Title: Understanding Colorado Settlement Agreements between the Estate of a Deceased Partner and the Surviving Partners Introduction: In Colorado, when a partner of a business entity passes away, it is crucial for the surviving partners and the deceased partner's estate to settle the outstanding matters. This is achieved through a legally binding agreement known as the Colorado Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners. This comprehensive document addresses various aspects and ensures a smooth transition for the business. In this article, we will delve into the details of this agreement, highlighting its importance and key considerations. Key Points: 1. Definition of a Colorado Settlement Agreement: A Colorado Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners is a legal contract that outlines the terms and conditions under which the estate of a deceased partner will be handled, including the distribution of assets and liabilities, as well as the future roles and responsibilities of the surviving partners. 2. Importance of Colorado Settlement Agreements: — Clearly defines the rights, obligations, and responsibilities of the surviving partners and the deceased partner's estate. — Minimizes potential conflicts and disputes by addressing important issues upfront. — Ensures an orderly transfer of assets and liabilities. — Facilitates a smooth continuation of business operations, if desired. — Provides a fair and equitable distribution of the deceased partner's share of the business. 3. Components of a Colorado Settlement Agreement: — Identification of parties involved: Clearly states the names and roles of the deceased partner, surviving partners, and any other relevant individuals or entities. — Asset and liability distribution: Outlines how the estate's assets, such as bank accounts, properties, investments, and debts, will be allocated among the parties. — Business valuation: Details the process for determining the value of the business interest held by the deceased partner and how it will be transferred. — Buyout provisions: Specifies if the surviving partners are willing to purchase the deceased partner's share and the terms and conditions associated with the buyout, including payment options and timelines. — Succession planning: Addresses the transition of management and decision-making powers within the business. — Confidentiality and non-compete clauses: Includes provisions to protect the business's sensitive information and prevent competing activities by the deceased partner's estate. — Dispute resolution: Outlines methods for resolving any future disputes that may arise during the execution of the agreement. Types of Colorado Settlement Agreements between the Estate of a Deceased Partner and the Surviving Partners: 1. Lump Sum Agreement: In this arrangement, the estate of the deceased partner receives a one-time payment in exchange for transferring their interest in the business to the surviving partners. 2. Installment Agreement: This type of agreement allows the surviving partners to make periodic payments to the estate over an agreed-upon period until the full value of the deceased partner's share is settled. 3. Partnership Reconfiguration Agreement: In certain cases, the remaining partners may choose to restructure the partnership to accommodate the absence of the deceased partner, including bringing in new partners or modifying profit-sharing arrangements. Conclusion: A well-drafted Colorado Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners is crucial for preserving the integrity and continuity of a business following the death of a partner. It establishes a solid framework to ensure a fair distribution of assets, seamless transition of responsibilities, and minimization of potential conflicts. Consulting with legal professionals experienced in business law and estate planning is vital to ensure the terms of the agreement align with the unique circumstances of the involved parties.

