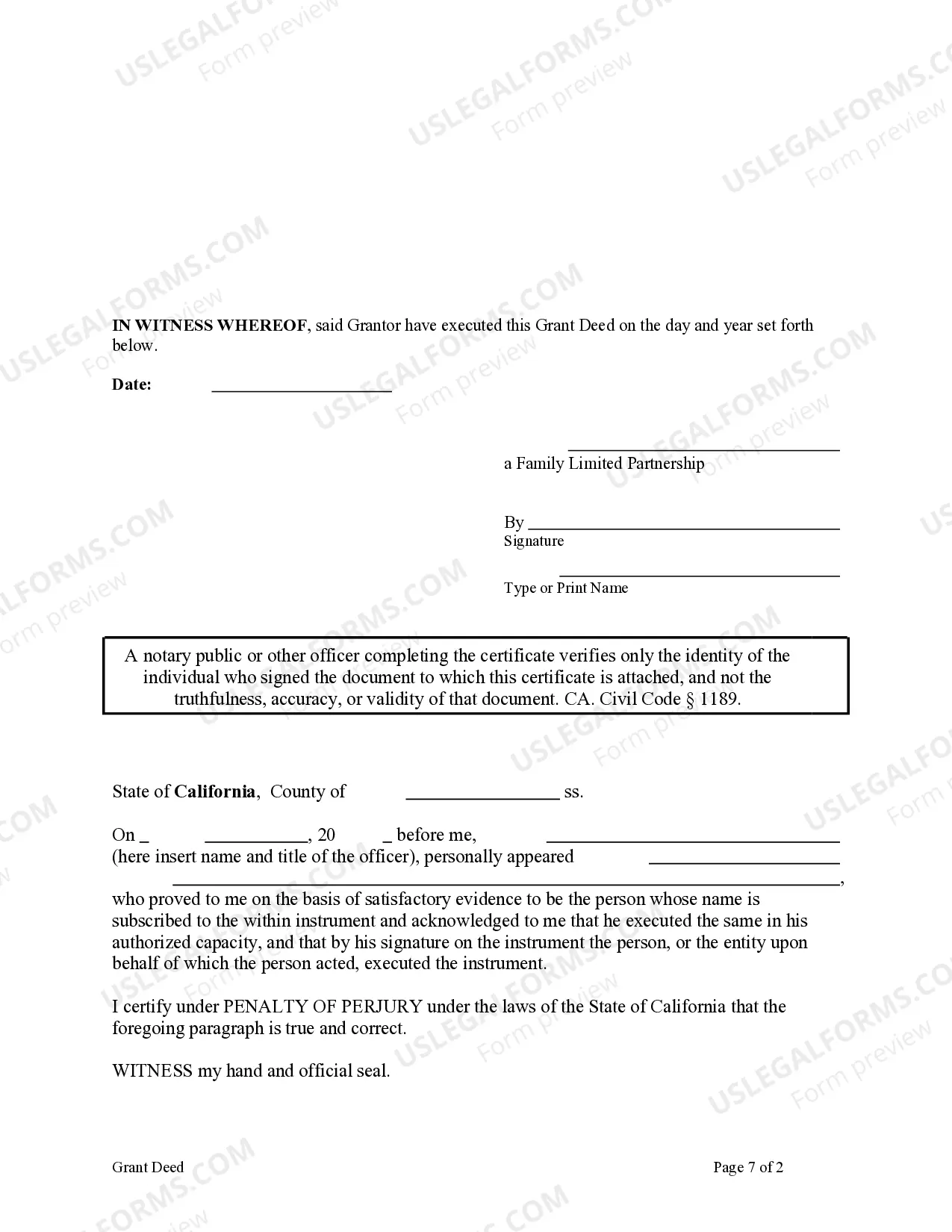

This form is a Grant Deed where the Grantor is a Family Limited Partnership and the

Grantee an individual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

California Grant Deed from Family Limited Partnership to an Individual.

