A private placement memorandum (PPM) is a document providing information about a proposed private placement of securities, where a company sells securities to select investors, rather than releasing them to the public. This document is sent to proposed investors so they can review the information and make a decision about whether they want to invest. Firms draft private placement memoranda in consultation with their attorneys to ensure accuracy and completeness Private placement of securities usually involves the sale of stocks, bonds, and other securities to institutional investors who are willing to buy large blocks of securities. The private placement allows a company to raise capital for activities without needing to formulate an initial public offering and it is highly discreet in nature, as members of the public are generally not aware of the sale of securities until after it is complete. In addition, private placements conducted within specific limits do not need to be registered with the Securities and Exchange Commission.

Title: Colorado Sample Private Placement Memorandum: A Comprehensive Guide to Private Investment in Colorado Introduction: A Colorado Sample Private Placement Memorandum (PPM) is a legal document that provides potential investors with important information about a private investment opportunity within the state of Colorado. It outlines all the necessary details, risks, terms, and conditions associated with the investment offering. This detailed description will take you through the different types of Colorado Sample Private Placement Memoranda and their significance. Types of Colorado Sample Private Placement Memoranda: 1. Real Estate Private Placement Memorandum: A real estate PPM focuses on private investment opportunities within the Colorado real estate market. It provides potential investors with detailed information about a project, such as the property location, development plans, expected returns, and associated risks. This type of PPM can be tailored for various real estate investment opportunities, including residential, commercial, or industrial projects. 2. Technology Private Placement Memorandum: A technology PPM pertains to private investment opportunities in the technology sector in Colorado. It presents potential investors with detailed information about technology startups or established companies seeking funding for expansion, research and development, or other specific projects. The PPM includes information about the technology's potential, competitive landscape, management team, investment terms, and risk factors associated with the technology sector. 3. Energy Private Placement Memorandum: An energy PPM focuses on private investment opportunities within the energy sector in Colorado. It may cover renewable energy projects, such as solar, wind, or hydroelectric power, as well as traditional energy sources like oil and gas. The PPM provides investors with insights into the project's feasibility, potential returns, operational plans, regulatory considerations, and environmental impact. 4. Cannabis Private Placement Memorandum: As Colorado has legalized recreational marijuana, a cannabis PPM covers private investment opportunities in the state's cannabis industry. This type of PPM provides prospective investors with comprehensive information about the cannabis company, including cultivation methods, product offerings, market analysis, legal and regulatory risks, and projected returns. It also outlines any specific challenges and opportunities within the rapidly evolving cannabis market. Importance of a Colorado Sample Private Placement Memorandum: 1. Legal Compliance: A Colorado Sample PPM is a vital legal document that helps issuers comply with securities regulations set forth by the Colorado Division of Securities. It ensures transparency and full disclosure of material information, protecting both investors and issuers. 2. Informed Investment Decisions: By providing comprehensive details about the investment opportunity, a PPM enables potential investors to make informed decisions. It presents relevant financial information, business models, investment terms, and risk factors, allowing individuals to assess the potential risks and rewards associated with investing in Colorado. 3. Documentation of the Offering: A PPM serves as an official record of the investment offering, documenting all the relevant details. This helps maintain transparency and clarity among all parties involved and provides evidence of the issuer's efforts to comply with securities regulations. Conclusion: A Colorado Sample Private Placement Memorandum plays a critical role in private investment opportunities within the state. It provides investors with the necessary information to make informed decisions and protects the interests of both issuers and investors. Whether focused on real estate, technology, energy, or cannabis, a well-drafted PPM helps outline the investment's potential, risks, and terms, ensuring compliance with Colorado's securities regulations.Title: Colorado Sample Private Placement Memorandum: A Comprehensive Guide to Private Investment in Colorado Introduction: A Colorado Sample Private Placement Memorandum (PPM) is a legal document that provides potential investors with important information about a private investment opportunity within the state of Colorado. It outlines all the necessary details, risks, terms, and conditions associated with the investment offering. This detailed description will take you through the different types of Colorado Sample Private Placement Memoranda and their significance. Types of Colorado Sample Private Placement Memoranda: 1. Real Estate Private Placement Memorandum: A real estate PPM focuses on private investment opportunities within the Colorado real estate market. It provides potential investors with detailed information about a project, such as the property location, development plans, expected returns, and associated risks. This type of PPM can be tailored for various real estate investment opportunities, including residential, commercial, or industrial projects. 2. Technology Private Placement Memorandum: A technology PPM pertains to private investment opportunities in the technology sector in Colorado. It presents potential investors with detailed information about technology startups or established companies seeking funding for expansion, research and development, or other specific projects. The PPM includes information about the technology's potential, competitive landscape, management team, investment terms, and risk factors associated with the technology sector. 3. Energy Private Placement Memorandum: An energy PPM focuses on private investment opportunities within the energy sector in Colorado. It may cover renewable energy projects, such as solar, wind, or hydroelectric power, as well as traditional energy sources like oil and gas. The PPM provides investors with insights into the project's feasibility, potential returns, operational plans, regulatory considerations, and environmental impact. 4. Cannabis Private Placement Memorandum: As Colorado has legalized recreational marijuana, a cannabis PPM covers private investment opportunities in the state's cannabis industry. This type of PPM provides prospective investors with comprehensive information about the cannabis company, including cultivation methods, product offerings, market analysis, legal and regulatory risks, and projected returns. It also outlines any specific challenges and opportunities within the rapidly evolving cannabis market. Importance of a Colorado Sample Private Placement Memorandum: 1. Legal Compliance: A Colorado Sample PPM is a vital legal document that helps issuers comply with securities regulations set forth by the Colorado Division of Securities. It ensures transparency and full disclosure of material information, protecting both investors and issuers. 2. Informed Investment Decisions: By providing comprehensive details about the investment opportunity, a PPM enables potential investors to make informed decisions. It presents relevant financial information, business models, investment terms, and risk factors, allowing individuals to assess the potential risks and rewards associated with investing in Colorado. 3. Documentation of the Offering: A PPM serves as an official record of the investment offering, documenting all the relevant details. This helps maintain transparency and clarity among all parties involved and provides evidence of the issuer's efforts to comply with securities regulations. Conclusion: A Colorado Sample Private Placement Memorandum plays a critical role in private investment opportunities within the state. It provides investors with the necessary information to make informed decisions and protects the interests of both issuers and investors. Whether focused on real estate, technology, energy, or cannabis, a well-drafted PPM helps outline the investment's potential, risks, and terms, ensuring compliance with Colorado's securities regulations.

