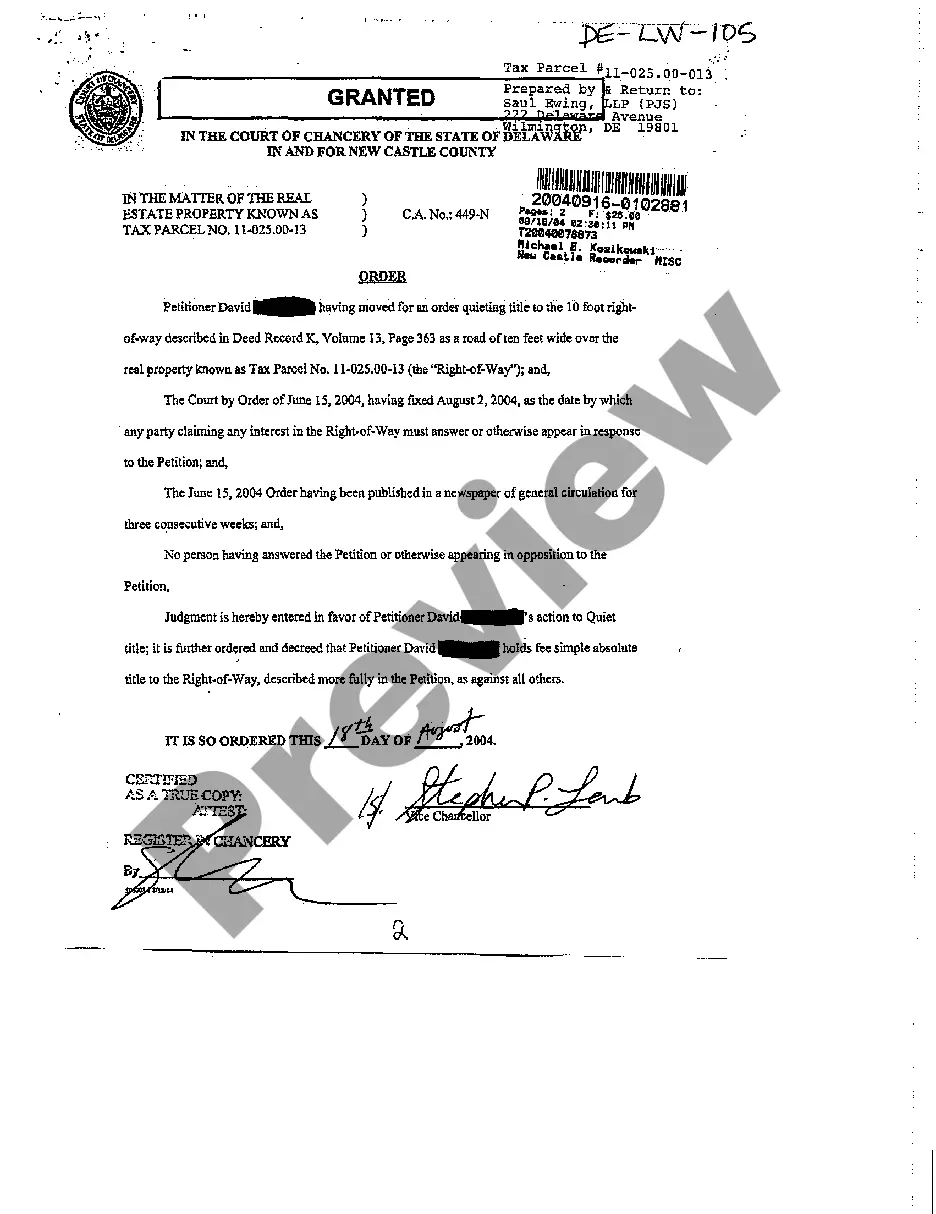

This is an official form from the Colorado State Judicial Branch, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Colorado statutes and law.

Colorado Instructions For Closing An Estate Formally

Description

How to fill out Colorado Instructions For Closing An Estate Formally?

The greater the documentation you need to prepare - the more uneasy you become.