Description

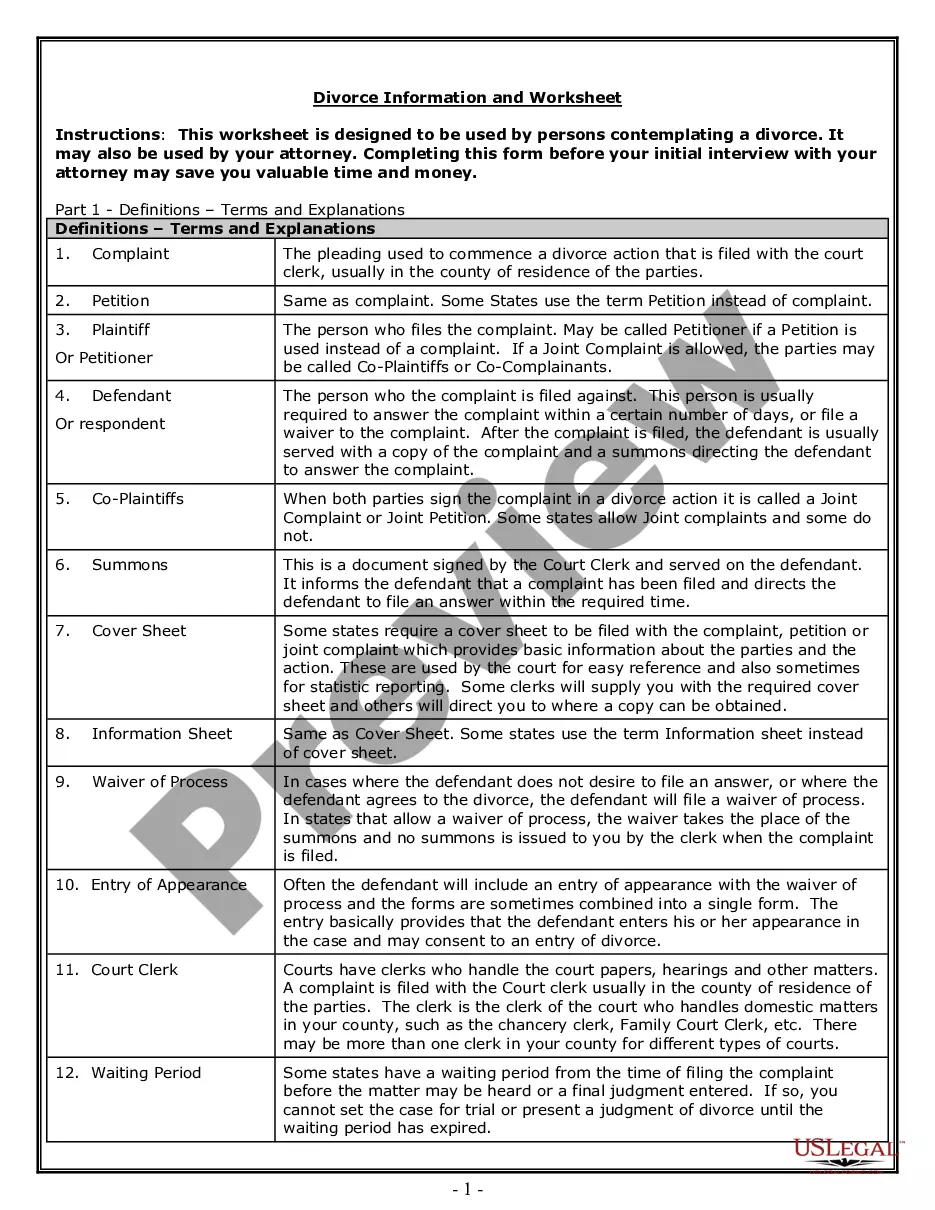

How to fill out California Grant Deed From Family Limited Partnership To An Individual.?

If you are looking for precise California Grant Deed from Family Limited Partnership to an Individual templates, US Legal Forms is precisely what you require; acquire documents created and verified by state-authorized attorneys.

