California Employee Time Sheet

Description

How to fill out Employee Time Sheet?

You can spend hours online searching for the legal document template that meets your state and federal requirements. US Legal Forms provides thousands of legal documents that have been evaluated by professionals.

You can easily download or print the California Employee Time Sheet from my service.

If you already have a US Legal Forms account, you may Log In and click the Obtain button. After that, you can complete, modify, print, or sign the California Employee Time Sheet. Each legal document template you purchase is yours forever.

Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Download the format of the document and save it to your device. Make changes to your document if necessary. You can complete, edit, sign, and print the California Employee Time Sheet. Access and print thousands of document templates using the US Legal Forms website, which offers the largest array of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To obtain another copy of any purchased form, visit the My documents section and click the respective button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the right document template for the state/region of your choice. Check the form summary to confirm you’ve chosen the correct one.

- If available, utilize the Preview button to view the document template simultaneously.

- If you wish to find an additional version of the form, use the Search field to locate the template that suits your requirements.

- Once you’ve found the template you need, click on Get now to proceed.

- Select the pricing plan you need, input your details, and create an account on US Legal Forms.

Form popularity

FAQ

All nonexempt employees are required to accurately record hours worked. Unless otherwise notified, employees are required to accurately record their work time through the use of a time card, an electronic time-keeping system or a handwritten record.

California Minimum Wage Effective January 1, 2022$15 per hour for workers at businesses with 26 or more employees. $14 per hour for workers at small businesses (25 or fewer employees). For more information on California minimum wage.

