A Colorado Financing Statement refers to a legal document that is filed to establish a security interest in collateral for a loan between a debtor and secured party. This statement serves as a public record and gives notice to other creditors about the creditor's interest in the collateral. It is crucial for lenders and creditors to file a financing statement to protect their rights and ensure their priority over other competing interests. The Colorado Uniform Commercial Code (UCC) governs the filing of financing statements in the state. According to the UCC Article 9, a financing statement should contain specific information about both the debtor and the secured party. This includes their names and addresses, a description of the collateral, and any additional terms or conditions. In Colorado, there are various types of financing statements, each serving a specific purpose: 1. Original Financing Statement: This is the primary document filed to initially establish a security interest in collateral. It is filed with the Colorado Secretary of State's Office, specifically through the Uniform Commercial Code filing system. 2. Amendment Financing Statement: When there are changes or corrections to the original filing, an amendment financing statement is filed. It updates the information such as changes in the debtor's or secured party's information, collateral description, or terms of the agreement. 3. Continuation Statement: A continuation statement is filed to extend the initial financing statement's effectiveness beyond its expiration date. In Colorado, the initial filing remains effective for five years, and by filing a continuation statement before expiration, the secured party can maintain their priority rights for an extended period. 4. Termination Statement: Once a loan has been repaid, a termination statement is filed to officially release the security interest and remove it from the public record. This document effectively marks the end of the relationship between the debtor and the secured party. 5. Partial Release Statement: In the case where only a portion of the collateral has been satisfied or released, a partial release statement is filed to release the lien on the collateral that is no longer subject to the security interest. It is important for debtors and secured parties to ensure accurate and timely filing of financing statements to protect their legal rights and avoid any potential disputes. The specific requirements and procedures for filing an effective financing statement can vary, so it is advisable to consult an attorney or refer to the Colorado Secretary of State's official guidelines for detailed instructions.

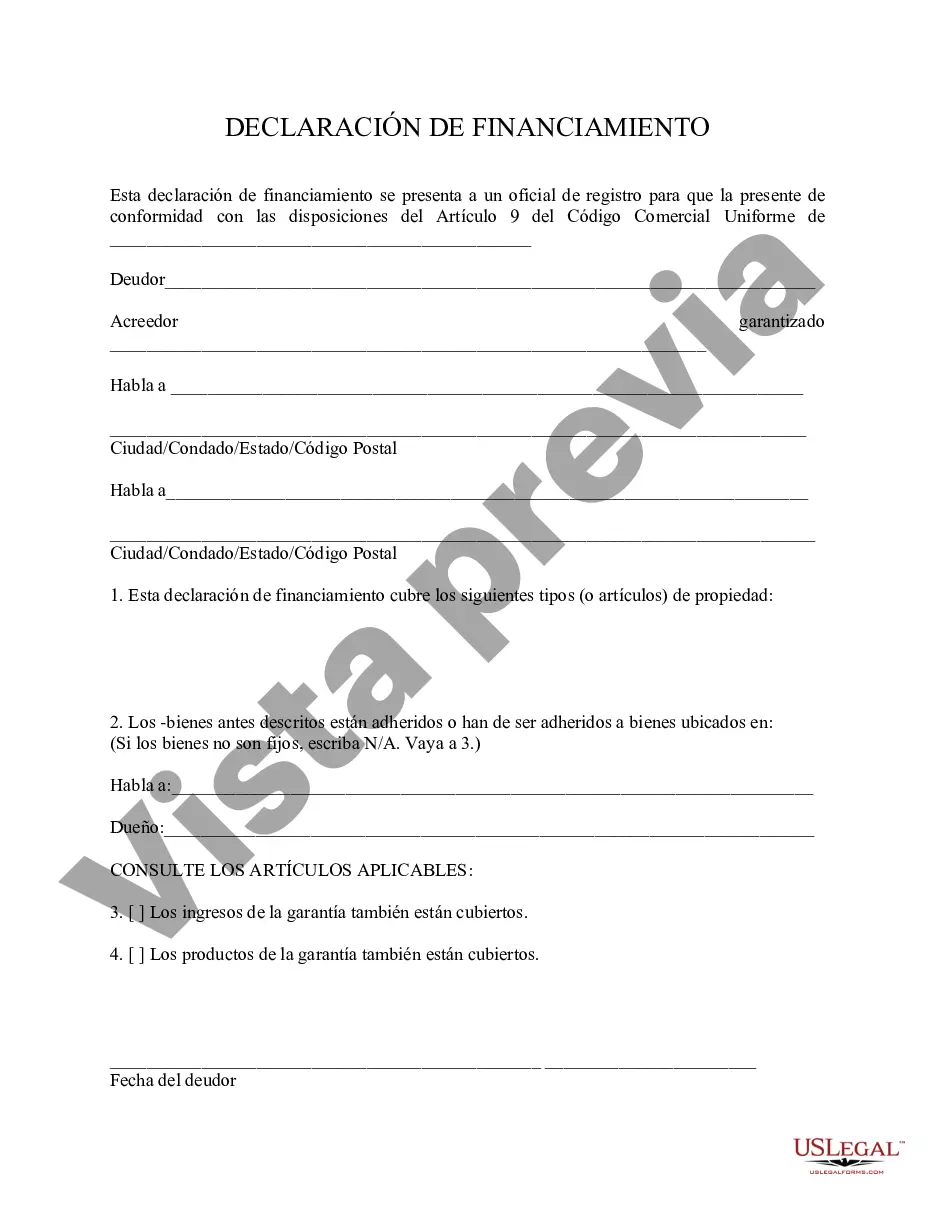

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Colorado Declaración de Financiamiento - Financing Statement

Description

How to fill out Colorado Declaración De Financiamiento?

US Legal Forms - one of several biggest libraries of legitimate forms in the United States - offers an array of legitimate document themes it is possible to obtain or produce. Using the website, you may get thousands of forms for business and specific functions, sorted by classes, claims, or keywords and phrases.You will discover the most up-to-date versions of forms such as the Colorado Financing Statement in seconds.

If you currently have a registration, log in and obtain Colorado Financing Statement in the US Legal Forms library. The Obtain key will show up on each and every type you see. You get access to all formerly downloaded forms within the My Forms tab of your own bank account.

If you want to use US Legal Forms initially, listed below are straightforward guidelines to help you began:

- Be sure you have picked the right type for your personal town/region. Click on the Preview key to review the form`s content material. Read the type outline to ensure that you have chosen the correct type.

- If the type doesn`t fit your requirements, take advantage of the Research area near the top of the monitor to find the the one that does.

- Should you be pleased with the form, verify your option by clicking the Purchase now key. Then, choose the pricing prepare you favor and offer your accreditations to register to have an bank account.

- Process the deal. Make use of Visa or Mastercard or PayPal bank account to complete the deal.

- Choose the formatting and obtain the form on your system.

- Make alterations. Complete, edit and produce and indication the downloaded Colorado Financing Statement.

Each web template you included with your money does not have an expiration particular date and is yours forever. So, in order to obtain or produce an additional backup, just visit the My Forms portion and click on on the type you require.

Gain access to the Colorado Financing Statement with US Legal Forms, the most extensive library of legitimate document themes. Use thousands of skilled and status-particular themes that fulfill your business or specific requirements and requirements.