Title: Understanding the Colorado Agreement to Partner and Incorporate Partnership: A Comprehensive Overview Introduction: The Colorado Agreement to Partner and Incorporate Partnership is a legal document that guides the establishment and operation of partnerships within the state of Colorado. This detailed description aims to provide a comprehensive understanding of this agreement, its purpose, and key elements involved. Additionally, it covers different types of partnerships under Colorado law. 1. Definition and Purpose: The Colorado Agreement to Partner and Incorporate Partnership encompasses the legal agreement between individuals or entities who wish to enter into a partnership, outlining the terms and conditions of their collaboration. Its primary purpose is to provide a framework for establishing a partnership and ensuring clear communication, governance, and distribution of assets, liabilities, profits, and losses between partners. 2. Key Components of the Agreement: a. Partnership Name and Purpose: This section includes the intended official name of the partnership and a brief description of its purpose or business activity. b. Duration: Specifies the duration and termination conditions of the partnership, whether it will be dissolved upon the occurrence of a specific event or if it is perpetual. c. Capital Contributions: Outlines the contributions made by partners to the partnership, including cash, property, or any other form of investment. d. Profit and Loss Distribution: Details how profits and losses will be shared among partners, often based on the agreed-upon capital contributions or some other allocation formula. e. Decision-Making Authority: Clarifies the decision-making process within the partnership, highlighting matters that require unanimous consent or certain majority votes. f. Management of Partnership: Describes the roles and responsibilities of each partner, highlighting their authority, decision-making powers, and obligations. g. Dissolution and Liquidation: Specifies the process of dissolving the partnership, including distribution of assets, settlement of liabilities, and any other necessary procedures. h. Dispute Resolution: Outlines mechanisms for resolving conflicts that may arise between partners, such as mediation, arbitration, or litigation, and the jurisdiction that would govern such disputes. 3. Types of Colorado Partnership Agreements: a. General Partnership (GP): A traditional partnership where all partners share equal responsibility, liability, and decision-making authority. b. Limited Partnership (LP): In an LP, some partners have limited liability and are not directly involved in the daily management of the partnership. c. Limited Liability Partnership (LLP): Designed primarily for professional service providers, this type of partnership offers limited liability protection to partners. d. Limited Liability Limited Partnership (LL LP): An LL LP combines features of an LP and an LLP, offering limited liability to all partners while allowing some partners to remain passive investors. Conclusion: The Colorado Agreement to Partner and Incorporate Partnership is an essential legal document for establishing partnerships within the state. Understanding its purpose and key components is vital for individuals or entities planning to collaborate in a partnership setting. Alongside the different types of partnerships mentioned, partners can choose the agreement that best suits their specific needs and objectives. Seeking legal counsel in the partnership formation process will ensure compliance with Colorado law and help build a solid foundation for a successful partnership venture.

