Title: California Corporate Guaranty — General: A Comprehensive Overview and Types Explained Description: California Corporate Guaranty — General is a legal arrangement that serves as a promise to fulfill financial obligations or debts of a business entity in the state of California. This detailed description sheds light on the key components, benefits, and types of California Corporate Guaranty — General that exist. Keywords: California Corporate Guaranty — General, legal arrangement, financial obligations, debts, business entity, state of California, components, benefits, types 1. Key Components: — A California CorporatGuaranint— - General involves three main parties: a. Guarantor: The entity or individual who guarantees the fulfillment of financial obligations. b. Obliged: The primary business entity that owes the debts or obligations. c. Obliged: The party or lender to whom the payments are owed. — The guarantor assumes the responsibility to pay the debts or fulfill obligations if the primary business entity fails to do so. 2. Benefits and Importance: — Enhances Credibility: A California Corporate Guaranty — General can boost the credibility of a business entity while strengthening its financial position. — Access to Funding: Lenders or creditors may be more willing to provide loans or credit facilities when a corporate guaranty is in place, giving the borrower increased access to funds. — Risk Mitigation: By having a guarantor, potential risks associated with non-payment or default are minimized, providing a safety net to the obliged. — Contractual Obligations: Guaranteeing repayment or fulfillment of contractual obligations creates a secure business environment for both parties involved. 3. Types of California Corporate Guaranty — General: There are several types of California Corporate Guaranty — General. Here are a few commonly encountered examples: — Unconditional Guaranty: The most common form of corporate guaranty, where the guarantor commits to fulfilling the obligations or debts of the business entity without any limitations or conditions. — Conditional Guaranty: In this type, the guarantor only becomes liable to fulfill the obligations if certain pre-agreed conditions, such as default by the obliged, are met. — Limited Guaranty: A restricted form of guaranty where the guarantor's liability is limited to a specific amount or particular obligations, offering a degree of protection against excessive liability. — Continuing Guaranty: This type of guaranty remains in effect until a specific event or trigger releases the guarantor from their obligation. It covers ongoing and future debts. — Joint Guaranty: Multiple guarantors collectively assume responsibility for the obligations, sharing the liability and commitment to fulfill the debts. In conclusion, California Corporate Guaranty — General is a legally binding agreement that offers financial protection to lenders or creditors by ensuring the obligations of a business entity are fulfilled. With various types available, businesses can choose the most suitable guaranty that aligns with their requirements and risk appetite.

