A Colorado Triple Net Commercial Lease Agreement is a legal document that outlines the terms and conditions of a real estate rental agreement between a landlord and a tenant for a commercial property in Colorado. The term "triple net" in this agreement refers to the three main expenses the tenant is responsible for: property taxes, insurance, and maintenance. This type of lease agreement is commonly used in commercial real estate, particularly for retail, office, or industrial properties. It is considered advantageous for landlords as it transfers many financial responsibilities to the tenant, allowing them to receive a consistent rental income. The Colorado Triple Net Commercial Lease Agreement typically includes various details such as the names of the landlord and tenant, the property address, lease term, rental payment amount, security deposit requirements, and any additional charges or fees. It also specifies the type of business allowed on the premises, the permitted use of the property, and any restrictions or covenants that must be adhered to. Additionally, the lease agreement may outline responsibilities regarding property maintenance, repairs, and improvements. It may also address insurance requirements, indemnification clauses, and the allocation of property taxes. The agreement may further include provisions regarding lease renewal options, termination clauses, and dispute resolution methods. While there may not be specific types of Colorado Triple Net Commercial Lease Agreements, variations can occur depending on the property type or specific needs of the landlord and tenant. For example, there may be variations in lease agreements for retail spaces compared to those for office spaces or industrial properties. Each type of property may have unique considerations and specifications that need to be addressed in the lease agreement. In summary, a Colorado Triple Net Commercial Lease Agreement is a comprehensive contract that governs the rental of commercial real estate property in Colorado, whereby the tenant is responsible for property taxes, insurance, and maintenance expenses. The agreement outlines the rights, obligations, and restrictions of both the landlord and tenant, providing a framework for a successful and mutually beneficial landlord-tenant relationship.

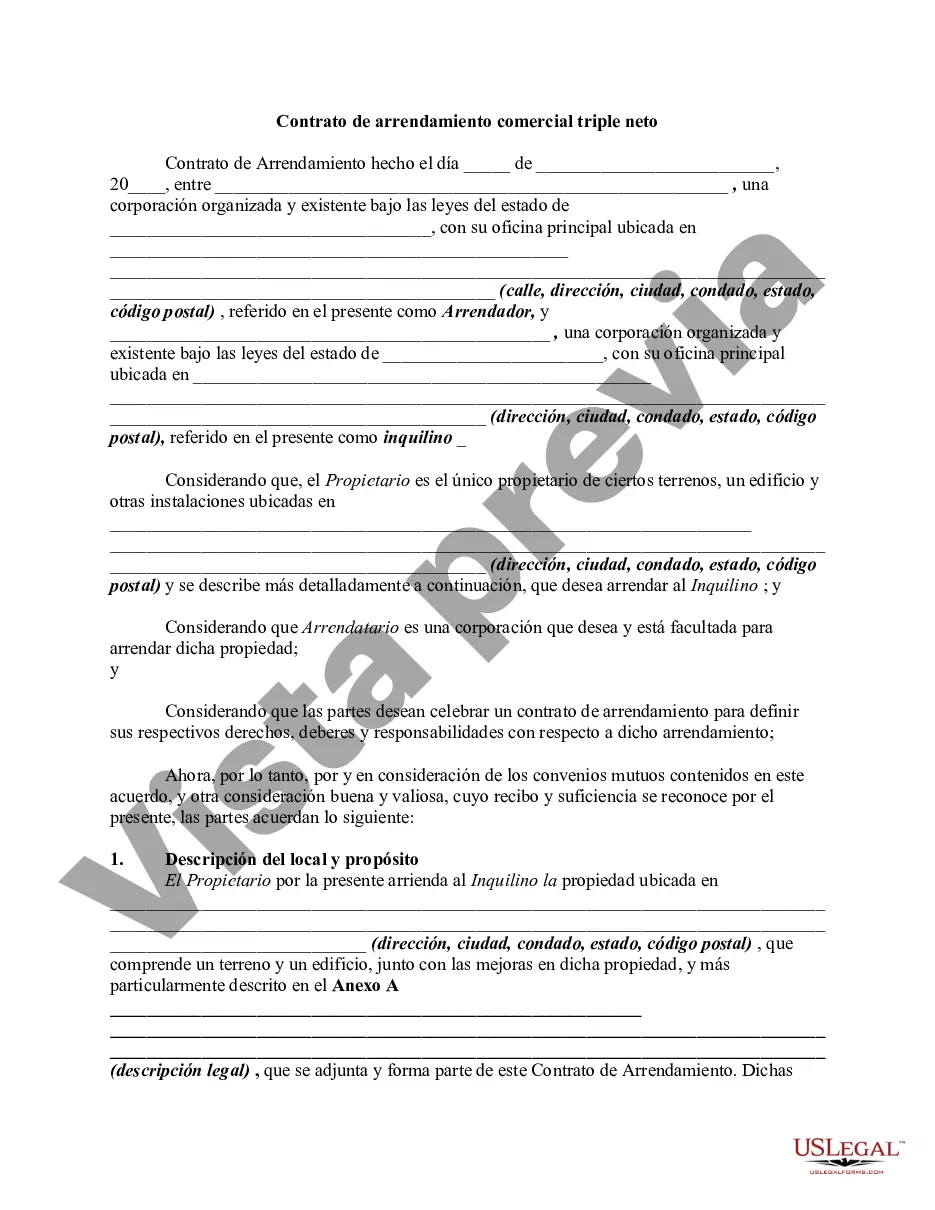

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Colorado Contrato de Arrendamiento Comercial Triple Neto - Alquiler de Bienes Raíces - Triple Net Commercial Lease Agreement - Real Estate Rental

Description

How to fill out Colorado Contrato De Arrendamiento Comercial Triple Neto - Alquiler De Bienes Raíces?

Are you presently in the placement that you require papers for possibly business or person purposes just about every day? There are plenty of authorized document templates available on the net, but discovering types you can depend on is not simple. US Legal Forms offers a large number of form templates, such as the Colorado Triple Net Commercial Lease Agreement - Real Estate Rental, that are written to satisfy state and federal specifications.

If you are previously familiar with US Legal Forms web site and have your account, merely log in. Afterward, it is possible to acquire the Colorado Triple Net Commercial Lease Agreement - Real Estate Rental template.

If you do not come with an accounts and need to start using US Legal Forms, follow these steps:

- Discover the form you need and ensure it is for the right city/area.

- Make use of the Review option to review the form.

- Look at the information to actually have selected the proper form.

- In case the form is not what you are seeking, utilize the Lookup field to obtain the form that meets your needs and specifications.

- When you find the right form, just click Purchase now.

- Pick the pricing plan you want, fill out the required details to generate your account, and buy an order making use of your PayPal or charge card.

- Select a handy file structure and acquire your copy.

Find each of the document templates you have bought in the My Forms menu. You may get a further copy of Colorado Triple Net Commercial Lease Agreement - Real Estate Rental whenever, if possible. Just click the needed form to acquire or produce the document template.

Use US Legal Forms, probably the most comprehensive selection of authorized varieties, in order to save some time and prevent blunders. The assistance offers skillfully created authorized document templates that can be used for a range of purposes. Generate your account on US Legal Forms and initiate making your way of life a little easier.