An independent contractor is a person or business who performs services for another person pursuant to an agreement and who is not subject to the other's control, or right to control, the manner and means of performing the services. The exact nature of the independent contractor's relationship with the hiring party is important since an independent contractor pays his/her own Social Security, income taxes without payroll deduction, has no retirement or health plan rights, and often is not entitled to worker's compensation coverage.

There are a number of factors which to consider in making the decision whether people are employees or independent contractors. One of the most important considerations is the degree of control exercised by the company over the work of the workers. An employer has the right to control an employee. It is important to determine whether the company had the right to direct and control the workers not only as to the results desired, but also as to the details, manner and means by which the results were accomplished. If the company had the right to supervise and control such details of the work performed, and the manner and means by which the results were to be accomplished, an employer-employee relationship would be indicated. On the other hand, the absence of supervision and control by the company would support a finding that the workers were independent contractors and not employees.

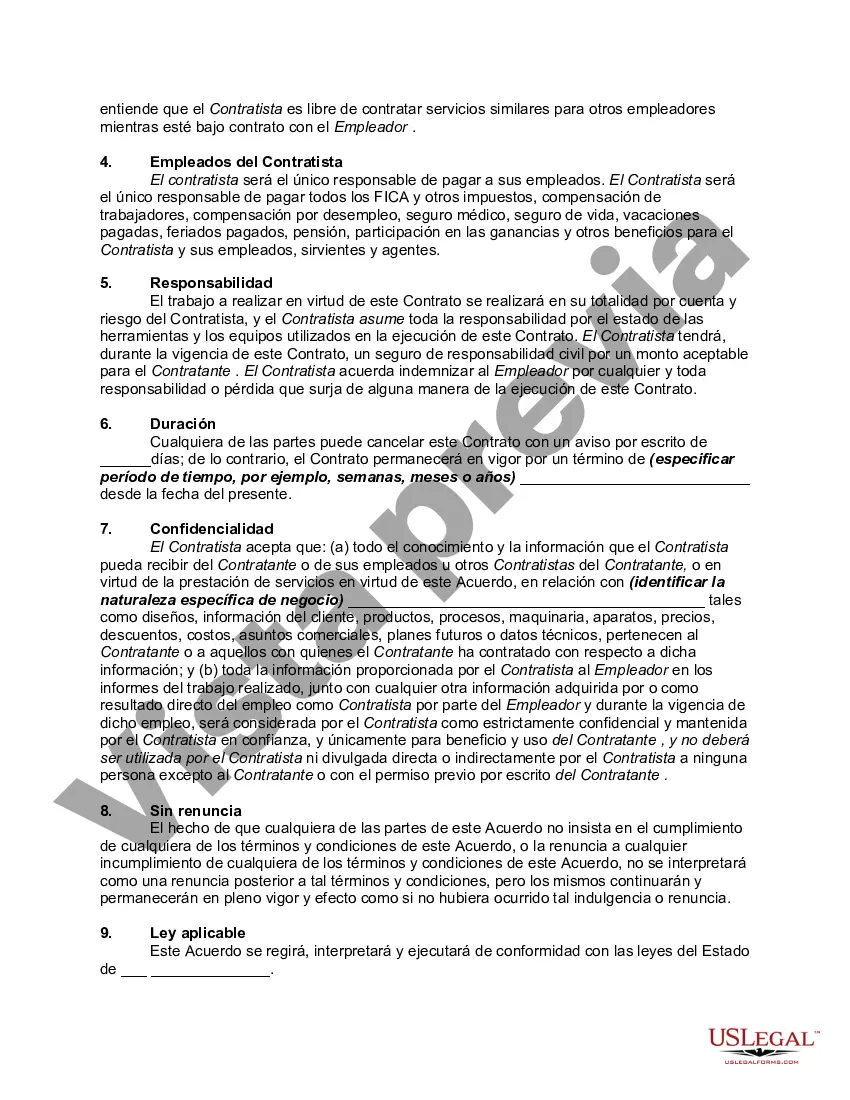

This form contains a confidentiality clause. The most important part of a confidentiality clause is the definition or description of the confidential information. Ideally, the contract should set forth as specifically as possible the scope of information covered by the agreement. However, the disclosing party may be reluctant to describe the information in the contract, for fear that some of the confidential information might be revealed in the contract itself.

