Colorado Warranty Deed from Trust to Two Grantees

Description

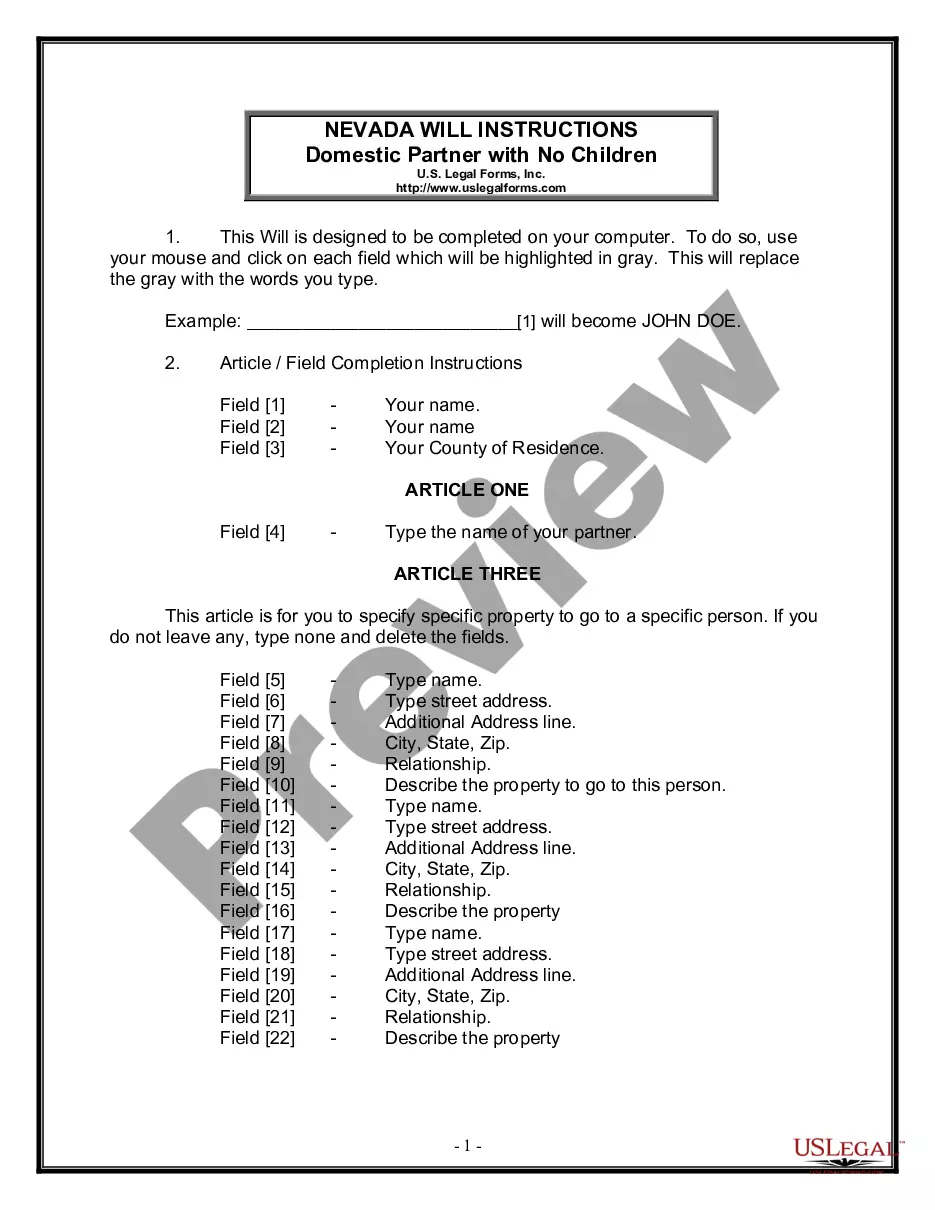

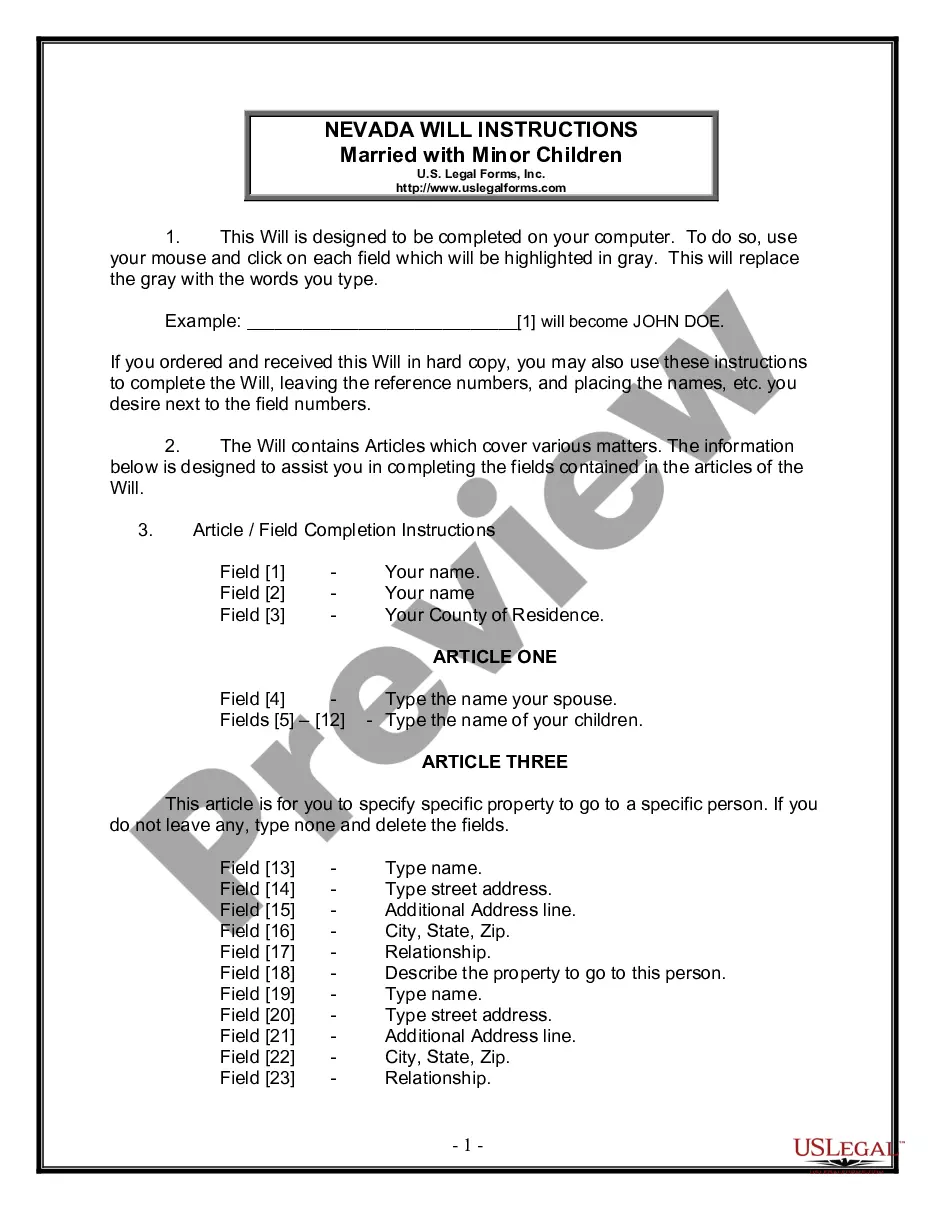

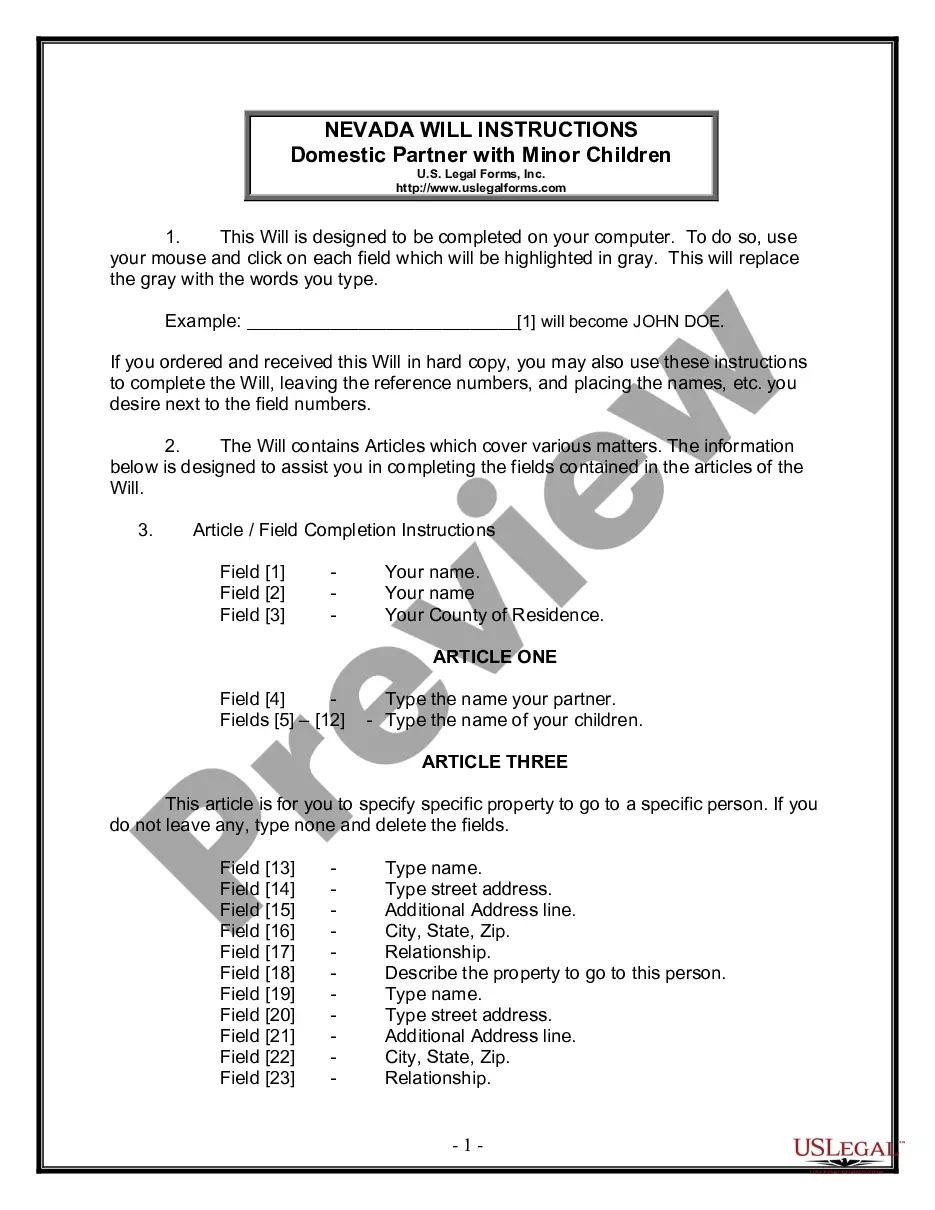

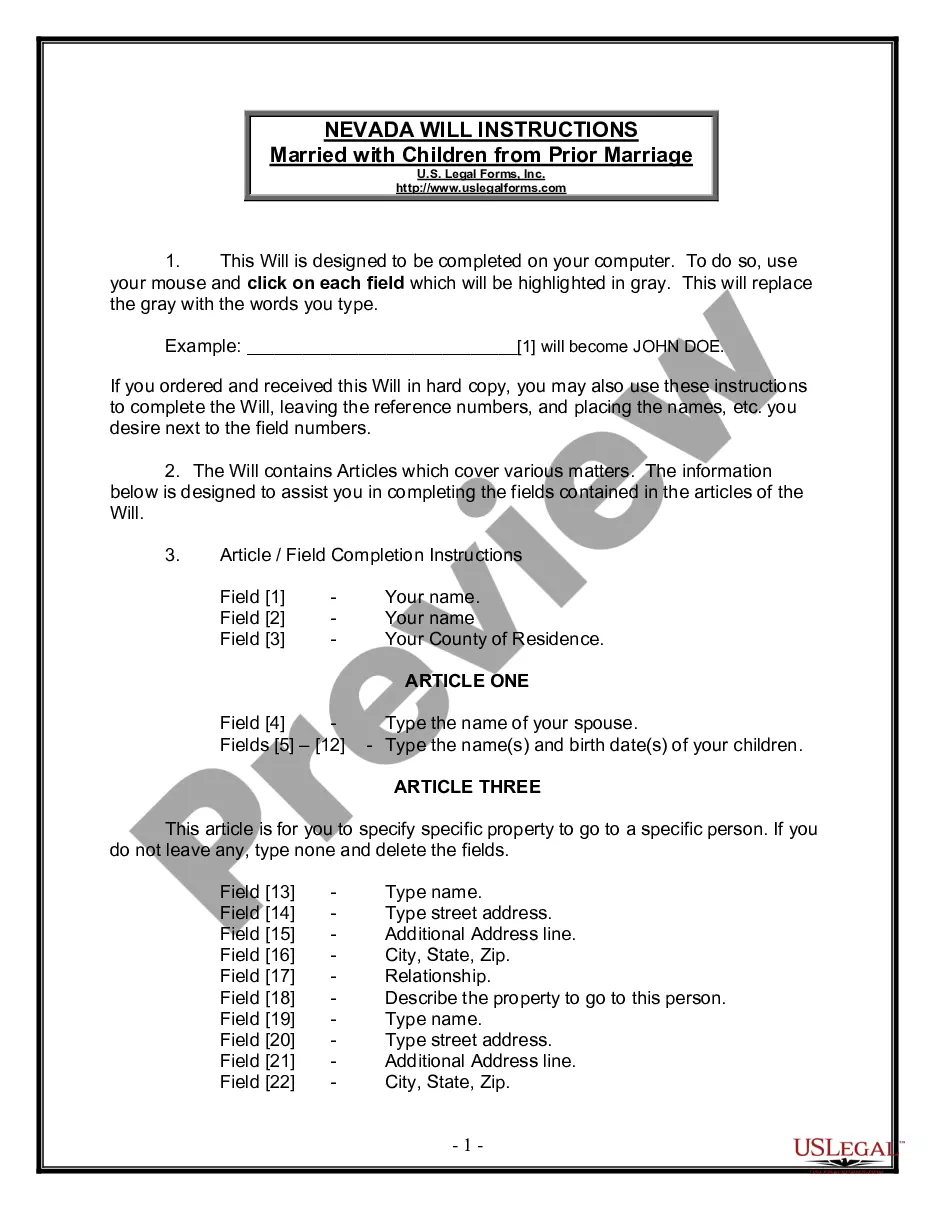

