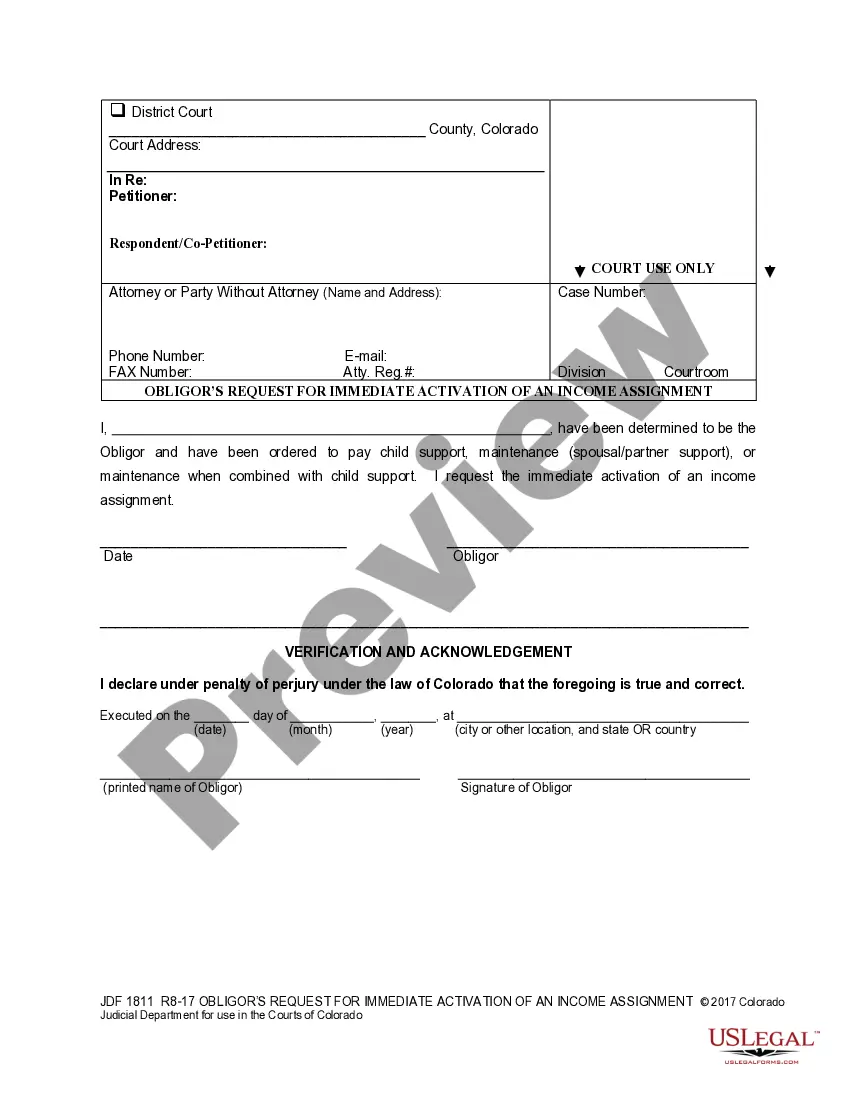

Colorado Obligor's Request for Immediate Activation of an Income Assignment

Description

How to fill out Colorado Obligor's Request For Immediate Activation Of An Income Assignment?

The more paperwork you have to produce - the more anxious you get.

You can find countless Colorado Obligor's Request for Immediate Activation of an Income Assignment templates online, but you may not know which ones to trust.

Eliminate the frustration and simplify acquiring samples with US Legal Forms. Obtain properly drafted documents that are designed to comply with state regulations.

Enter the required information to create your account and complete the payment using PayPal or a credit card. Choose a desired document format and obtain your sample. You can find every document you acquire in the My documents section. Just go there to complete a new version of your Colorado Obligor's Request for Immediate Activation of an Income Assignment. Even when utilizing accurately drafted templates, it’s still advisable that you consider consulting a local attorney to verify that your form is properly filled out. Achieve more for less with US Legal Forms!

- If you are already a US Legal Forms subscriber, Log In to your account, and you will see the Download option on the page for the Colorado Obligor's Request for Immediate Activation of an Income Assignment.

- If you haven't used our service before, follow these guidelines to complete the registration process.

- Ensure that the Colorado Obligor's Request for Immediate Activation of an Income Assignment is applicable in your state.

- Confirm your choice by reading the description or by utilizing the Preview feature if it is available for the selected document.

- Just click Buy Now to initiate the registration process and select a pricing plan that suits your requirements.

Form popularity

FAQ

Colorado-source income includes any income derived from sources within Colorado including, but not limited to: (a)Ownership of Real or Tangible Personal Property.

You must file a Colorado income tax return if during the year you were: A full-year resident of Colorado, or. A part-year resident of Colorado with taxable income during that part of the year you were a resident, or.

However, verify the refund amount you have entered and verify that you are using the primary SSN for the refund. If it's still not showing anything, you may contact customer service at 1-303-238-7378, Monday through Friday, 8 a.m. to p.m. or contact the Colorado Department of Revenue.

To check the status of your Colorado state refund online, go to https://www.colorado.gov/revenueonline/. There is no need to login. Simply choose the option Check the Status of Your Refund under Welcome to Revenue Online.

Colorado has a flat income tax rate of 4.63%.

DENVER (KDVR) The Colorado Department of Revenue announced Thursday that it will extend the individual income tax payment and filing deadline.Individuals now have the option to postpone any 2020 income tax payments due on April 15, 2021 to May 17, 2021 without penalties and interest, regardless of the amount owed.

Find out if Your Tax Return Was Submitted Using the IRS Where's My Refund tool. Viewing your IRS account information. Calling the IRS at 1-800-829-1040 (Wait times to speak to a representative may be long.) Looking for emails or status updates from your e-filing website or software.

You must file a Colorado income tax return if during the year you were: A full-year resident of Colorado, or. A part-year resident of Colorado with taxable income during that part of the year you were a resident, or.

You can check the status of your refund on Revenue Online. There is no need to login. Simply choose the option "Tax Refund for Individuals" in the box labeled "Where's my Refund?". Then, enter your SSN or ITIN and the refund amount you claimed on your current year income tax return.