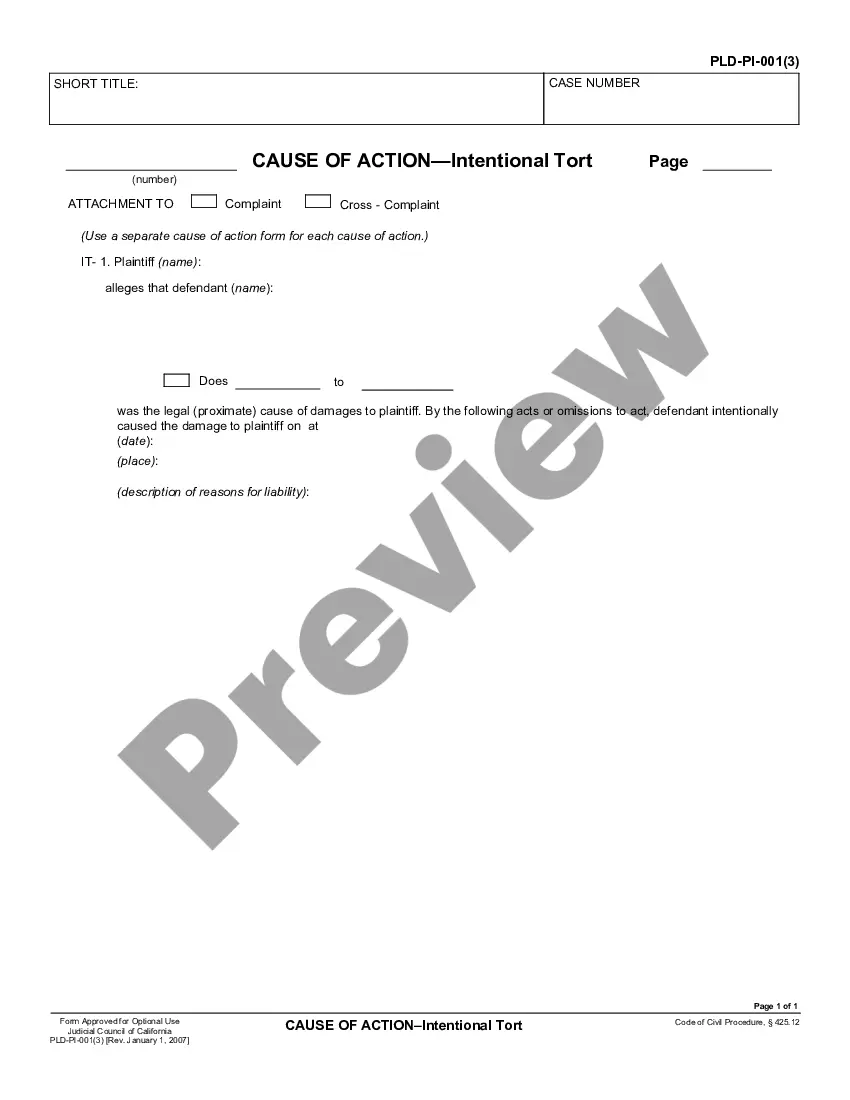

Colorado Escrow Instructions in Short Form are legal documents that outline the essential terms and conditions related to a real estate transaction in Colorado, where an escrow agent acts as a neutral third party to ensure a smooth closing process. These instructions serve as a guide to facilitate the transfer of property ownership and the handling of funds. The primary purpose of Colorado Escrow Instructions in Short Form is to provide a concise and summarized version of the terms agreed upon by the buyer, seller, and lender (if applicable). They typically include key details such as the identification of the parties involved, property description, purchase price, deposit amount, closing date, and the allocation of costs. The instructions also define the duties and responsibilities of the escrow agent, including the disbursement of funds, record-keeping, and the release of documents. Different types of Colorado Escrow Instructions in Short Form may include variations based on the specific nature of the real estate transaction. Some common types include: 1. Residential Escrow Instructions: These pertain to the purchase or sale of a residential property, such as a house, condominium, or town home in Colorado. The instructions will address specific considerations related to residential real estate transactions. 2. Commercial Escrow Instructions: These instructions are tailored for commercial real estate transactions, involving properties such as offices, retail spaces, industrial buildings, or land for development. Commercial escrow instructions may have additional clauses covering aspects like inspection periods, zoning concerns, or lease agreements. 3. Refinance Escrow Instructions: These instructions come into play when an existing loan is being refinanced. They outline the necessary steps for transferring the mortgage lien from the original lender to the new lender, including the payment of outstanding fees, verification of title, and distribution of funds. Overall, Colorado Escrow Instructions in Short Form provide a concise overview of crucial terms and obligations involved in a real estate transaction. It is essential for all parties involved to carefully review and agree upon these instructions to ensure a smooth and efficient process.

