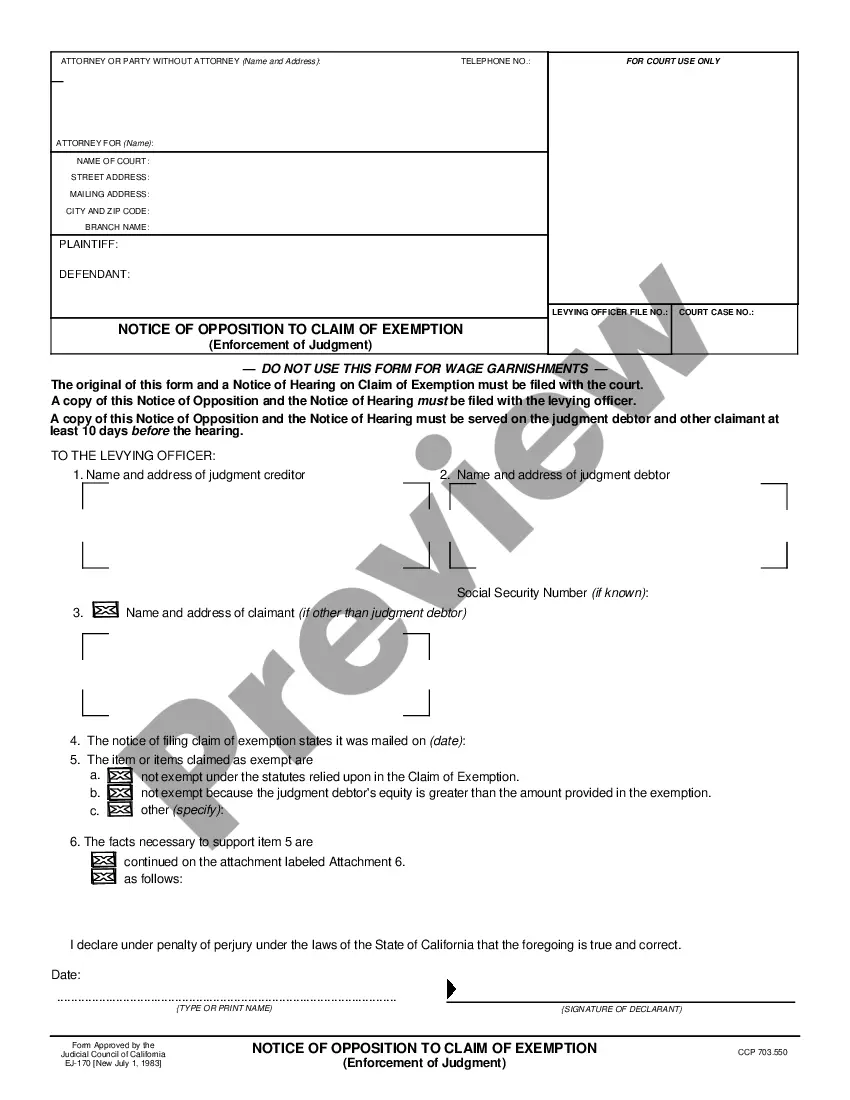

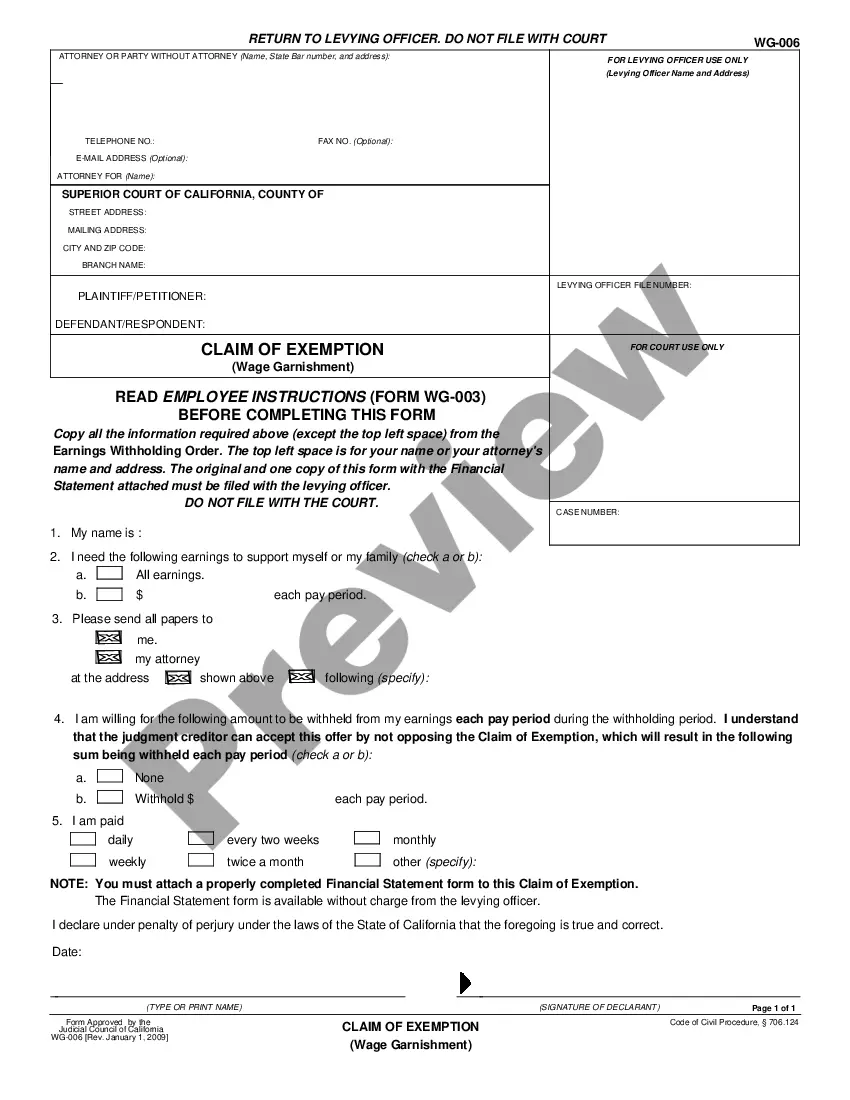

Claim of Exemption: A Claim of Exemption lists certain property, or monies, which one claims are exempt from levying. The Claimant must state statutory reasons as to why the property is exempt. This form is not to be filed with the court, but only with the Levying Officer.

California Claim of Exemption

Description

Understanding Claim of Exemption

Claim of exemption is a legal declaration made by a debtor stating that certain property or income is exempt from debt collection, often linked to wage garnishment imposed by a judgment creditor.

Steps to File a Claim of Exemption

- Identify which money property or wages are exempt under state or federal law.

- Obtain and complete the appropriate claim exemption forms from your local court or the enforcing agency, like the sheriff constable office.

- File the claim with the court and notify the debt collector or judgment creditor.

- Attend a hearing if the creditor challenges your claim.

- Wait for the court’s tentative ruling to determine the outcome.

Risk Analysis for Not Filing a Claim

Failing to file a claim of exemption can result in continued wage garnishment, where judgment creditors can legally claim up to a certain percentage of your disposable earnings, leading to financial distress.