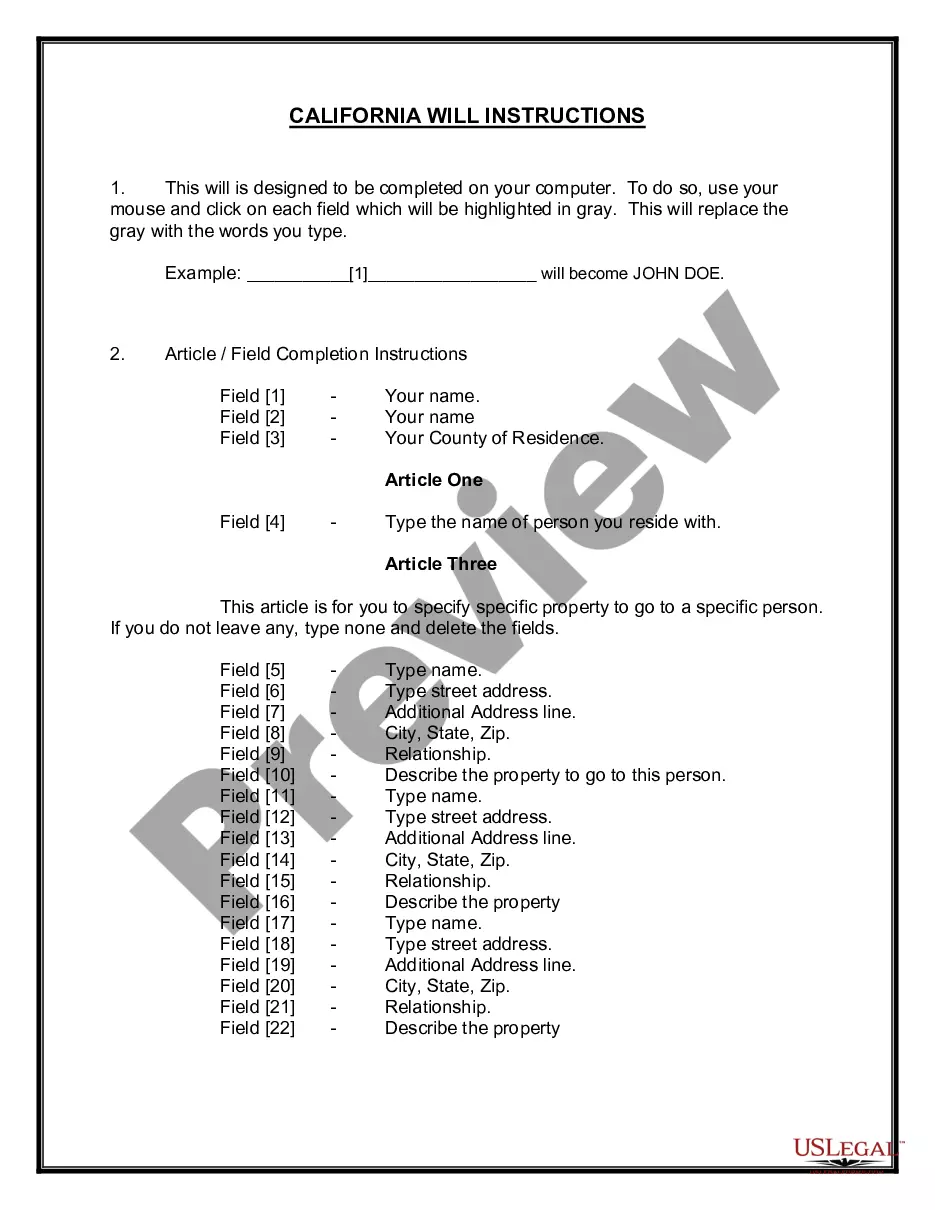

How to fill out Colorado Warranty Deed From Trust To Two Grantees?

Among many complimentary and paid samples that you can discover online, you cannot be guaranteed about their dependability.

For instance, who created them or whether they possess the expertise necessary to handle what you require them for.

Stay composed and utilize US Legal Forms!

Click Buy Now to initiate the purchasing procedure or search for another example using the Search field in the header. Choose a pricing plan, register for an account, make the payment for the subscription through your credit/debit card or PayPal. Download the form in the desired file format. Once you have registered and completed your purchase, you may use your Colorado Warranty Deed from Trust to Two Grantees as often as you need or as long as it remains active in your area. Amend it in your preferred offline or online editor, complete it, sign it, and produce a hard copy. Achieve more for less with US Legal Forms!