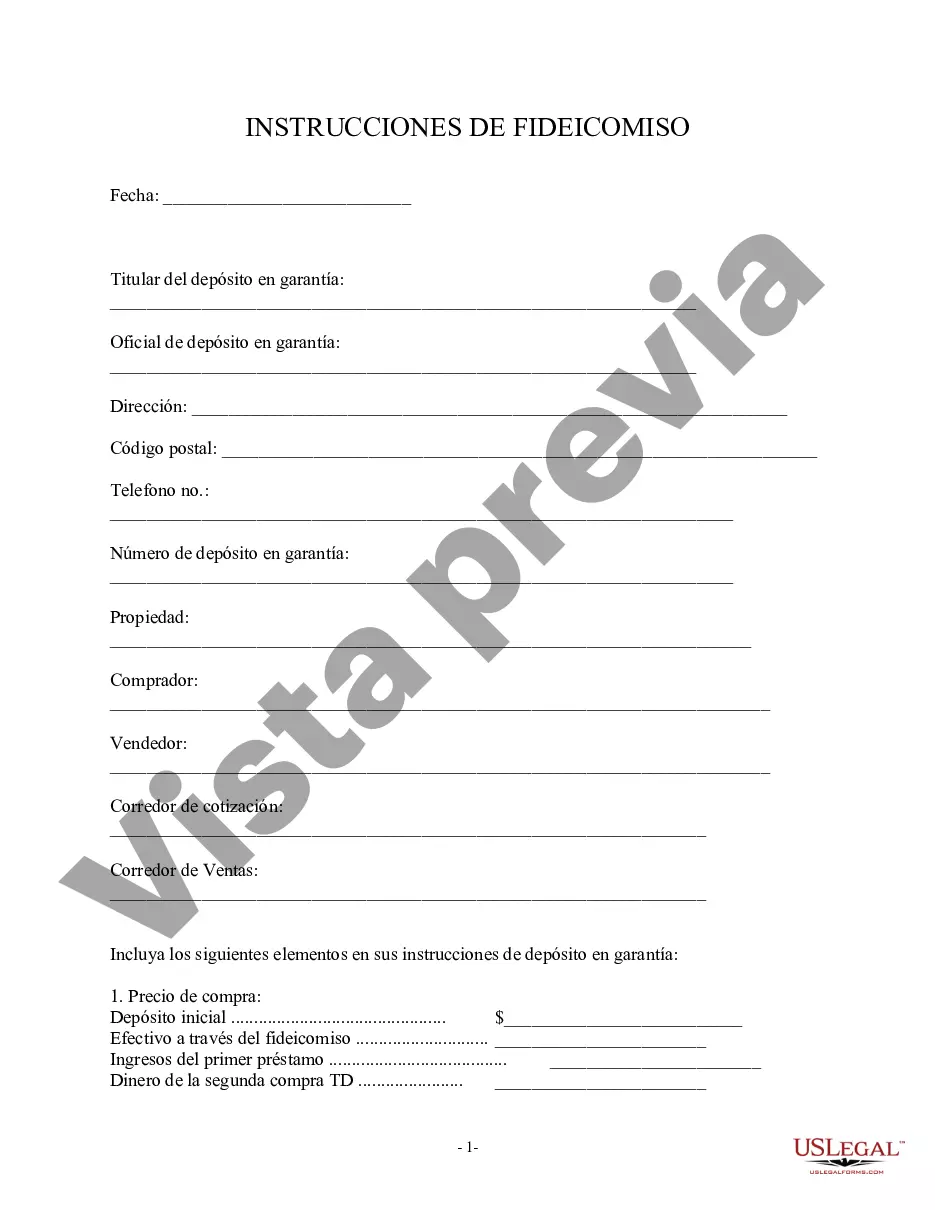

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Colorado Instrucciones de depósito en garantía en forma abreviada - Escrow Instructions in Short Form

Description

How to fill out Colorado Instrucciones De Depósito En Garantía En Forma Abreviada?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by type, state, or keywords. You can quickly find the latest versions of forms such as the Colorado Escrow Instructions in Short Form.

If you possess a subscription, Log In and download Colorado Escrow Instructions in Short Form from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms within the My documents section of your account.

Select the file format and download the form to your device.

Make edits. Fill out, modify, print, and sign the downloaded Colorado Escrow Instructions in Short Form. Each template you add to your account does not have an expiration date and is yours permanently. Therefore, to download or print another copy, simply go to the My documents section and click on the form you need.

- To use US Legal Forms for the first time, follow these simple steps.

- Ensure you have selected the correct form for your city/county.

- Click the Preview button to review the contents of the form.

- Check the form details to confirm that you have selected the correct form.

- If the form does not meet your needs, utilize the Search field at the top of the page to find one that does.

- Once satisfied with the form, confirm your choice by clicking the Get now button. Then select your desired pricing plan and provide your credentials to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

