Title: Understanding Colorado Acceptance of Claim by Collection Agency and Report of Experience with Debtor Introduction: In the State of Colorado, the Acceptance of Claim by Collection Agency and Report of Experience with Debtor is a crucial tool utilized by collection agencies to document and report their interactions with debtors. This detailed description aims to explain the purpose, requirements, types, and significance of this process, using relevant keywords to provide a comprehensive understanding of the topic. 1. Purpose of the Acceptance of Claim by Collection Agency and Report of Experience with Debtor: The Acceptance of Claim by Collection Agency and Report of Experience with Debtor serves multiple purposes, including: — Validating the claim: The collection agency assesses the legitimacy of the claim against the debtor before pursuing further actions. — Compliance with legal regulations: Colorado law requires collection agencies to document their interactions accurately and maintain transparency throughout the debt collection process. — Protecting debtors' rights: By receiving and reviewing debtor claims, the collection agency ensures fair treatment and adherence to relevant protocols. — Establishing a paper trail: The report helps create a documented history of communication, payment agreements, and any disputes or resolutions. 2. Requirements for Filing the Acceptance of Claim: To file the Acceptance of Claim, the collection agency must adhere to specific requirements, such as: — Submitting accurate debtor information including name, address, contact details, and account numbers. — Providing a comprehensive narrative of the creditor's claim against the debtor, including the original debt amount, interest charges, and any additional fees. — Including any supporting documentation like invoices, contracts, or payment history records, strengthening the claim's validity. — Demonstrating compliance with Colorado collection laws, such as the Fair Debt Collection Practices Act (FD CPA) and the Colorado Fair Debt Collection Practices Act (CFD CPA). 3. Types of Colorado Acceptance of Claim by Collection Agency and Report of Experience with Debtor: Depending on the circumstances, there may be a few variations of the Acceptance of Claim and Report of Experience. Some common types include: — Initial Claim Acceptance: The report filed when a collection agency first accepts a claim from a creditor against a debtor. — Amended Claim Acceptance: Filed when there are updates, modifications, or corrections to the original claim or debtor information that need to be documented. — Positive Reporting: In cases where the debtor has successfully resolved their debt, the collection agency files a report detailing the experience and confirming their satisfactory payment. 4. Significance and Benefits: The Colorado Acceptance of Claim by Collection Agency and Report of Experience with Debtor offers several advantages, which include: — Legal protection: By rigorously documenting their actions and communications, collection agencies mitigate legal risks and ensure compliance with state and federal regulations. — Improved efficiency: Having a standardized procedure helps streamline debt collection efforts, reduce errors, and maintain consistency in handling claims. — Transparency and accountability: The report provides transparency to debtors, allowing them to track the progress of their claims and serves as evidence if any legal disputes arise. — Creditor satisfaction: Accurate reporting and timely updates build trust between the collection agency and the creditor, establishing a professional relationship. Conclusion: Complying with the Colorado Acceptance of Claim by Collection Agency and Report of Experience with Debtor requirements ensures fair treatment of debtors and legal compliance. By adhering to the necessary guidelines, collection agencies can effectively manage the debt collection process, maintain transparency, and strengthen their professional reputation.

