California Agreement to Compromise Debt by Returning Secured Property

Description

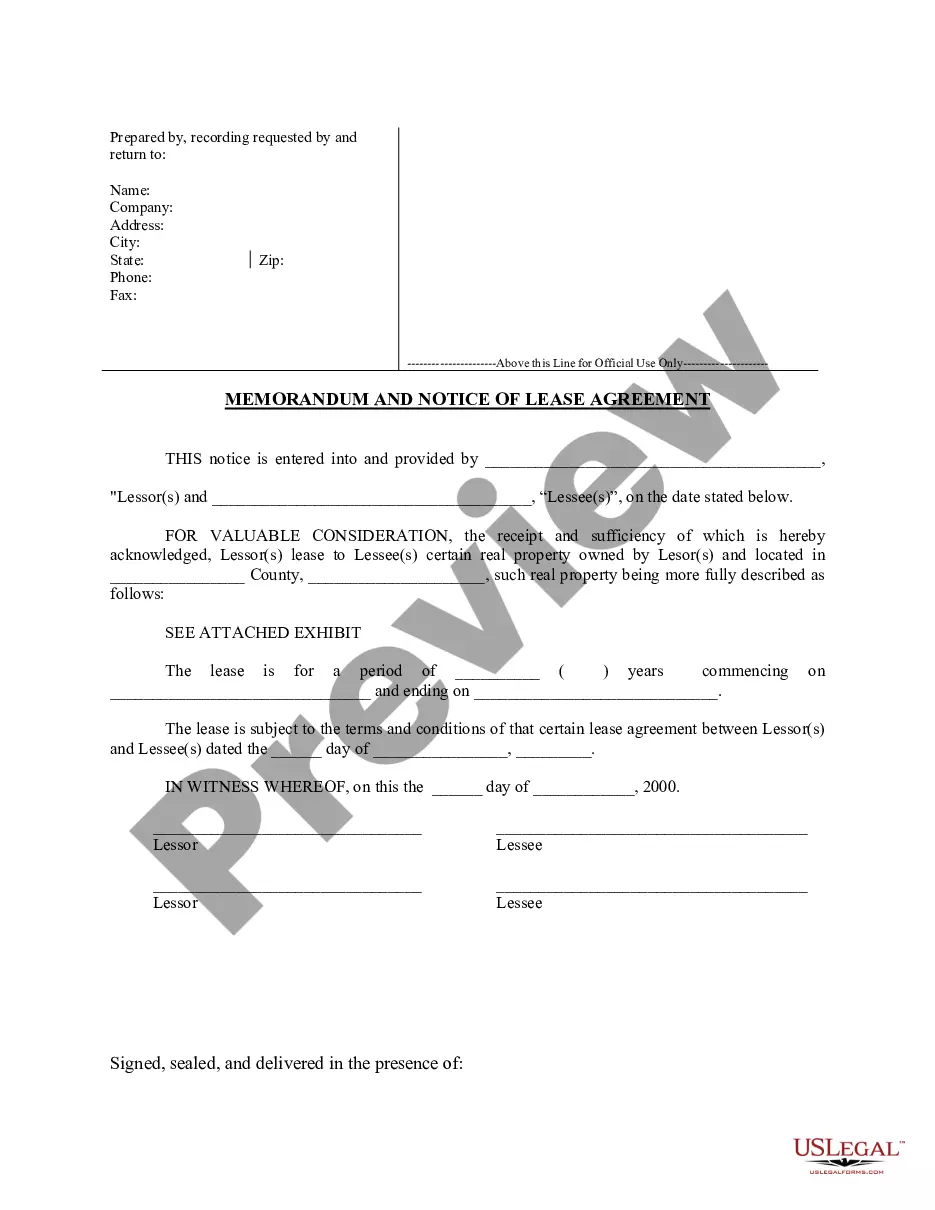

How to fill out Agreement To Compromise Debt By Returning Secured Property?

If you need thorough, acquire, or print authentic document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the website's straightforward and user-friendly search to locate the documents you require.

Numerous templates for commercial and personal uses are organized by categories and titles, or keywords.

Step 4. Once you have identified the form you want, click on the Purchase now button. Select the pricing plan you prefer and enter your details to create an account.

Step 5. Process the payment. You may utilize your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to locate the California Agreement to Compromise Debt by Returning Secured Property in just a few clicks.

- If you are a current US Legal Forms user, Log In to your account and then click the Acquire button to obtain the California Agreement to Compromise Debt by Returning Secured Property.

- You can also find forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions listed below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Review option to peruse the form's content. Do not forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

The 777 rule in California refers to the provision that allows debtors to claim certain personal property exemptions from collection. Specifically, it protects a limited amount of equity in personal property from being seized. Seeking to settle debts through the California Agreement to Compromise Debt by Returning Secured Property can also help preserve your valuable assets while addressing your financial obligations. Always consult with a professional to understand how this rule affects your situation.

In California, a debt typically becomes uncollectible after four years, which is the statute of limitations for most personal debts. After this period, creditors cannot take legal action to collect the debt. However, it's essential to explore options like the California Agreement to Compromise Debt by Returning Secured Property, as it may provide a more immediate solution for your financial situation. Understanding these timelines helps you make informed decisions about your finances.

To write a debt agreement, begin by specifying the parties involved and the total debt amount. Clearly define the repayment terms and any collateral included under the California Agreement to Compromise Debt by Returning Secured Property. Using resources like USLegalForms can simplify this process, providing you with legally vetted templates to create an effective, enforceable agreement.

Writing a debt settlement agreement requires clarity and structure. Start by outlining the key terms, including the amount owed, payment schedule, and any conditions. Ensure you include the California Agreement to Compromise Debt by Returning Secured Property if applicable. Consider using a platform like USLegalForms to access templates and legal guidance for creating a comprehensive agreement.

To write a settlement agreement, start by outlining the parties involved and explicating the dispute being resolved. Clearly state the terms of the settlement, including any payments, timelines, and responsibilities under the agreement. Ensure both parties sign and date the document to make it legally binding. Utilizing services like USLegalForms can streamline this process and assist you in crafting a thorough California Agreement to Compromise Debt by Returning Secured Property.

As of 2023, California has implemented new laws to protect consumers from aggressive debt collection practices. These laws require greater transparency from collectors and enhance your rights during the collection process. Knowing these protections can help you navigate negotiations effectively, particularly when dealing with a California Agreement to Compromise Debt by Returning Secured Property. Always stay informed about your rights to make empowered decisions.

In California, the statute of limitations on secured debt is typically four years. This period begins from the date of your last payment or the date you acknowledged the debt. After this time frame, creditors may be unable to sue you for the debt. It's crucial to understand this timeline when negotiating a California Agreement to Compromise Debt by Returning Secured Property.