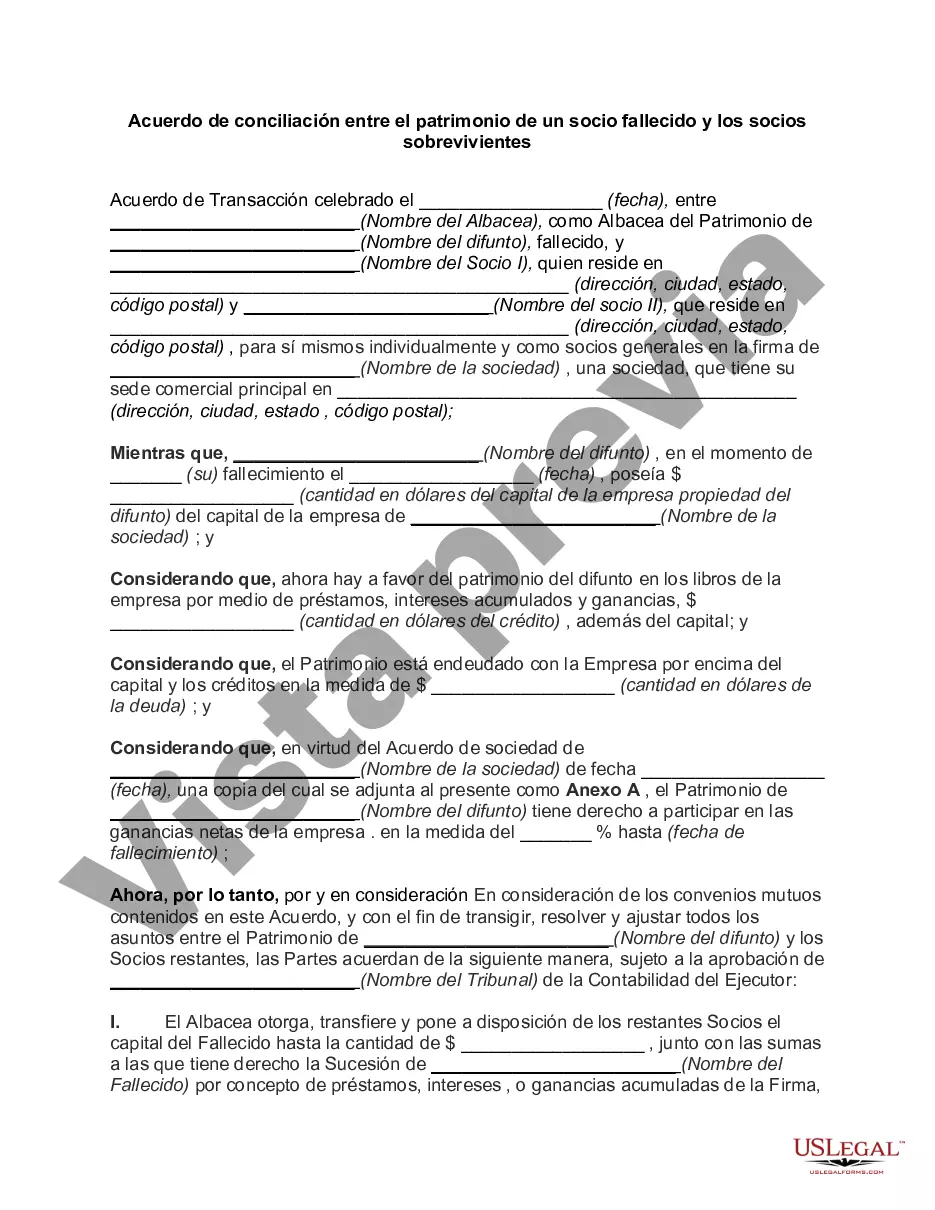

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Colorado Acuerdo de conciliación entre el patrimonio de un socio fallecido y los socios sobrevivientes - Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners

Description

How to fill out Colorado Acuerdo De Conciliación Entre El Patrimonio De Un Socio Fallecido Y Los Socios Sobrevivientes?

US Legal Forms - one of the greatest libraries of lawful kinds in the States - delivers an array of lawful document web templates you can acquire or print out. While using site, you may get 1000s of kinds for enterprise and person functions, sorted by classes, claims, or keywords.You can find the latest models of kinds much like the Colorado Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners within minutes.

If you have a subscription, log in and acquire Colorado Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners from the US Legal Forms catalogue. The Acquire option will show up on each and every type you perspective. You get access to all previously delivered electronically kinds inside the My Forms tab of your respective accounts.

If you wish to use US Legal Forms the very first time, here are straightforward recommendations to obtain began:

- Make sure you have chosen the correct type to your city/region. Click the Review option to analyze the form`s content material. See the type explanation to actually have chosen the appropriate type.

- If the type does not satisfy your specifications, use the Search area near the top of the display screen to find the the one that does.

- If you are content with the form, confirm your selection by visiting the Buy now option. Then, pick the costs prepare you want and give your accreditations to register to have an accounts.

- Process the deal. Make use of Visa or Mastercard or PayPal accounts to finish the deal.

- Choose the formatting and acquire the form on the product.

- Make adjustments. Fill up, change and print out and sign the delivered electronically Colorado Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners.

Every single format you included with your bank account lacks an expiration time and is yours eternally. So, if you would like acquire or print out one more backup, just go to the My Forms portion and click in the type you need.

Obtain access to the Colorado Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners with US Legal Forms, by far the most extensive catalogue of lawful document web templates. Use 1000s of specialist and condition-certain web templates that meet your small business or person needs and specifications.