In Colorado, a Corporate Resolution for Single Member LLC is a legal document that outlines the decisions and actions taken by the sole member of a limited liability company (LLC). This resolution serves as a formal record of the member's intentions and directs the LLC on how to carry out specific tasks or make certain decisions. The purpose of a Colorado Corporate Resolution for Single Member LLC is to facilitate effective communication and clarity within the company. It helps establish clear guidelines for the member's role in managing the LLC's affairs, including authorization of activities, financial matters, and other significant decisions. Some common types of Colorado Corporate Resolution for Single Member LLC may include: 1. Appointment of an Authorized Representative: This resolution grants authority to a specific individual to act on behalf of the LLC in various capacities, such as signing contracts, managing finances, or making legal decisions. 2. Approval of Company Agreements: This resolution pertains to authorizing or approving various types of agreements made by the LLC. This can include contracts with vendors, clients, or other parties, as well as leases or licensing agreements. 3. Decisions on Financial Matters: This resolution addresses matters related to the LLC's finances, such as opening or closing bank accounts, authorizing loans or lines of credit, or making financial investments. 4. Tax-related Resolutions: These can include decisions regarding the LLC's tax status, filing requirements, or appointing a tax professional to handle the company's tax matters. 5. Amendments to the Operating Agreement: This resolution allows the single member to make modifications or changes to the LLC's operating agreement, which is the foundational document that governs the company's management and operations. It's important to note that the specific types of resolutions may vary depending on the needs and circumstances of the Single Member LLC. The resolutions should comply with Colorado state laws and adhere to the provisions outlined in the LLC's operating agreement. It is advisable to consult with a legal professional or a qualified attorney to draft or review these resolutions to ensure compliance with all relevant laws and regulations.

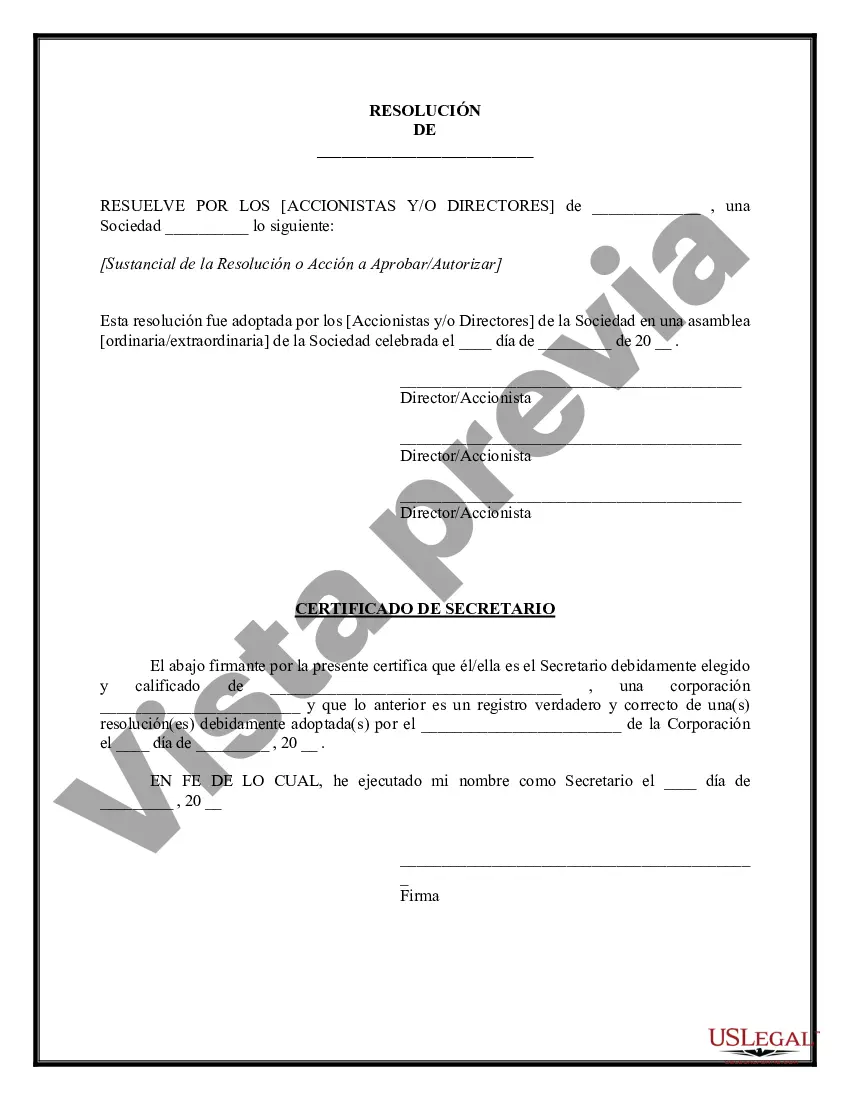

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Colorado Resolución corporativa para un solo miembro LLC - Corporate Resolution for Single Member LLC

Description

How to fill out Colorado Resolución Corporativa Para Un Solo Miembro LLC?

Are you within a place that you will need documents for sometimes company or personal uses just about every working day? There are tons of legitimate file layouts available online, but discovering types you can depend on isn`t simple. US Legal Forms offers a large number of type layouts, such as the Colorado Corporate Resolution for Single Member LLC, that are written to satisfy state and federal requirements.

When you are previously knowledgeable about US Legal Forms site and get your account, simply log in. Following that, it is possible to obtain the Colorado Corporate Resolution for Single Member LLC design.

Unless you have an accounts and would like to start using US Legal Forms, adopt these measures:

- Discover the type you will need and make sure it is for your appropriate town/state.

- Use the Preview button to review the shape.

- Browse the explanation to actually have selected the proper type.

- If the type isn`t what you`re seeking, use the Lookup field to obtain the type that meets your requirements and requirements.

- If you discover the appropriate type, simply click Get now.

- Pick the rates program you desire, fill out the required info to create your money, and pay for an order making use of your PayPal or charge card.

- Pick a hassle-free document structure and obtain your backup.

Locate each of the file layouts you may have bought in the My Forms menu. You can aquire a additional backup of Colorado Corporate Resolution for Single Member LLC anytime, if possible. Just select the needed type to obtain or produce the file design.

Use US Legal Forms, the most comprehensive variety of legitimate types, in order to save efforts and prevent errors. The service offers appropriately created legitimate file layouts which can be used for a variety of uses. Create your account on US Legal Forms and commence creating your way of life a little easier.