The California Waiver of Qualified Joint and Survivor Annuity (JSA) is an important provision that individuals should understand when considering their retirement and pension plans. This waiver, which is specific to California, allows a participant in a qualified retirement plan to waive the automatic survivor benefit for their spouse or beneficiary. In a JSA, a retiree is typically offered a lifetime annuity payout with the condition that a portion of the pension benefits will continue to be paid to their surviving spouse or designated beneficiary after their death. However, with the California Waiver of JSA, a retiree can choose to waive this survivor benefit and receive a higher monthly payment during their lifetime. This decision must be made jointly by the retiree and their spouse before retirement, considering the potential financial implications for the surviving spouse. There are different types of California Waiver of JSA, including Single-Life Annuity Option and Lump Sum Option. The Single-Life Annuity Option allows the retiree to receive a higher monthly pension payment while foregoing any survivor benefits to their spouse/beneficiary. This can be a suitable choice when the retiree and their spouse have alternative financial arrangements in place to support the surviving spouse in the event of the retiree's death. On the other hand, the Lump Sum Option permits the retiree to receive a one-time payment instead of a lifetime annuity. By choosing this option, the retiree effectively waives both the survivor benefit and the ongoing monthly pension payments. This option may be appropriate for retirees who prefer to have control over a lump sum of money to invest or allocate differently to meet their financial needs or to leave a legacy for their loved ones. It is important for individuals to carefully evaluate and assess their financial situation, their spouse's financial situation, and their long-term retirement goals before making a decision about the California Waiver of JSA. Consulting with a financial advisor or retirement specialist is highly recommended, as they can provide guidance on the best option considering factors such as age, health, dependents, and overall retirement objectives. In summary, the California Waiver of Qualified Joint and Survivor Annuity (JSA) offers retirees the option to waive survivor benefits and receive higher lifetime pension payments or a lump sum payout instead. The two main types of waivers are the Single-Life Annuity Option and the Lump Sum Option, both of which have their own considerations and implications. Proper evaluation, planning, and seeking professional advice are integral to making an informed decision regarding the California Waiver of JSA.