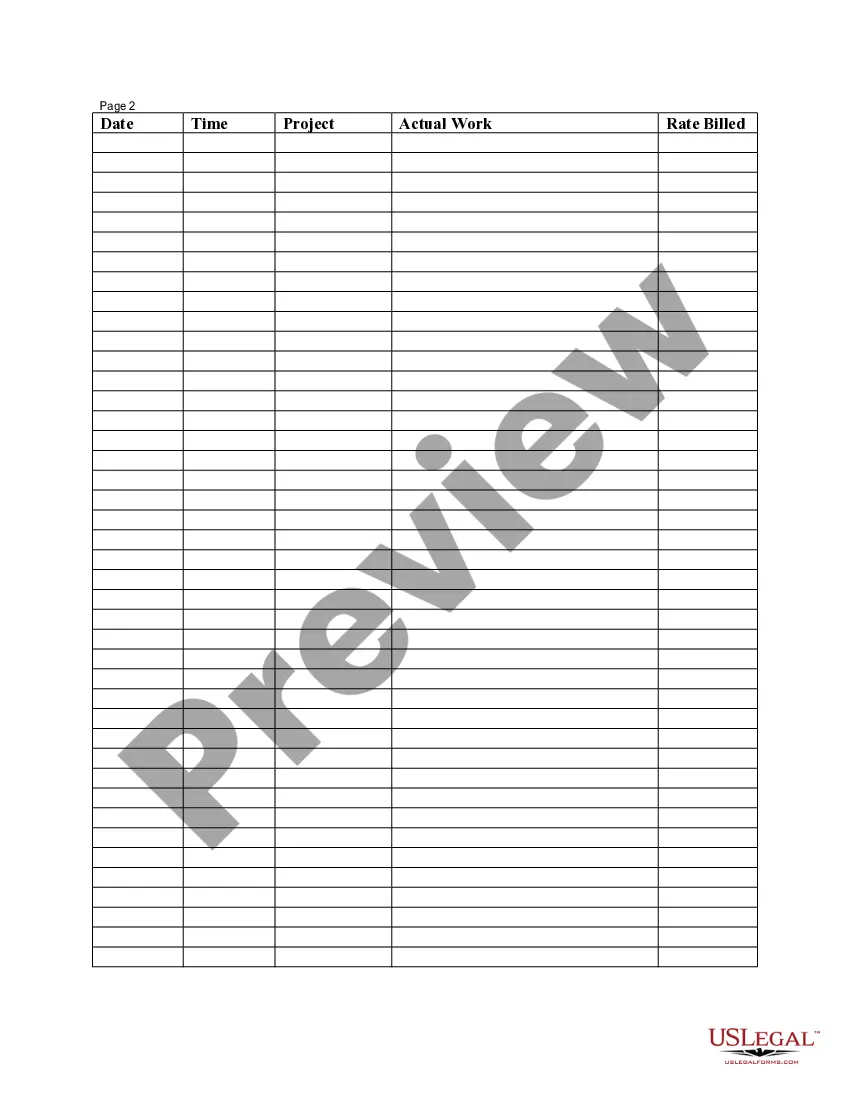

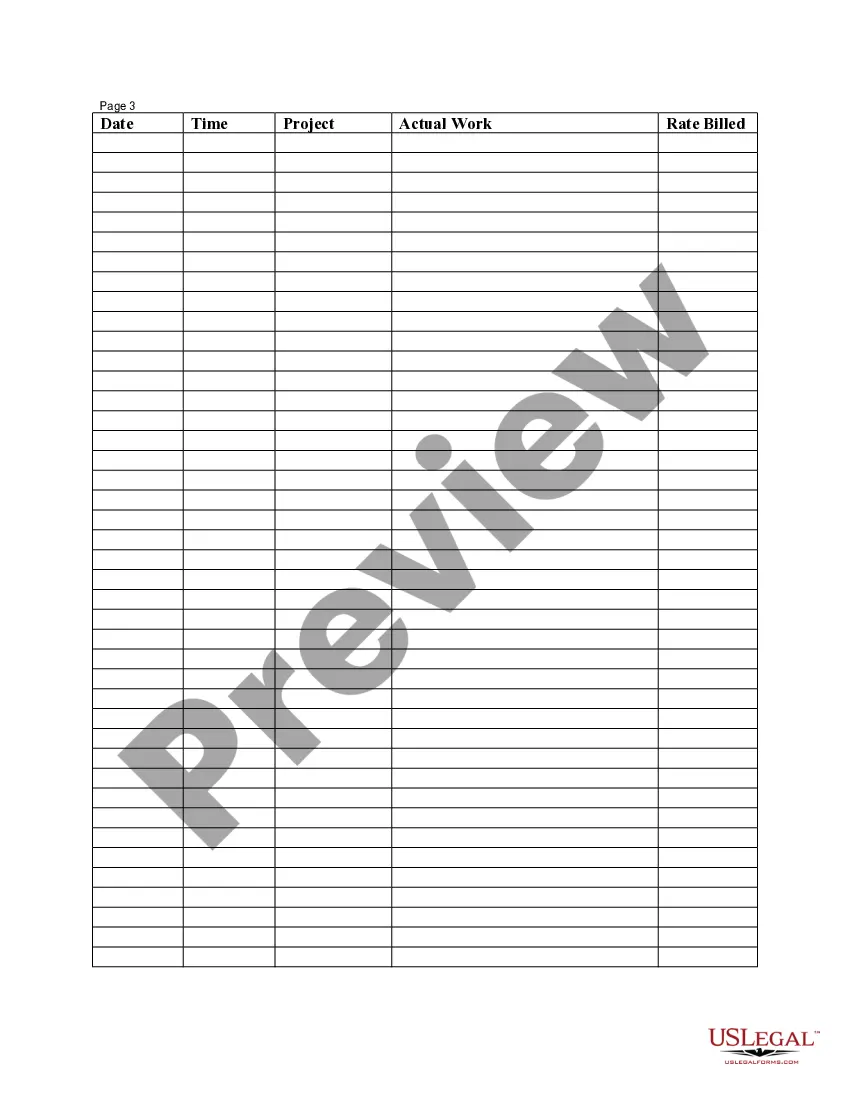

Timesheets or electric time clock systems must include the employee's name, any company assigned employee ID code, hours worked each day with date and times worked and other company specific information necessary to process payroll according to the pay schedule.

Records must be maintained in California These records must be maintained in the state or at the plants or establishments at which employees are employed. The records must be kept for at least three years.

You must keep all payroll records for at least three years, according to the Fair Labor Standards Act (FLSA). And, you need to keep records that show how you determined wages for two years (e.g., time cards that comply with FLSA timekeeping requirements).

As set forth below, the Wage Orders require time records shall be kept on file by the employer for at least three years at the place of employment or at a central location within the State of California. Therefore, employers should consider maintaining a copy of employee time records, either electronically or on

In California, there are no mandatory grace periods. But as an employer you may choose to provide an employee with a 10 minute grace period for when they clock out. This grace period is voluntary and you've done so to grant employees flexibility when clocking in and out.

1. Are employers required to use a particular type of timekeeping system? California law does not require the use of any electronic type of timekeeping system or time clocks. Employers may elect to use paper and pen in recording an employee's time.