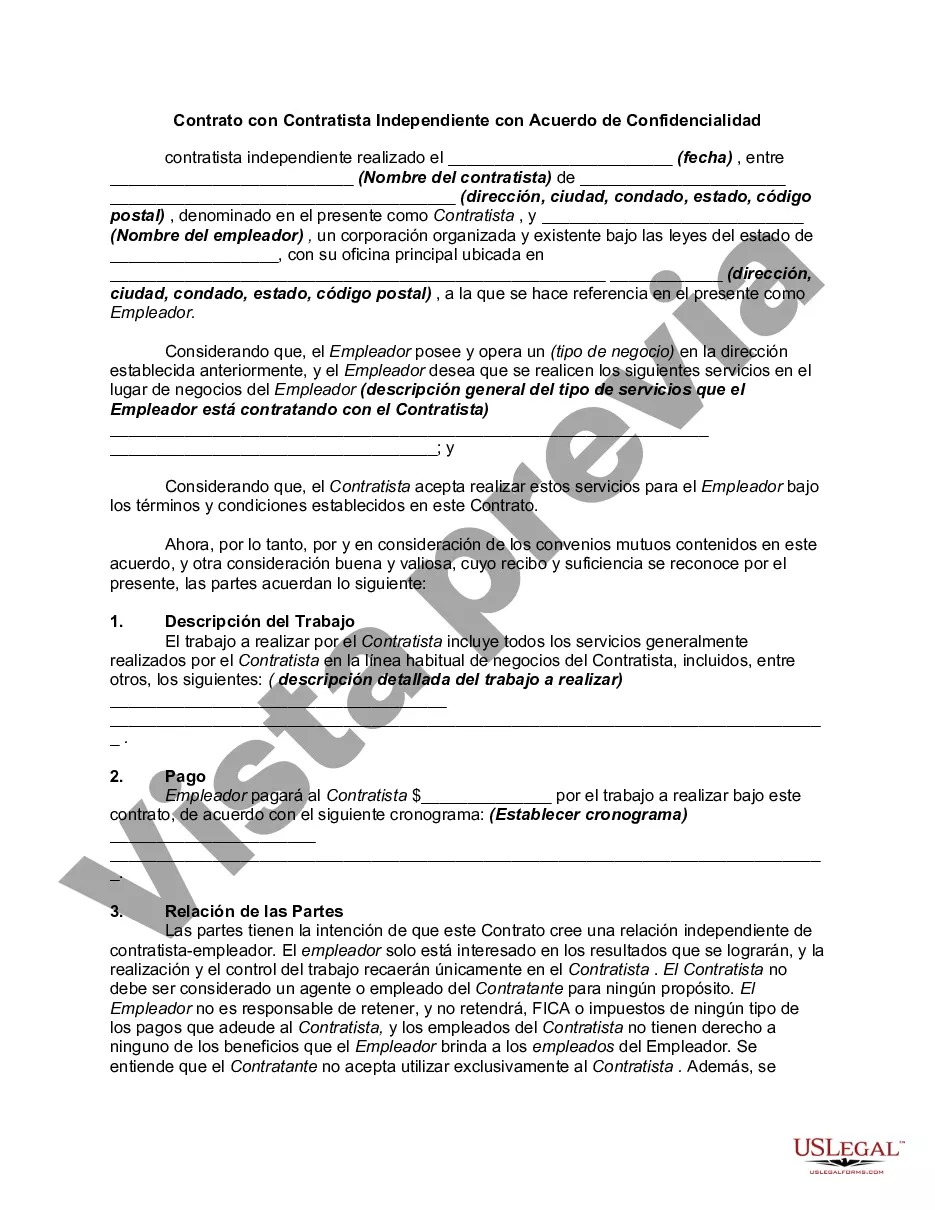

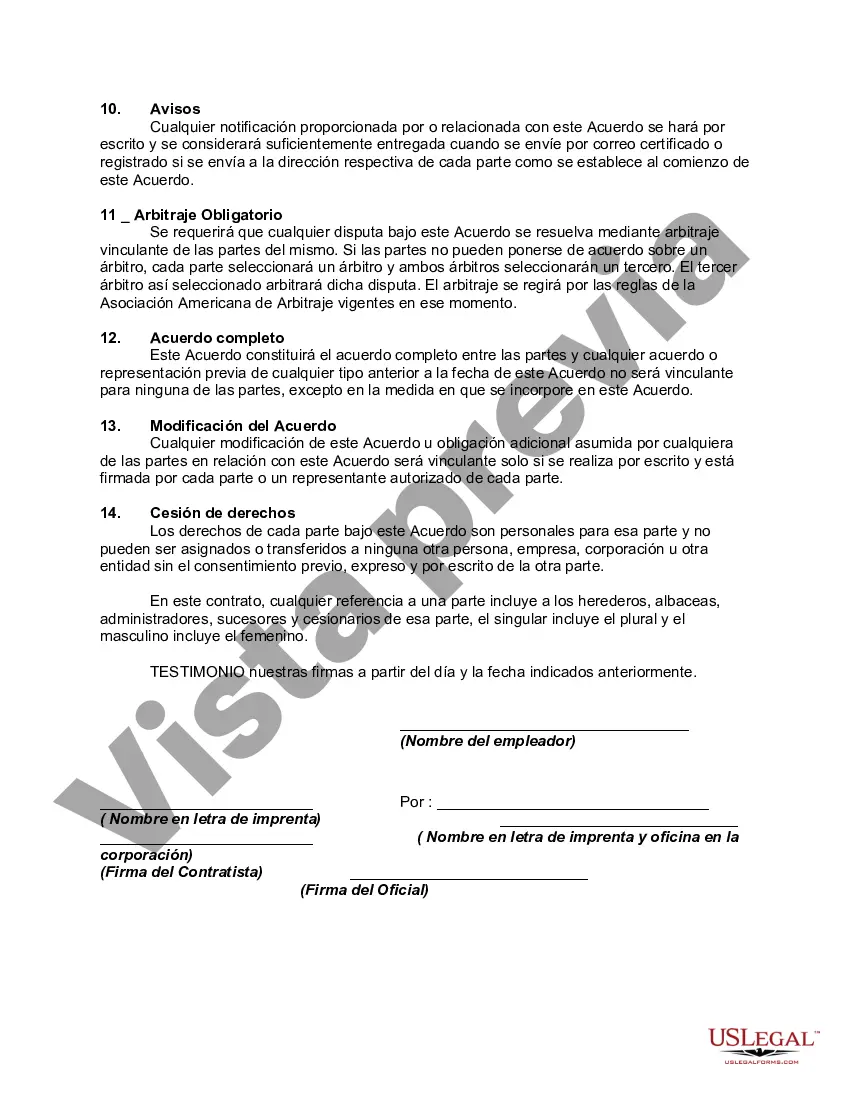

California Contract with Self-Employed Independent Contractor with Confidentiality Agreement is a legal document designed to outline the working relationship between a hiring company or individual and a self-employed independent contractor in the state of California. It specifies the terms and conditions of the engagement, ensuring both parties have a clear understanding of their rights, responsibilities, and the protection of confidential information. This type of contract can come in various forms, tailored to the specific needs of different industries and professions. Some common types of California Contract with Self-Employed Independent Contractor with Confidentiality Agreement include: 1. General Service Agreement: This contract is used when the independent contractor is hired to provide general services, such as consulting, marketing, or IT support. It covers essential clauses like project scope, payment terms, intellectual property rights, and confidentiality obligations. 2. Non-Disclosure Agreement (NDA): This type of contract is specifically focused on ensuring the protection of confidential information shared between the hiring company and the independent contractor. It establishes restrictions on the disclosure, use, or sharing of trade secrets, proprietary information, client lists, and other sensitive data. 3. Intellectual Property Agreement: When an independent contractor is hired to create or develop intellectual property (such as software, artwork, or designs), this agreement ensures clear ownership and usage rights are established. It outlines the transfer of intellectual property from the contractor to the hiring company and any licensing or future usage considerations. 4. HIPAA Business Associate Agreement: In scenarios where an independent contractor may have access to protected health information (PHI) while performing services for a healthcare-related entity, this contract ensures compliance with the Health Insurance Portability and Accountability Act (HIPAA). It outlines the responsibilities, duties, and safeguards necessary to protect PHI and maintain HIPAA compliance. 5. Sales Representative Agreement: This contract is commonly used when an independent contractor is engaged to sell products or services on behalf of a hiring company. It establishes terms related to commissions, territories, termination conditions, confidentiality, and any exclusivity arrangements. It's crucial for both parties involved, the hiring company, and the self-employed independent contractor, to carefully review and fully understand the terms and conditions of the California Contract with Self-Employed Independent Contractor with Confidentiality Agreement before signing. Furthermore, it is advisable to seek legal counsel to ensure the contract adheres to all applicable laws and protects the interests