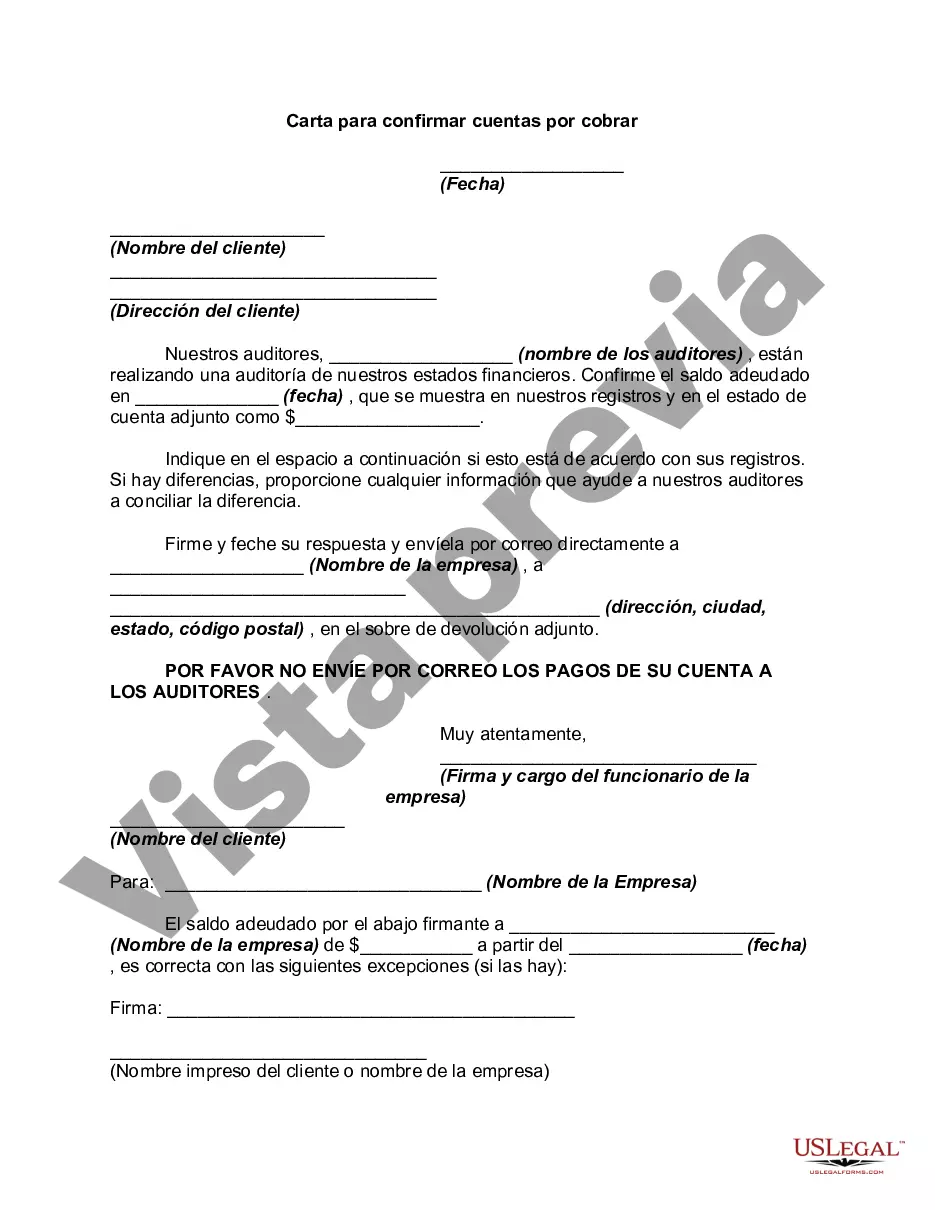

California Letter to Confirm Accounts Receivable is a legal document that serves as a written confirmation of outstanding accounts receivable between two parties. This letter is commonly used in business transactions within the state of California. The purpose of this letter is to ensure transparency, accuracy, and accountability regarding the accounts receivable balances. The content of a California Letter to Confirm Accounts Receivable typically includes: 1. Date: The date on which the letter is written. 2. Parties involved: The names and addresses of the sender (company or individual) and the recipient (customer or client) are mentioned. 3. Account details: A concise summary of the relevant account details, such as the customer's unique account number and the dates covered by the accounts receivable. 4. Invoice information: A listing of invoices issued and the corresponding amounts due, including invoice numbers, invoice dates, and balances owed. 5. Outstanding balance: The total amount outstanding, which is the sum of all unpaid invoices. 6. Payment terms: Mentioning the agreed-upon payment terms, such as due date, early payment discount (if applicable), and penalties for late payment (if any). 7. Confirmation request: A clear statement requesting the recipient to confirm the accuracy and validity of the outstanding balances within a specified timeframe. It may also include instructions on how to respond, whether by email, fax, or mail. 8. Contact information: Providing contact details of the sender, including phone number, email address, and physical address. 9. Closing: The letter is closed with a professional closing, usually "Sincerely" or "Best regards," followed by the sender's name, designation, and company details. Different types of California Letters to Confirm Accounts Receivable may include variations based on the industry, specific payment terms, and unique business requirements. Some examples of these variations could be: 1. Retail California Letter to Confirm Accounts Receivable: Specifically designed to confirm outstanding balances for retail businesses dealing with individual customers. 2. B2B California Letter to Confirm Accounts Receivable: Focused on confirming accounts receivable balances between two businesses, often involving wholesale or large-scale transactions. 3. Service-based California Letter to Confirm Accounts Receivable: Tailored to service-oriented companies, such as consultants or contractors, to validate service invoicing and outstanding payments. 4. Manufacturing California Letter to Confirm Accounts Receivable: Customized for manufacturing companies to confirm accounts receivable balances for bulk orders and supply chain transactions. 