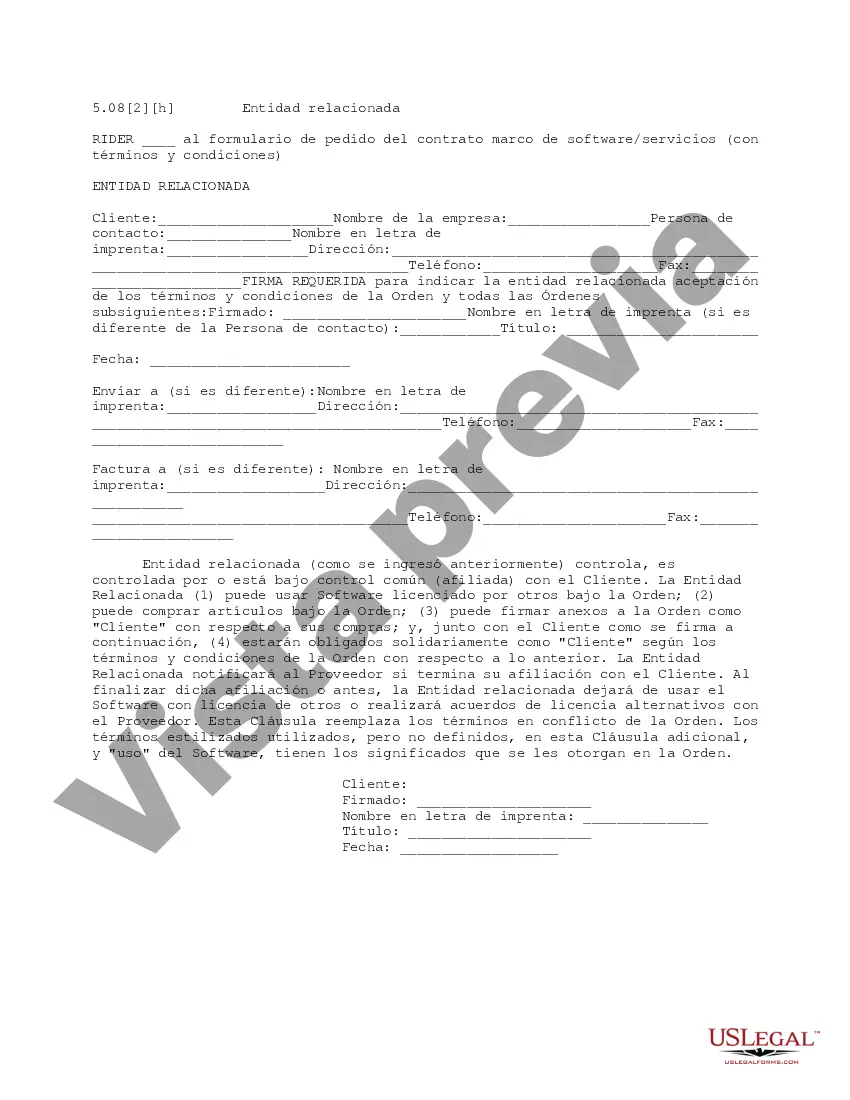

This is a rider to the software/services master agreement order form. It provides that a related entity of the customer may use the software purchased from the vendor.