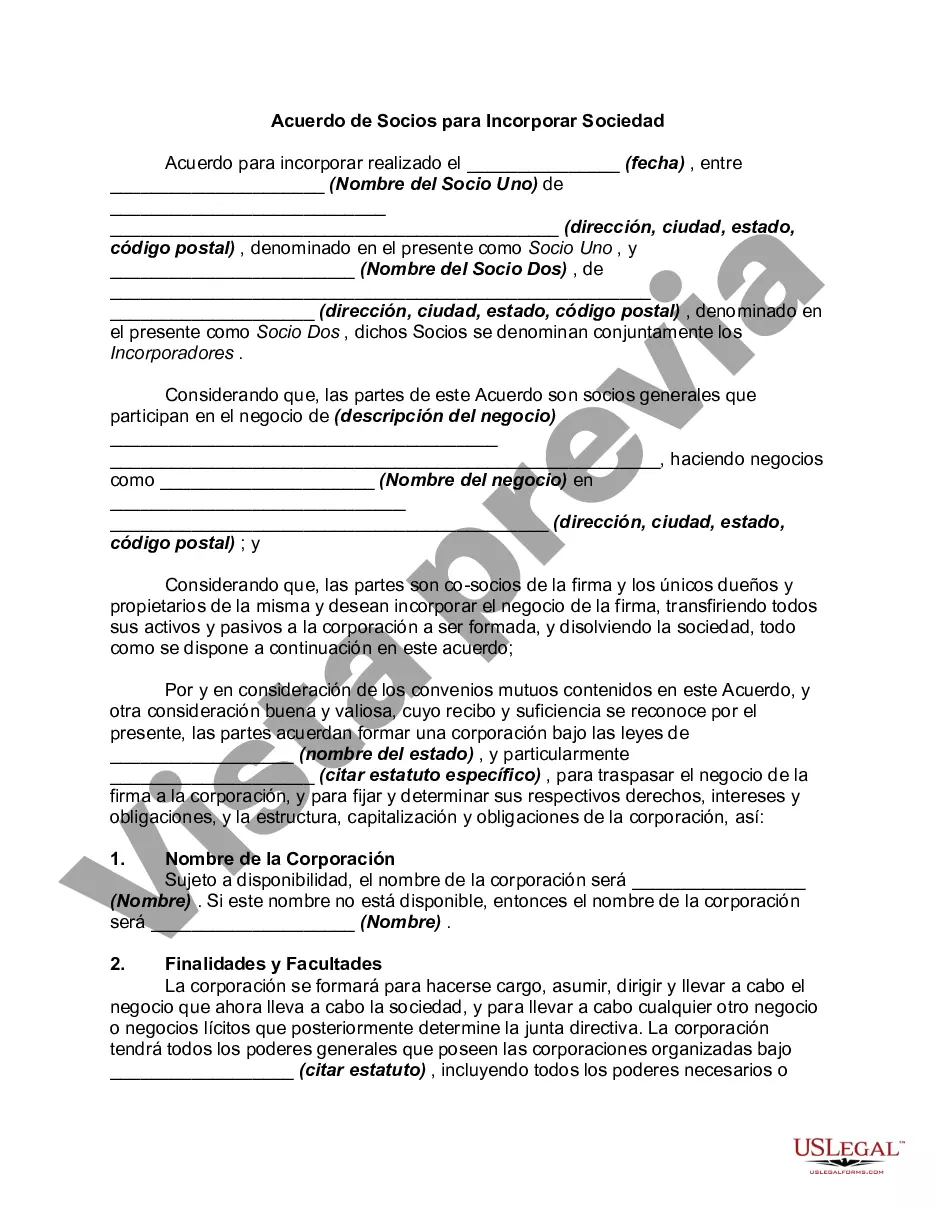

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Colorado Acuerdo de Socios para Incorporar Sociedad - Agreement to Partners to Incorporate Partnership

Description

How to fill out Colorado Acuerdo De Socios Para Incorporar Sociedad?

US Legal Forms - one of the largest libraries of authorized varieties in the States - delivers a wide array of authorized document web templates you can down load or print. Using the internet site, you can get 1000s of varieties for organization and individual uses, categorized by categories, says, or search phrases.You will discover the newest models of varieties much like the Colorado Agreement to Partners to Incorporate Partnership within minutes.

If you currently have a registration, log in and down load Colorado Agreement to Partners to Incorporate Partnership in the US Legal Forms catalogue. The Acquire key will show up on each type you see. You have access to all earlier saved varieties from the My Forms tab of your bank account.

If you wish to use US Legal Forms the very first time, here are simple directions to get you started off:

- Make sure you have chosen the best type for your metropolis/area. Select the Review key to analyze the form`s information. Look at the type outline to ensure that you have selected the appropriate type.

- In case the type does not suit your requirements, utilize the Search field on top of the monitor to get the one who does.

- If you are pleased with the shape, validate your decision by simply clicking the Purchase now key. Then, opt for the rates program you like and provide your credentials to register for an bank account.

- Process the financial transaction. Utilize your charge card or PayPal bank account to finish the financial transaction.

- Pick the format and down load the shape on your own system.

- Make alterations. Load, change and print and indication the saved Colorado Agreement to Partners to Incorporate Partnership.

Each template you added to your money does not have an expiry day which is your own property permanently. So, if you want to down load or print yet another version, just visit the My Forms portion and click on about the type you will need.

Gain access to the Colorado Agreement to Partners to Incorporate Partnership with US Legal Forms, by far the most considerable catalogue of authorized document web templates. Use 1000s of professional and express-certain web templates that satisfy your small business or individual needs and requirements.