Utilizing US Legal Forms not only shields you from the hassles of legal documents; you also save time, effort, and money! Downloading, printing, and filling out a professional document is significantly cheaper than requesting legal advice to handle it for you.

And there you go; with a few simple steps, you receive an editable California Grant Deed from Family Limited Partnership to an Individual. When you create an account, all future orders will be processed even more effortlessly. Once you have a US Legal Forms subscription, simply Log In to your account and click the Download button available on the form's page. Then, whenever you need to use this blank again, you'll always be able to find it in the My documents section. Don't waste your time and effort searching through numerous forms on various websites. Obtain authentic copies from a single secure platform!

- To begin, complete your sign-up process by providing your email and creating a password.

- Follow the instructions below to set up an account and locate the California Grant Deed from Family Limited Partnership to an Individual template to address your needs.

- Utilize the Preview option or review the document description (if available) to confirm that the template is what you need.

- Verify its legality in your state.

- Click Buy Now to place an order.

- Select a suggested pricing plan.

- Establish an account and pay with your credit card or PayPal.

- Choose a preferable file format and save the document.

Form popularity

FAQ

Transferring property from an LLC to an individual involves several steps. First, you need to draft a California Grant Deed from Family Limited Partnership to an Individual, which clearly outlines the transfer. This deed should be signed and notarized to ensure its validity. Finally, file the deed with the county recorder's office to formalize the property transfer and update public records.

Filling out a California grant deed requires careful attention to detail. First, you need to identify the grantor, which is the Family Limited Partnership, and the grantee, the individual receiving the property. Clearly describe the property being transferred, including its legal description and address. Using platforms like USLegalForms can guide you through the process, ensuring that your California Grant Deed from Family Limited Partnership to an Individual is completed accurately and efficiently.

To change a grant deed in California, you must prepare a new grant deed that reflects the changes you intend to make. This document needs to be signed by the current owner and notarized. Once completed, file the new deed with the county recorder's office. If you need assistance with creating a new California Grant Deed from Family Limited Partnership to an Individual, consider using US Legal Forms for easy access to the necessary resources.

Yes, a grant deed serves as proof of ownership in California. This legal document verifies that the grantor has the right to transfer the property. It contains the details of the property and the parties involved in the transaction. For those dealing with a California Grant Deed from Family Limited Partnership to an Individual, it is crucial to properly execute and record the deed to establish ownership.

To transfer property from one person to another in California, you need to execute a grant deed. This document clearly states the transfer of ownership. When transferring property from a Family Limited Partnership to an individual, ensure you meet all legal requirements. Using a platform like US Legal Forms can help you create a compliant California Grant Deed from Family Limited Partnership to an Individual.

The most common method to transfer ownership is through a deed, such as the California Grant Deed from Family Limited Partnership to an Individual. This method allows for a clear and legally recognized transfer of property. It’s always wise to keep proper records and consult legal resources to ensure compliance with local laws.

The best way to leave property to a family member is to create a clear legal document, such as a California Grant Deed from Family Limited Partnership to an Individual, during your lifetime. This has the added advantage of avoiding probate, which can delay the transfer. Working with a qualified expert ensures that your wishes are respected and executed correctly.

Transferring a grant deed in California generally involves drafting the deed, signing it, and then recording it with the county recorder’s office. Using a California Grant Deed from Family Limited Partnership to an Individual makes this process straightforward. It's beneficial to follow local requirements closely to avoid any future issues regarding ownership.

Yes, an LLC can gift property to an individual, typically through a formal deed like the California Grant Deed from Family Limited Partnership to an Individual. However, it is crucial to consult with a legal advisor to understand any tax consequences that may arise from the gift. Proper documentation ensures that the transfer is legally binding and clear.

To transfer property within a family, a California Grant Deed from Family Limited Partnership to an Individual is a preferred method due to its clarity and legal recognition. This deed helps establish ownership while protecting the rights of both the giver and recipient. It creates a transparent record of the property’s new ownership, which can simplify future transactions.