California Partnership Agreement for Profit Sharing is a legal contract established between two or more entities in California for the purpose of sharing profits generated from a business venture. It outlines the rights, responsibilities, and obligations of each partner involved, ensuring clarity and fairness in profit distribution. The California Partnership Agreement for Profit Sharing is essential for any business structure that involves multiple owners or partners. This agreement outlines the terms and conditions under which the profits from the business will be shared among the partners. It addresses crucial aspects like profit allocation, decision-making authority, capital contributions, and dispute resolution mechanisms. Types of California Partnership Agreements for Profit Sharing: 1. General Partnership Agreement: This is the most common type of partnership agreement in California. It establishes a partnership in which all partners have equal rights and responsibilities, including equal shares of profits and losses. 2. Limited Partnership Agreement: In this type of agreement, there are two types of partners: general partners and limited partners. General partners are responsible for managing the business and have unlimited liability, while limited partners contribute capital but enjoy limited liability. Profit sharing is determined based on the agreed terms outlined in the partnership agreement. 3. Limited Liability Partnership (LLP): An LLP combines the benefits of a general partnership and a limited liability company (LLC). It offers partners protection against personal liability while still allowing them to participate in profit sharing and management decisions. 4. Joint Venture Agreement: This agreement is formed when two or more entities join forces for a specific business project. The profit sharing terms may vary depending on the specific project and the roles and contributions of each party. 5. Professional Partnership Agreement: This type of partnership agreement is specifically designed for professionals such as lawyers, doctors, or accountants. It allows licensed professionals to form partnerships and share profits while adhering to industry regulations and ethics. In summary, the California Partnership Agreement for Profit Sharing is a crucial legal document that establishes clear guidelines for how profits are shared among partners in a business venture. The agreement helps maintain harmony and fairness among partners, ensuring the smooth operation and success of the partnership.

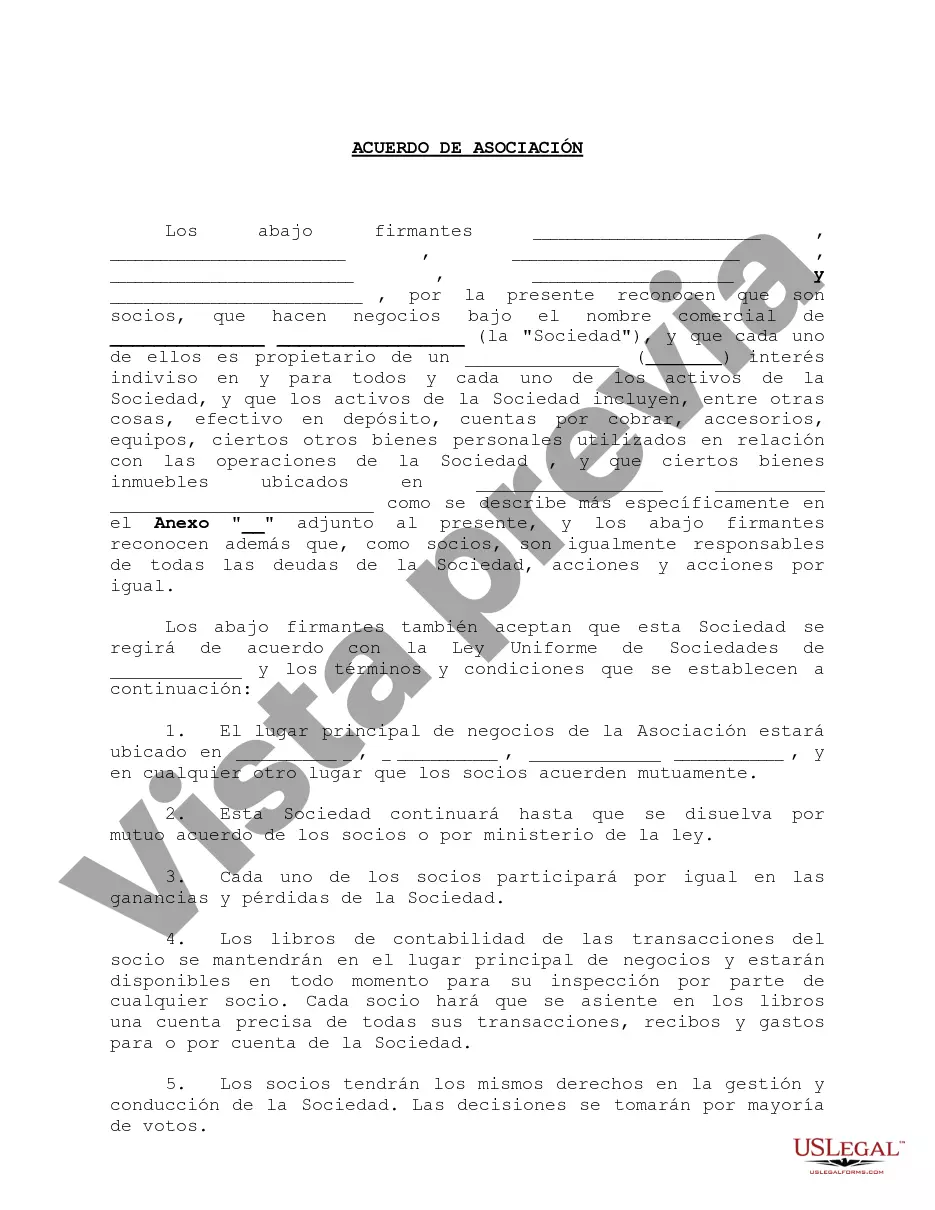

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.California Acuerdo de Asociación para el Reparto de Utilidades - Partnership Agreement for Profit Sharing

Description

How to fill out California Acuerdo De Asociación Para El Reparto De Utilidades?

If you want to full, obtain, or print out lawful record templates, use US Legal Forms, the most important collection of lawful forms, which can be found on the web. Utilize the site`s simple and practical search to get the papers you will need. Various templates for organization and specific reasons are categorized by categories and says, or keywords and phrases. Use US Legal Forms to get the California Partnership Agreement for Profit Sharing with a number of clicks.

When you are previously a US Legal Forms consumer, log in to the account and click the Download key to obtain the California Partnership Agreement for Profit Sharing. Also you can entry forms you in the past downloaded in the My Forms tab of the account.

If you are using US Legal Forms initially, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape for your correct metropolis/nation.

- Step 2. Take advantage of the Review method to examine the form`s information. Never neglect to read through the information.

- Step 3. When you are unsatisfied together with the kind, utilize the Research field at the top of the display screen to discover other models of the lawful kind web template.

- Step 4. Upon having found the shape you will need, click on the Purchase now key. Pick the rates strategy you prefer and add your qualifications to sign up to have an account.

- Step 5. Method the transaction. You can utilize your Мisa or Ьastercard or PayPal account to finish the transaction.

- Step 6. Select the format of the lawful kind and obtain it in your product.

- Step 7. Total, edit and print out or sign the California Partnership Agreement for Profit Sharing.

Every lawful record web template you get is your own eternally. You may have acces to each kind you downloaded with your acccount. Click on the My Forms section and choose a kind to print out or obtain yet again.

Be competitive and obtain, and print out the California Partnership Agreement for Profit Sharing with US Legal Forms. There are millions of skilled and condition-specific forms you may use for the organization or specific demands.