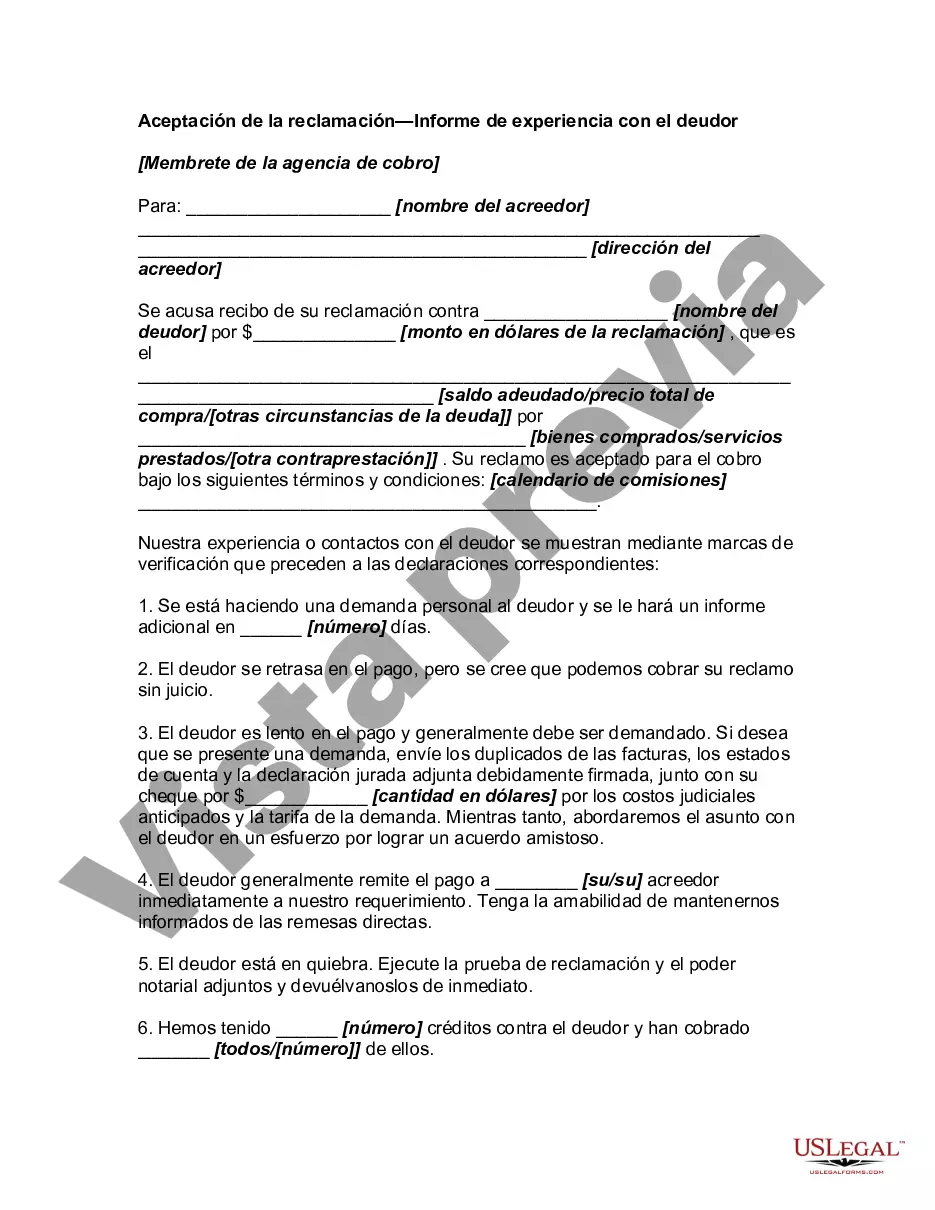

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Colorado Aceptación de Reclamo por Agencia de Cobranza e Informe de Experiencia con Deudor - Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

How to fill out Colorado Aceptación De Reclamo Por Agencia De Cobranza E Informe De Experiencia Con Deudor?

Choosing the right legal document template could be a have difficulties. Naturally, there are a lot of themes available online, but how do you find the legal kind you will need? Utilize the US Legal Forms web site. The services offers 1000s of themes, such as the Colorado Acceptance of Claim by Collection Agency and Report of Experience with Debtor, which can be used for organization and private demands. Each of the forms are checked by experts and fulfill federal and state requirements.

If you are previously registered, log in in your profile and click the Obtain option to have the Colorado Acceptance of Claim by Collection Agency and Report of Experience with Debtor. Make use of profile to search through the legal forms you possess bought earlier. Proceed to the My Forms tab of the profile and acquire yet another version in the document you will need.

If you are a new consumer of US Legal Forms, here are basic guidelines so that you can adhere to:

- Very first, make sure you have selected the right kind for the city/county. You can look over the form using the Preview option and study the form explanation to make sure this is basically the best for you.

- In case the kind will not fulfill your preferences, take advantage of the Seach discipline to discover the right kind.

- Once you are sure that the form is acceptable, select the Get now option to have the kind.

- Pick the pricing strategy you would like and type in the needed information. Build your profile and purchase the transaction making use of your PayPal profile or charge card.

- Opt for the submit file format and down load the legal document template in your device.

- Comprehensive, revise and print out and signal the attained Colorado Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

US Legal Forms is the biggest collection of legal forms for which you can find various document themes. Utilize the company to down load appropriately-made files that adhere to express requirements.