Title: Understanding California Related Entity: Types and Functions Introduction: In the state of California, various business entities can be classified as "California Related Entity," serving different purposes based on their organizational structure. This article delves into the details of California Related Entity, exploring its different types, functions, and their significance. Keywords: California, Related Entity, business entity, organizational structure, types, functions Types of California Related Entity: 1. California Limited Liability Company (LLC): A California LLC is a flexible business entity that combines aspects of a corporation and a partnership. It offers limited liability protection to its owners, known as members, while allowing them to benefit from pass-through taxation. Laying out the responsibilities and ownership structure, a California LLC provides a legal framework for a wide range of business activities. 2. California Corporation: California Corporation, also known as a C Corporation or simply a Corp, is an independent legal entity formed to conduct business in the state. It is owned by shareholders who enjoy limited liability protection. Corporations issue stock and are regulated by the California Secretary of State. These entities have the ability to raise capital through the issuance of stocks and can have an unlimited number of shareholders. 3. California Non-Profit Organization: A California Non-Profit Organization is formed to serve charitable, educational, scientific, or religious purposes, rather than generating profit. They are exempt from certain taxes and must apply for tax-exempt status with the IRS and the California Franchise Tax Board. These entities operate under bylaws and their focus is on furthering a specific cause or mission. 4. California Partnership: A California Partnership involves two or more individuals or entities joining forces to conduct business. In a general partnership, partners share equal responsibility and liability. Limited partnerships have both general and limited partners, where limited partners have limited liability and do not actively participate in day-to-day operations. Partnerships can be formed through a written agreement or established by default when two or more parties start a business together. Functions of California Related Entities: 1. Limited Liability Protection: All California Related Entities offer limited liability protection, shielding the personal assets of owners from business debts and liabilities. This means that creditors cannot pursue personal assets of the members or shareholders if the business faces financial difficulties. 2. Pass-through Taxation: Many California Related Entities, such as LCS and partnerships, follow pass-through taxation. This means that the entity itself does not pay income taxes. Instead, profits and losses flow through to the individual tax returns of the owners, avoiding double taxation. 3. Separation of Ownership and Control: California Related Entities provide a clear distinction between ownership and operational management. Shareholders or members can appoint directors or managers to handle the day-to-day affairs, which allows for efficient decision-making and professional management. Conclusion: California Related Entity encompasses various types of business entities, each designed to cater to specific organizational needs. Whether it's the versatile California LLC, the widely recognized California Corporation, non-profit organizations, or partnerships, each entity serves a distinct purpose and offers unique benefits. Understanding the nature and characteristics of each type is essential for entrepreneurs and business owners aiming to establish their presence in California. Keywords: California, Related Entity, business entity, limited liability, pass-through taxation, ownership, California LLC, California Corporation, non-profit organization, partnership.Title: Understanding California Related Entity: Types and Functions Introduction: In the state of California, various business entities can be classified as "California Related Entity," serving different purposes based on their organizational structure. This article delves into the details of California Related Entity, exploring its different types, functions, and their significance. Keywords: California, Related Entity, business entity, organizational structure, types, functions Types of California Related Entity: 1. California Limited Liability Company (LLC): A California LLC is a flexible business entity that combines aspects of a corporation and a partnership. It offers limited liability protection to its owners, known as members, while allowing them to benefit from pass-through taxation. Laying out the responsibilities and ownership structure, a California LLC provides a legal framework for a wide range of business activities. 2. California Corporation: California Corporation, also known as a C Corporation or simply a Corp, is an independent legal entity formed to conduct business in the state. It is owned by shareholders who enjoy limited liability protection. Corporations issue stock and are regulated by the California Secretary of State. These entities have the ability to raise capital through the issuance of stocks and can have an unlimited number of shareholders. 3. California Non-Profit Organization: A California Non-Profit Organization is formed to serve charitable, educational, scientific, or religious purposes, rather than generating profit. They are exempt from certain taxes and must apply for tax-exempt status with the IRS and the California Franchise Tax Board. These entities operate under bylaws and their focus is on furthering a specific cause or mission. 4. California Partnership: A California Partnership involves two or more individuals or entities joining forces to conduct business. In a general partnership, partners share equal responsibility and liability. Limited partnerships have both general and limited partners, where limited partners have limited liability and do not actively participate in day-to-day operations. Partnerships can be formed through a written agreement or established by default when two or more parties start a business together. Functions of California Related Entities: 1. Limited Liability Protection: All California Related Entities offer limited liability protection, shielding the personal assets of owners from business debts and liabilities. This means that creditors cannot pursue personal assets of the members or shareholders if the business faces financial difficulties. 2. Pass-through Taxation: Many California Related Entities, such as LCS and partnerships, follow pass-through taxation. This means that the entity itself does not pay income taxes. Instead, profits and losses flow through to the individual tax returns of the owners, avoiding double taxation. 3. Separation of Ownership and Control: California Related Entities provide a clear distinction between ownership and operational management. Shareholders or members can appoint directors or managers to handle the day-to-day affairs, which allows for efficient decision-making and professional management. Conclusion: California Related Entity encompasses various types of business entities, each designed to cater to specific organizational needs. Whether it's the versatile California LLC, the widely recognized California Corporation, non-profit organizations, or partnerships, each entity serves a distinct purpose and offers unique benefits. Understanding the nature and characteristics of each type is essential for entrepreneurs and business owners aiming to establish their presence in California. Keywords: California, Related Entity, business entity, limited liability, pass-through taxation, ownership, California LLC, California Corporation, non-profit organization, partnership.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.