Title: California Sample Letter for Reporting Fraudulent Charges on Client's Account Introduction: In the unfortunate event of encountering fraudulent charges on a client's account, it is essential to promptly take action to safeguard their financial well-being and rectify any unauthorized transactions. This article provides a detailed description of what a California sample letter for reporting fraudulent charges against a client's account should include, ensuring accuracy and clarity while effectively communicating the issue at hand. Keywords: California sample letter, fraudulent charges, client's account, unauthorized transactions. 1. California Sample Letter for Fraudulent Credit Card Charges: This type of letter specifically addresses unauthorized credit card charges made on the client's account. It outlines the steps taken by the client to protect their financial interests and seeks assistance in investigating and resolving the issue. Relevant keywords: fraudulent credit card charges, unauthorized transactions, protection, investigation, resolution. 2. California Sample Letter for Fraudulent Bank Account Charges: This sample letter targets fraudulent charges made on a client's bank account without their knowledge or consent. It informs the bank about the unauthorized activities, requests immediate investigation, and asks for the reimbursement of the stolen funds. Relevant keywords: fraudulent bank account charges, unauthorized activities, investigation, reimbursement, stolen funds. 3. California Sample Letter for Fraudulent Online Payment Charges: Addressing the increasing occurrence of online fraud, this type of letter reports unauthorized online payment charges made on the client's account. It highlights the need for immediate action, including investigating the source of the fraudulent charges and securing the account to prevent further unauthorized transactions. Relevant keywords: fraudulent online payment charges, unauthorized transactions, immediate action, investigation, account security. 4. California Sample Letter for Reporting Cybersecurity Breach and Fraudulent Charges: When a client's personal information is compromised due to a cybersecurity breach, this letter focuses on reporting the breach and fraudulent charges resulting from it. It requests assistance from the concerned parties in stopping further unauthorized activities, recovering any losses, and ensuring the client's online safety. Relevant keywords: cybersecurity breach, fraudulent charges, unauthorized activities, recovery, online safety. Conclusion: Using a legally sound and comprehensive California sample letter when reporting fraudulent charges against a client's account is crucial in ensuring that the appropriate steps are taken to resolve the issue. By employing the keywords provided, you can select the specific type of sample letter that aligns with the fraudulent charges encountered, subsequently enhancing the effectiveness of your report. Remember to tailor the letter content according to the unique circumstances and provide all the necessary details for a prompt and efficient resolution to the fraudulent charges.