Comparison of Exemption Laws in Different States

| State | Exemption Wage | Property |

|---|---|---|

| California | 75% of wages | Personal belongings, $3000 value |

| Florida | Head of family wages 100% exempt | Homestead |

| New York | 90% of wages | $1000 personal property |

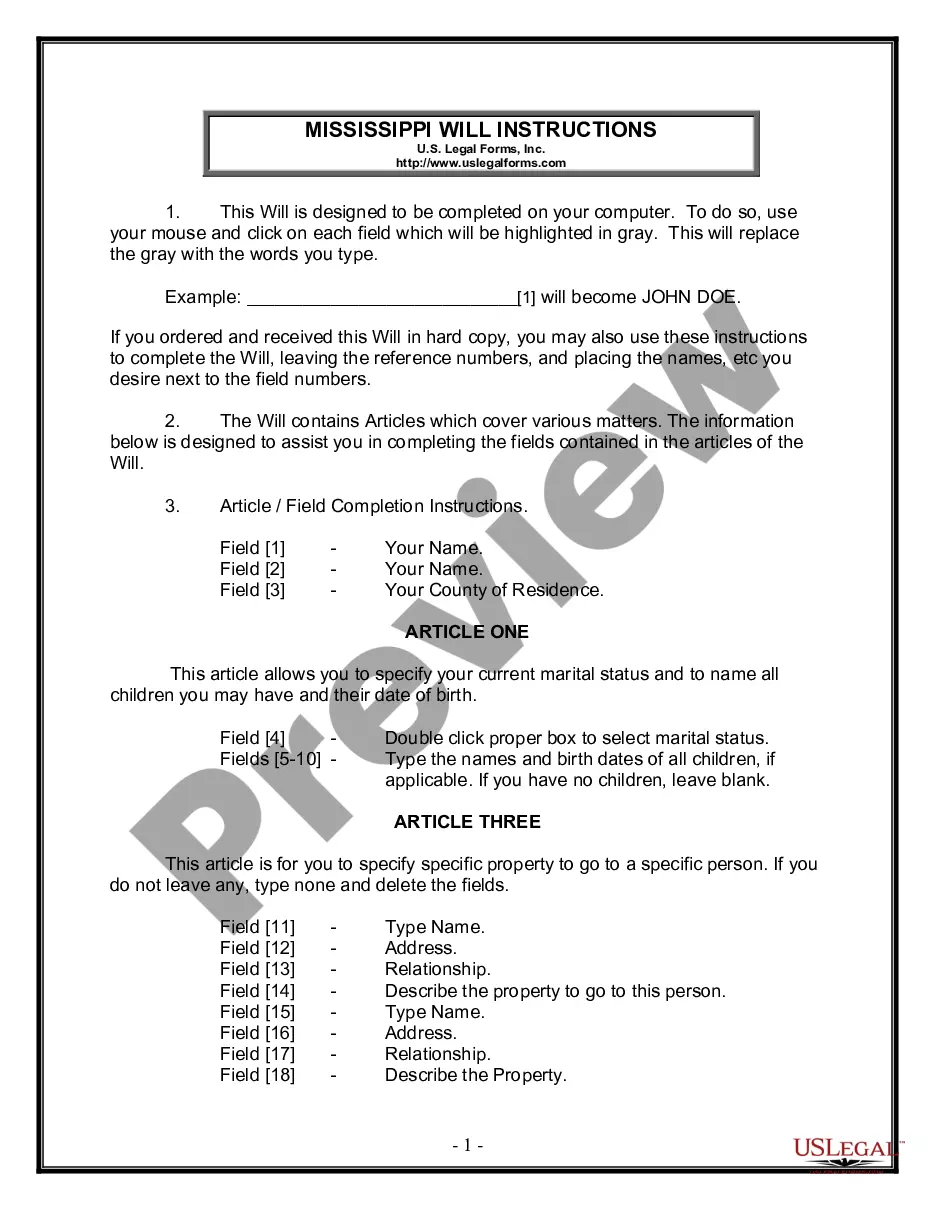

How to fill out California Claim Of Exemption?

If you're looking for accurate California Claim of Exemption templates, US Legal Forms is what you seek; acquire documents crafted and reviewed by state-approved legal professionals.

Using US Legal Forms not only spares you from concerns about official forms; furthermore, you save time, effort, and money! Downloading, printing, and completing a professional template is considerably less expensive than hiring an attorney to do it for you.

