Use this form to file a declared homestead as a married couple at the County Recorder's Office in the county where the property is located.

California Homestead Declaration for Husband and Wife

Description California Homestead Actually

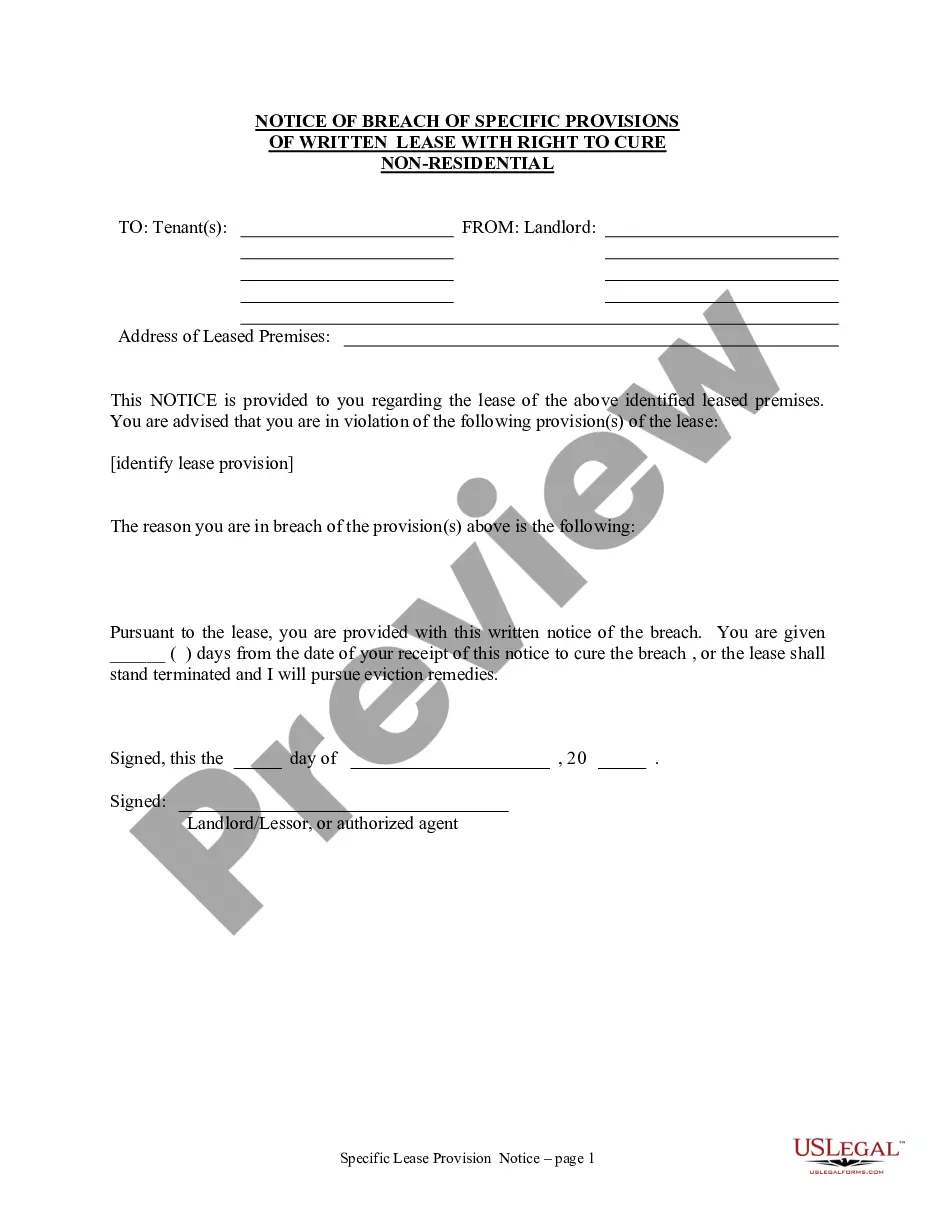

How to fill out California Homestead Form Download?

If you're looking for the accurate California Homestead Declaration for Married Couples templates, US Legal Forms is what you require; find documents provided and reviewed by state-licensed legal experts.

Utilizing US Legal Forms not only saves you from hassles related to legal paperwork; you also save time, effort, and money! Downloading, printing, and filling out a professional form is notably less costly than asking a lawyer to draft it for you.

And that’s all. In just a few simple clicks, you’ll have an editable California Homestead Declaration for Married Couples. Once you create an account, all future purchases will be processed even more efficiently. After obtaining a US Legal Forms subscription, just Log In/">Log In and click the Download button you’ll find on the form’s page. Then, when you need to use this form again, you can always find it in the My documents section. Don’t waste your time and effort comparing countless forms on various platforms. Acquire precise templates from a single reliable service!

