The California Estoppel Affidavit of Mortgagor is a legal document used in real estate transactions that helps establish the rights and obligations of the mortgagor (borrower) related to a mortgage loan. It is a sworn statement provided by the mortgagor, usually during the refinancing or sale of a property, to confirm important information about the mortgage to potential buyers or lenders. The Estoppel Affidavit of Mortgagor serves as a declaration stating certain vital facts regarding the mortgage, preventing any misrepresentations or misunderstandings. It typically includes key information such as the outstanding balance, interest rate, payment terms, due dates, and any other significant details that may impact the validity or conditions of the mortgage. By providing this affidavit, the mortgagor assures potential buyers or lenders that the information provided is accurate and complete, preventing any subsequent disputes or discrepancies between parties involved in the transaction. The affidavit is signed under oath and is legally binding to the mortgagor, ensuring they are held accountable for the accuracy of the information provided. In California, there are additional types of Estoppel Affidavits that can be used, depending on the specific circumstances of the mortgage transaction. These may include: 1. Estoppel Affidavit of Mortgagor — Refinance: This type of affidavit is used when a borrower is refinancing their existing mortgage. It outlines the terms and conditions of the new loan, including any changes or modifications compared to the original mortgage. 2. Estoppel Affidavit of Mortgagor — Loan Assumption: If a borrower is transferring their mortgage to another party, this affidavit will detail the original mortgage terms, as well as any modifications or alterations made during the assumption process. 3. Estoppel Affidavit of Mortgagor — Subordination: This specific affidavit type applies when a subsequent mortgage is being placed on a property that already has an existing mortgage. It outlines the priorities of the mortgages and explains how the new mortgage will interact with the previous mortgage. In conclusion, the California Estoppel Affidavit of Mortgagor is an essential document in real estate transactions. It provides a comprehensive and accurate representation of the mortgage details, protecting all parties involved from potential disputes or misunderstandings. By utilizing various types of Estoppel Affidavits, borrowers can ensure the correct information is presented in situations such as refinancing, loan assumptions, or subordination.

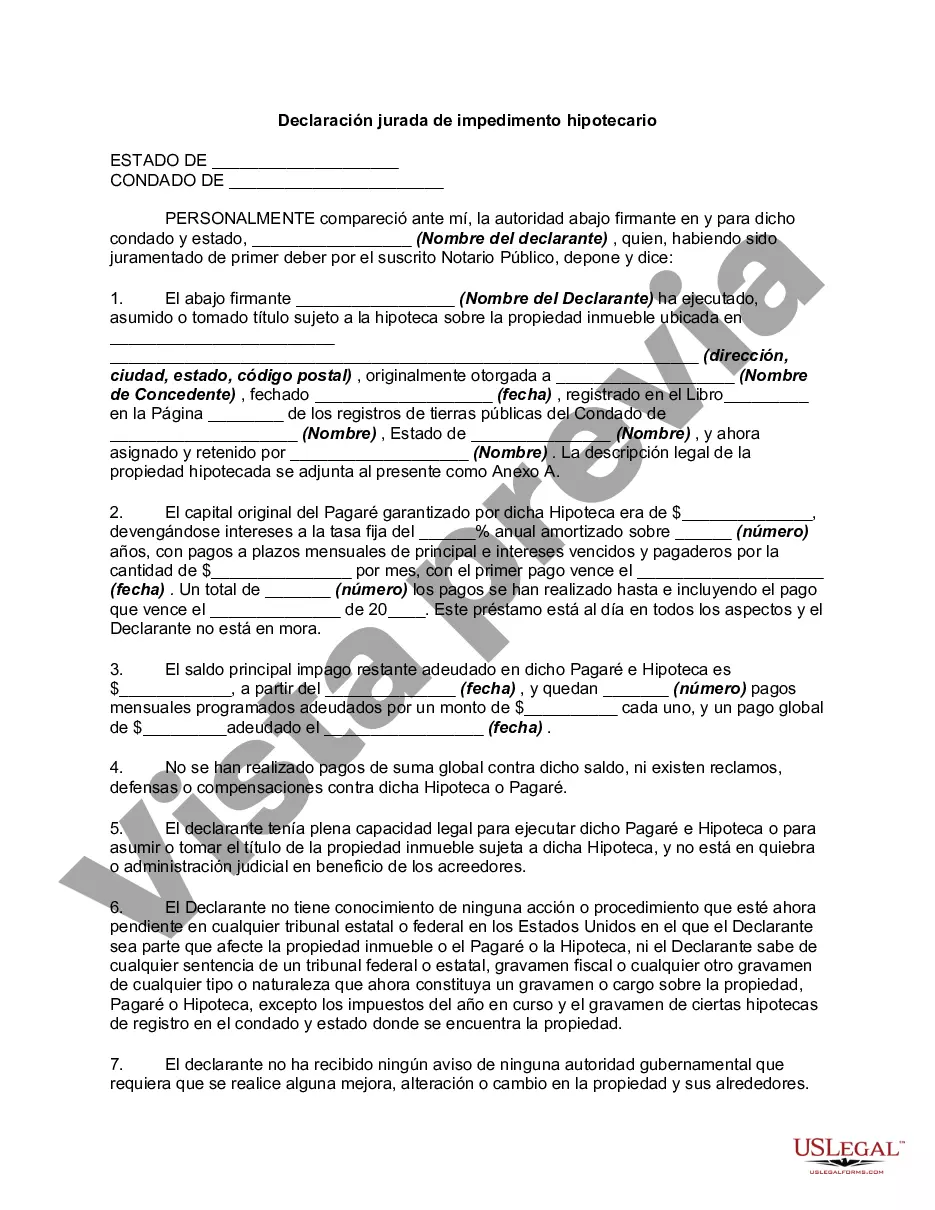

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.California Declaración jurada de impedimento hipotecario - Estoppel Affidavit of Mortgagor

Description

How to fill out California Declaración Jurada De Impedimento Hipotecario?

US Legal Forms - one of the biggest libraries of legal kinds in the States - offers a wide range of legal file templates you are able to obtain or print. Making use of the website, you may get 1000s of kinds for organization and person reasons, sorted by classes, suggests, or key phrases.You can get the most up-to-date variations of kinds just like the California Estoppel Affidavit of Mortgagor within minutes.

If you already have a membership, log in and obtain California Estoppel Affidavit of Mortgagor from your US Legal Forms library. The Obtain option will show up on each and every form you see. You have access to all earlier downloaded kinds inside the My Forms tab of your respective accounts.

In order to use US Legal Forms for the first time, listed below are straightforward instructions to help you get started out:

- Ensure you have picked the proper form for your personal area/county. Click the Preview option to check the form`s articles. Look at the form information to actually have chosen the appropriate form.

- In the event the form doesn`t suit your demands, make use of the Search industry near the top of the screen to get the one which does.

- If you are happy with the form, affirm your choice by simply clicking the Purchase now option. Then, choose the costs program you want and give your credentials to sign up for an accounts.

- Approach the financial transaction. Utilize your credit card or PayPal accounts to complete the financial transaction.

- Find the formatting and obtain the form on your gadget.

- Make changes. Load, modify and print and indicator the downloaded California Estoppel Affidavit of Mortgagor.

Every design you added to your bank account lacks an expiration day and is your own property forever. So, if you would like obtain or print yet another backup, just visit the My Forms section and click about the form you require.

Get access to the California Estoppel Affidavit of Mortgagor with US Legal Forms, one of the most considerable library of legal file templates. Use 1000s of specialist and state-distinct templates that fulfill your company or person requirements and demands.