And there you go! In just a few simple steps, you obtain an editable California Claim of Exemption. Once you create your account, any future requests will be processed even more easily. After subscribing to US Legal Forms, simply Log In to your account and click the Download button you see on the form's page. Then, whenever you need to access this template again, you'll always be able to find it in the My documents section. Don't waste your time searching through multiple websites for different forms. Purchase professional documents from a single trusted source!

- Start by completing your registration process by entering your email and creating a secure password.

- Follow the instructions provided below to establish your account and locate the California Claim of Exemption template to address your situation.

- Utilize the Preview feature or review the file description (if available) to confirm that the template meets your needs.

- Verify its validity in your residing state.

- Click on Buy Now to place an order.

- Select a preferred pricing plan.

- Create your account and pay using your credit card or PayPal.

- Choose a convenient format and save the document.

Form popularity

FAQ

To qualify for a California Claim of Exemption, the property must meet two essential conditions: first, it must be owned by a qualified entity or individual, and second, it must be used exclusively for fulfilling exempt purposes. If either of these criteria is not met, the exemption could be denied. Understanding these key conditions can significantly improve your chances of a successful claim. For personalized guidance, consider turning to resources like USLegalForms.

In California, a tax exemption qualifies when the property is used exclusively for exempt purposes, such as religious, educational, or charitable activities. Additionally, properties owned and utilized by non-profit organizations often fall under this exemption category. To succeed in claiming this exemption, it's important to comply with all regulations and guidelines set forth by the state. Utilizing platforms like USLegalForms can streamline this process for you.

When determining whether a property is exempt or nonexempt in California, the three key factors include ownership, use of the property, and whether the property serves a charitable purpose. The property must be owned by the qualifying entity and utilized accordingly. By understanding these factors, you can better assess your eligibility for a California Claim of Exemption. Consulting legal resources can provide further assistance.

To file a property tax exemption in California, you need to submit a California Claim of Exemption form to your local county assessor’s office. This form collects information about your property and your eligibility for the exemption. Make sure to provide accurate details and any required documentation to support your claim. The process can be simplified using services like USLegalForms, which help guide you in completing the necessary forms correctly.

In California, the processing time for a California Claim of Exemption typically varies based on the specific county and the volume of claims being processed. Generally, you can expect your claim to be reviewed within a few weeks to a couple of months. However, if additional information is required, this may extend the timeframe. Keeping track of your submission status ensures you remain informed throughout the process.

The conditions for exemption in California often revolve around income levels, types of income, and specific personal circumstances such as being a head of household or facing financial hardship. Generally, certain amounts of wages, pensions, and public benefits can qualify for exemptions from collections. It is crucial to understand these conditions to ensure that you submit a valid claim of exemption. The US Legal Forms platform can help you identify whether you meet the criteria and provide necessary paperwork.

To file a claim of exemption in California, you must complete the appropriate forms, such as the claim of exemption or Form EJ 160, and submit them to the court handling your case. Ensure that you provide accurate information regarding your finances and the reasons for your exemption claim. After you file, a hearing may be scheduled where you can present your case. Utilizing US Legal Forms can streamline this process by offering easy-to-follow templates and guidance.

A claim of exemption in California is a legal declaration that allows you to protect certain income or assets from creditor actions. This claim is often invoked in situations such as wage garnishments or bank levies. By filing a California claim of exemption, you ensure that your essential financial resources remain accessible. The US Legal Forms platform can guide you through the forms and requirements necessary for a successful exemption claim.

When you submit a claim of exemption from California withholding, you are stating that your income is below a certain threshold, or you meet specific criteria that allow for exemption. This means you will not have state taxes withheld from your paycheck. It is important to ensure that you qualify for this exemption by understanding the guidelines set by California law. For assistance, you might consider using the US Legal Forms platform to navigate this process effectively.

In California, an exempt employee is typically someone whose role meets certain criteria relating to job duties and salary thresholds. Common exemptions include executive, administrative, and professional categories. To confirm your status, ensure that you meet the specific guidelines surrounding job responsibilities and compensation. If you have questions, resources like USLegalForms can clarify the requirements for exemption.