Colorado Jury Instruction - 10.10.6 Section 6672 Penalty

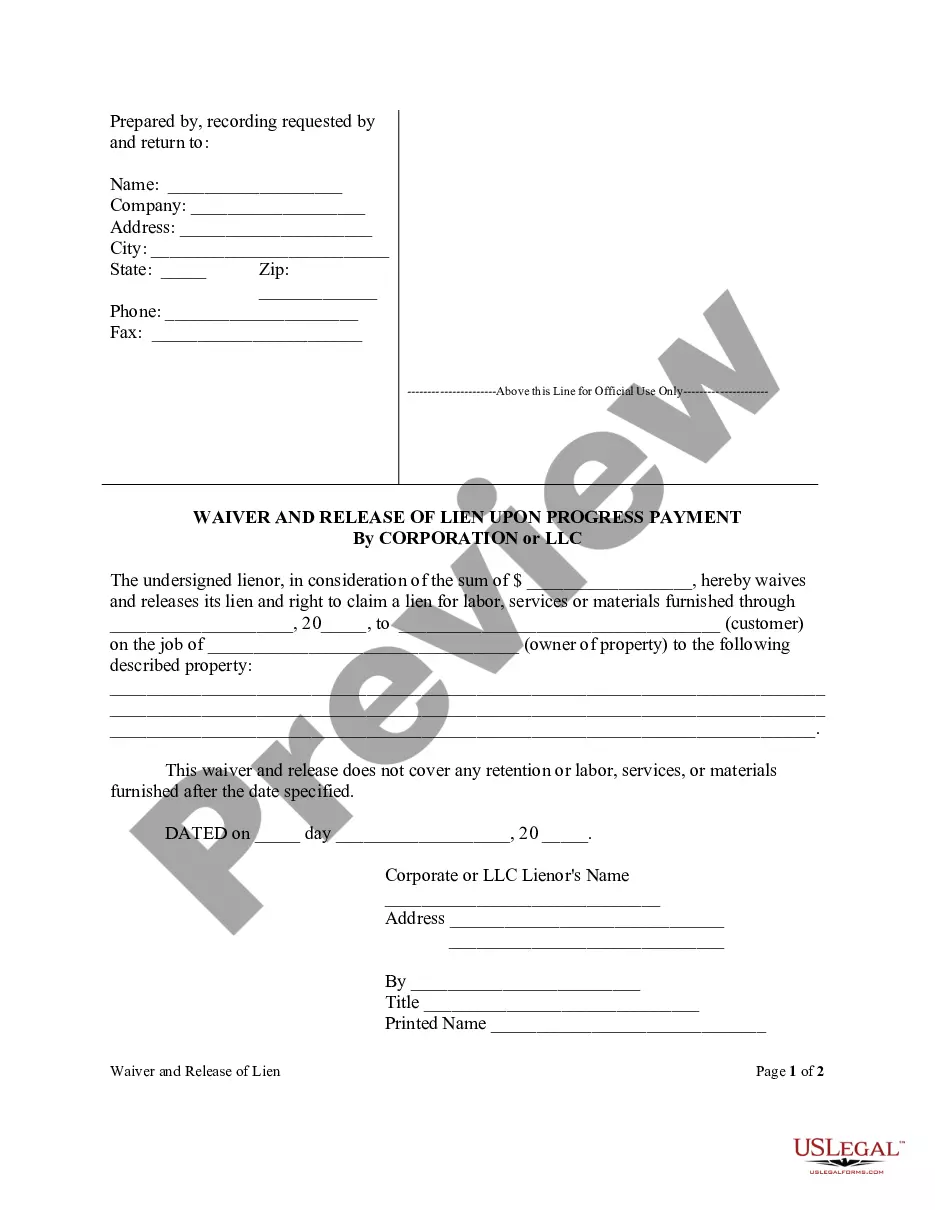

Description

How to fill out Jury Instruction - 10.10.6 Section 6672 Penalty?

Finding the right legal papers design can be a battle. Of course, there are a variety of templates available on the net, but how would you get the legal develop you require? Make use of the US Legal Forms internet site. The support delivers a huge number of templates, such as the Colorado Jury Instruction - 10.10.6 Section 6672 Penalty, that can be used for enterprise and personal needs. All of the kinds are examined by specialists and satisfy federal and state demands.

When you are previously registered, log in to the accounts and click the Obtain switch to find the Colorado Jury Instruction - 10.10.6 Section 6672 Penalty. Make use of accounts to look from the legal kinds you may have ordered formerly. Go to the My Forms tab of your accounts and obtain an additional duplicate of your papers you require.

When you are a fresh user of US Legal Forms, listed below are basic recommendations that you should comply with:

- Very first, ensure you have chosen the appropriate develop for your personal area/region. You may examine the form using the Review switch and read the form outline to make certain it will be the right one for you.

- In the event the develop will not satisfy your expectations, take advantage of the Seach discipline to get the appropriate develop.

- Once you are certain the form is suitable, click on the Purchase now switch to find the develop.

- Choose the costs prepare you would like and enter the needed info. Make your accounts and pay for the order using your PayPal accounts or Visa or Mastercard.

- Select the submit format and acquire the legal papers design to the gadget.

- Total, edit and print and indication the attained Colorado Jury Instruction - 10.10.6 Section 6672 Penalty.

US Legal Forms may be the greatest local library of legal kinds for which you can find various papers templates. Make use of the service to acquire appropriately-produced files that comply with express demands.

Form popularity

FAQ

The instruction tells jurors that if they're ?firmly convinced? of the defendant's guilt, the crime has been proven beyond a reasonable doubt, but if they think there's a ?real possibility? the defendant isn't guilty, the prosecution didn't prove the crime beyond a reasonable doubt.

It is not required that the government prove guilt beyond all possible doubt. A reasonable doubt is a doubt based upon reason and common sense and is not based purely on speculation. It may arise from a careful and impartial consideration of all the evidence, or from lack of evidence.

Before the recent update, the applicable jury instruction in Colorado defined reasonable doubt: ?Reasonable doubt means a doubt based upon reason and common sense which arises from a fair and rational consideration of all of the evidence, or the lack of evidence, in the case.

Reasonable doubt exists when you are not firmly convinced of the Defendant's guilt, after you have weighed and considered all the evidence. A Defendant must not be convicted on suspicion or speculation. It is not enough for the State to show that the Defendant is probably guilty.

In a criminal case, the prosecution bears the burden of proving that the defendant is guilty beyond all reasonable doubt. This means that the prosecution must convince the jury that there is no other reasonable explanation that can come from the evidence presented at trial.