- To begin, complete your registration process by entering your email and creating a password.

- Follow the guidelines below to set up an account and find the California Homestead Declaration for Married Couples template to meet your requirements.

- Use the Preview option or check the document description (if available) to confirm that the template fits your needs.

- Verify its legality in your residing state.

- Click Buy Now to place your order.

- Select a recommended pricing plan.

- Create an account and make a payment using a credit card or PayPal.

Homestead Declaration Form Form popularity

California Homestead Form Pdf Other Form Names

California Homestead Declaration FAQ

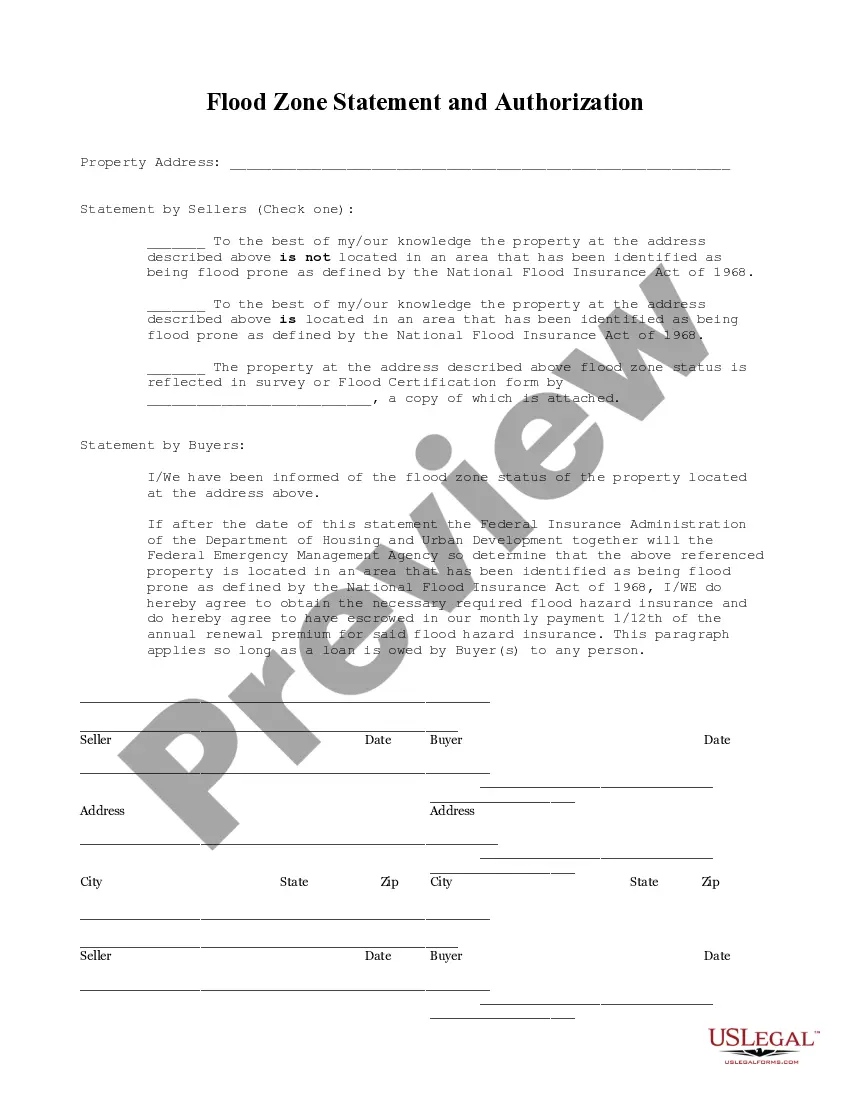

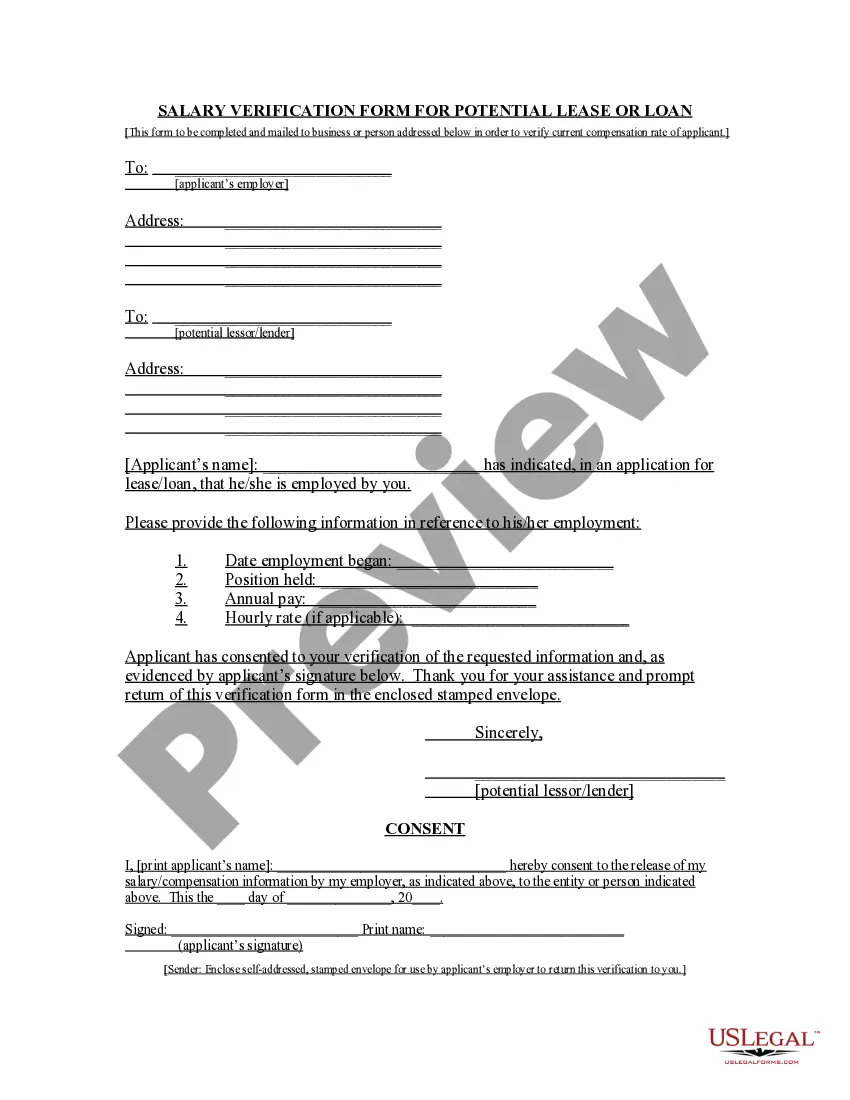

Filing a California Homestead Declaration for Husband and Wife involves a few straightforward steps. First, complete the homestead declaration form, which you can find on legal websites like US Legal Forms. After filling out the form correctly, submit it to your local county recorder's office, either in person or via mail. This ensures your property receives the legal protections intended under California law.

No, the California Homestead Declaration for Husband and Wife is not automatic. You must actively file a declaration to receive homestead protection. Without filing, your home may not qualify for the protections against creditors. It is an important step for married couples to prioritize their home's security.

To file a California Homestead Declaration for Husband and Wife, you need to complete the required form. First, obtain the form from your local county recorder's office or download it from a reliable source like US Legal Forms. Next, fill it out with necessary details and submit it in person or by mail to your county recorder. Ensure that both spouses sign the declaration for it to be valid.

Filing a California Homestead Declaration for Husband and Wife is not automatic; you must submit the required form to your local county recorder. Once this declaration is filed, it provides legal acknowledgment of your homestead rights. This proactive step is essential to protect your home against certain types of creditors. For detailed guidance, UsLegalForms provides tools to ensure your filing is accurate and timely.