5. Legal California Letter to Confirm Accounts Receivable: Suitable for law firms or legal service providers, ensuring accounting accuracy and timely payments for services rendered. It is essential to consult legal counsel or an expert in preparing this document to ensure compliance with California state laws and any specific industry regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.California Carta para confirmar cuentas por cobrar - Letter to Confirm Accounts Receivable

Description

How to fill out California Carta Para Confirmar Cuentas Por Cobrar?

You may spend hrs online trying to find the legal papers web template that fits the state and federal requirements you will need. US Legal Forms supplies thousands of legal forms that happen to be analyzed by experts. You can easily acquire or printing the California Letter to Confirm Accounts Receivable from the support.

If you currently have a US Legal Forms bank account, you are able to log in and then click the Acquire option. After that, you are able to complete, edit, printing, or indicator the California Letter to Confirm Accounts Receivable. Each legal papers web template you purchase is yours permanently. To obtain one more backup of any bought kind, go to the My Forms tab and then click the corresponding option.

If you work with the US Legal Forms website the first time, keep to the easy directions listed below:

- Initial, ensure that you have selected the best papers web template for your state/area of your choice. Browse the kind explanation to ensure you have chosen the right kind. If readily available, take advantage of the Preview option to look with the papers web template as well.

- If you would like locate one more model of the kind, take advantage of the Research field to obtain the web template that fits your needs and requirements.

- When you have found the web template you want, click on Purchase now to move forward.

- Pick the rates plan you want, type your accreditations, and register for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You should use your charge card or PayPal bank account to pay for the legal kind.

- Pick the formatting of the papers and acquire it for your device.

- Make adjustments for your papers if possible. You may complete, edit and indicator and printing California Letter to Confirm Accounts Receivable.

Acquire and printing thousands of papers themes utilizing the US Legal Forms web site, that offers the largest variety of legal forms. Use professional and condition-certain themes to handle your business or specific needs.