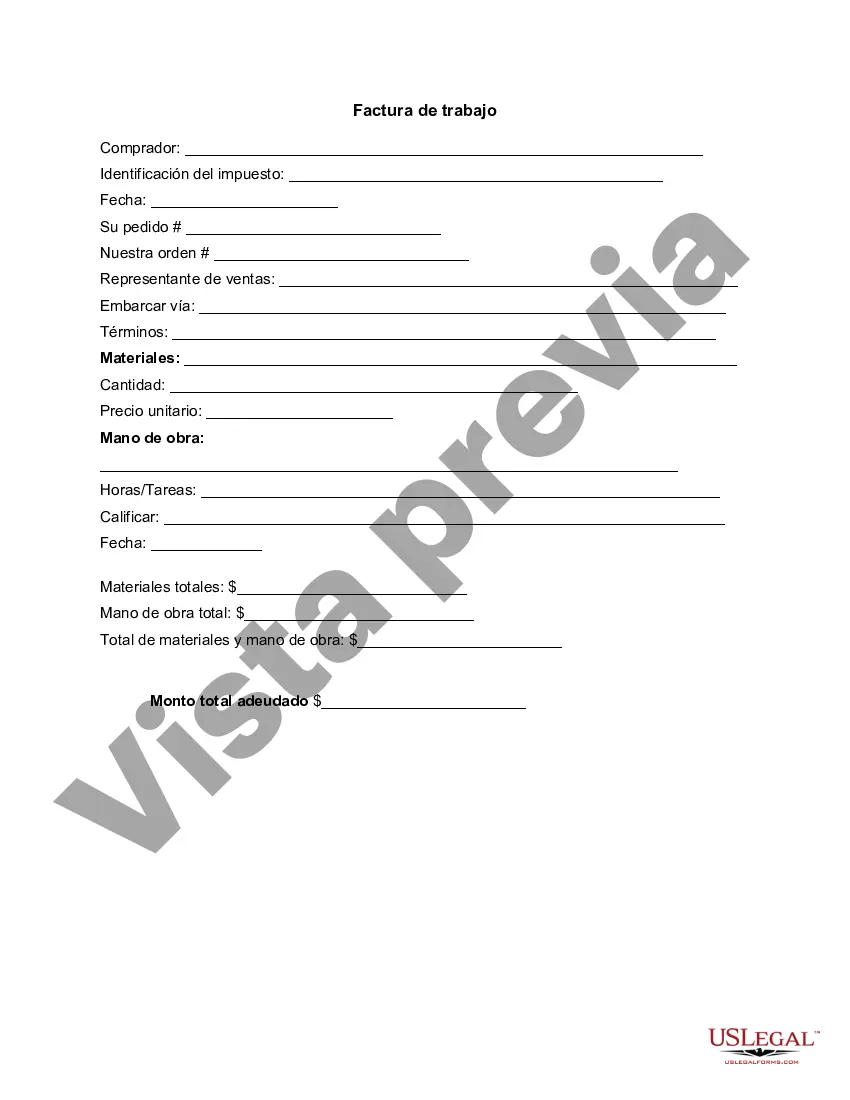

A California Invoice Template for Tailors is a customizable document that enables tailors and garment makers operating in California to create professional and legally compliant invoices for their services. This template serves as a convenient tool for tailors to bill their clients accurately, consistently, and effectively. Tailors in California often require a specialized invoice template that adheres to the state's specific regulations and requirements. These templates are designed to include all the necessary details and elements needed for such invoices. They typically come in various formats, including Microsoft Word, Excel, and PDF, allowing tailors to choose the option that best suits their preferences and needs. Key features and sections that can be found in a California Invoice Template for Tailor include: 1. Header: This section usually contains the tailor's or tailoring business's name, logo, address, and contact information. 2. Invoice Number and Date: Each invoice should have a unique identification number to ease tracking and reference. The date of issue is also mentioned for record-keeping purposes. 3. Client Information: This section includes the client's name, address, and contact details. It is crucial for keeping track of the client and ensuring accurate invoicing. 4. Description of Services: This part outlines the specific tailoring services provided, such as garment alterations, custom clothing creation, repairs, or any other related service. A detailed breakdown of each service with corresponding prices can be included. 5. Quantity and Rate: For each service provided, the quantity or units involved, along with their respective rates, should be clearly stated. This helps in calculating the total charges accurately. 6. Subtotal: The subtotal is the sum of all the tailoring services provided, excluding any taxes or additional charges. 7. Taxes and Discounts: If applicable, the invoice template should have a section for adding applicable sales taxes, such as California's state sales tax or local taxes. Any discounts or promotional offers can also be noted here. 8. Total Amount Due: This section provides the grand total of the invoice, which includes the subtotal, taxes, and discounts. It represents the final amount the client needs to pay for the tailoring services provided. Types of California Invoice Templates for Tailor: 1. Basic California Invoice Template for Tailor: This template includes the essential sections mentioned above and is suitable for tailors with straightforward invoicing needs. 2. Detailed California Invoice Template for Tailor: This template offers more comprehensive sections and allows for additional customization options. It is suitable for tailors who provide a wide range of services or have more complex invoicing requirements. 3. California Sales Tax Invoice Template for Tailor: This template specifically caters to tailors who need to add and calculate sales taxes according to California state laws. It ensures accurate compliance with tax regulations. In conclusion, a California Invoice Template for Tailor simplifies the invoicing process for tailors and ensures professionalism, accuracy, and regulatory compliance. With customizable options and various types available, tailors can select the template that best suits their specific invoicing needs in the state of California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.California Plantilla de factura para sastre - Invoice Template for Tailor

Description

How to fill out California Plantilla De Factura Para Sastre?

Are you presently in a placement the place you need to have papers for sometimes organization or individual uses almost every day time? There are a lot of lawful file templates available on the net, but getting types you can trust is not straightforward. US Legal Forms offers thousands of kind templates, much like the California Invoice Template for Tailor, which can be created in order to meet state and federal demands.

If you are presently knowledgeable about US Legal Forms internet site and get a free account, just log in. Afterward, you can download the California Invoice Template for Tailor design.

Should you not come with an accounts and need to start using US Legal Forms, abide by these steps:

- Discover the kind you need and ensure it is to the correct area/county.

- Take advantage of the Review key to examine the shape.

- Look at the information to ensure that you have chosen the appropriate kind.

- If the kind is not what you are trying to find, take advantage of the Look for industry to find the kind that fits your needs and demands.

- Once you get the correct kind, simply click Acquire now.

- Choose the costs prepare you need, submit the desired information and facts to generate your account, and buy your order with your PayPal or credit card.

- Select a practical document formatting and download your backup.

Get all of the file templates you have bought in the My Forms food selection. You can obtain a further backup of California Invoice Template for Tailor at any time, if needed. Just select the essential kind to download or print the file design.

Use US Legal Forms, by far the most extensive assortment of lawful varieties, to save lots of time as well as steer clear of errors. The assistance offers appropriately made lawful file templates that can be used for an array of uses. Generate a free account on US Legal Forms and begin making your way of life easier.