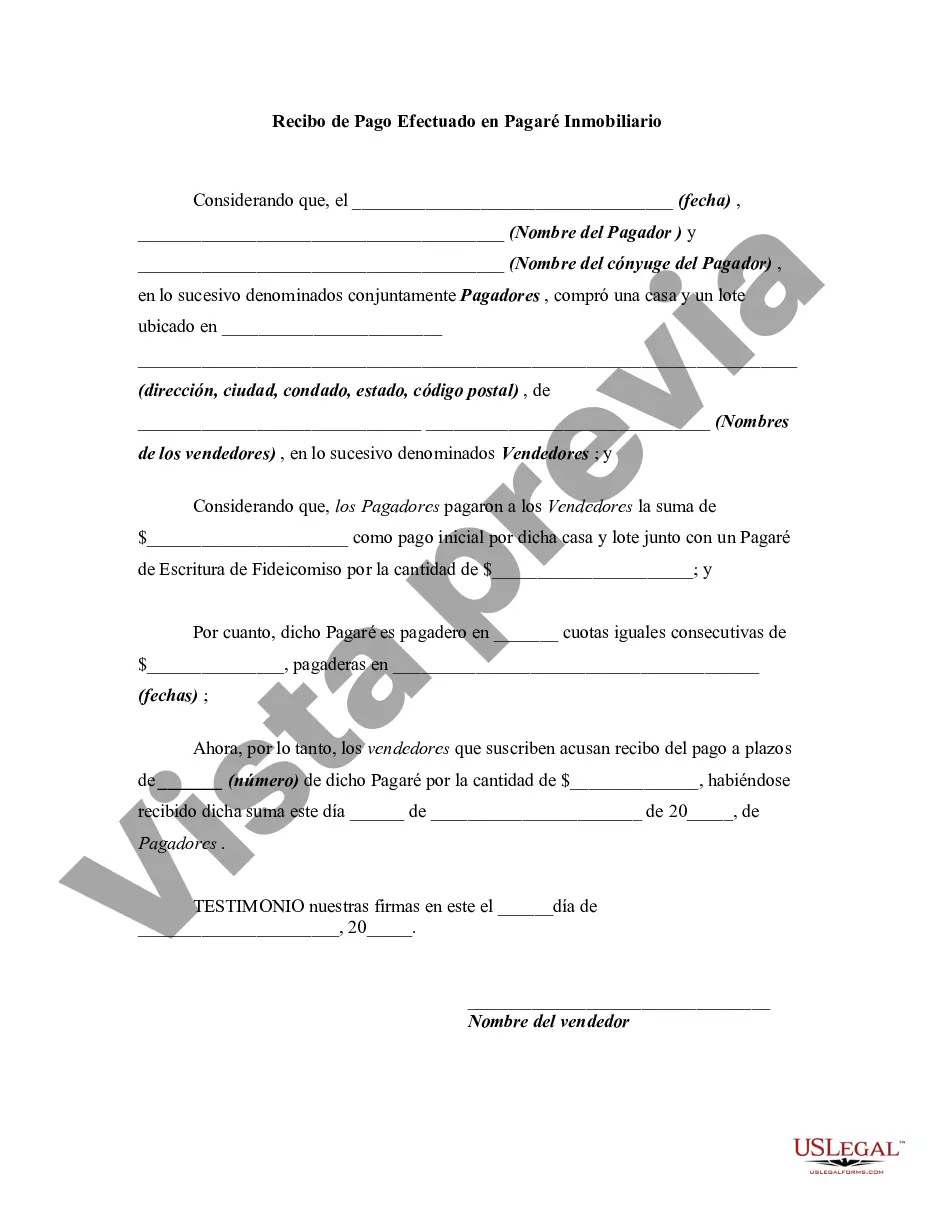

This form is a generic sample of a receipt for an installment payment for an owner financed real estate sale/purchase.