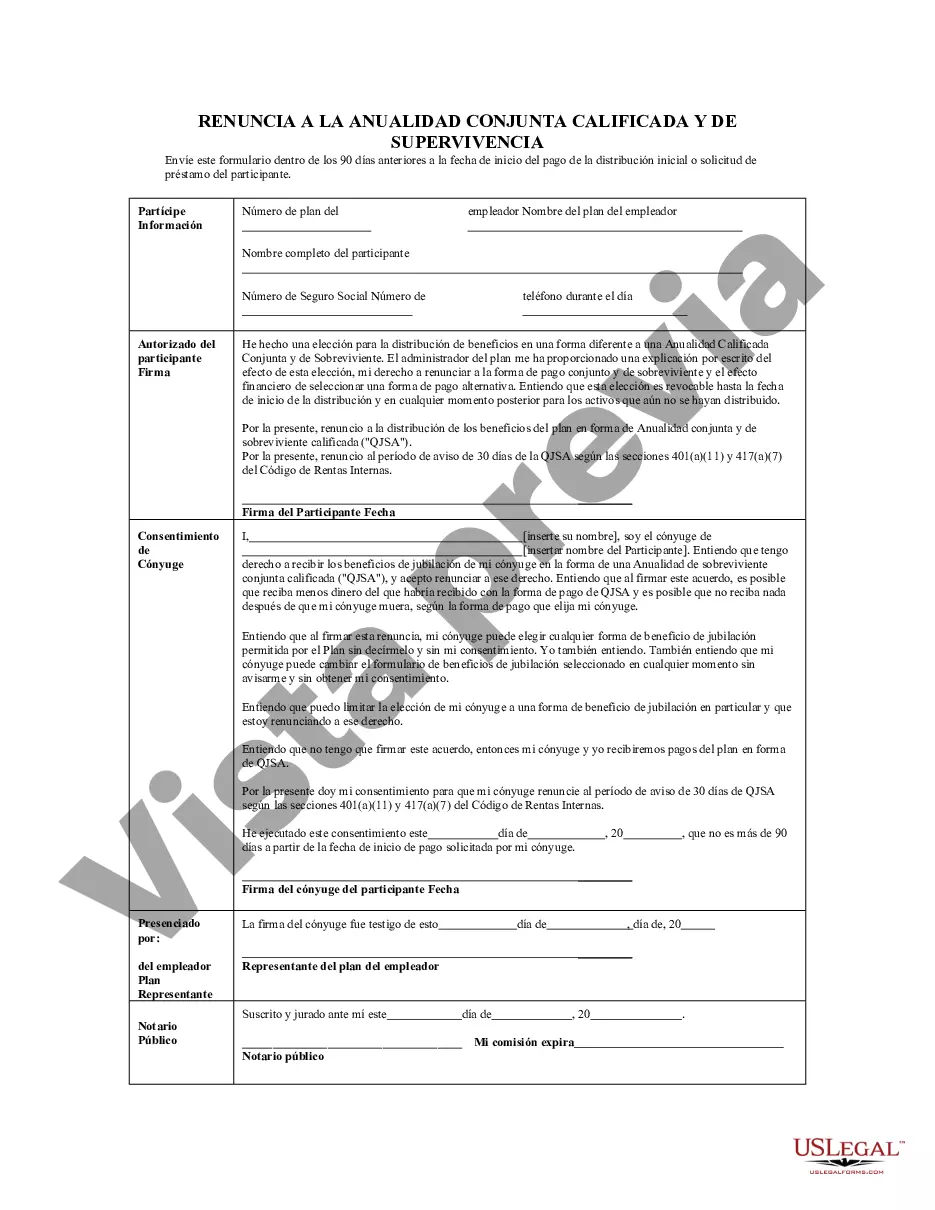

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.California Renuncia a la anualidad conjunta y de sobreviviente calificada - QJSA - Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

How to fill out California Renuncia A La Anualidad Conjunta Y De Sobreviviente Calificada - QJSA?

US Legal Forms - among the largest libraries of authorized forms in America - gives a variety of authorized papers layouts you can acquire or print. While using web site, you will get a huge number of forms for business and individual functions, categorized by classes, states, or key phrases.You will discover the latest variations of forms such as the California Waiver of Qualified Joint and Survivor Annuity - QJSA in seconds.

If you currently have a membership, log in and acquire California Waiver of Qualified Joint and Survivor Annuity - QJSA from the US Legal Forms library. The Download switch will show up on each and every form you see. You have access to all previously saved forms from the My Forms tab of the profile.

If you would like use US Legal Forms the very first time, listed here are straightforward directions to obtain started:

- Ensure you have selected the right form to your town/region. Click the Preview switch to review the form`s information. See the form description to actually have chosen the correct form.

- When the form does not suit your specifications, take advantage of the Search field near the top of the display to get the one which does.

- When you are pleased with the shape, validate your option by clicking the Buy now switch. Then, opt for the costs prepare you prefer and give your credentials to register to have an profile.

- Process the transaction. Utilize your charge card or PayPal profile to accomplish the transaction.

- Select the formatting and acquire the shape on your system.

- Make alterations. Fill up, edit and print and signal the saved California Waiver of Qualified Joint and Survivor Annuity - QJSA.

Each design you included in your account lacks an expiry day and it is your own property permanently. So, if you would like acquire or print another duplicate, just proceed to the My Forms segment and then click around the form you require.

Obtain access to the California Waiver of Qualified Joint and Survivor Annuity - QJSA with US Legal Forms, by far the most comprehensive library of authorized papers layouts. Use a huge number of skilled and condition-distinct layouts that satisfy your company or individual needs and specifications.