California Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation

Description

Although no definite rule exists for determining whether one is an independent contractor or an employee, certain indicia of the status of an independent contractor are recognized, and the insertion of provisions embodying these indicia in the contract will help to insure that the relationship reflects the intention of the parties. These indicia generally relate to the basic issue of control. The general test of what constitutes an independent contractor relationship involves which party has the right to direct what is to be done, and how and when. Another important test involves the method of payment of the contractor.

How to fill out Agreement Between Physician As Self-Employed Independent Contractor And Professional Corporation?

Have you ever found yourself in a situation where you require documents for business or personal purposes almost all the time.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of template forms, including the California Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, designed to meet federal and state regulations.

Once you find the correct form, click Acquire now.

Choose your payment plan, complete the required information to create your account, and pay for your order using PayPal or credit card. Select a convenient document format and download your copy. You can access all the document templates you have purchased in the My documents list. You can obtain another copy of the California Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation whenever necessary. Just select the desired form to download or print the document template. Use US Legal Forms, the largest collection of legal forms, to save time and avoid errors. The service offers expertly crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the California Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

- Use the Review option to assess the form.

- Check the details to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search box to find the form that meets your needs.

Form popularity

FAQ

Generally, contractors cannot work without a proper license in California. Working without a license may lead to legal issues and can undermine credibility with clients. However, certain professions may have exceptions, but utilizing a California Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation can help ensure all aspects of your status are properly managed.

Yes, freelancers often need a business license in California, depending on their services and location. Researching local regulations is crucial as different cities may have specific requirements. Using a California Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation helps clarify your operations and comply with licensing mandates.

To become an independent contractor in California, you should start by determining your business structure and registering if required. Next, you can draft a California Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation to clarify the relationship with clients. It’s also a good idea to understand tax implications and obtain necessary licenses.

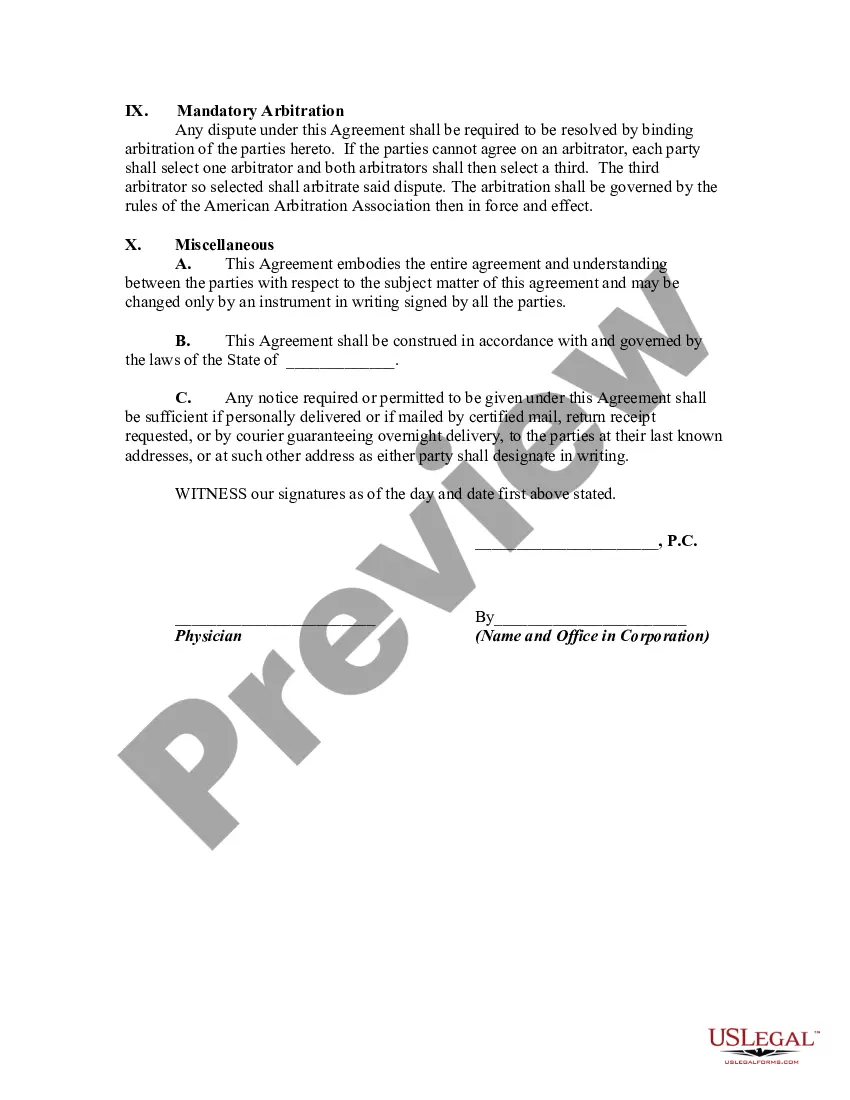

An agreement between a contractor and a company outlines the terms of their working relationship. In the case of a California Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, it dictates the duties, payment terms, and responsibilities of both parties. Such agreements help ensure that both sides understand their rights and obligations.

The main difference between a 1099 and a W-2 revolves around employment status. A 1099 form is for independent contractors, like those working under a California Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, while a W-2 is for employees. This distinction affects taxes, benefits, and overall obligations between parties.

Most likely, you will need a business license to operate as an independent contractor in California. Each city has its own requirements, so checking local regulations is essential. A California Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation can support this process by clarifying your business status.

Yes, a doctor can indeed operate as an independent contractor in California. Through a California Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, physicians can enjoy the benefits of self-employment while maintaining control over their practice. This arrangement allows doctors to work flexibly without being tied to a specific employer.

In California, the classification between an employee and an independent contractor often hinges on the degree of control and independence within the working relationship. The ABC test is widely used, focusing on three criteria to establish classification. For a comprehensive understanding, resources like US Legal can help clarify this distinction, especially when contemplating a California Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation.

To identify an independent contractor, look for key indicators in their work arrangement. These include the ability to set their hours, use their own tools, and provide services to multiple clients. If the nature of the relationship aligns with these traits, it may be beneficial to draft a California Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation to formalize the terms.

In California, an employee is defined primarily based on the level of control an employer has over the worker. Factors include the ability to dictate how work is performed and the degree of supervision provided. Understanding this definition is crucial when establishing a California Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, as it helps clarify your working relationship.