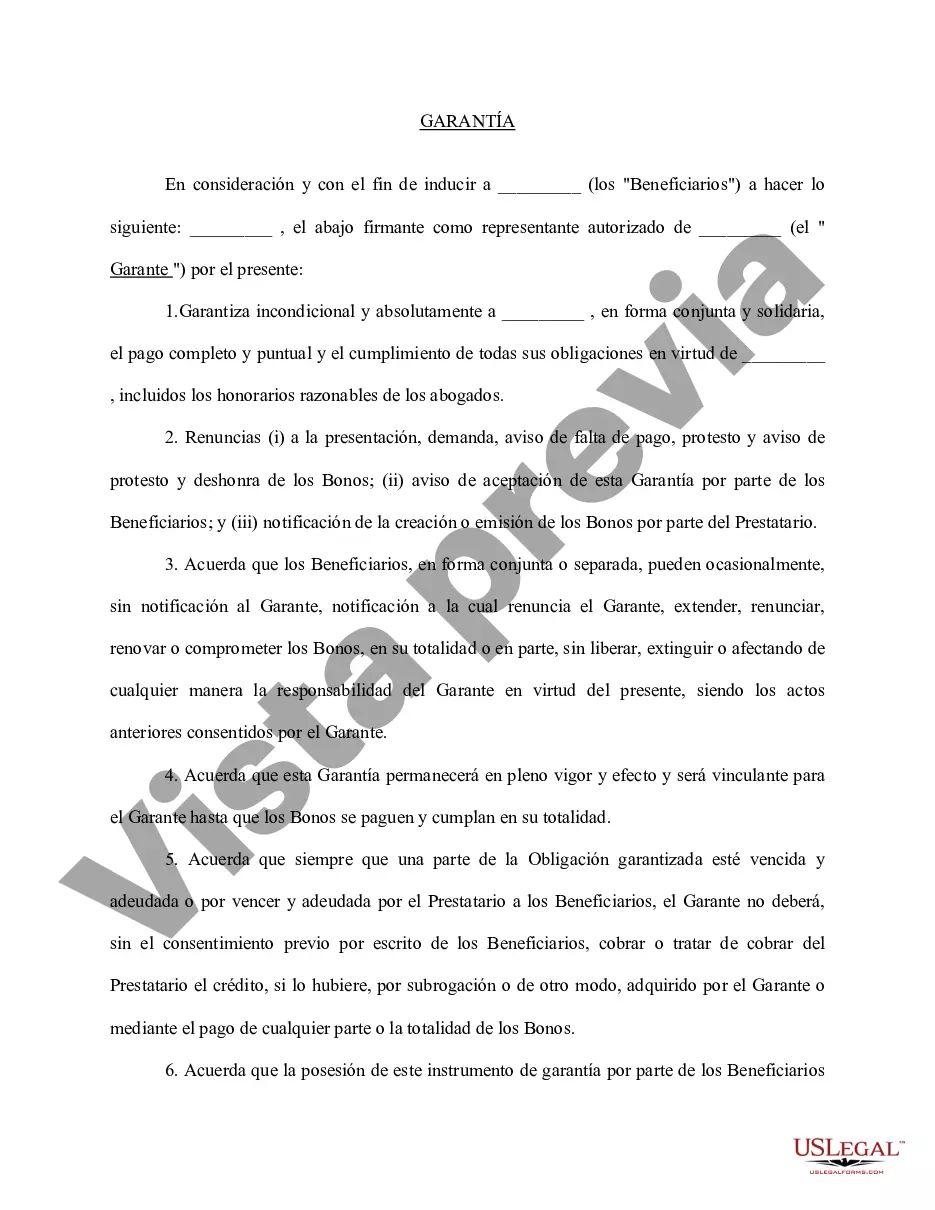

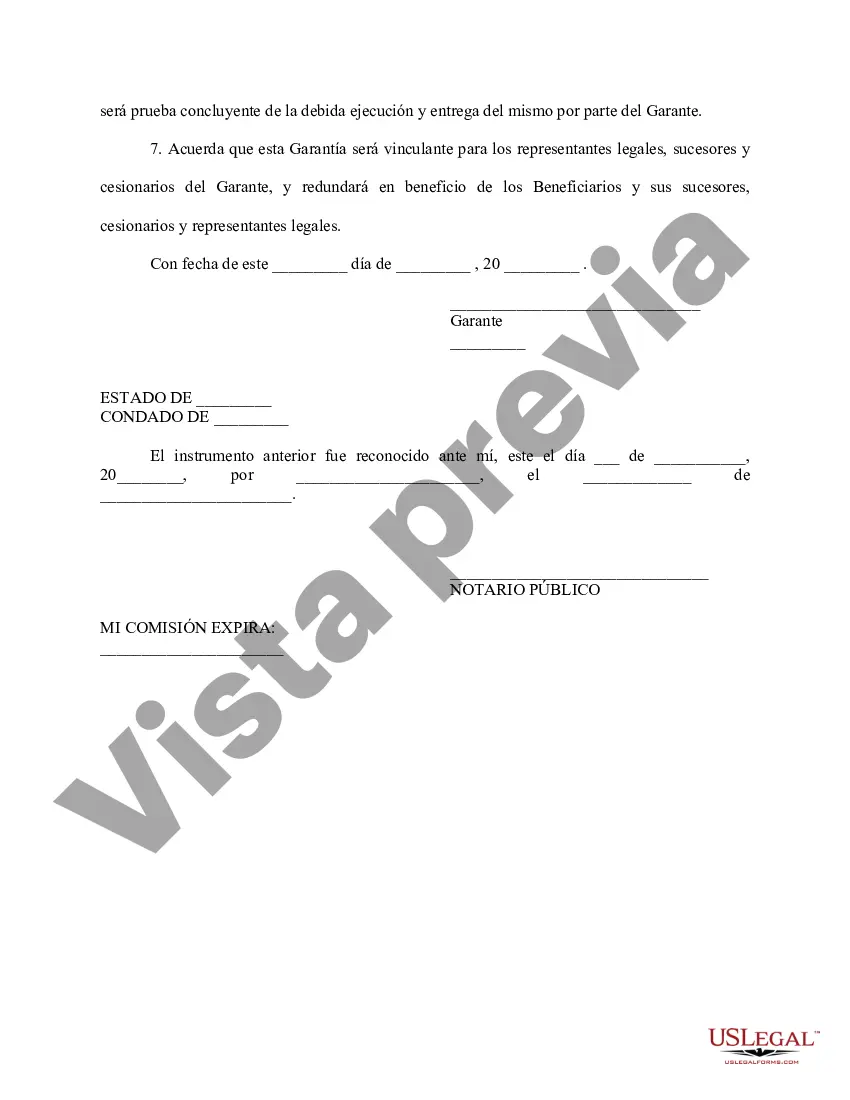

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.California Garantía Corporativa - General - Corporate Guaranty - General

Description

How to fill out California Garantía Corporativa - General?

Are you currently in a situation where you need documents for either business or personal reasons nearly every working day.

There are numerous legitimate document templates accessible online, but locating forms you can trust isn't simple.

US Legal Forms offers thousands of template forms, such as the California Corporate Guaranty - General, which are designed to fulfill federal and state requirements.

Once you find the correct form, click on Get now.

Select the pricing plan you want, fill in the required information to create your account, and purchase your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the California Corporate Guaranty - General template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and make sure it's for the correct city/region.

- Use the Preview option to review the form.

- Read the description to ensure you have selected the appropriate form.

- If the form isn't what you're looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

A guarantee in which a corporation agrees to be held responsible for completing the duties and obligations of a Sponsor, in the event that the Sponsor fails to fulfill the terms of the contract.

The guarantee is a contract by which a natural or legal person guarantees or assures the fulfillment of obligations, assuming the payment a debt of another person if this does not.

When used as a verb, to agree to pay another person's debt or perform another person's duty, if that person fails to come through. As a noun, the written document in which this assurance is made.

A general guaranty is a guaranty that is not addressed to specific person and can be enforced by anyone who acts on it. It is a written undertaking that can be enforced by anyone. General guaranty also covers obligation incurred by the guarantor.