California Receipt for Payment Made on Real Estate Promissory Note: A Comprehensive Overview A California Receipt for Payment Made on Real Estate Promissory Note is a legal document used to acknowledge and record the receipt of payment made towards a promissory note related to a real estate transaction in the state of California. This receipt serves as proof that the payment has been made by the borrower or debtor to the lender or creditor. California offers several types of Receipts for Payment Made on Real Estate Promissory Notes, each serving a specific purpose. Some notable types include: 1. Initial Payment Receipt: This type of receipt is issued when the borrower or debtor makes the first payment towards the real estate promissory note. It typically includes the payment amount, date, payment method, and details of the promissory note. 2. Regular Payment Receipt: As the name suggests, this receipt is provided when the borrower or debtor makes regular payments as per the terms of the promissory note. It includes the payment amount, date, payment method, and relevant details of the promissory note. 3. Lump-Sum payment Receipt: In certain cases, the borrower may opt to make a lump-sum payment towards the promissory note, typically to reduce the remaining principal balance. This receipt specifies the lump-sum payment amount, date, payment method, and important details of the promissory note. 4. Final Payment Receipt: When the borrower completes the payment obligations as per the terms of the promissory note, a final payment receipt is issued. This receipt signifies the conclusion of the lending arrangement and includes the final payment amount, date, payment method, and particulars of the promissory note. A California Receipt for Payment Made on Real Estate Promissory Note typically contains vital information, such as the names and addresses of both the borrower and the lender, the date of payment, details of the promissory note, including the principal amount, interest rate, and repayment terms, and any relevant conditions or terms specific to the transaction. It is important to note that the format and content of the receipt may vary depending on the individual transaction and the lender's requirements. It is essential to adhere to the legal guidelines and consult with a real estate attorney or expert to draft an accurate and enforceable receipt. In conclusion, a California Receipt for Payment Made on Real Estate Promissory Note is a crucial document that acknowledges the receipt of a payment made towards a promissory note related to a real estate transaction in the state of California. By recording these payments, this receipt provides transparency and legal protection to both the lender and the borrower involved in the real estate transaction.California Receipt for Payment Made on Real Estate Promissory Note: A Comprehensive Overview A California Receipt for Payment Made on Real Estate Promissory Note is a legal document used to acknowledge and record the receipt of payment made towards a promissory note related to a real estate transaction in the state of California. This receipt serves as proof that the payment has been made by the borrower or debtor to the lender or creditor. California offers several types of Receipts for Payment Made on Real Estate Promissory Notes, each serving a specific purpose. Some notable types include: 1. Initial Payment Receipt: This type of receipt is issued when the borrower or debtor makes the first payment towards the real estate promissory note. It typically includes the payment amount, date, payment method, and details of the promissory note. 2. Regular Payment Receipt: As the name suggests, this receipt is provided when the borrower or debtor makes regular payments as per the terms of the promissory note. It includes the payment amount, date, payment method, and relevant details of the promissory note. 3. Lump-Sum payment Receipt: In certain cases, the borrower may opt to make a lump-sum payment towards the promissory note, typically to reduce the remaining principal balance. This receipt specifies the lump-sum payment amount, date, payment method, and important details of the promissory note. 4. Final Payment Receipt: When the borrower completes the payment obligations as per the terms of the promissory note, a final payment receipt is issued. This receipt signifies the conclusion of the lending arrangement and includes the final payment amount, date, payment method, and particulars of the promissory note. A California Receipt for Payment Made on Real Estate Promissory Note typically contains vital information, such as the names and addresses of both the borrower and the lender, the date of payment, details of the promissory note, including the principal amount, interest rate, and repayment terms, and any relevant conditions or terms specific to the transaction. It is important to note that the format and content of the receipt may vary depending on the individual transaction and the lender's requirements. It is essential to adhere to the legal guidelines and consult with a real estate attorney or expert to draft an accurate and enforceable receipt. In conclusion, a California Receipt for Payment Made on Real Estate Promissory Note is a crucial document that acknowledges the receipt of a payment made towards a promissory note related to a real estate transaction in the state of California. By recording these payments, this receipt provides transparency and legal protection to both the lender and the borrower involved in the real estate transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.