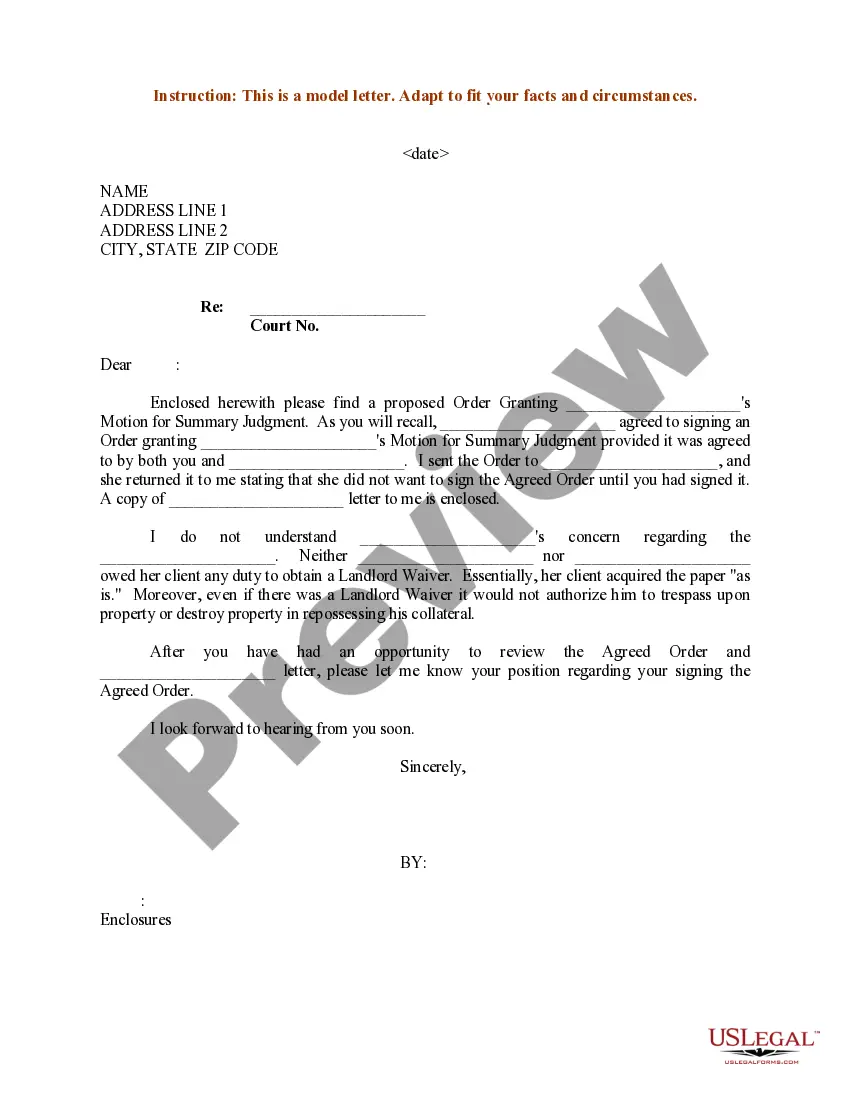

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

California Consulting Invoice

Description

How to fill out Consulting Invoice?

Finding the appropriate legal document template can be quite a challenge. Clearly, numerous templates exist online, but how can you locate the legal form you require.

Utilize the US Legal Forms website. This service provides thousands of templates, including the California Consulting Invoice, which can be used for both business and personal purposes. All forms are reviewed by professionals and meet state and federal requirements.

If you are already a member, Log In to your account and click on the Download button to obtain the California Consulting Invoice. Use your account to search for the legal forms you have previously ordered. Go to the My documents tab of your account and get an extra copy of the document you need.

Select the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained California Consulting Invoice. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Utilize the service to acquire professionally crafted documents that comply with state regulations.

- First, make sure you have selected the correct form for your city/state.

- You can view the document using the Preview button and review the form details to ensure it is suitable for you.

- If the form does not meet your needs, use the Search box to find the appropriate form.

- Once you are confident the form is correct, click the Buy Now button to obtain the form.

- Choose the pricing plan you desire and enter the required information.

- Create your account and complete the purchase using your PayPal account or credit card.

Form popularity

FAQ

Submitting an invoice for a service typically involves sending it directly to your client's designated contact. Ensure that your California Consulting Invoice is professionally formatted and includes all necessary information, such as payment options and due dates. You can send it via email or through an invoicing platform, like USLegalForms, that allows electronic submissions for faster processing.

To invoice as a freelance consultant, start by using a clear format that includes your name, contact information, and the client's details. Make sure to list all services provided, along with the corresponding fees. Don’t forget to specify payment terms and include a California Consulting Invoice number for tracking. Choosing a user-friendly invoicing platform, like USLegalForms, can streamline the process.

Consultants typically bill their clients based on an hourly rate, project fees, or retainers, depending on the agreement. When billing, it's important to detail the time spent or services rendered in your California Consulting Invoice. This clarity helps maintain transparency and establishes trust between you and your client. Utilizing platforms like US Legal Forms can aid in creating accurate invoices that reflect your unique consulting approach.

Making an invoice for consulting services is straightforward. Begin with your contact information and the client’s details, then list the services you provided, including dates and rates. Ensure your California Consulting Invoice includes a section for applicable taxes and the total due. Tools like US Legal Forms offer user-friendly templates that simplify the invoicing process, ensuring compliance with state regulations.

To invoice for consulting services, start by including your business information, client details, and the date of the invoice. Then, itemize your services with clear descriptions and rates. A California Consulting Invoice should express the total amount due while providing payment instructions to streamline the payment process. Consider using platforms like US Legal Forms to create a professional invoice template that meets California's requirements.

Generating an invoice as a consultant can be straightforward with the right tools. Begin by compiling the necessary information, then use a template or invoicing software to create a California Consulting Invoice. Platforms like uslegalforms offer user-friendly invoice templates that help you meet professional standards while saving you time and effort.

To bill someone as a consultant, start by creating a clear and detailed California Consulting Invoice that outlines the services you provided, the hours worked, and the total due. Include your contact information and payment instructions to facilitate a smooth transaction. It’s vital to maintain professionalism and clarity in your communication throughout this process.

A California Consulting Invoice must meet certain regulatory requirements, including essential details such as your business name, your client’s information, a unique invoice number, and a description of services rendered. Additionally, specifying the payment terms and including any relevant tax information is crucial. Utilizing platforms like uslegalforms can help ensure your invoices comply with state regulations.

In California, the law does not specify a particular time limit for paying an invoice, such as a California Consulting Invoice. However, it is good practice to set payment terms clearly in your invoice. Common practices include expecting payment within 30 days. Always communicate payment expectations to avoid misunderstandings.

Filling in invoice details for your California Consulting Invoice requires precision. Begin with your and your client's contact information, followed by a detailed line item of services rendered. Ensure the total amount due accurately reflects all charges, and include payment terms to clarify the expectations.