The Colorado General Form of Assignment as Collateral for Note is a legal document used to transfer ownership rights of a specific item or property to a lender as collateral for a loan. This form is commonly used in Colorado when a borrower pledges personal property as security for a promissory note, providing assurance to the lender that they have the ability to recover their funds in case of default. Keywords: Colorado, General Form of Assignment, Collateral, Note, legal document, transfer ownership, property, lender, loan, borrower, personal property, security, promissory note, assurance, default. There are different types of Colorado General Form of Assignment as Collateral for Note, which include: 1. Real Estate Assignment: This form is used when the collateral involves real estate holdings, such as land, buildings, or any other immovable property. The borrower will assign their ownership rights to the lender as collateral, providing a level of security for the loan. 2. Chattel Assignment: This form is utilized when the collateral consists of movable personal property, excluding real estate. It includes items like vehicles, equipment, inventory, or any other tangible assets that can be easily transferred. The borrower would assign their rights to these assets as collateral to secure the note. 3. Intellectual Property Assignment: This specific form is relevant when the collateral involves intangible assets like patents, trademarks, copyrights, or any other intellectual property rights. The borrower assigns their ownership rights of these intangible assets to the lender to secure the note. 4. Accounts Receivable Assignment: This type of assignment is employed when a borrower pledges their rights to outstanding accounts receivable as collateral. The lender takes ownership of these accounts, enabling them to collect unpaid debts directly if the borrower defaults on the note. 5. Investment Securities Assignment: In cases where the collateral involves investment securities such as stocks, bonds, or mutual funds, this form is used. The borrower assigns their ownership rights of these securities to the lender, providing security for the loan. In all these scenarios, the Colorado General Form of Assignment as Collateral for Note ensures a legally binding transfer of ownership rights from the borrower to the lender, safeguarding the lender's interest in the event of non-payment or default. It is crucial for both parties to understand the terms and conditions stated within the document to avoid any disputes or legal complications in the future.

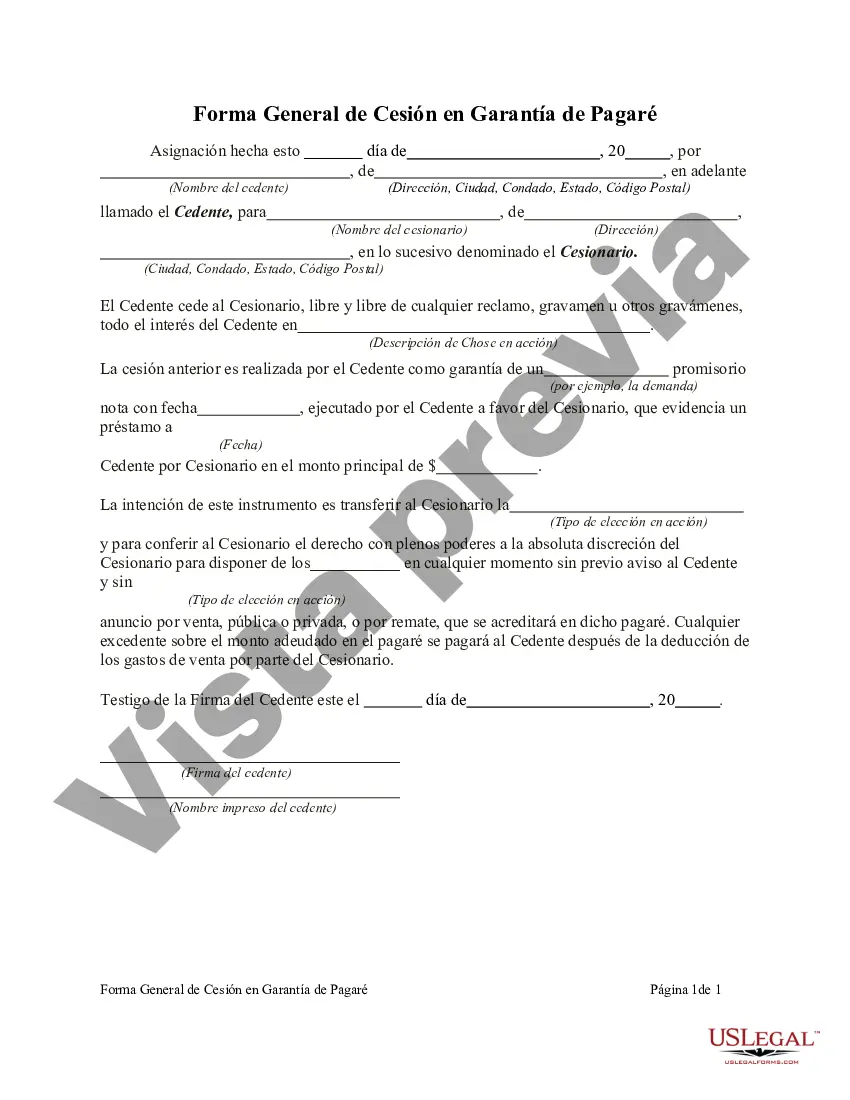

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Colorado Forma General de Cesión en Garantía de Pagaré - General Form of Assignment as Collateral for Note

Description

How to fill out Colorado Forma General De Cesión En Garantía De Pagaré?

US Legal Forms - among the biggest libraries of legal kinds in the States - offers a wide range of legal record themes you may obtain or printing. Utilizing the internet site, you can find a large number of kinds for business and person uses, sorted by types, states, or search phrases.You will discover the most recent models of kinds such as the Colorado General Form of Assignment as Collateral for Note in seconds.

If you currently have a membership, log in and obtain Colorado General Form of Assignment as Collateral for Note from your US Legal Forms local library. The Acquire key can look on each type you perspective. You have access to all in the past acquired kinds in the My Forms tab of your bank account.

In order to use US Legal Forms initially, listed below are straightforward recommendations to obtain started out:

- Make sure you have chosen the correct type to your city/region. Click the Preview key to check the form`s content. Look at the type outline to ensure that you have chosen the correct type.

- If the type doesn`t match your demands, utilize the Look for discipline at the top of the monitor to discover the the one that does.

- When you are pleased with the shape, verify your selection by clicking on the Buy now key. Then, opt for the prices plan you like and supply your qualifications to sign up to have an bank account.

- Procedure the deal. Make use of your bank card or PayPal bank account to accomplish the deal.

- Choose the file format and obtain the shape on your gadget.

- Make alterations. Fill out, change and printing and indicator the acquired Colorado General Form of Assignment as Collateral for Note.

Every single format you included with your account does not have an expiry time and is also your own forever. So, if you wish to obtain or printing yet another version, just check out the My Forms section and click around the type you require.

Get access to the Colorado General Form of Assignment as Collateral for Note with US Legal Forms, probably the most comprehensive local library of legal record themes. Use a large number of expert and condition-particular themes that meet up with your business or person needs and demands.