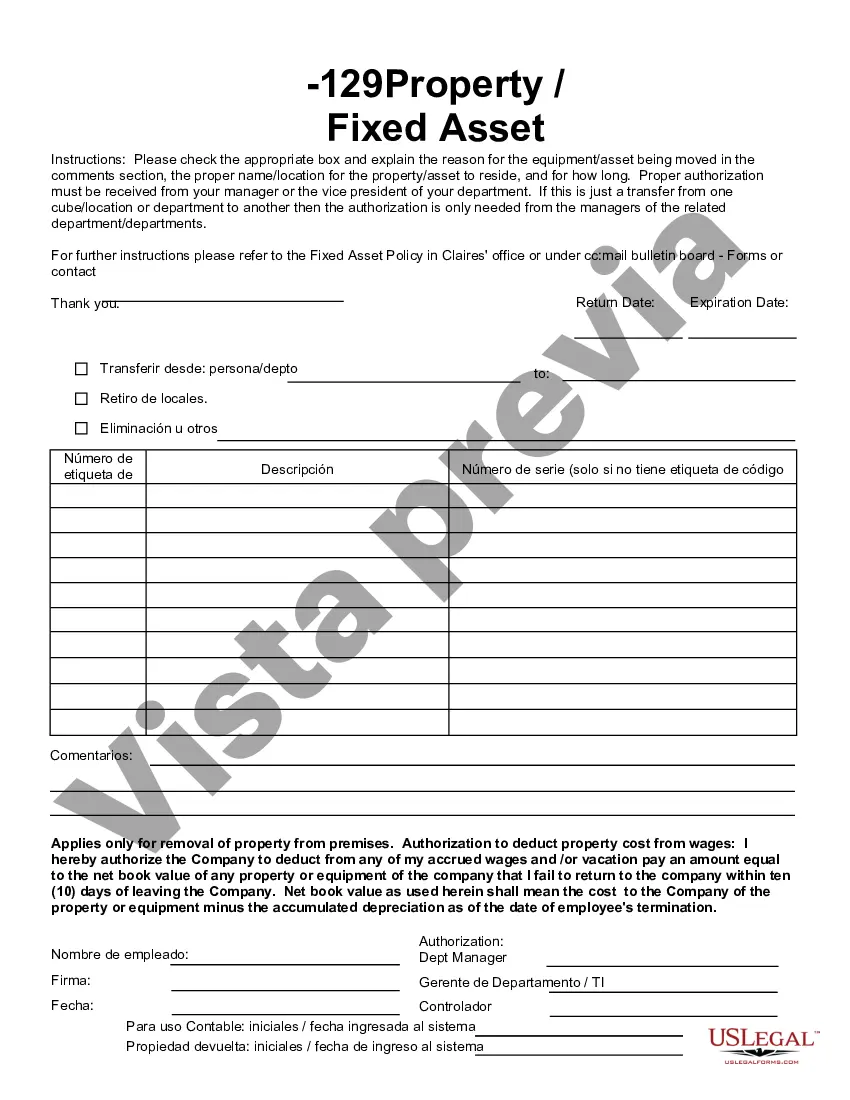

The Colorado Fixed Asset Removal Form is a crucial document that enables individuals or organizations to record and document the removal or disposal of fixed assets in the state of Colorado. This form ensures compliance with state regulations and provides a comprehensive record of all fixed asset removal activities. Keywords: Colorado, fixed asset removal, form, disposal, compliance, record-keeping. There are several types of Colorado Fixed Asset Removal Forms that cater to specific asset removal scenarios. These forms include: 1. Colorado Fixed Asset Disposal Form: This form is used to document the disposal of fixed assets such as equipment, furniture, or vehicles. It requires detailed information about the asset being disposed of, including its description, serial number, condition, and disposal method. Additionally, the form may request the reason for disposal, authorization signatures, and relevant dates. 2. Colorado Fixed Asset Transfer Form: This type of form is utilized when a fixed asset is being transferred from one department or entity to another within Colorado. It captures essential information about the asset being transferred, including its current location, recipient, and supporting documentation endorsing the transfer. The form may also include an acknowledgment of receipt section for the receiving entity to indicate acceptance. 3. Colorado Fixed Asset Sale Form: When fixed assets are sold, this form is employed to document the details of the transaction. It includes information about the asset, buyer, sale price, sale date, and any supporting documentation such as invoices or contracts. This form ensures proper record-keeping and legal compliance during asset sales in Colorado. 4. Colorado Fixed Asset Donation Form: In cases where fixed assets are donated to charitable organizations or institutions, this form facilitates the documentation process. It captures information about the asset, the recipient organization, donation value, and supporting documents such as donation receipts or acknowledgment letters. This form serves as evidence of the donation for tax or auditing purposes. By utilizing the appropriate Colorado Fixed Asset Removal Form, individuals and organizations can ensure accurate record-keeping, regulatory compliance, and transparency in all fixed asset removal activities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Colorado Formulario de retiro de activos fijos - Fixed Asset Removal Form

Description

How to fill out Colorado Formulario De Retiro De Activos Fijos?

Choosing the best authorized file template can be quite a have difficulties. Needless to say, there are plenty of web templates accessible on the Internet, but how will you find the authorized develop you require? Use the US Legal Forms internet site. The support delivers thousands of web templates, for example the Colorado Fixed Asset Removal Form, which you can use for company and personal needs. Each of the varieties are inspected by experts and meet up with federal and state specifications.

In case you are already signed up, log in in your accounts and click the Down load option to find the Colorado Fixed Asset Removal Form. Make use of your accounts to check throughout the authorized varieties you might have bought previously. Check out the My Forms tab of the accounts and acquire yet another duplicate of your file you require.

In case you are a whole new consumer of US Legal Forms, allow me to share basic directions that you should stick to:

- First, be sure you have selected the correct develop for your town/county. You are able to look through the form making use of the Review option and look at the form description to guarantee this is the best for you.

- If the develop fails to meet up with your needs, take advantage of the Seach discipline to find the right develop.

- When you are sure that the form would work, click the Buy now option to find the develop.

- Select the rates program you need and enter in the required information. Build your accounts and buy the transaction using your PayPal accounts or charge card.

- Pick the submit formatting and down load the authorized file template in your system.

- Full, revise and produce and indication the attained Colorado Fixed Asset Removal Form.

US Legal Forms is definitely the greatest library of authorized varieties where you can discover a variety of file web templates. Use the service to down load skillfully-created files that stick to status specifications.