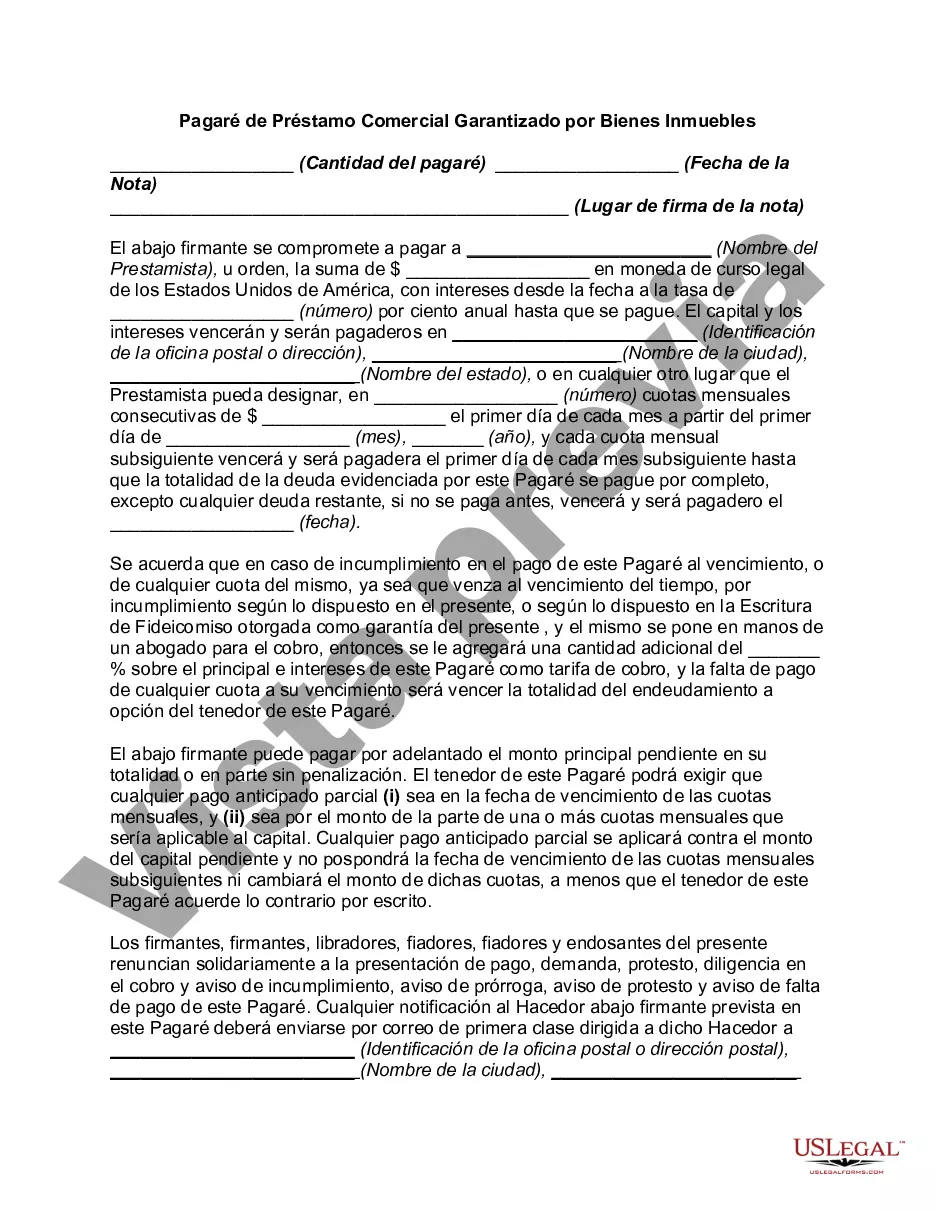

A California Promissory Note for a Commercial Loan Secured by Real Property is a legal document used in the state of California to outline the terms of a commercial loan that is secured by real estate property. This type of promissory note is commonly used when a borrower (typically a business or commercial entity) needs to obtain financing for various purposes, such as expansion, purchasing new equipment, or funding operational expenses. Keywords: California, promissory note, commercial loan, secured, real property, legal document, terms, borrower, financing, business, commercial entity, expansion, equipment, operational expenses. There are several types of California Promissory Notes for Commercial Loans Secured by Real Property, each tailored to specific situations and needs: 1. Fixed-Rate Promissory Note: This type of promissory note establishes a fixed interest rate that remains constant throughout the loan term. Borrowers can rely on predictable and stable monthly payments, making it suitable for long-term loans where interest rates are expected to rise. 2. Adjustable-Rate Promissory Note: Unlike a fixed-rate note, an adjustable-rate promissory note features an interest rate that can fluctuate periodically during the loan term. This can be advantageous if interest rates are expected to decrease, potentially leading to lower monthly payments. 3. Balloon Promissory Note: A balloon promissory note allows borrowers to make smaller monthly payments over an initial period while deferring a large portion of the principal balance to the end of the loan term. This can be helpful for borrowers with short-term cash flow constraints but expect to pay off the outstanding principal balance in a lump sum later. 4. Interest-Only Promissory Note: With an interest-only promissory note, borrowers are only required to make regular interest payments during a specified period, usually at the beginning of the loan term. This allows borrowers to minimize their initial cash outflow but later transition into principal and interest payments. 5. Demand Promissory Note: A demand promissory note gives the lender the ability to request full repayment of the loan at any time they deem necessary. This type of note provides flexibility to both parties but can be potentially risky for borrowers who may need a longer-term loan. 6. Nonrecourse Promissory Note: A nonrecourse promissory note protects the borrower by limiting the lender's right to seize other assets beyond the secured real property in case of default. This type of note is common in commercial real estate loans. In conclusion, a California Promissory Note for a Commercial Loan Secured by Real Property is a legally binding document that outlines the terms, repayment structure, and rights of the borrower and lender in a commercial loan agreement. The various types provide flexibility and cater to different financial situations and preferences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.California Pagaré de Préstamo Comercial Garantizado por Bienes Inmuebles - Promissory Note for Commercial Loan Secured by Real Property

Description

How to fill out California Pagaré De Préstamo Comercial Garantizado Por Bienes Inmuebles?

Are you currently in the situation the place you will need files for possibly company or individual functions virtually every time? There are a variety of legal record themes available on the Internet, but getting kinds you can rely isn`t simple. US Legal Forms provides thousands of type themes, much like the California Promissory Note for Commercial Loan Secured by Real Property, that happen to be composed to meet state and federal specifications.

When you are presently familiar with US Legal Forms website and also have your account, merely log in. Afterward, it is possible to obtain the California Promissory Note for Commercial Loan Secured by Real Property template.

If you do not come with an accounts and would like to begin using US Legal Forms, follow these steps:

- Find the type you will need and make sure it is for the proper metropolis/county.

- Make use of the Preview option to review the shape.

- Read the explanation to actually have selected the right type.

- In the event the type isn`t what you`re seeking, utilize the Look for field to obtain the type that suits you and specifications.

- When you obtain the proper type, click Get now.

- Select the costs strategy you need, fill out the necessary details to make your account, and buy an order using your PayPal or credit card.

- Select a handy data file file format and obtain your version.

Discover each of the record themes you possess bought in the My Forms menus. You can aquire a additional version of California Promissory Note for Commercial Loan Secured by Real Property any time, if required. Just click on the required type to obtain or print the record template.

Use US Legal Forms, probably the most substantial selection of legal types, to save lots of time and steer clear of errors. The services provides expertly manufactured legal record themes that you can use for an array of functions. Create your account on US Legal Forms and begin creating your lifestyle easier.