This is an official California Judicial Council family law form, which may be used in domestic litigation in California. Enter the information as indicated on the form and file with the court as appropriate.

California Order Determining Claim of Exemption or Third-Party Claim Governmental

Description

How to fill out California Order Determining Claim Of Exemption Or Third-Party Claim Governmental?

If you are seeking suitable California Order Determining Claim of Exemption or Third-Party Claim Governmental templates, US Legal Forms is what you require; obtain documents created and verified by state-authorized attorneys.

Using US Legal Forms not only saves you from issues related to legal documentation; additionally, it preserves your time, effort, and money! Downloading, printing, and completing a professional document is significantly less expensive than hiring a lawyer to do it on your behalf.

And that’s it. In just a few simple steps, you will have an editable California Order Determining Claim of Exemption or Third-Party Claim Governmental. Once you create an account, all future orders will be processed even more easily. After subscribing to US Legal Forms, simply Log In to your account and click the Download option available on the form’s page. Then, whenever you need to use this template again, you will always find it in the My documents section. Don't waste your time searching through multiple forms across different platforms. Purchase accurate templates from a single secure source!

- Begin by completing your registration process by providing your email and setting up a secure password.

- Follow the steps below to establish your account and acquire the California Order Determining Claim of Exemption or Third-Party Claim Governmental template to address your situation.

- Utilize the Preview feature or review the file details (if available) to ensure that the form you need is correct.

- Verify its legality in your location.

- Click Buy Now to place an order.

- Select a preferred pricing option.

- Create your account and pay using a credit card or PayPal.

- Choose a convenient file format and save the document.

