Title: Complete Guide to California Sample Letters for Requesting a Free Credit Report, Permitted by Federal Law Introduction: Under federal law, individuals are entitled to request a free copy of their credit report from each of the major credit reporting agencies once every 12 months. This provision ensures that consumers have access to accurate information about their credit history. In California, residents have an additional right to request free credit reports from these agencies. This article serves as a comprehensive guide, providing detailed descriptions and sample letters for requesting free credit reports in California. Section 1: Understanding the Importance of Credit Reports 1. Importance of Credit Reports in California 2. How Credit Reports Influence Financial Health 3. Federal Law Protecting Consumers' Access to Credit Reports Section 2: Overview of California's Additional Rights 1. California's Free Credit Report Law 2. Additional Benefits for Active Duty Military Personnel 3. Key Significance of California's Provisions Section 3: Types of California Sample Letters for Requesting Free Credit Reports: 1. General California Sample Letter: — Generic letter for requesting a free credit report in California. 2. California Sample Letter for Active Duty Military Personnel: — Letter designed for military personnel stationed in California, highlighting additional benefits specific to their circumstances. 3. California Sample Letter for Identity Theft Victims: — A specialized letter for individuals who have fallen victim to identity theft, addressing unique concerns and steps to be taken. 4. Sample Letter for Deceased Individuals' Family Members: — Addressing the rights of family members to obtain free credit reports after the demise of a loved one. Section 4: Step-by-Step Instructions for Crafting an Effective Letter 1. Gathering Required Information: — List of personal information required to complete the letter. 2. Letter Formatting and Structure: — Guidance on how to format and structure the letter appropriately. 3. Addressing the Right Credit Reporting Agencies: — Identifying the major credit reporting agencies and their contact information. 4. Including Essential Details: — What information must be included in the letter to ensure a successful request. 5. Proof of Identity: — Documentation or identification requirements to verify identity. Conclusion: In compliance with federal law, California residents have the right to request free credit reports to gain insight into their financial standing. This guide has provided you with an overview of California's additional rights, different types of sample request letters, and step-by-step instructions for creating an effective communication. Utilize the information provided to exercise your rights and gain access to your credit report, empowering you to make more informed financial decisions.

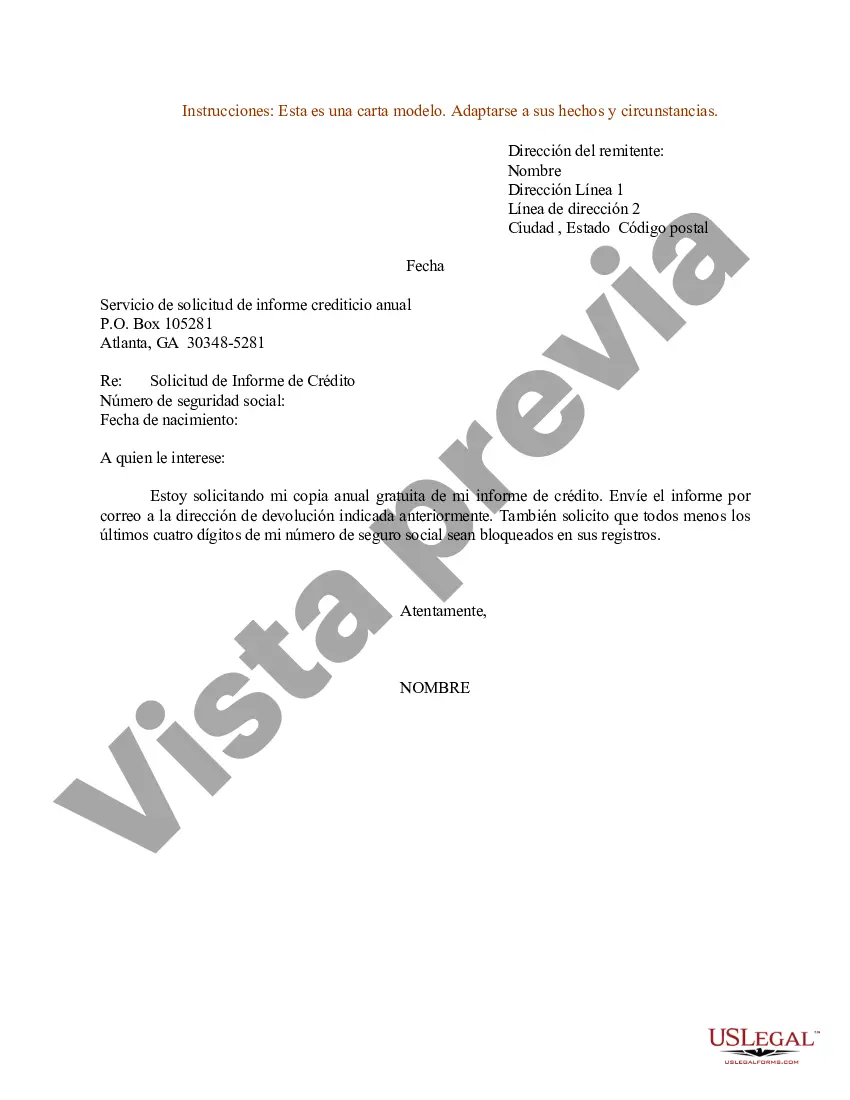

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.California Ejemplo de carta de solicitud de informe de crédito gratuito permitido por la ley federal - Sample Letter for Request for Free Credit Report Allowed by Federal Law

Description

How to fill out California Ejemplo De Carta De Solicitud De Informe De Crédito Gratuito Permitido Por La Ley Federal?

If you have to full, down load, or print legal file themes, use US Legal Forms, the largest assortment of legal forms, which can be found on-line. Make use of the site`s easy and hassle-free look for to obtain the files you want. A variety of themes for company and person purposes are categorized by categories and states, or search phrases. Use US Legal Forms to obtain the California Sample Letter for Request for Free Credit Report Allowed by Federal Law in just a handful of mouse clicks.

Should you be previously a US Legal Forms buyer, log in to your account and then click the Down load key to get the California Sample Letter for Request for Free Credit Report Allowed by Federal Law. You can even entry forms you formerly delivered electronically from the My Forms tab of your account.

If you use US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have selected the form for your proper town/land.

- Step 2. Take advantage of the Preview method to examine the form`s articles. Never forget to read the outline.

- Step 3. Should you be unsatisfied with all the kind, utilize the Lookup field at the top of the monitor to find other types in the legal kind template.

- Step 4. When you have identified the form you want, click the Acquire now key. Choose the rates program you like and include your accreditations to sign up for an account.

- Step 5. Approach the deal. You can utilize your credit card or PayPal account to perform the deal.

- Step 6. Find the format in the legal kind and down load it on your system.

- Step 7. Complete, revise and print or sign the California Sample Letter for Request for Free Credit Report Allowed by Federal Law.

Each and every legal file template you get is your own forever. You might have acces to each and every kind you delivered electronically within your acccount. Go through the My Forms portion and pick a kind to print or down load again.

Contend and down load, and print the California Sample Letter for Request for Free Credit Report Allowed by Federal Law with US Legal Forms. There are millions of expert and condition-certain forms you may use for the company or person requirements.