The California Homestead Declaration for Husband and Wife does not directly lower your property taxes. Instead, it offers protection against creditors and helps ensure that a portion of your home's equity remains safe. This means that while your property tax rate remains unchanged, the homestead exemption allows you to safeguard your assets effectively. If you need assistance, UsLegalForms offers resources to navigate the homestead declaration process.

Starting a homestead in California involves a few straightforward steps. First, ensure your property qualifies as a primary residence. Then, complete and file the California Homestead Declaration for Husband and Wife, which establishes your homestead rights. If you need assistance, platforms like USLegalForms can guide you through the process, making it easier to protect your home.

The new homestead exemption in California offers increased protection for homeowners facing debt collection. As of recent legislation, the exemption allows for a larger portion of your home's value to be shielded from creditors. Filing a California Homestead Declaration for Husband and Wife helps couples access these protections effectively and secure their home.

To establish a homestead in California, several requirements must be met. First, the property must be your primary residence, and you must be an owner or spouse on title. Additionally, filing a California Homestead Declaration for Husband and Wife is necessary to ensure your homestead rights are protected under state law.

A homestead specifically refers to a property that receives legal protection under California law, while a home is simply a place where someone lives. The distinction lies in the legal rights and benefits afforded to a homestead homeowner. By filing a California Homestead Declaration for Husband and Wife, couples can secure their residence from unwanted claims.

In California, a homestead qualifies as a primary residence that fulfills specific criteria under state law. To qualify, the home must be owned by you or your spouse, and it should serve as your main dwelling. Additionally, you must file a California Homestead Declaration for Husband and Wife to protect your home from certain creditors.