Form popularity

FAQ

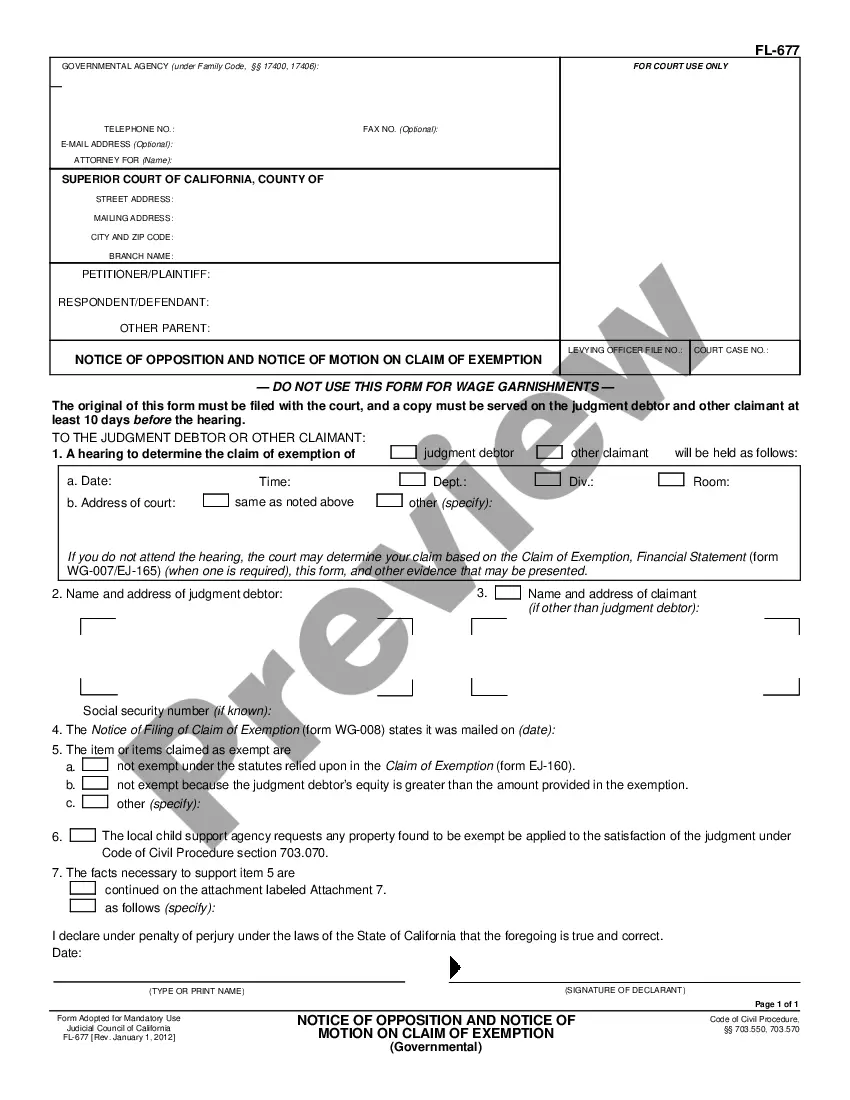

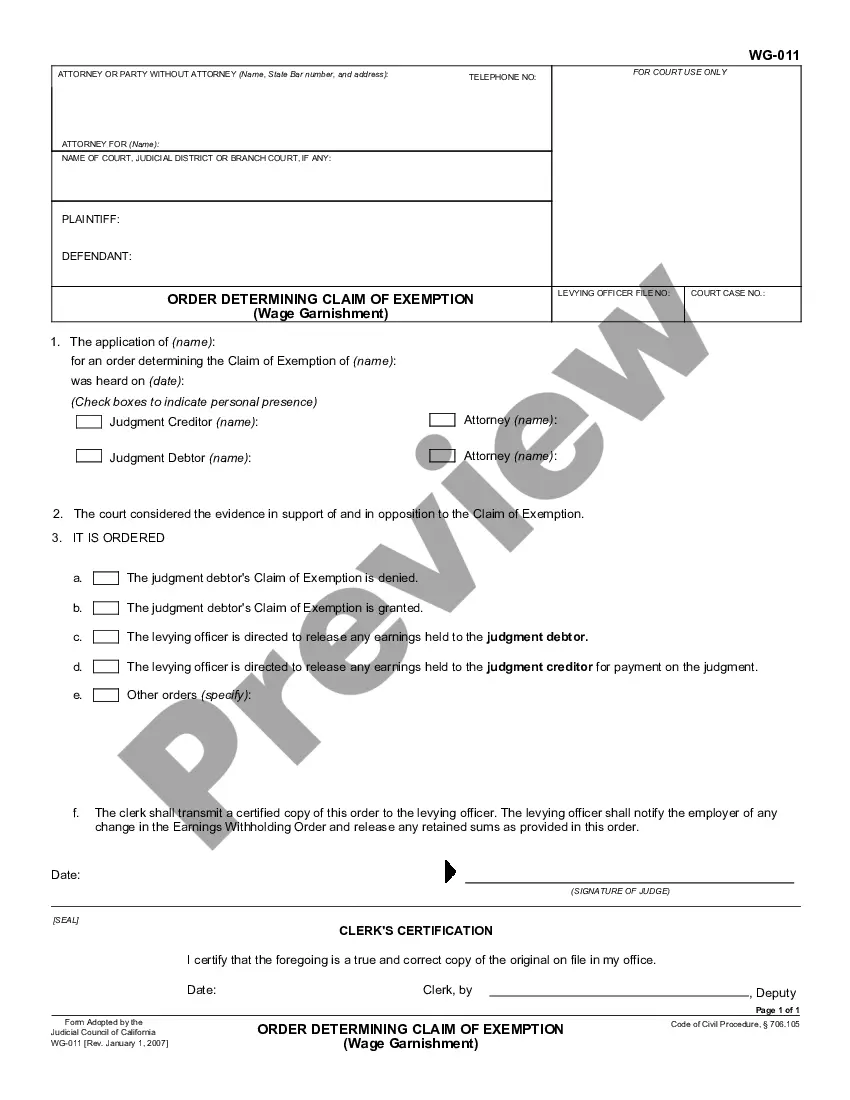

In California, certain types of income are exempt from garnishment, including Social Security benefits, unemployment payments, and specific pension income. Additionally, the law protects a portion of your wages based on your income level. Understanding these exemptions can be crucial when facing financial challenges. If you need help navigating these regulations, a California Order Determining Claim of Exemption or Third-Party Claim Governmental can assist in protecting your rights.

To file a claim of exemption for wage garnishment in California, you must complete and submit the appropriate forms to the court. Start by gathering your financial documents to support your claim. Once you have completed the necessary paperwork, file it with the court and provide a copy to the creditor's attorney. Utilizing resources like US Legal Forms can simplify this process, guiding you through the steps to manage your California Order Determining Claim of Exemption or Third-Party Claim Governmental efficiently.

While quitting your job may seem like a quick solution to evade wage garnishment, it's not advisable. This action can lead to significant financial strain and may not stop the garnishment if a court has already issued an order. Instead, consider filing a California Order Determining Claim of Exemption or Third-Party Claim Governmental, which can showcase your financial hardship and potentially reduce the garnishment amount. Seeking a legal solution is a more strategic approach.

A WG 006 claim of exemption is a legal document used to protect certain income from wage garnishment in California. This form allows individuals to request a court order for determining exemptions that apply to their earnings. It's essential to understand this process if you are facing wage garnishment, as the California Order Determining Claim of Exemption or Third-Party Claim Governmental can provide you relief. By using this form, you can effectively communicate your financial situation to the court.

In California, you should file an opposition to a motion as soon as you receive notice of the motion's hearing date. Typically, there are strict deadlines for filing opposition documents to ensure your response is considered. Specifically, for a California Order Determining Claim of Exemption or Third-Party Claim Governmental, you usually have to file your opposition within a specific time frame outlined by the court rules. Utilizing USLegalForms can help simplify this process by offering the necessary forms and clear instructions.

An opposition to claim of exemption refers to a legal response challenging an individual's claim that their assets are exempt from seizure due to a debt. In the context of a California Order Determining Claim of Exemption or Third-Party Claim Governmental, this can occur when a creditor disputes the exemptions cited by a debtor. It is essential to file an opposition in a timely manner to protect your rights and potentially affect the outcome of the exemption claim. For detailed guidance, consider using USLegalForms, which can provide essential documents and resources.

Rights of exemption allow individuals to safeguard certain income and property from creditors during legal proceedings. Under the California Order Determining Claim of Exemption or Third-Party Claim Governmental, these rights are designed to provide protection and peace of mind. Understanding these rights can empower you to navigate financial difficulties more effectively, ensuring that you have the means to support yourself.

When you claim exemptions, you assert your right to protect specific assets from legal collection actions. This process is guided by the California Order Determining Claim of Exemption or Third-Party Claim Governmental, which outlines what you can exempt. By claiming these exemptions, you can maintain essential financial stability during legal challenges.

Claiming exemptions is a legal right, and typically there is no penalty if you do so accurately and in good faith. However, misrepresentation could lead to legal consequences under the California Order Determining Claim of Exemption or Third-Party Claim Governmental. Always ensure your claims are honest and reflect your true situation to avoid potential issues.

Whether to claim 0 or 1 exemptions ultimately depends on your financial situation. Claiming exemptions can shield a portion of your income or property from claims made by creditors, aligning with the California Order Determining Claim of Exemption or Third-Party Claim Governmental. You should carefully assess your circumstances and consult with a legal expert to determine the best approach.