An escrow is the deposit of a written instrument or something of value with a third person with instructions to deliver it to another when a stated condition is performed or a specified event occurs. The use of an escrow is most common in real estate sales transactions where the grantee deposits earnest money with the escrow agent to be delivered to the grantor upon consummation of the purchase and sale of the real estate and performance of other specified conditions.

California Escrow Agreement for Sale of Real Property and Deposit of Earnest Money is a legal document that outlines the terms and conditions of a real estate transaction in California. This agreement serves as a safeguard for both the buyer and seller, ensuring a smooth and secure transfer of property ownership. The primary purpose of the agreement is to protect the parties involved by establishing a neutral third party, known as an escrow agent, to handle the financial aspect of the transaction. The escrow agreement sets forth various key provisions, starting with the identification of the parties involved, including the buyer, seller, and escrow agent. It specifies the essential details of the real property being sold, such as the address, legal description, and any included fixtures or personal property. Additionally, the agreement outlines the purchase price, earnest money deposit amount, and the deadline for the deposit to be made. The escrow agreement includes comprehensive instructions for the handling of the earnest money deposit. It specifies that the funds shall be held in an escrow account until the closing of the transaction or until the terms of the agreement are met. The agreement also details the circumstances under which the deposit may be released or refunded, including scenarios where the buyer fails to secure financing or when certain contingencies are not met. There are various types of California Escrow Agreements for the Sale of Real Property and Deposit of Earnest Money, tailored to specific situations within the real estate market. These include: 1. Standard Escrow Agreement: This is the most common type of escrow agreement used in California for the sale of real property. It outlines the general terms and conditions applicable to the transaction and provides a framework for the process. 2. Short Sale Escrow Agreement: This type of agreement is used when the seller intends to sell the property for a price less than the outstanding mortgage balance. The agreement outlines the specific conditions and requirements for a successful short sale transaction. 3. Commercial Property Escrow Agreement: Designed for commercial real estate transactions, this agreement addresses the unique aspects and complexities associated with buying or selling commercial properties, such as income-generating buildings, office spaces, or retail units. 4. New Construction Escrow Agreement: This agreement is specific to the sale of newly constructed homes or properties where the buyer deals directly with the builder or developer. It includes provisions for warranty protections, inspections, and obtaining necessary construction permits. Regardless of the specific type, California Escrow Agreements for the Sale of Real Property and Deposit of Earnest Money play a crucial role in ensuring a transparent and secure real estate transaction. By setting clear guidelines, these agreements protect the interests of both buyers and sellers, facilitating a successful sale and transfer of property ownership.California Escrow Agreement for Sale of Real Property and Deposit of Earnest Money is a legal document that outlines the terms and conditions of a real estate transaction in California. This agreement serves as a safeguard for both the buyer and seller, ensuring a smooth and secure transfer of property ownership. The primary purpose of the agreement is to protect the parties involved by establishing a neutral third party, known as an escrow agent, to handle the financial aspect of the transaction. The escrow agreement sets forth various key provisions, starting with the identification of the parties involved, including the buyer, seller, and escrow agent. It specifies the essential details of the real property being sold, such as the address, legal description, and any included fixtures or personal property. Additionally, the agreement outlines the purchase price, earnest money deposit amount, and the deadline for the deposit to be made. The escrow agreement includes comprehensive instructions for the handling of the earnest money deposit. It specifies that the funds shall be held in an escrow account until the closing of the transaction or until the terms of the agreement are met. The agreement also details the circumstances under which the deposit may be released or refunded, including scenarios where the buyer fails to secure financing or when certain contingencies are not met. There are various types of California Escrow Agreements for the Sale of Real Property and Deposit of Earnest Money, tailored to specific situations within the real estate market. These include: 1. Standard Escrow Agreement: This is the most common type of escrow agreement used in California for the sale of real property. It outlines the general terms and conditions applicable to the transaction and provides a framework for the process. 2. Short Sale Escrow Agreement: This type of agreement is used when the seller intends to sell the property for a price less than the outstanding mortgage balance. The agreement outlines the specific conditions and requirements for a successful short sale transaction. 3. Commercial Property Escrow Agreement: Designed for commercial real estate transactions, this agreement addresses the unique aspects and complexities associated with buying or selling commercial properties, such as income-generating buildings, office spaces, or retail units. 4. New Construction Escrow Agreement: This agreement is specific to the sale of newly constructed homes or properties where the buyer deals directly with the builder or developer. It includes provisions for warranty protections, inspections, and obtaining necessary construction permits. Regardless of the specific type, California Escrow Agreements for the Sale of Real Property and Deposit of Earnest Money play a crucial role in ensuring a transparent and secure real estate transaction. By setting clear guidelines, these agreements protect the interests of both buyers and sellers, facilitating a successful sale and transfer of property ownership.