You can find a vast number of Colorado Guidance For Completing An Estate Formally blanks online, but you are unsure which ones to trust.

Simplify the process to make finding samples simpler by using US Legal Forms. Obtain professionally crafted forms designed to comply with state requirements.

Enter the required information to set up your account and complete the payment for your order using your PayPal or credit card. Choose a preferred document format and obtain your copy. Access every document you receive in the My documents section. Simply visit there to create a new copy of your Colorado Guidance For Completing An Estate Formally. Even when using well-crafted templates, it’s still essential to consider consulting your local attorney to verify that your document is accurately completed. Achieve more for less with US Legal Forms!

- If you possess a US Legal Forms subscription, Log In to your account, and you will see the Download button on the Colorado Guidance For Completing An Estate Formally’s page.

- If you have not utilized our site before, follow the registration steps outlined below.

- Confirm that the Colorado Guidance For Completing An Estate Formally is legitimate in your state.

- Double-check your choice by reviewing the description or by using the Preview feature if it’s available for the chosen file.

- Click Buy Now to initiate the signup process and choose a pricing plan that suits your requirements.

Form popularity

FAQ

To effectively close an estate in Colorado, you first need to gather all necessary documents, including the will and any relevant financial records. Next, follow the Colorado instructions for closing an estate formally by filing the required paperwork with the local probate court. It is important to settle any debts and allocate assets according to the will or state law. For a smoother process, consider utilizing US Legal Forms, which provides valuable resources and templates to help you navigate estate closure efficiently.

The time it takes for an executor to settle an estate varies depending on the estate's complexity. Typically, it can range from a few months to over a year. Executors who follow the Colorado Instructions For Closing An Estate Formally can help minimize this time. Clear guidance allows for efficient management of the estate’s affairs and paves the way for beneficiaries to receive their inheritances sooner.

An executor should generally wait until debts and taxes are settled before distributing assets. This waiting period ensures there are sufficient funds to cover all obligations of the estate. By adhering to the Colorado Instructions For Closing An Estate Formally, executors can ensure they act responsibly. Proper planning leads to a smoother transition of assets to beneficiaries.

Settling an estate in Colorado can take several months or even years. The process depends on various factors, such as the complexity of the estate and any disputes among heirs. Following the Colorado Instructions For Closing An Estate Formally can help expedite the process. Generally, clearer instructions lead to a smoother transition, making it easier for executors and heirs alike.

An executor can hold funds for as long as it takes to complete the estate’s administration. This period typically depends on various factors, such as settling debts and taxes. However, the guidance found in Colorado Instructions For Closing An Estate Formally indicates that executors should not unnecessarily delay distribution. It’s essential to strike a balance between prudent management and timely distribution.

An estate closing letter is a document sent to beneficiaries and interested parties that summarizes the conclusion of the estate administration. It outlines how assets were distributed and confirms that debts have been settled. By utilizing the Colorado Instructions For Closing An Estate Formally, you can create a detailed and professional closing letter that fulfills all legal requirements.

Yes, in Colorado, the time limit to file probate is generally within four years from the date of death. If the estate is complex, it may be beneficial to file sooner to address any issues that could arise. For detailed steps and information, refer to Colorado Instructions For Closing An Estate Formally for a thorough understanding of the timeline.

To perform a final accounting for an estate, gather all financial records, including income, expenses, distributions, and debts. You will need to provide a detailed report to the court and beneficiaries before closing the estate. Following the Colorado Instructions For Closing An Estate Formally will streamline this process and ensure accuracy.

A notice to close estate is a formal declaration that informs interested parties of the executor's intention to finalize the estate. This notice is crucial to ensure transparency and to provide a timeline for any claims or objections. Utilizing Colorado Instructions For Closing An Estate Formally can help you understand how to properly file this notice.

An executor in Colorado can take several months to a few years to settle an estate, depending on the complexity of the estate. Factors such as asset distribution, debt repayment, and tax obligations influence the timeline. By following the Colorado Instructions For Closing An Estate Formally, you can navigate the executor's responsibilities efficiently.