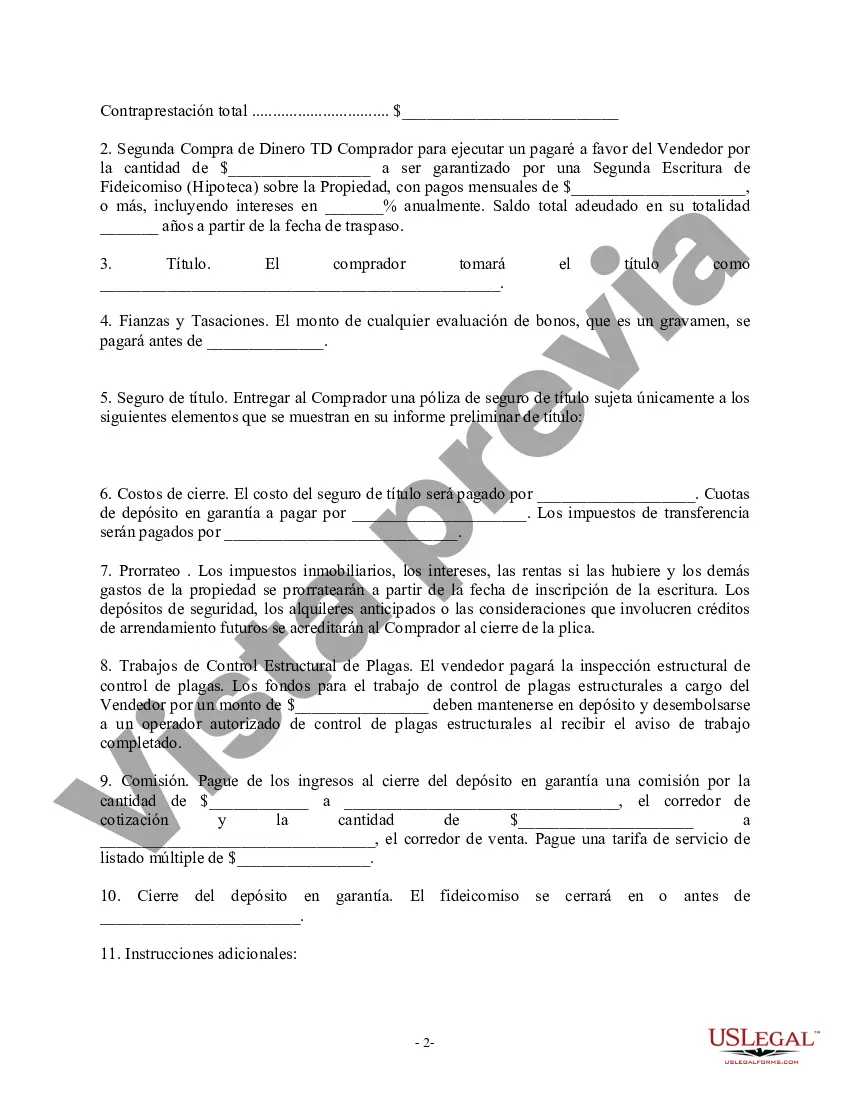

Escrow closing instructions are specific directives that guide the final steps of closing a real estate transaction. They detail the necessary actions required to complete the transfer of ownership, often including the distribution of funds and the execution of relevant documents. Understanding and following these instructions as outlined in Colorado Escrow Instructions in Short Form can help ensure a successful closing experience.

Escrow instructions are generally prepared by the parties involved in the transaction, often with assistance from real estate professionals. An experienced escrow officer or attorney may also draft the instructions to ensure they comply with legal standards. By leveraging resources like US Legal Forms, you can simplify the creation of these critical documents, ensuring you have accurate Colorado Escrow Instructions in Short Form.

Escrow instructions usually consist of a formal agreement created by the buyer and seller. This document outlines key details such as payment terms, property description, and any contingencies. Utilizing Colorado Escrow Instructions in Short Form can help streamline this process and make it more efficient for everyone involved.

Typically, escrow instructions are written documents that detail the terms and conditions agreed upon by the parties involved. These instructions might include information on the transaction, timelines, and specific actions required from each party. By following these guidelines outlined in Colorado Escrow Instructions in Short Form, all parties ensure a smooth transaction process.

For escrow to be valid, it must contain three critical components. First, there must be an agreement between the parties regarding the terms of the escrow. Second, the item of value must be safely held by a neutral third party. Finally, the release conditions must be clearly defined to ensure that the assets or funds are released when appropriate, aligning perfectly with Colorado Escrow Instructions in Short Form.

