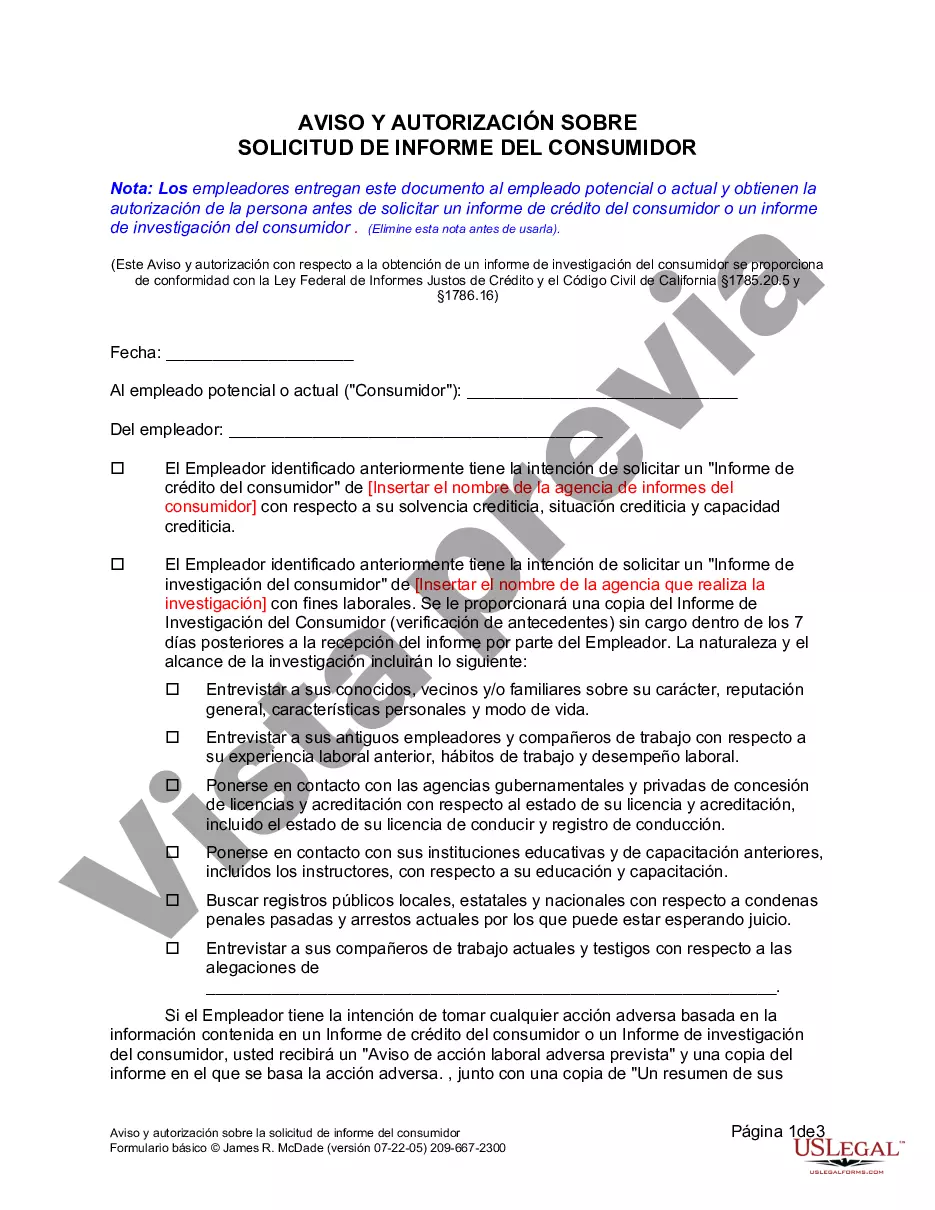

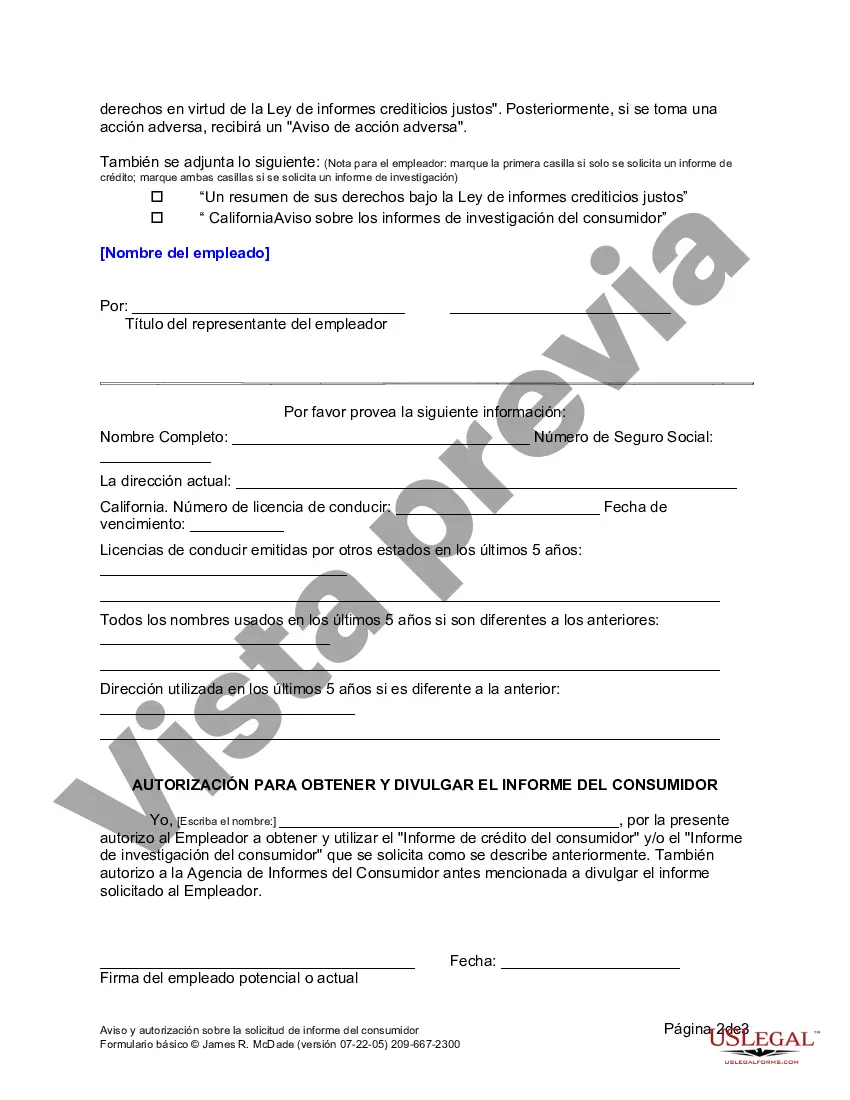

This form is used to obtain permission from an employee or prospective employee prior to the employer requesting a consumer credit report or background investigation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Notificación y Autorización sobre el Informe del Consumidor - California Notice and Authorization Regarding Consumer Report

Description

How to fill out California Aviso Y Autorización Sobre El Informe Del Consumidor?

If you're seeking precise California Notice and Authorization Regarding Consumer Report templates, US Legal Forms is precisely what you require; access documents created and reviewed by state-licensed attorneys.

Using US Legal Forms not only spares you from difficulties related to legal documents; moreover, you save time, effort, and funds! Obtaining, printing, and completing a professional document is significantly less expensive than having a lawyer do it for you.

And that’s it. In just a few simple steps, you possess an editable California Notice and Authorization Regarding Consumer Report. After your account setup, all subsequent transactions will be even more straightforward. When you have a US Legal Forms subscription, simply Log In to your profile and select the Download button available on the form’s page. Then, whenever you need to use this template again, you can always find it in the My documents section. Don't waste your time comparing numerous documents across different websites. Order exact versions from a single reliable source!

- To commence, finalize your registration process by providing your email and creating a secure password.

- Follow the guidelines outlined below to set up your account and acquire the California Notice and Authorization Regarding Consumer Report template to address your needs.

- Utilize the Preview feature or check the document details (if available) to confirm that the template is what you require.

- Verify its validity in your state.

- Click Buy Now to place your order.

- Select a suitable pricing plan.

- Establish an account and pay using your credit card or PayPal.

Form popularity

FAQ

Como conseguir sus informes de crA©dito gratis Una vez al aA±o usted puede solicitar una copia de cada compaA±Aa a travA©s de Annualcreditreport.com (en inglA©s) o llamando al 1-877-322-8228. La ComisiA³n Federal de Comercio ofrece mA¡s informaciA³n sobre estos informes de crA©dito gratis.