The difference between corporate and personal guarantors is quite simple: a personal guarantor is an individual who agrees to take on the obligations of a debt for a debtor, whereas a corporate guarantor is a corporation that takes on payment responsibilities.

The "guarantor" is the person guarantying the debt while the party who originally incurred the debt is the "principle" and the creditor is the "guaranteed party." Under California law, if properly drafted, a guaranty is a fully enforceable obligation which allows the guaranteed party to proceed directly against the

A personal guarantor is a person agreeing to take over the loan payment or other obligations for the debtor, as outlined in the agreement. A corporation that agrees to take on these obligations is a corporate guarantor.

Types of GuaranteesBid/Tender Guarantee. Issued in support of an exporter's bid to supply goods or services and, if successful, ensures compensation in the event that the contract is not signed.Performance Guarantee.Advance Payment Guarantee.Warranty Guarantee.Retention Guarantee.

Definition of General GuaranteeWritten undertaking (to fulfill an obligation) that can be enforced by anyone, or that covers any obligation incurred by the guarantor.

Interesting Questions

More info

Counselor BIM Business Information Management Analyst Disclaimer This document may contain certain general information as to the subject of this document. It is not, in and of itself, a representation or warranty of any kind as to the accuracy, completeness, or correctness of such information. Such information should be independently verified. Any and all statements and projections contained herein are forward-looking statements. The information contained in this document may contain assumptions, estimates, projections, positions, values, and assumptions which are subject to risk and uncertainty. Actual results may vary materially from those currently anticipated due to numerous factors.