- Obtain Colorado Warranty Deed from Trust to Two Grantees templates crafted by proficient lawyers and evade the costly and time-consuming task of seeking out an attorney and subsequently compensating them to draft a document for you that you can obtain by yourself.

- If you already hold a subscription, Log In to your account and locate the Download button adjacent to the file you are seeking.

- You will also have the ability to reach your previously downloaded documents in the My documents section.

- If you are using our service for the first time, adhere to the guidelines outlined below to acquire your Colorado Warranty Deed from Trust to Two Grantees effortlessly.

- Ensure that the document you see is valid in your location.

- Examine the template by checking the description for employing the Preview feature.

Form popularity

FAQ

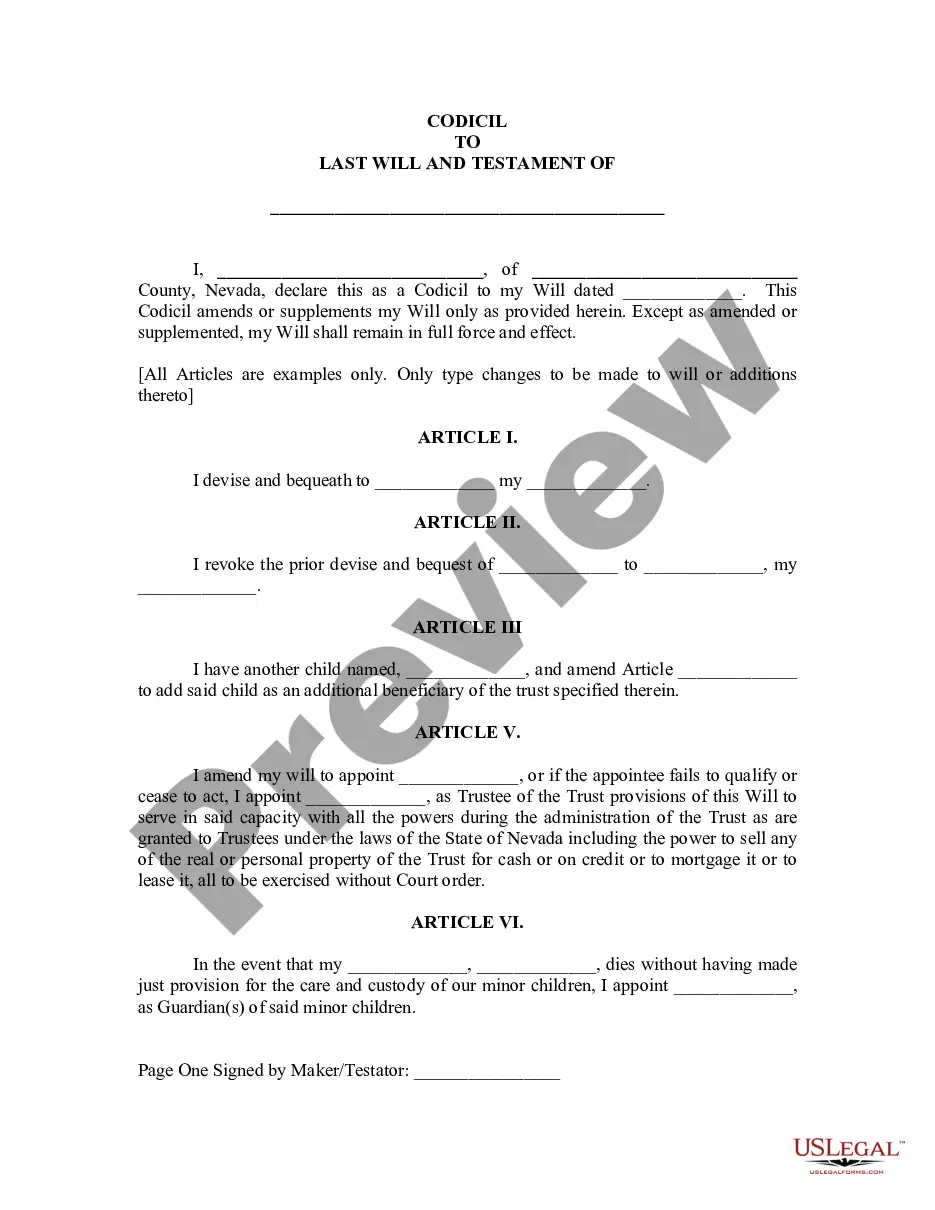

A trustee deed offers no such warranties about the title.

