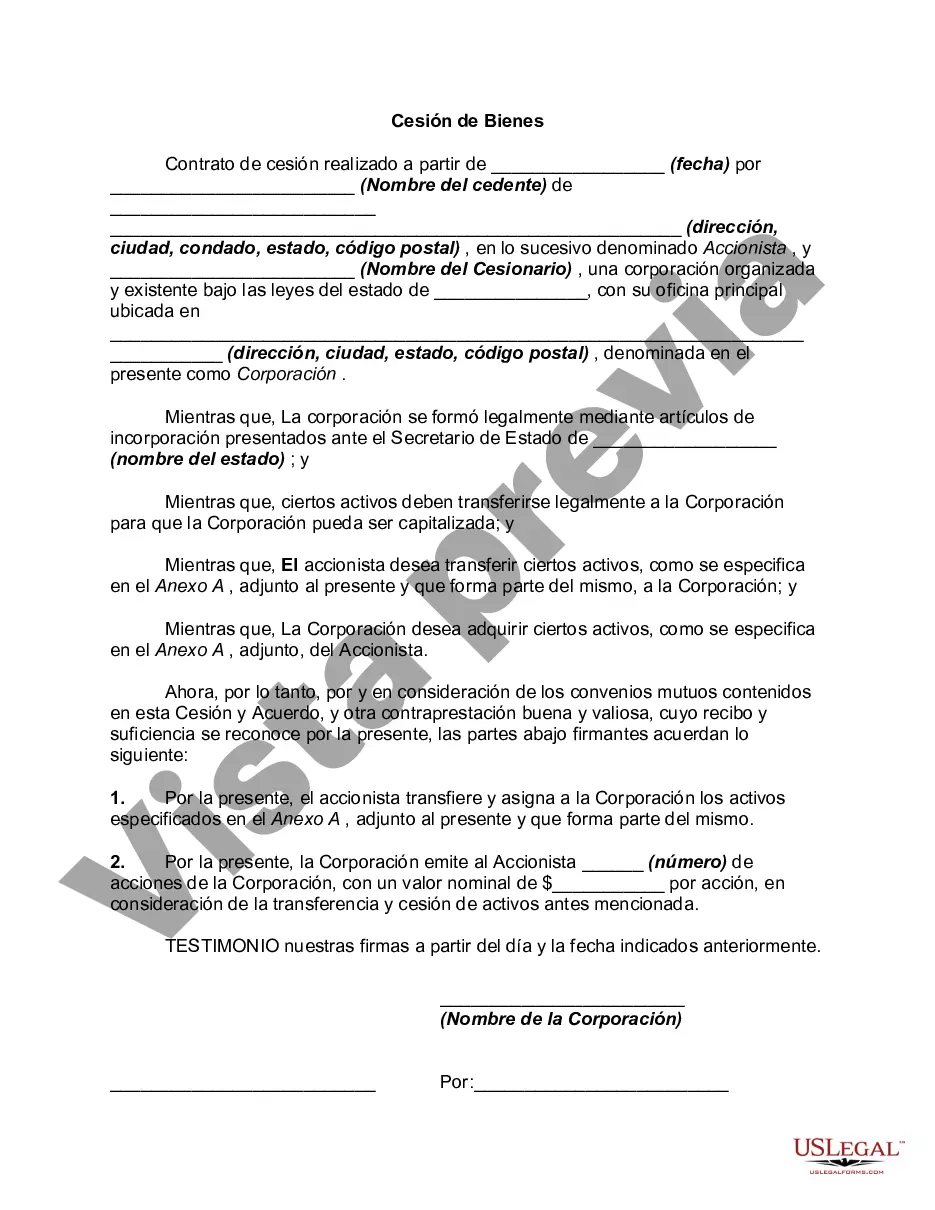

California Assignment of Assets is a legal document that allows an individual or entity to transfer their rights, interests, or ownership of specific assets to another party. This process helps ensure a smooth transfer of ownership and facilitates the proper distribution of assets. The primary purpose of a California Assignment of Assets is to legally document the transfer of ownership of assets between the assignor (original owner) and the assignee (new owner). This document is commonly used in various situations such as business mergers and acquisitions, estate planning, debt settlements, or simply as a means to transfer assets in a certain arrangement. There are different types of California Assignment of Assets that can be utilized depending on the nature and purpose of the transfer: 1. Real Estate Assignment: This type of assignment involves the transfer of ownership rights, interests, or claims to real estate properties, including land, buildings, or other structures. 2. Intellectual Property Assignment: In this case, the assignment relates to the transfer of ownership of intangible assets such as patents, copyrights, trademarks, or trade secrets. This ensures that the assignee becomes the new owner with exclusive rights to use, sell, or protect the intellectual property. 3. Financial Asset Assignment: This type of assignment involves the transfer of ownership of financial assets, such as stocks, bonds, mutual funds, or commodities. It enables the assignee to control and manage the financial assets, including the right to receive any income or proceeds generated. 4. Personal Property Assignment: This assignment applies to the transfer of ownership of movable assets, including tangible items such as vehicles, equipment, furniture, or artwork. It ensures that the assignee becomes the legal owner of the personal property and can use, sell, or dispose of it as they see fit. 5. Business Asset Assignment: This type of assignment is commonly used in business transactions, where the assignor transfers ownership of specific business assets, such as equipment, inventory, contracts, or customer lists. It allows the assignee to step into the assignor's shoes and carry on their business operations seamlessly. Regardless of the type of assignment, a California Assignment of Assets must contain essential details, including the names and addresses of both parties involved, a description of the assets being assigned, any limitations or conditions imposed on the assignment, and the effective date of the transfer. To ensure the document's legality and validity, it is crucial to seek professional legal advice or assistance when drafting or executing a California Assignment of Assets.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.California Cesión de Bienes - Assignment of Assets

Description

How to fill out California Cesión De Bienes?

Discovering the right authorized papers template might be a battle. Obviously, there are plenty of themes available on the Internet, but how do you find the authorized form you want? Utilize the US Legal Forms web site. The services provides thousands of themes, including the California Assignment of Assets, that you can use for enterprise and private requires. Each of the kinds are checked by professionals and satisfy federal and state needs.

When you are previously listed, log in to the accounts and then click the Download key to get the California Assignment of Assets. Utilize your accounts to check through the authorized kinds you possess acquired previously. Check out the My Forms tab of your accounts and obtain another version in the papers you want.