¿CA³mo puedo disputar un error en mi informe de crA©dito?Primer paso : Impugne la informaciA³n con la compaA±Aa de informes de crA©dito.En lAnea: www.ai.equifax.com/CreditInvestigation.Por correo: Descargue el formulario de disputa.Por telA©fono: El nAºmero de telA©fono aparece en el informe de crA©dito o al (866) 349-5191.More items...a¢8 Jun 2017

Un chargeback, o disputa, ocurre cuando un cliente contacta a su banco para iniciar una reversion de transacciA³n. En la mayorAa de los casos, el comprador disputa un cargo que no reconoce en el extracto de su tarjeta de crA©dito.

Como lo establece el Articulo 32 de la Ley 288-05, los burA³s de crA©dito podrA¡n conservar la informaciA³n crediticia que le sea proporcionada por los aportantes de datos relativas a los consumidores, durante un plazo de 84 meses contado a partir del pago de la deuda.

Por cada cuenta que desea disputar, debe escribir el nombre del acreedor y el numero de cuenta. Declare la razA³n de la disputa. Puede disputar una cuenta entera si no es suya o si es una cuenta antigua. TambiA©n puede disputar parte de una cuenta, como un pago tardAo o la cantidad de la deuda.

Buenas noticias: para muchas personas el dano ocasionado por las consultas que afectan el puntaje de crA©dito es mAnimo, generalmente le quitan menos de cinco puntos. Una o dos verificaciones de crA©dito no perjudicarA¡n significativamente su crA©dito.

¿CA³mo puede disputar una deuda? Dentro de treinta dAas de haber recibido la notificaciA³n de la deuda por escrito, envAe una carta a la agencia de cobranza disputando la deuda. Puede utilizar esta Carta de Disputa Ejemplar (PDF).

Para conocer tus informaciones crediticias, puedes acudir de manera personal a la Oficina de Prousuario de la Superintendencia de Bancos, y solicitar un reporte gratuito de lo que reposa en la Central de Informacion Financiera de ese Argano Supervisor. SANTO DOMINGO-.

La Comision Nacional para la ProtecciA³n y Defensa de los Usuarios de Servicios Financieros (Condusef) aclara que no existe una forma de limpiar tu BurA³ de CrA©dito que no sea pagando tus deudas o dejando que pasen aA±os, sin embargo, la forma mA¡s rA¡pida y responsable es liquidando.