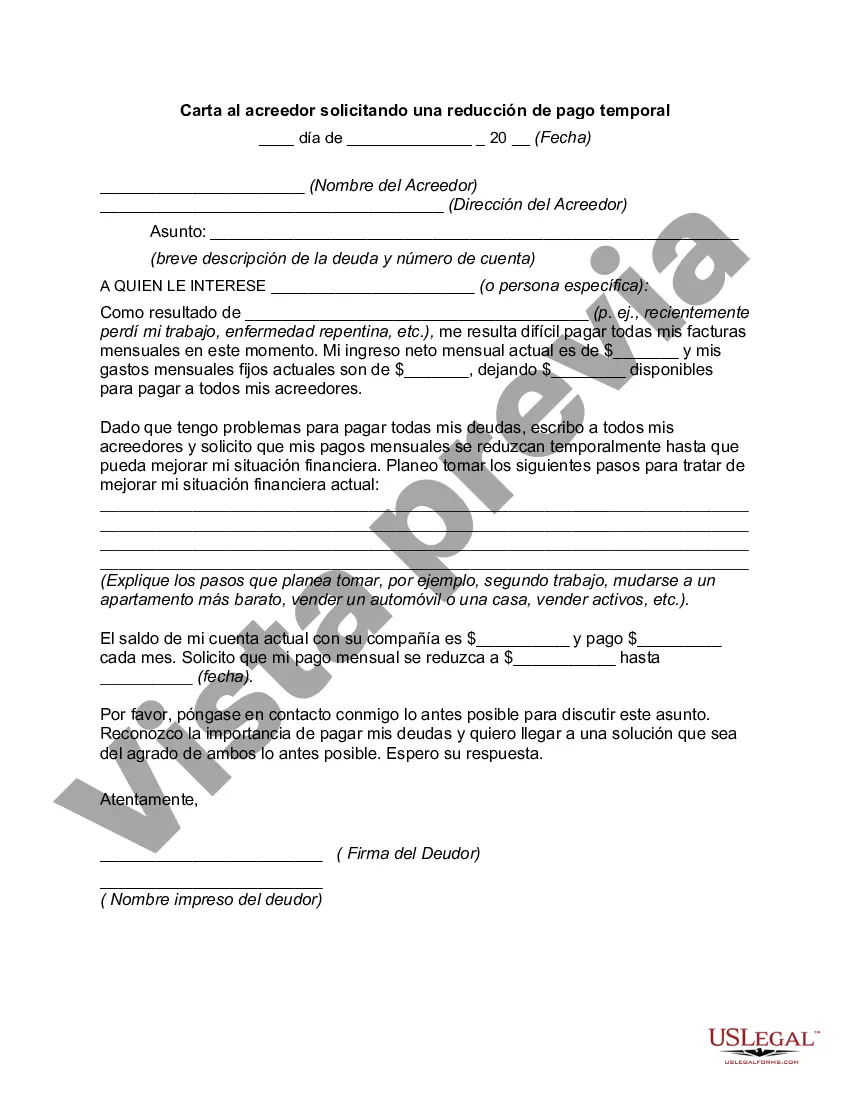

Title: California Letter to Creditor Requesting a Temporary Payment Reduction: A Detailed Guide Introduction: In specific circumstances, individuals residing in California may face financial hardships that make it challenging to keep up with their debt obligations. When faced with this situation, one option to consider is writing a California Letter to Creditor Requesting a Temporary Payment Reduction. This article provides a comprehensive overview of what this letter entails, its importance, and the different types available. 1. Understanding the Purpose of the Letter: A California Letter to Creditor Requesting a Temporary Payment Reduction is a written communication sent by individuals to their creditors, aiming to temporarily reduce their monthly payment obligations. This request is typically made during periods of financial strain, such as unemployment, medical emergencies, or other unexpected circumstances. 2. Importance of Writing the Letter: By sending a well-crafted letter to creditors, Californians can proactively address their financial situation and avoid defaulting on their payments. These letters demonstrate the borrower's commitment to fulfill their obligations while seeking temporary relief, portraying responsible financial conduct. 3. Key Components to Include: When drafting a California Letter to Creditor Requesting a Temporary Payment Reduction, it is vital to ensure the document is thorough and concise. The following components should be included: — Heading: Personal information, including name, address, and contact details. — Creditor Information: Address the letter to the specific creditor, including their name, address, and contact details. — Account Details: Clearly state relevant account details, such as loan or credit card numbers, to ensure accuracy. — Reason for Request: Explain in detail the financial hardship faced, emphasizing the temporary nature of the request. — Proposed Temporary Payment Reduction: Present a reasonable proposed reduction amount or payment plan, considering your current financial situation. — Supporting Documentation: Include any necessary supporting documents, such as medical bills, layoff notices, or income statements, to lend credibility to your request. — Request for Confirmation and Response: Politely request the creditor to confirm receipt of the letter and request a written response within a specified timeframe. 4. Types of California Letter to Creditor Requesting a Temporary Payment Reduction: — Mortgage Payment Reduction Letter: When facing difficulties in paying the monthly mortgage, Californians can write this letter to request a temporary reduction, avoiding potential foreclosure. — Credit Card Payment Reduction Letter: This type of letter is specific to credit card outstanding balances, providing a temporary reduction plan to cope with overwhelming debts. — Student Loan Payment Reduction Letter: Students or recent graduates burdened by high student loan payments can write this letter to seek temporary relief until their financial situation stabilizes. — Personal Loan Payment Reduction Letter: Individuals with personal loans can use this letter to request reduced monthly payments temporarily, reducing financial strain during challenging periods. Conclusion: When individuals in California face financial hardship, a well-crafted California Letter to Creditor Requesting a Temporary Payment Reduction serves as a crucial tool for seeking short-term financial relief. By following the guidelines and including all necessary information, borrowers can effectively communicate their needs to their creditors and work towards a realistic resolution during challenging times.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.California Carta al acreedor solicitando una reducción de pago temporal - Letter to Creditor Requesting a Temporary Payment Reduction

Description

How to fill out California Carta Al Acreedor Solicitando Una Reducción De Pago Temporal?

Are you currently in a situation that you need documents for sometimes company or specific purposes virtually every day? There are a lot of authorized papers layouts available on the Internet, but getting types you can rely is not easy. US Legal Forms provides 1000s of form layouts, just like the California Letter to Creditor Requesting a Temporary Payment Reduction, that are composed to fulfill federal and state requirements.

In case you are previously familiar with US Legal Forms internet site and also have a merchant account, just log in. Afterward, it is possible to down load the California Letter to Creditor Requesting a Temporary Payment Reduction web template.

If you do not come with an profile and wish to start using US Legal Forms, follow these steps:

- Obtain the form you want and make sure it is to the correct town/county.

- Utilize the Review switch to review the form.

- Look at the explanation to actually have chosen the right form.

- If the form is not what you are seeking, take advantage of the Look for industry to get the form that meets your needs and requirements.

- Once you find the correct form, click on Get now.

- Choose the prices program you need, submit the desired information to produce your account, and pay for the order with your PayPal or Visa or Mastercard.

- Choose a handy document format and down load your version.

Find all the papers layouts you may have bought in the My Forms menu. You can aquire a additional version of California Letter to Creditor Requesting a Temporary Payment Reduction at any time, if possible. Just select the necessary form to down load or print out the papers web template.

Use US Legal Forms, the most substantial variety of authorized kinds, to save efforts and steer clear of errors. The support provides expertly manufactured authorized papers layouts which can be used for a range of purposes. Generate a merchant account on US Legal Forms and commence making your life a little easier.