California Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement

Description

How to fill out Stock Purchase Agreement Between Two Sellers And One Investor With Transfer Of Title Concurrent With Execution Of Agreement?

If you need to finish, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site’s simple and user-friendly search to find the documents you require.

A selection of templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to obtain the California Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement in just a few clicks.

Every legal document template you purchase is yours for years. You will have access to every form you saved in your account. Click the My documents section and select a form to print or download again.

Be proactive and download and print the California Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to obtain the California Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Use the Preview option to review the form’s content. Don’t forget to check the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Get now button. Choose the pricing plan you prefer and enter your information to register for the account.

- Step 5. Process the transaction. You may use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the California Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement.

Form popularity

FAQ

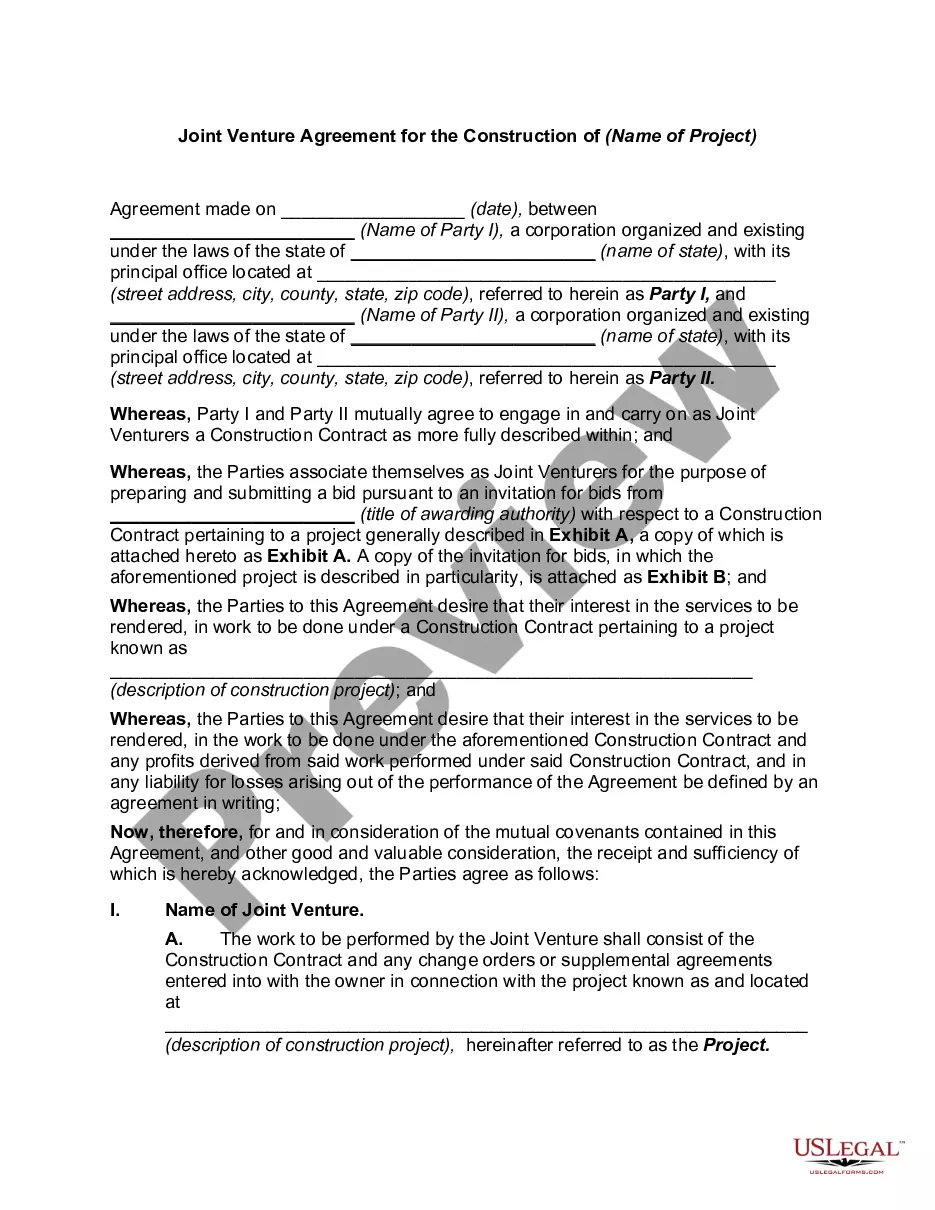

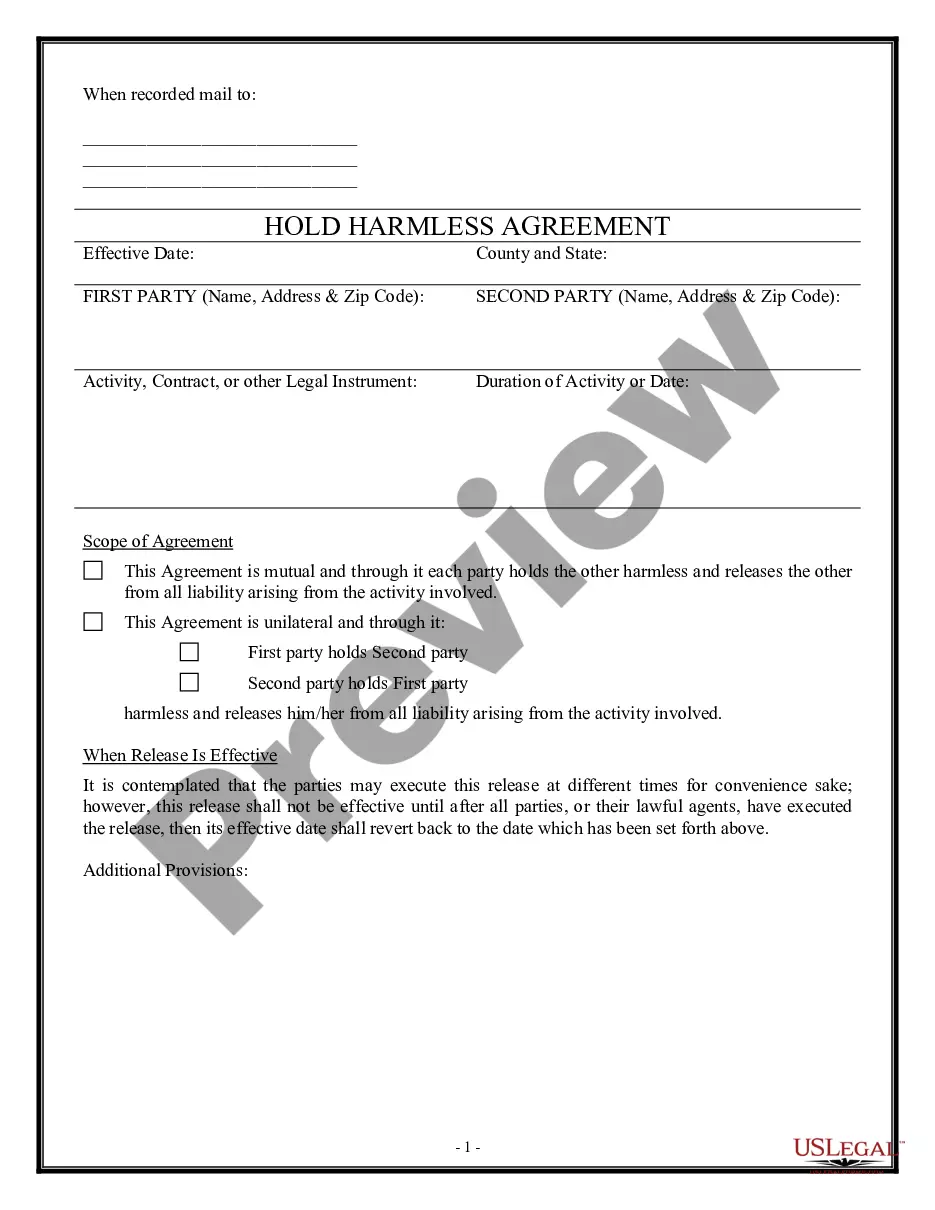

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

Share Purchase Agreement is an agreement entered into between the buyer and seller(s) of shares of a target company. Usually Share Purchase Agreements entail that the buyer would be taking over whole or significantly whole of the undertaking of the company.

It's important to include details about the type of shares being sold in your Share Purchase Agreement because the type of share will determine the buyer's voting rights, dividend yields, and percentage of ownership in the company.

In the first instance, the buyer and the seller will conclude a sales contract, often referred to as a share purchase agreement, where they agree on the price for which the shares are sold and the other terms of the transfer. The second step is the transfer of the share(s).

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

The major difference between a Share purchase agreement and a share subscription agreement is that in a Share purchase agreement the consideration is credited into the account of the seller of the share (who is generally an investor or promoter of the company) who wants to sell his stake in the company.

Stock Purchase Agreement: Everything You Need to KnowName of company.Purchaser's name.Par value of shares.Number of shares being sold.When/where the transaction takes place.Representations and warranties made by purchaser and seller.Potential employee issues, such as bonuses and benefits.More items...?

5 easy steps to file share purchase agreementReview of the share purchase agreement by both the parties.Signature by both the parties.Copies should be made for a purchaser, seller and the company.Giving the certificate after the payment.It can register if you meet certain criteria.27-May-2020

Stock purchase agreements or SPAs are transaction contracts for stock sale and acquisition. Their primary purpose is to establish the price of the stock being sold. SPAs achieve this by: Listing out the prices of the stock being sold.