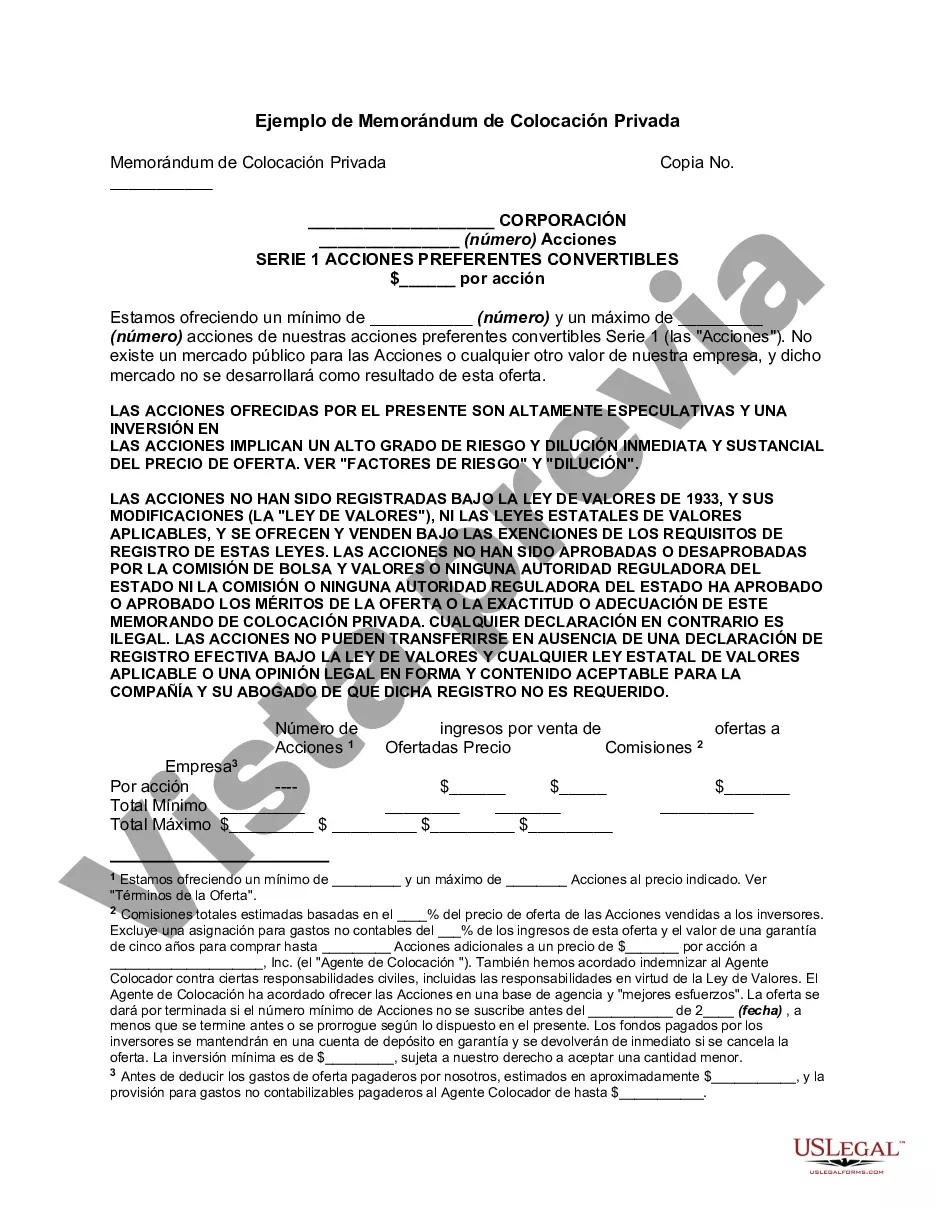

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.