of both parties involved.California Contract with Self-Employed Independent Contractor with Confidentiality Agreement is a legal document designed to outline the working relationship between a hiring company or individual and a self-employed independent contractor in the state of California. It specifies the terms and conditions of the engagement, ensuring both parties have a clear understanding of their rights, responsibilities, and the protection of confidential information. This type of contract can come in various forms, tailored to the specific needs of different industries and professions. Some common types of California Contract with Self-Employed Independent Contractor with Confidentiality Agreement include: 1. General Service Agreement: This contract is used when the independent contractor is hired to provide general services, such as consulting, marketing, or IT support. It covers essential clauses like project scope, payment terms, intellectual property rights, and confidentiality obligations. 2. Non-Disclosure Agreement (NDA): This type of contract is specifically focused on ensuring the protection of confidential information shared between the hiring company and the independent contractor. It establishes restrictions on the disclosure, use, or sharing of trade secrets, proprietary information, client lists, and other sensitive data. 3. Intellectual Property Agreement: When an independent contractor is hired to create or develop intellectual property (such as software, artwork, or designs), this agreement ensures clear ownership and usage rights are established. It outlines the transfer of intellectual property from the contractor to the hiring company and any licensing or future usage considerations. 4. HIPAA Business Associate Agreement: In scenarios where an independent contractor may have access to protected health information (PHI) while performing services for a healthcare-related entity, this contract ensures compliance with the Health Insurance Portability and Accountability Act (HIPAA). It outlines the responsibilities, duties, and safeguards necessary to protect PHI and maintain HIPAA compliance. 5. Sales Representative Agreement: This contract is commonly used when an independent contractor is engaged to sell products or services on behalf of a hiring company. It establishes terms related to commissions, territories, termination conditions, confidentiality, and any exclusivity arrangements. It's crucial for both parties involved, the hiring company, and the self-employed independent contractor, to carefully review and fully understand the terms and conditions of the California Contract with Self-Employed Independent Contractor with Confidentiality Agreement before signing. Furthermore, it is advisable to seek legal counsel to ensure the contract adheres to all applicable laws and protects the interests of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.