The California Investment Letter — Intrastate Offering is an important legal document created under California law to facilitate the fundraising process for businesses and startups within the state. This offering is specifically designed for companies seeking to raise capital from California residents only, and it ensures compliance with the state's intrastate crowdfunding exemptions. The purpose of the California Investment Letter — Intrastate Offering is to provide potential investors with detailed information about the investment opportunity, including the company's background, financial information, risk factors, and terms of the offering. The document serves as a means for the company to present a comprehensive picture of its business model and growth potential, helping potential investors make an informed decision about whether to invest. Keywords: California, Investment Letter, Intrastate Offering, legal document, fundraising, businesses, startups, capital, California residents, compliance, intrastate crowdfunding exemptions, investment opportunity, company background, financial information, risk factors, terms of the offering, business model, growth potential, investors. Different types of California Investment Letter — Intrastate Offering may include: 1. Equity Offering: This type of offering entails the sale of company shares in exchange for investment capital. Investors become partial owners in the company and may benefit from potential future profits or dividends. 2. Debt Offering: In this case, the company seeks to raise funds by offering debt securities to investors. Investors essentially become creditors to the company and receive regular interest payments until the debt is repaid. 3. Convertible Offering: A convertible offering provides investors the opportunity to convert their investment into company shares at a later date, usually when certain predetermined conditions are met. This type of offering provides flexibility for both the company and investors. 4. Revenue Sharing Offering: This offering structure allows investors to receive a portion of the company's future revenue in proportion to their investment. It provides investors with a direct link to the company's financial success while potentially reducing some risks associated with traditional equity investments. 5. Preferred Stock Offering: Preferred stock offerings provide investors with a higher claim on assets and earnings compared to common stockholders. Investors who opt for preferred stock usually receive fixed dividends and have a greater chance of recouping their investment before common shareholders. These different types of offerings can cater to varying needs and preferences of potential investors, allowing companies to tailor their investment offerings accordingly.

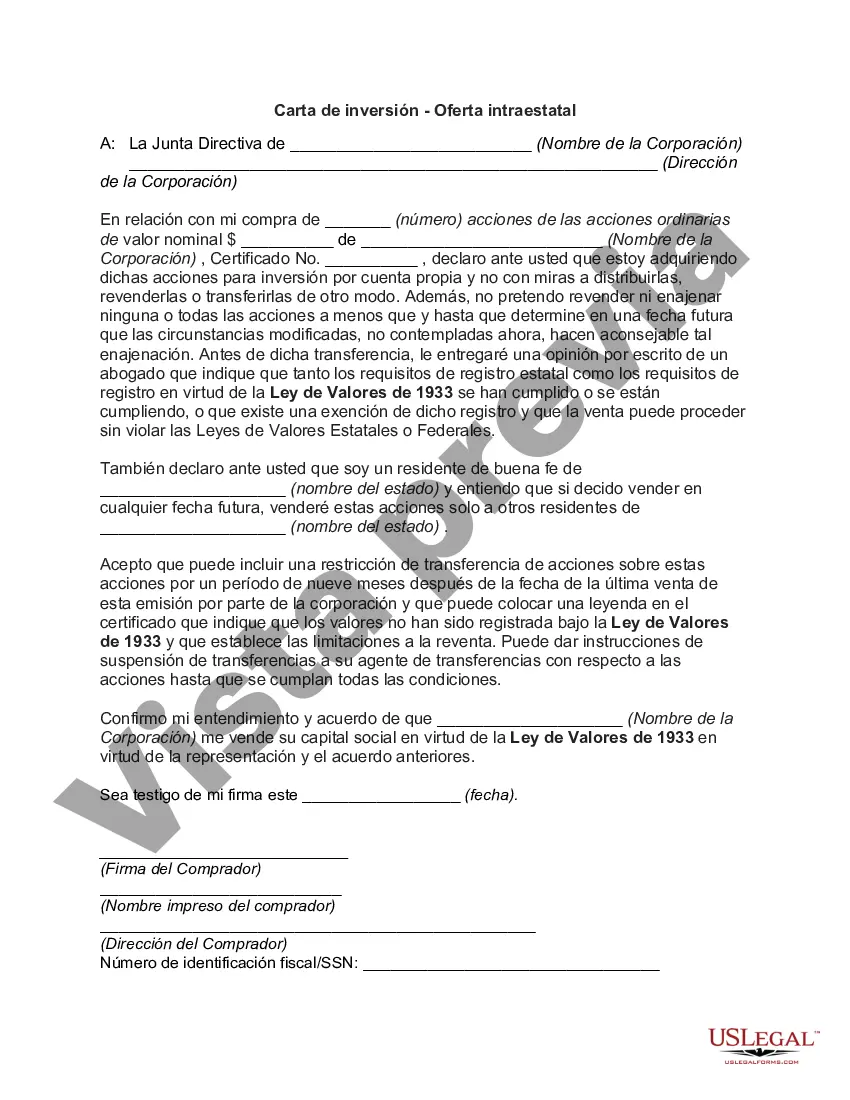

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.California Carta de inversión - Oferta intraestatal - Investment Letter - Intrastate Offering

Description

How to fill out California Carta De Inversión - Oferta Intraestatal?

If you need to complete, down load, or produce lawful papers templates, use US Legal Forms, the greatest selection of lawful forms, which can be found online. Make use of the site`s basic and hassle-free research to obtain the documents you want. Various templates for company and individual uses are sorted by classes and says, or key phrases. Use US Legal Forms to obtain the California Investment Letter - Intrastate Offering in a handful of click throughs.

When you are already a US Legal Forms client, log in in your profile and click on the Acquire switch to have the California Investment Letter - Intrastate Offering. You can even accessibility forms you earlier downloaded in the My Forms tab of your profile.

If you work with US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for your correct town/region.

- Step 2. Make use of the Review option to look over the form`s content material. Don`t overlook to see the description.

- Step 3. When you are not happy together with the kind, use the Research industry on top of the screen to find other models of your lawful kind format.

- Step 4. When you have located the form you want, go through the Buy now switch. Pick the pricing strategy you like and add your qualifications to register to have an profile.

- Step 5. Procedure the transaction. You should use your Мisa or Ьastercard or PayPal profile to perform the transaction.

- Step 6. Select the structure of your lawful kind and down load it in your device.

- Step 7. Comprehensive, edit and produce or indicator the California Investment Letter - Intrastate Offering.

Every single lawful papers format you purchase is your own eternally. You might have acces to every single kind you downloaded with your acccount. Select the My Forms portion and pick a kind to produce or down load again.

Compete and down load, and produce the California Investment Letter - Intrastate Offering with US Legal Forms. There are millions of professional and express-distinct forms you may use for your company or individual needs.