California Hippa Release Form for Insurance

Description

How to fill out Hippa Release Form For Insurance?

Are you currently in a circumstance where you require documents for various organizational or specific purposes nearly every day.

There are numerous legal document templates available online, but finding reliable ones isn't easy.

US Legal Forms offers a wide variety of template forms, including the California Hippa Release Form for Insurance, which are drafted to comply with federal and state regulations.

Once you find the correct form, click on Purchase now.

Choose the pricing plan you prefer, fill out the necessary information to create your account, and complete the transaction with your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the California Hippa Release Form for Insurance template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you require and ensure it is for the correct region/county.

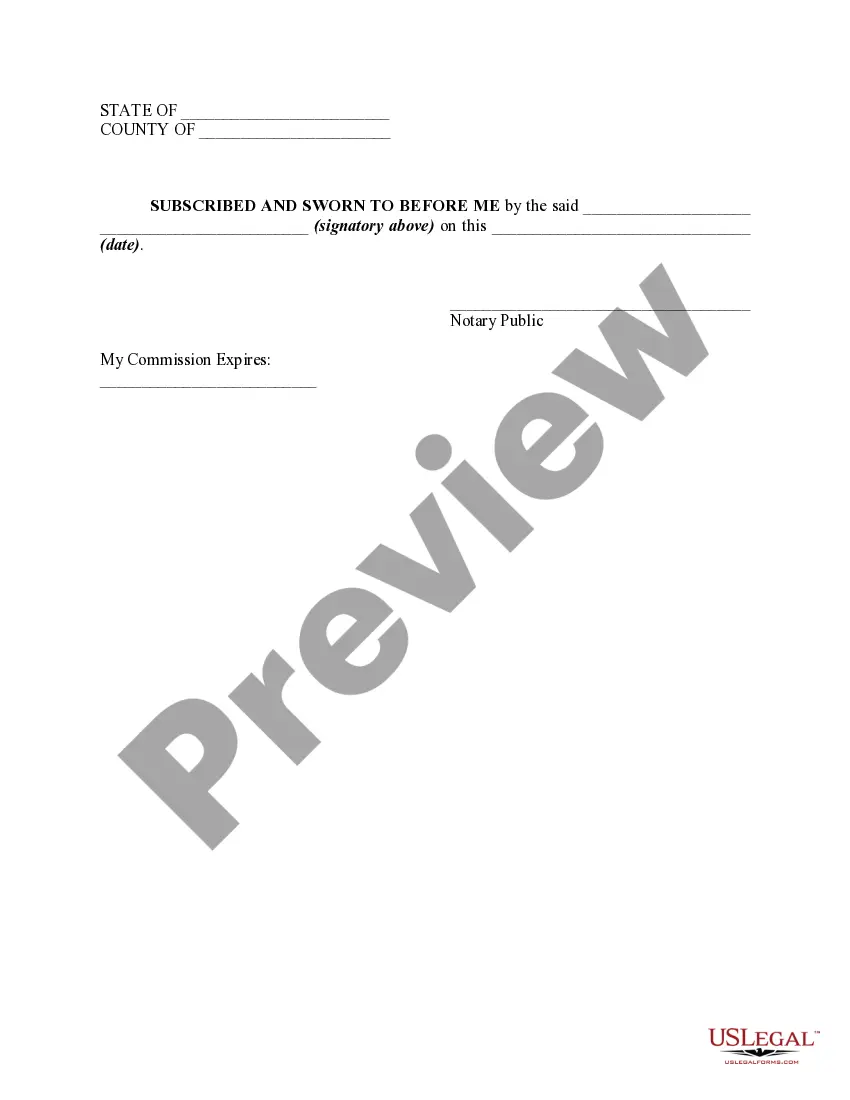

- Utilize the Preview button to examine the form.

- Review the summary to confirm that you have chosen the appropriate form.

- If the form is not what you need, use the Lookup field to find the form that fits your needs.

Form popularity

FAQ

When utilizing a California HIPAA Release Form for Insurance, it's crucial to consider patient privacy and security. This includes ensuring that the release form is signed, detailing only necessary information, and confirming that the recipient is authorized to receive the data. Adhering to these requirements enhances trust and safeguards patient confidentiality.

Filling out a California HIPAA Release Form for Insurance involves entering accurate patient details, specifying the records to be released, and clearly stating the purpose of the release. Make sure to sign and date the form, as this indicates consent for the information to be shared. It’s important to double-check that all sections are completed to avoid delays in processing.

The California HIPAA Release Form for Insurance typically includes personal identifiers, such as the patient's name and date of birth, along with a detailed description of the information being disclosed. It may also feature the dates between which the information is valid and the purpose for release. Clear eligibility of the intended recipients ensures that sensitive data is transferred to authorized individuals only.

When utilizing a California HIPAA Release Form for Insurance, the form should clearly state the patient’s identification details, specify what information is being shared, and indicate the recipient of the information. It should also outline the duration of the release and include the patient’s consent signature. This comprehensive approach ensures transparency and compliance with HIPAA regulations.

A California HIPAA Release Form for Insurance must include the patient's full name, the specific information being released, the purpose of the release, and the name of the entities involved. Additionally, it should include the date of the patient's signature and a statement that informs the patient of their rights regarding their health information. Ensuring these elements are present protects both the patient and the provider.

In most cases, a California HIPAA Release Form for Insurance does not require notarization to be valid. Nevertheless, certain instances may call for additional verification, depending on the policies of specific institutions. Always check with your healthcare provider or insurance company to confirm their requirements. Utilizing services like US Legal Forms can provide clarity on whether notarization is necessary for your specific situation.

HIPAA does not inherently require a release of information; however, it establishes guidelines on how your health information can be shared. The California HIPAA Release Form for Insurance allows you to provide your consent for specific disclosures, thus facilitating smoother interactions with your insurer. This authorization helps ensure that your health information is shared appropriately and securely. By using this form, you can maintain control over your personal health data.

A California HIPAA Release Form for Insurance typically remains valid until the specified expiration date mentioned on the document, or until the individual revokes it. However, ensure to review the terms for any updates or changes in your healthcare needs. For continuous protection, consider renewing the form as necessary. It's vital to keep your release form current for timely communication with your insurance provider.

Creating a medical release form starts with identifying the patient and the specific medical information to be shared. Clearly mention who will receive this information and for what purpose. Ensure that the form has a place for the patient’s signature and date for legal validity. For a reliable solution, consider using a California HIPAA Release Form for Insurance available online to ensure compliance with legal standards.

Yes, HIPAA release forms can be signed electronically, provided that the method used complies with both HIPAA regulations and state laws. Electronic signatures are generally accepted as valid, as long as they cannot be forged and link the signer to the signed document. For convenience, using a California HIPAA Release Form for Insurance through a trusted online platform can simplify electronic signing.