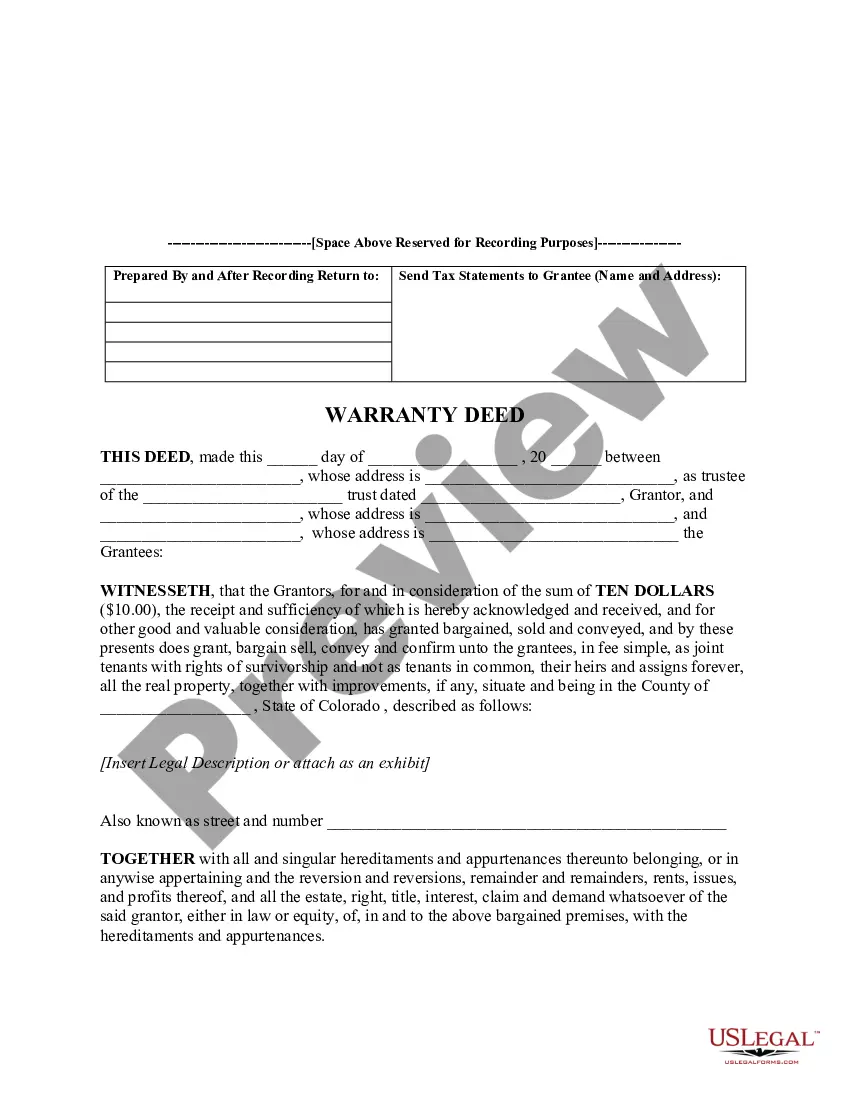

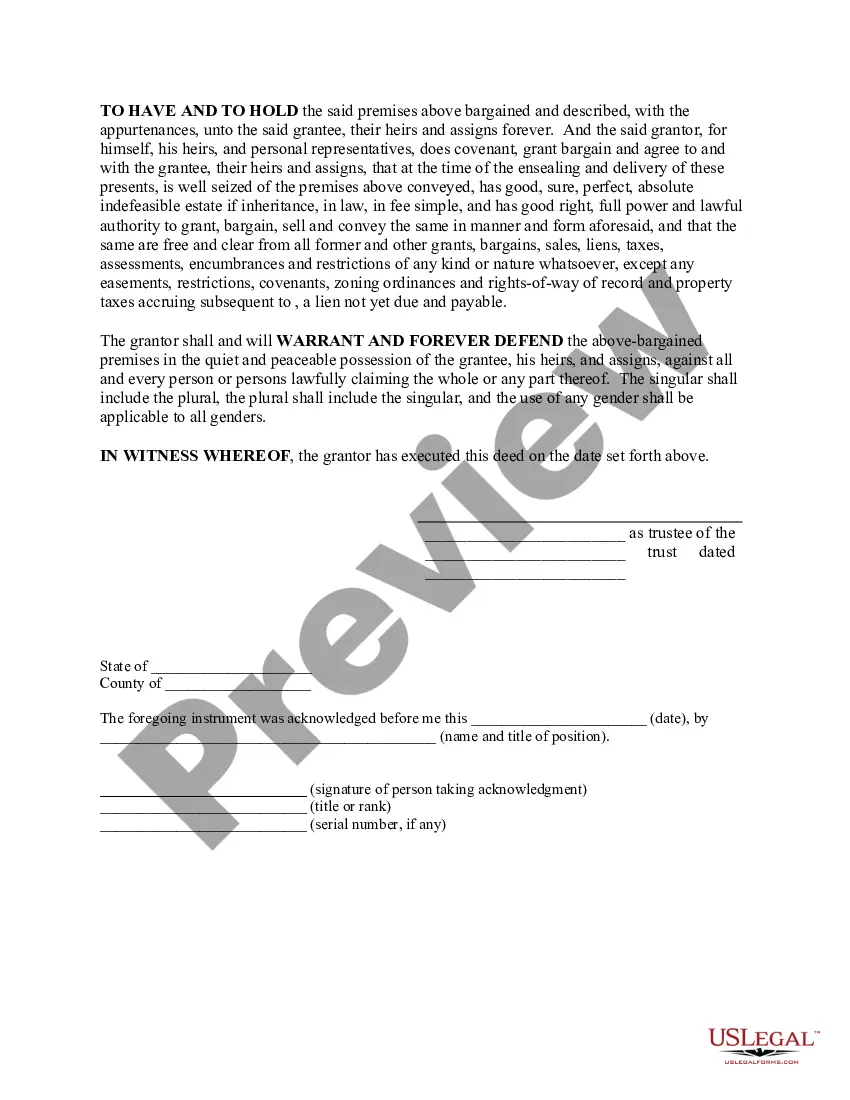

To make the form legally binding, you must sign it in front of a notary public. You must then file your signed and notarized deed with the county office that's in charge of recording property documents. Once the grantee signs the warranty deed, he/she legally has ownership and claim to the property.

The deed must be signed by all grantors, in front of a qualified notary, and notarized by the notary to be complete. Contact the local county recorder's office to find out what type of notaries are allowed to notarize deeds and where the notaries are located.

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

For any type of real estate title transfer, you'll need to fill out the appropriate forms and have all parties sign in front of a notary. The new owner is responsible for filling out a Real Property Transfer Declaration form and recording the deed at both the recorder's and county clerk's offices.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

Let's start with the definition of a deed: DEED: A written instrument by which one party, the Grantor, conveys the title of ownership in property to another party, the Grantee. A Warranty Deed contains promises, called covenants, that the Grantor makes to the Grantee.