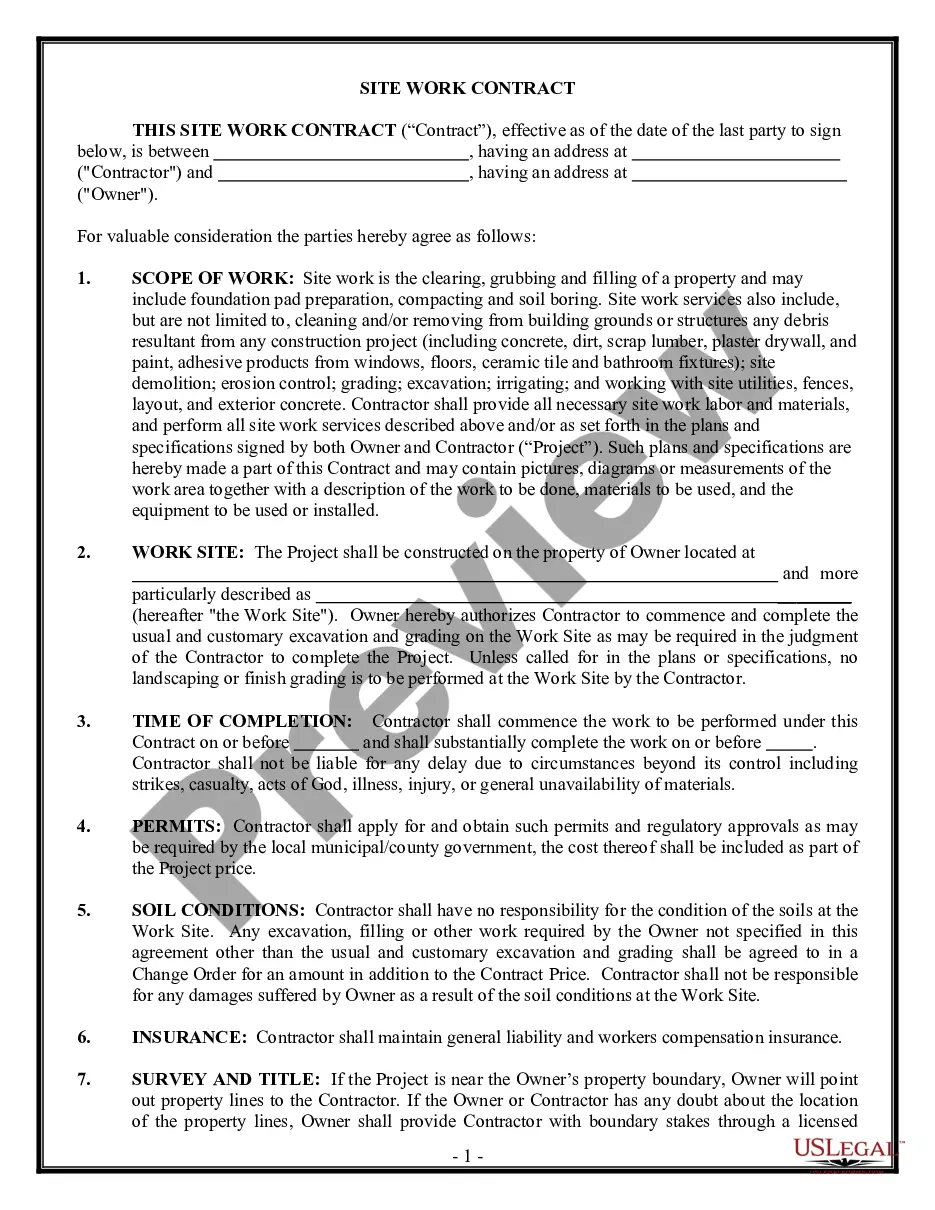

California Sample Letter for Fraudulent Charges against Client's Account

Description

How to fill out California Sample Letter For Fraudulent Charges Against Client's Account?

Choosing the right lawful document web template could be a have a problem. Obviously, there are plenty of templates available on the Internet, but how would you find the lawful kind you want? Take advantage of the US Legal Forms site. The assistance delivers 1000s of templates, for example the California Sample Letter for Fraudulent Charges against Client's Account, which can be used for organization and personal requires. All of the varieties are checked by professionals and fulfill state and federal specifications.

Should you be already signed up, log in in your profile and click the Acquire key to have the California Sample Letter for Fraudulent Charges against Client's Account. Make use of your profile to appear throughout the lawful varieties you may have acquired previously. Go to the My Forms tab of your profile and obtain another duplicate in the document you want.

Should you be a brand new end user of US Legal Forms, here are easy instructions for you to comply with:

- Initial, be sure you have selected the right kind for your personal metropolis/county. You are able to examine the shape making use of the Preview key and read the shape outline to make sure it is the best for you.

- If the kind is not going to fulfill your requirements, make use of the Seach area to get the proper kind.

- When you are certain the shape would work, go through the Purchase now key to have the kind.

- Choose the prices strategy you want and type in the required info. Build your profile and purchase the order making use of your PayPal profile or charge card.

- Choose the file file format and download the lawful document web template in your system.

- Total, modify and printing and indication the acquired California Sample Letter for Fraudulent Charges against Client's Account.

US Legal Forms may be the most significant local library of lawful varieties that you will find a variety of document templates. Take advantage of the company to download appropriately-manufactured files that comply with express specifications.