California Agreement and Release for Working at a Novelty Store - Self-Employed

Description

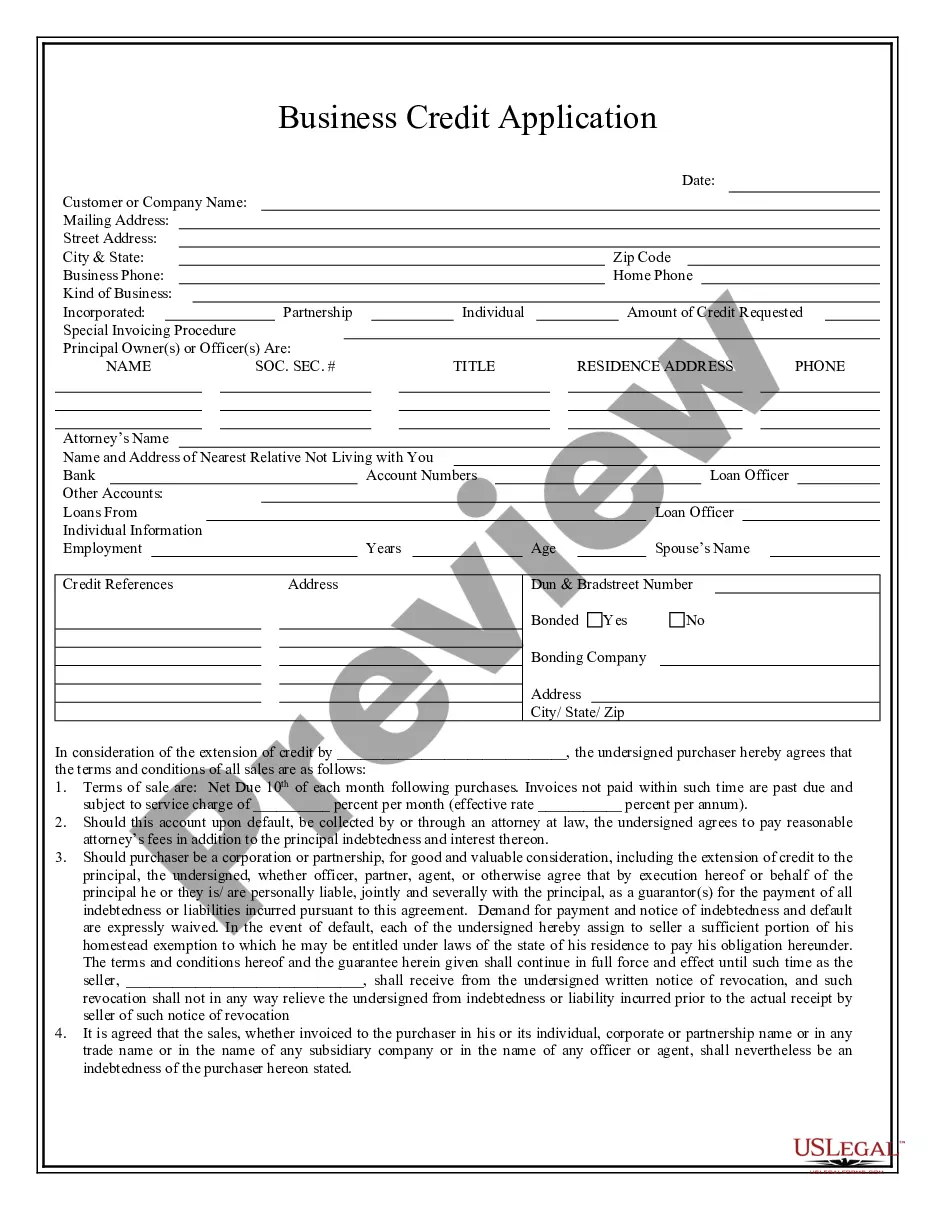

How to fill out Agreement And Release For Working At A Novelty Store - Self-Employed?

Are you in a situation where you need documents for both organizational or specific reasons almost daily.

There are many legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the California Agreement and Release for Working at a Novelty Store - Self-Employed, that are crafted to comply with state and federal regulations.

Once you find the right form, click Buy now.

Select a payment plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card. Choose a convenient document format and download your version. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the California Agreement and Release for Working at a Novelty Store - Self-Employed at any time, if needed. Just navigate to the necessary form to obtain or print the document template. Utilize US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid errors. The service provides properly created legal document templates that can be utilized for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the California Agreement and Release for Working at a Novelty Store - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Get the form you need and ensure it is for your correct city/region.

- Use the Preview button to examine the form.

- Check the description to confirm you've selected the correct form.

- If the form is not what you need, use the Search field to find the form that fits your requirements.

Form popularity

FAQ

The new law for independent contractors in California, largely influenced by AB5, changes how many workers can be classified as independent contractors. It creates stricter criteria to prevent misclassification. For those drafting a California Agreement and Release for Working at a Novelty Store, being aware of this law helps clarify your working relationship and the protections afforded by the state.

The 72-hour rule in California relates to the deadlines for certain employer responsibilities, such as providing paychecks or additional documentation upon termination. Employers must provide employees written notice detailing their rights within this timeframe. This can be relevant in a California Agreement and Release for Working at a Novelty Store, ensuring both parties are informed about their rights and obligations.

In California, a 1099 employee is typically classified as an independent contractor rather than a traditional employee. This classification means that workers receive a Form 1099 at the end of the year instead of a W-2. If you are working under a California Agreement and Release for Working at a Novelty Store, remember that the classification impacts tax obligations and benefits.

For a contract to be legally binding in California, it must include essential elements such as an offer, acceptance, consideration, and mutual consent. Additionally, both parties must have the legal capacity to contract. If you are using a California Agreement and Release for Working at a Novelty Store, ensuring these elements are met is vital to uphold the contract's enforceability.

An employment agreement in California should clearly outline the terms of employment, including job responsibilities, compensation, and termination clauses. It must comply with state labor laws and be signed by both parties. When dealing with a California Agreement and Release for Working at a Novelty Store, transparency about all agreements ensures mutual understanding and legal protection.

The AB5 law in California establishes clear criteria for classifying workers as independent contractors or employees. It aims to provide more protection to workers but can complicate arrangements for self-employed individuals. If you're drafting a California Agreement and Release for Working at a Novelty Store, understanding this law is crucial for determining the proper classification.

To hire an employee in California, you need to complete specific paperwork and comply with state laws. First, you must obtain an Employer Identification Number (EIN) from the IRS, register with the California Employment Development Department, and ensure workplace safety regulations are in place. If you're utilizing a California Agreement and Release for Working at a Novelty Store, make sure to clarify the terms of employment for independent contractors.

In California, when hiring an employee, you need several documents to follow legal requirements. Typically, a completed W-4 form, proof of identity and employment authorization, such as a driver’s license or passport, are necessary. Additionally, for self-employed individuals working under a California Agreement and Release for Working at a Novelty Store, having a business license may also be beneficial.

In 2024, the salary exempt threshold in California will increase to ensure fair compensation for employees. Salaried workers must meet specific criteria to qualify as exempt from overtime regulations. Those drafting their California Agreement and Release for Working at a Novelty Store - Self-Employed should stay updated on these salary standards to ensure adherence to the law.

California is set to introduce additional employee protection laws in July 2024. These laws will likely include revisions to health and safety regulations, as well as enhancements in workers' compensation provisions. If you operate or are self-employed in a novelty store, a tailored California Agreement and Release for Working at a Novelty Store - Self-Employed will help you stay informed and compliant with these legislative updates.