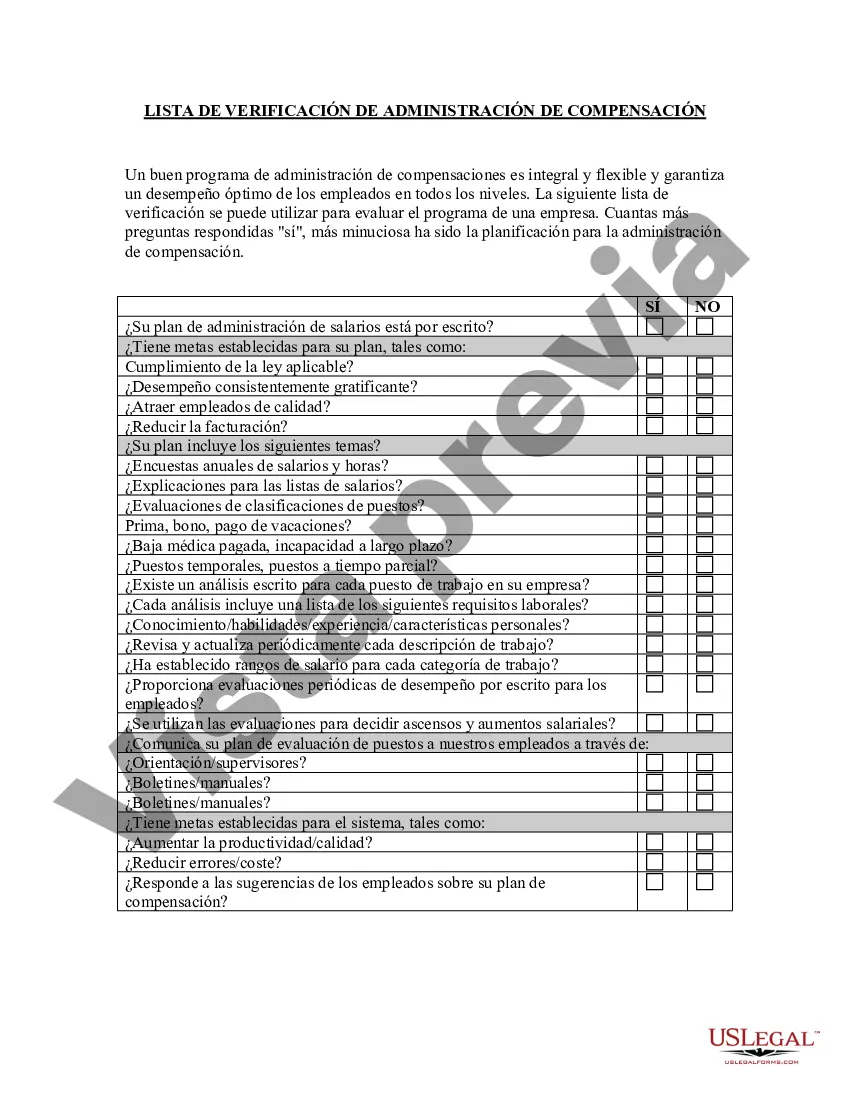

California Compensation Administration Checklist is a comprehensive tool used by organizations operating in California to ensure compliance with the state's compensation laws and regulations. This checklist is designed to assist employers in effectively managing and administering compensation practices in accordance with California labor laws. It covers various aspects of compensation, including wage and hour laws, overtime calculations, minimum wage requirements, salary deductions, reimbursement policies, and more. Keywords: California, compensation administration, checklist, compliance, labor laws, wage and hour, overtime calculations, minimum wage, salary deductions, reimbursement policies. Different types of California Compensation Administration Checklists: 1. California Wage and Hour Checklist: This checklist focuses specifically on ensuring compliance with California's wage and hour laws and regulations, including proper calculation and payment of overtime, meal and rest break requirements, record-keeping guidelines, and employee classification rules. 2. California Minimum Wage Checklist: This checklist outlines the procedures and requirements for complying with California's minimum wage laws. It covers minimum wage rates, exemptions, annual adjustments, and proper documentation and notification to employees. 3. California Salary Deduction Checklist: This checklist helps employers understand and adhere to California's strict regulations regarding permissible salary deductions. It provides guidelines on authorized deductions, such as employee loans, overpayment recoveries, benefits contributions, and lawful deductions for absences or tardiness. 4. California Expense Reimbursement Checklist: This checklist assists employers in properly reimbursing employees for business-related expenses, as mandated by California law. It includes guidelines for reimbursements of travel expenses, mileage, meals, lodging, and other business-related costs. 5. California Compensation Policy Review Checklist: This checklist is designed to review and evaluate an organization's overall compensation policy and practices ensuring compliance with California labor laws. It covers areas such as pay equity, commission structures, bonus plans, performance-based pay, and incentives. Employers in California can use these checklists to maintain compliance, mitigate legal risks, and foster a fair and transparent compensation administration process. It is important to consult legal professionals or employment specialists to ensure accuracy and compliance with ever-changing laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.California Lista de verificación de administración de compensación - Compensation Administration Checklist

Description

How to fill out California Lista De Verificación De Administración De Compensación?

You may commit hrs on the Internet searching for the legal record design which fits the federal and state needs you will need. US Legal Forms supplies a huge number of legal varieties which are analyzed by specialists. It is simple to obtain or print the California Compensation Administration Checklist from your support.

If you already possess a US Legal Forms bank account, you are able to log in and then click the Down load button. Next, you are able to comprehensive, revise, print, or sign the California Compensation Administration Checklist. Every legal record design you get is yours eternally. To have an additional version of any obtained kind, proceed to the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms site the first time, stick to the simple instructions beneath:

- Initially, ensure that you have chosen the best record design for your region/metropolis of your liking. Browse the kind outline to make sure you have picked out the proper kind. If readily available, make use of the Review button to search through the record design also.

- If you would like locate an additional model of your kind, make use of the Lookup discipline to get the design that meets your requirements and needs.

- Upon having located the design you desire, just click Purchase now to proceed.

- Select the costs prepare you desire, key in your accreditations, and sign up for a merchant account on US Legal Forms.

- Total the financial transaction. You can use your Visa or Mastercard or PayPal bank account to fund the legal kind.

- Select the file format of your record and obtain it for your system.

- Make alterations for your record if required. You may comprehensive, revise and sign and print California Compensation Administration Checklist.

Down load and print a huge number of record templates utilizing the US Legal Forms web site, that offers the greatest variety of legal varieties. Use skilled and status-specific templates to tackle your business or personal demands.