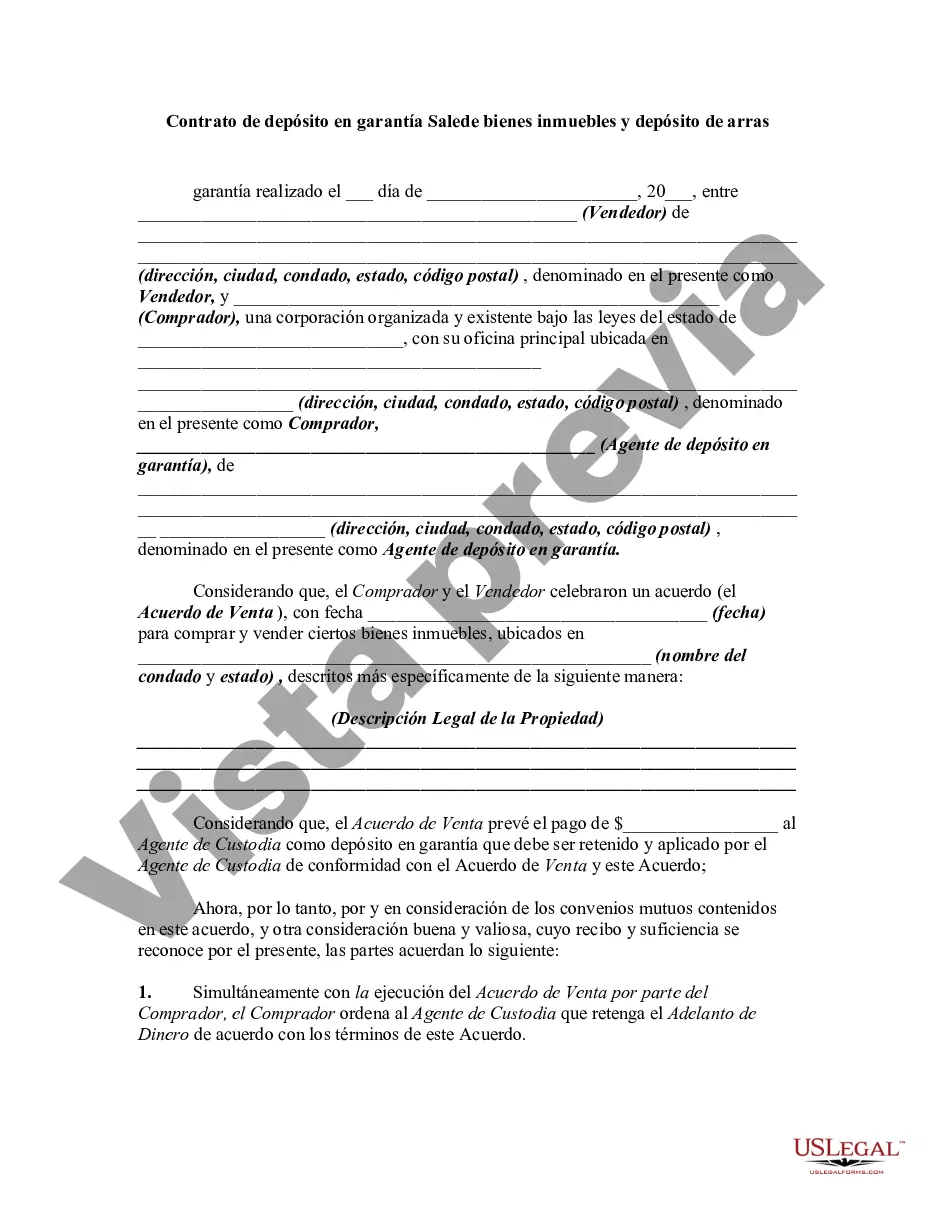

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.