Escrow is a financial arrangement where a third party temporarily holds funds or assets until specific conditions are met. In real estate transactions, it often involves holding the buyer's deposit until both sides fulfill their obligations. This process ensures that all parties act fairly and protects the interests of everyone involved, making Colorado Escrow Instructions in Short Form an essential consideration.

The document that serves as escrow instructions is typically a written agreement prepared by the parties involved. This document outlines the terms and conditions necessary for the escrow agent to fulfill their role. It ensures that all transaction details are transparent and understood by everyone involved. Adopting Colorado Escrow Instructions in Short Form can help create a more efficient process.

Escrow instructions are detailed guidelines that dictate how the escrow process should proceed. They specify the duties of the escrow agent and outline actions for releasing funds and transferring property ownership. Essentially, these instructions create a framework for the transaction, ensuring all parties understand their responsibilities. Utilizing Colorado Escrow Instructions in Short Form simplifies this vital communication.

An escrow agent uses written escrow instructions provided by the parties involved in the transaction. These instructions act as a guide for the agent to execute the transaction as planned. The document outlines specific conditions for the release of funds and transfer of property. For clarity, utilizing Colorado Escrow Instructions in Short Form can streamline these instructions.

Escrow instructions are typically signed by the buyer and seller of a property. Both parties must agree on the terms set forth in these instructions to finalize the agreement. Additionally, any legal representatives may also sign the documents if they act on behalf of a party. Familiarizing yourself with Colorado Escrow Instructions in Short Form ensures everyone is on the same page.