When you are a whole new customer of US Legal Forms, here are basic recommendations that you should stick to:

- First, ensure you have selected the correct form to your metropolis/county. You can look through the form while using Preview key and look at the form outline to guarantee this is basically the best for you.

- When the form fails to satisfy your expectations, utilize the Seach field to discover the proper form.

- When you are certain that the form is acceptable, click the Purchase now key to get the form.

- Opt for the rates program you need and type in the essential info. Build your accounts and pay money for the transaction making use of your PayPal accounts or charge card.

- Pick the submit format and download the authorized papers template to the device.

- Full, change and produce and indicator the acquired California Assignment of Assets.

US Legal Forms may be the greatest local library of authorized kinds in which you will find different papers themes. Utilize the service to download professionally-produced papers that stick to state needs.

Form popularity

FAQ

Assignment for the benefit of the creditors (ABC)(also known as general assignment for the benefit of the creditors) is a voluntary alternative to formal bankruptcy proceedings that transfers all of the assets from a debtor to a trust for liquidating and distributing its assets.

In the United States, a general assignment or an assignment for the benefit of creditors is simply a contract whereby the insolvent entity ("Assignor") transfers legal and equitable title, as well as custody and control of its property, to a third party ("Assignee") in trust, to apply the proceeds of sale to the

The ABC transaction is that the "sale" of the leasehold to C is actually. an assignment of future rent by B. The result would be to hold B. amount paid and received would represent the interest on a conventional mortgage.

(2) Assignee means a natural person solely in such person's capacity as an assignee for the benefit of creditors under the provisions of this chapter, which assignee shall not be a creditor or an equity security holder or have any interest adverse to the interest of the estate.

The term debt assignment refers to a transfer of debt, and all the associated rights and obligations, from a creditor to a third party. The assignment is a legal transfer to the other party, who then becomes the owner of the debt.

One of the key benefits of filing for bankruptcy is the imposition of an automatic stay, which halts all efforts to collect a claim against the debtor or the debtor's property (11 U.S.C. § 362). Unlike bankruptcy cases, in an ABC, there is no automatic stay.

An assignee in an assignment for the benefit of creditors serves in a capacity that is analogous to a bankruptcy trustee and is responsible for liquidating the assets of the assignment estate and distributing the net proceeds, if any, to the assignor's creditors.

It normally takes about 12 months to conclude an ABC. An ABC generally is faster and less costly than a bankruptcy proceeding. Parties can often agree and determine what is going to happen prior to execution of the assignment.

Assignment for the benefit of the creditors (ABC)(also known as general assignment for the benefit of the creditors) is a voluntary alternative to formal bankruptcy proceedings that transfers all of the assets from a debtor to a trust for liquidating and distributing its assets.